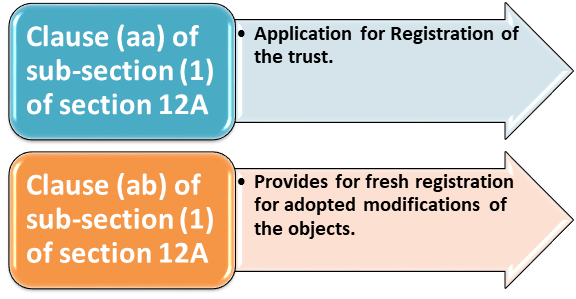

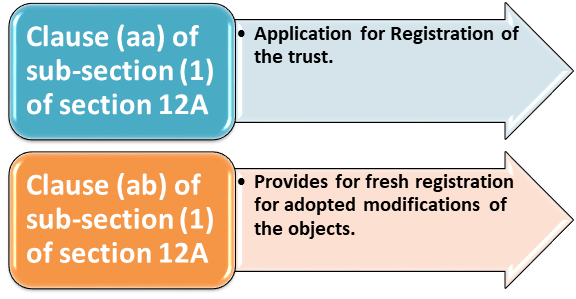

Section 12A (1) a/aa/ab provides new registration of trust where a trust or an institution has granted registration. However, afterward, it has adopted or undertaken alterations of the objects which do not conform to the state of affairs of registration.

As we all know, the existing Form No. 10A has exchanged by the Central Board of Direct Taxes- Notification No.10/2018, dated 19/02/2018. It has also changed rule 17A that has been replaced by the Income-tax (known to be First Amendment) Rules, 2018, w.e.f. 19-2-2018. This article will enclose all the details regarding Form 10A and a new registration procedure under 12A (1) a/aa/ab grant for trust.

What do you mean by application in Form No. 10A for registration of charitable or religious trusts?

The application for registration of a charitable trust will be made in Form No. 10A under the clause (aa) or clause (ab) of sub-section (1) of section 12A.

List of Documents to be submitted with Form 10A

The following stated documents shall supplement the application in Form 10A:

- Proof of instrument creating the trust or establishing the institution- Self Certified Copies

- Proof of creation of the trust, or establishment of the institution otherwise than under an instrument- Self-certified copy

- Proof of evidencing adoption or modification of the objects, if any- Self-certified copy

- Copies of annual reports of the trust/institution for three immediately preceding financial years- All certified Documents.

- Note on the accomplishments of the trust or institution.

- Copies of existing order granting registration under section 12A or section 12AA, if any – Self Certified

- Copies of the order of rejection of an application, if any- Self Certified

E-Filing & Verification of the Form No. 10A:

- As applicable to the assesse, Form No. 10A shall be verified by the individual who is authorized and has the power to verify the return of income under section 140.

- Form No. 10A shall be furnished electronically. The following may do it by: – a) digital signature and b) electronic verification code.

- In furtherance with a digital signature, the return of income is compulsory to get furnished under digital signature.

- The electronic verification code has to get done in a case not covered in the above clause.

What is the Procedure for Registration under section 12A?

We all are aware that Section 12AA of the Income Tax Act 1961 suggests the approved procedure for Trust Registration or institutions. The brief of the process is as follows:-

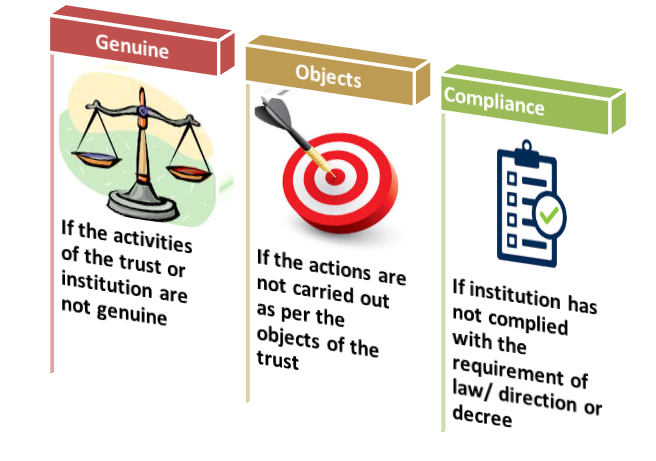

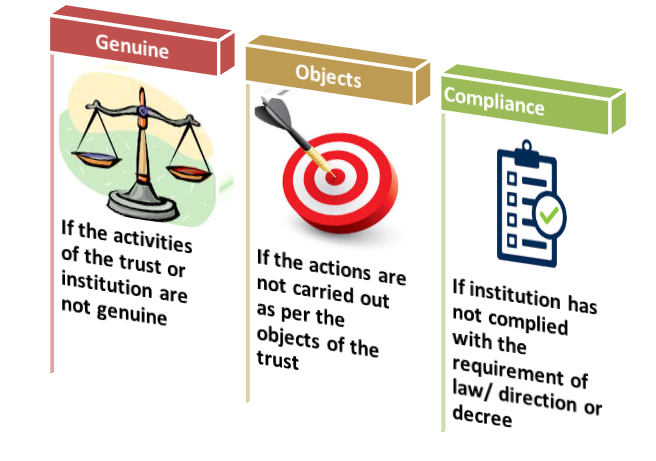

Step one: – Based on the application for registration of a trust or institution, the Principal Commissioner or Commissioner shall:-

- Call for such approved documents or statistics from the trust or institution. It must be done as the Principal Commissioner, or Commissioner thinks essential to satisfy himself about:-

- The genuineness of activities of the trust or institution; and

- The compliance of such necessities which are material to attain its objects

Step two: – After sustaining himself about the ‘objects’ of the trust, the ‘genuineness’ of its accomplishments and compliance of the requests, he shall

- Authorize and pass an order in writing concerning the registration of the trust or institution

- If not so fulfilled, pass an order in writing rejecting to register the trust or institution- stating reason.

- At last, a copy of such order shall be directed to the applicant Trust.

- It should get noted that no order shall be approved unless the applicant has specified with a ‘reasonable opportunity’ of being heard.

What do Supreme Court & CBDT says on Cancellation of Registration granted u/s 12A

- Supreme Court Case: – CIT vs. Society for the Promotion of Education, Adventure Sport & Conservation of Environment- 2016

- Following the case, the Supreme court held that every single order granting or refusing registration should be accepted before the termination of ‘six months’ from the end of the month in which the application was acknowledged.

- Central Board of Direct Taxes Instruction:- The Central Board of Direct Taxes has delivered Instruction No. 16 dated 06.11.2015, in which the time limit of six months specified in s. 12AA (2) of the Income-tax Act 1961- for approving an order granting or refusing registration.

- Exemptions: The Registration under s. 12AA (2) of the Income-tax Act 1961 is not to be followed by the Commissioners of Income Tax.

- Therefore, The CBDT has directed guidelines to the Chief Commissioners of Income-tax to monitor if Commissioners are sticking to the time limit. If case of any violation of the given instructions, the Chief Commissioners can take suitable administrative action in the case of laxity.

- Avenues on which registration can get canceled:-

- Activities & events are not genuine of such trust or institution.

- Activities are not consonance with the objects of the trust or institution being carried out.

- Income of the Trust does not sustain for the advantage of the general public.

- In cases where the income is for the benefit of any specific religious community or caste.

- If the income or property of the trust applied for the profit orientations to specified persons like the author of trust, trustees, etc.

- If the income or wealth of the trust was used, its funds and invested in prohibited modes of arena.

- Amendment by Finance Act’ 2017:- The said Amendment speaks about the trust or an institution that has established registration-grant. Subsequently, it has implemented or adopted modifications of the objects which do not fit into the objectives of registration.

- In such cases, it shall be required to obtain ‘fresh registration’ by making an application within thirty days from the date of such implementations of the objects in the suggested form and prescribed manner.

What are the New replaced sections for Charitable Institutions as per Budget 2020? : Latest Rules

Section 12AB to replace Section 12AA and Section 12A

- The Finance Act of 2020 has released specific new compliance responsibilities on Charitable Trusts and all Exempted Institutions. In this context, the new provisions of the Finance Act, 2020 for Charitable Trusts and exempt institutions, need to re-apply for Income Tax registration as per the Act.

- Moreover, Section 12AA, dealing with registration for a charitable institution, will come to an end to applicability from 01.06.2020. In place of this, a new section 12AB has been introduced, suggesting the procedure for new registration.

- Requirements of registration under section 12AA or section 12A will become redundant, and new section 12AB will come into force. All the prevailing registered trusts under the preceding section 12A or section 12AA would transfer to the new provision under section 12AB.

- Besides, instead of CIT (Exemption) examination, an application is a prerequisite to be made need-fully to the Commissioner or Principal Commissioner of Income-tax.

National Register for Charitable Institutions

- The Government proposes to create a ‘National Register’ of charitable and religious institutions. Moreover, the Income Tax Department will produce an electronically generated ‘Unique Registration Number’ (URN) to all charitable trust and religious institutions.

- The procedure of re-validation of all the charitable trust and religious institutions will qualify/enable the Government to pull out all the dis-functional and out-dated charitable institutions.

- Even following the past, many registered trusts are found involved in malpractices for private exploiting and taking out profits rather than doing any unpretentious social work.

- The revitalization of registration after every five years will make an opportunity to withdraw the exemptions without going through the complex cancellation provisions. In the year of 2019, the rules interrelated to charitable trusts/NGOs got tightened up to remove the registration even for social abuses under other laws for attaining its objectives.

Section 80G Certification and TDS Provisions

- All the exempted charitable trusts and institutions will now be required to re-apply online for registration or approval, which already has Section 80G certificates, which will be the latest by August 31, 2020. The re-applied registration certificate shall persist and remain valid for the next five years.

- The compliance and submission burden on Charitable Trusts and Exempt Institutions goes with few additional parameters to file statements of donation received and matters of donation certificates to donors in line by TDS provisions[1]. In case of failure, heavy fines and penalties are imposed on file such statements.

What are the amended provisions of the Time limit to make an application for re-registration and to file a Tax Audit Report?

- Kindly get the detailed time limit prescribed by the Amendment:-

|

Incidents |

Time Limit |

|

Institution registered under section 12A or 12AA |

Within 31st August, 2020 |

|

Institution registered under section 12AB |

6 months prior to the expiry date of 5 years |

|

Institution provisionally registered under section 12AB |

|

|

Institution becomes inoperative |

6 months prior to the commencement |

|

Institution has modified the objectives |

within a period of 30 days of such modification |

|

Other Events |

at least 1 month prior to the commencement of the previous year |

- Tax Audit Report: The Audit Tax Report required filing Tax Audit under section 12A of a trust or institution.

- Time Limit: The Tax Audit Report shall be filed in one month preceding the due date of filing of return under section 139(4A); read with section 139(1).

- Due to this Corona outbreak, the due date for filing of return of income in Tax Audit cases is post-pond to 31st October. Henceforth, Tax Audit Report shall be provided by 30th September positively.

Read our article:Investment by Trust & Compliance U/s 11(5)

What are the Fresh Registration Procedural aspects as per the amended provisions of section 12AB, getting exemption u/s 11 and u/s 12?

Applicability of exemption

- Situation 1:- Where a trust or institution is registered under section 12A or 12AA

Applicability: It starts from the assessment year from which registration was granted before to the charitable trust or institution

- Situation 2:- Where a Charitable trust or institution is provisionally registered under section 12AB

Applicability: It starts from the first assessment year in which provisional registration was granted.

Procedure for fresh registration & Granting Under section 12AB

It gets done by the Principal Commissioner or the Commissioner after receipt of an application under the conditions stated in section 12A (1)(i) to (vi).

- Condition 1: Registration will be granted for 5 years [Section 12AB(1)(a)]

Illustration: – In this case, no documents will be called, or inquiry will be made for granting the registration.

- Condition 2: Registration may be granted for five years if PCIT or CIT is satisfied about the genuineness of activities and compliances under any other laws of the trust or institutions. [Section 12AB(1)(b)(ii)]

Illustration: In this case, PCIT or CIT shall have the powers to call for documents or information from the trust or institution or to make inquiries before the renewal of the registration after five years.

- Condition 3: Registration may be canceled after providing a reasonable opportunity of being heard to the trust or institution.

Illustration: Further, before canceling the registration, the trust or institution shall be allowed to present its case

- Condition 4: Provisional Registration shall be granted for three years from the assessment year from which the registration is sought. [Section 12AB(1)(c)]

Illustration: It appears that in this case, no documents will be called, or inquiry will be made for granting the provisional registration.

- Condition 5: Any pending application filed under section 12AA

Illustration: All the pending application filed under section 12AA as on 01.06.2020 will be considered to be an application made under section 12A(1)(ac)(vi)

What is the time limit to get the New Registration Granted u/s 12AB as specified in section 12A (1) (i) to (vi)?

It will be granted by the Principal Commissioner or the Commissioner after the receiving of an application under the conditions specified in section 12A (1) (i) to (vi).

- 12A (1)(ac) (i):- Registration will be granted for a period of 5 years. [Section 12AB (1)(a)]

Time Limit: – Within three months from the end of the month, in which application is made.

- 12A(1)(ac) (ii)/(iii)/(iv)/(v):- Registration may be granted for five years if PCIT or CIT is satisfied about the genuineness of activities and compliances under any other laws of the trust or institutions. [Section 12AB (1)(b)(ii)]

Time Limit: – Within six months from the end of the month, in which application is made.

- 12A (1)(ac) (vi): Provisional Registration shall be granted for three years from the assessment year from which the registration is sought.

Time Limit: – Within one month from the end of the month, in which application is made.

- Cancelation u/s 12AB (1)(a) or u/s 12AB(1)(b):- Any registration granted u/s 12AB (1) (a) or u/s 12AB (1)(b) can be cancelled subsequently if the Principal Commissioner or the Commissioner are satisfied with few conditions. Those are:-

What does CBDT say on the compliance date for the process of the New Section in the middle of COVID-19?

- The Central Board of Direct Taxes has extended the compliance date for new section 12AB for Charitable Trusts procedures in the middle of this dreadful disease COVID-19.

- Central Board of Direct Taxes has extended or postponed the operation of the new procedure for ‘approval/ registration/ notification’ of individual entities ‘u/s 10(23C), 12AA, 35 & 80G’ of the Income Tax Act, 1961 to ‘October 1, 2020’.

- All the schools and colleges are registered simultaneously under section 10(23C) and 12AA. All institutions registered under both section 10(23C) and section 12AA will now are compulsorily required to apply for re-validation under section 10(23C) ‘or’ registration under section 12AA.

- The new compliances under the mentioned section were made applicable from June 1, 2020, and should have been finished by August 31, 2020. Relying on the Tweet released by Income Tax Department (such info is not law), the new date of compliances will begin on October 1, 2020, and shall remain till December 31, 2020.

Conclusion

The Ministry of Finance has released a press note on May 9, 2020, in this respect of the necessary legislative amendments in this regard shall be planned in due course. In this epidemic situation, the NGOs and other charitable institutions are the ones who are playing a dynamic role in the social order, and their assistance cannot be disregarded at this moment.

Therefore, it is essential to allow them to remain engaged in social actions rather than formalities. Please check in to our Corpbiz team if you need expert advice on the new procedures of Trust Registrations. We will help you to ensure complete New Trust Registration Compliances as per your desired activities, ensuring the successful and well-timed completion of your work.

Read our article:Paid Donations: Guide on Tax Treatment for Charitable Purpose