A Trust is an institution or association that is formed to provide or assist in the development of ecosystem, monuments, and offer aid to the needy and poor people in the form of medical relief, education, clothing, etc. These trusts can be established for charitable or religious purposes. The trusts does not hold any commercial or economic activity and so are liable for several tax benefits under Income Tax Act. They are solely made for the advancement of society and upliftment of the poor people. In this Blog, you are going to learn about the Income Tax Return Filing for Trust in India.

Under Section 2(15) of the Income Tax Act, 1961, it is given that, a trust is considered as charitable, if it is established for the purpose of providing benefit to the public, at large and not for an individual or group of individuals.

Overview of Income Tax Return Filing for Trust

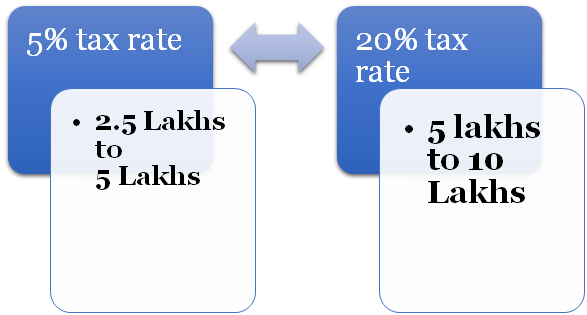

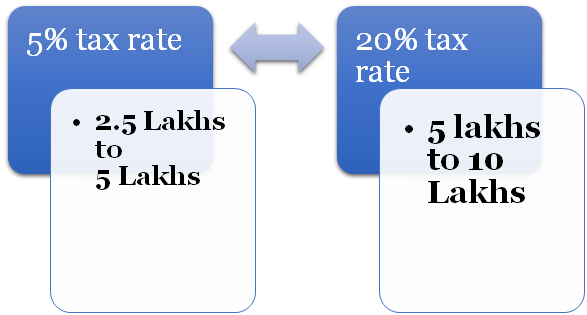

Under Section 139(4A), any trust whose total income exceeds the maximum amounts which is not chargeable to tax, is required to file its return. The trust which earns more than 2.5 lakhs a year must file returns as per the Income Tax Act Rules. As per Financial Year 2018-2019, the income tax rate for trusts were –

What is Form ITR-7?

Form ITR-7 is used for the Income Tax Return Filing for Trust, before the date specified in Section 139. The due date, as per Section 139 of Income Tax Act for filing of return is 30th September of every year and if the trust do not want to get their records and account verified, then the due date is 31st July of every year.

Surcharge on Income Tax Return Filing for Trust

On top of the income tax, which is levied on the trust, there is also a surcharge which need to be payable by these trusts or institutions. A surcharge of 10% will be levied, if the annual turnover of the trust exceeds Rs.50 lakhs. And, if the income exceeds Rs.1 crore, then the surcharge is calculated at a rate of 15% on the total income amount.

Both these are subjected to marginal relief, and therefore the total amount payable as the tax will not be more than the total amount payable as tax by an amount greater than Rs.50 lakhs or Rs.1 crore. In case of education or higher education cess comes up to 2% and 1% respectively and this is added with the already mentioned surcharge.

Read our article:Types of ITR (Income Tax Returns)

Section 139- Income Tax Return Filing irrespective of Income Parameters

It is mentioned under Section 139 that any trust whose income exceeds Rs. 2,50,000, is liable to file income tax return but there are some trusts that, irrespective of their incomes are expected to file their income tax returns and these are, Research Associations, News Companies, Universities or educational institutions, Venture Capital fund, Trade Unions, Business Trusts, etc. The trusts must file their returns in an electronic form, and if the records and the accounts of the trust have to be verified by a registered Chartered Accountant, then both the tax return statement and a digital signature of the trustee must be filed together.

In case, return is not filed by the prescribed date, then benefit of accumulation under Section 11(2) of Income Tax Act[1] will not be available. Section 11 provides for several exemptions and benefits to the Trusts which do not undertake any commercial activity or any activity for the profit gain.

Important Points to Consider while Income Tax Return Filing for Trust

The points to consider while Income Tax Return Filing for Trust are as follows-

- The most important point of consideration is to examine whether the trust has been established, in accordance with law.

- The Trust or institution has been established or formed with proper Constitution and Rules.

- To examine whether the objectives of the Trust is for Charitable or religious purposes only and if the gross receipts from the activities mentioned under Section 2(15) of Income Tax Act, is more than Rs.25 lakhs, then it is not to be considered for charitable or religious purposes.

- To examine whether the Trust has been formed solely for the benefit of public or ecosystem, and that it is not been formed for the benefit of ‘specified person’ or some particular religious community or caste.

- To examine whether the use of or application of income draws a list of the authors of the trust, substantial contributors of the trust and managers of the institution and also, all the transactions of the trust had been transacted with the ‘specified person’ so as to come within the net of provisions of Section 13(2) of Income Tax Act.

- To examine whether the trust has applied for registration in Form No. 1 OA in accordance with the provision of Income- Tax Act.

- To examine whether the 85% of the income of the trust has been applied to its objects in the previous year.

- To examine whether there are any donations in the nature of anonymous donations and its application on the income of the trust.

- To examine whether the return of income has been filed under Section 139(4A) of Income Tax Act in the prescribed Form ITR-7 and exemption from tax has been claimed under Section 11.

Conclusion

The Charitable and Religious Trust has been formed to provide help or assist in the development of the country, public, ecosystem, monuments, etc. They are assisting or helping in every possible way so as to eradicate all the deficiency or poverty which is in our country. These institutions have been helping from past several years and without any government help. They are self-reliant and independent. They are providing help from the donations that they received from any individual, some institutions or some leading name. Besides that, they are not getting any financial help from any other sources.

But from some past years, it has been found out by Government that some trusts have been formed, which are not providing any benefits to the public, rather they are created for economic gains in the disguise of social service and are eligible for Income Tax Return Filing for Trust. So to curb these, Taxation Laws have evolved over a period of time. The very rationale of providing tax incentives and exemptions to these trusts is to encourage them to render public service and development of the society, rather than to accumulate tax-free wealth in the name of social service.

Read our article:An overview on Tax Residency Certificate & Double Taxation Avoidance Agreement: How To Get It?