Recently, the Income Tax Appellate Tribunal (ITAT) apprehended that any registration ‘under section 12AA’ of the Income-tax Act, 1961, cannot get rejected on the ground that trust hasn’t commenced its anticipated activities as yet.

What is the Provisional Interpretation made under the caption12AA of ITAT Pronouncements 2020?

- Section 12AA:- It says that registration can get practiced for any newly proposed trust. There is no obligation that the trust should have already been in continuation and should have engaged any activities before requesting for registration.

- Furthermore, the term ‘activities,’ according to S. 12AA, incorporates ‘proposed activities.’ The Commissioner of Income-tax must analyze whether the objects of the trust are charitable or not. Whether the activities which the trust proposed to carry on is genuine or not. It should Exhibit the sense that they are in line with the objects of the trust. Nevertheless, he cannot refuse registration on the ground that no activities have commenced out yet.

What would be the position of Commissioner to cancel the registrations?

In contradiction, the position would be inconsistent where the Commissioner proposes to discontinue the Registration of Trust under sub-section (3) of section 12AA of the Act. In those cases, Commissioner would oblige to record the finding that the ‘activities carried‘ by the trust are not genuinely being obeying the objects of the trust. Similarly, the situation would get altered where the trust has before practicing for registration found to have initiated activities contrary to the purposes of the trust.

What are the Considered Facts and Issues of the case?

Considered Facts: –

- According to facts of the case, the assessee registered under the society of the Registrar, Uttar Pradesh. The said registration was renewed for five years by way of renewal Certificate. Society declared its objectives comprising the opening of ‘paramedical management,’ ‘computer engineering,’ ‘medicine/Ayurvedic science’ educational institution, etc. for the development of education.

- The society applied the CIT for Registration under section 12AA of the Act and got asked in return to file essential documents before him. After examining the documents filed by the society and after carrying out necessary inquiries, the Learned CIT rejected the application of the assessee for registration under section 12A (1) of the Act.

Considered Issues:

- Whether a newly formed trust entitled to registration U/s 12AA of the IT Act, 1961, even if any activity has not undertaken yet

Read our article:Medical Relief under Income Tax: An Updated Overview

What are the Considered Arguments of the case?

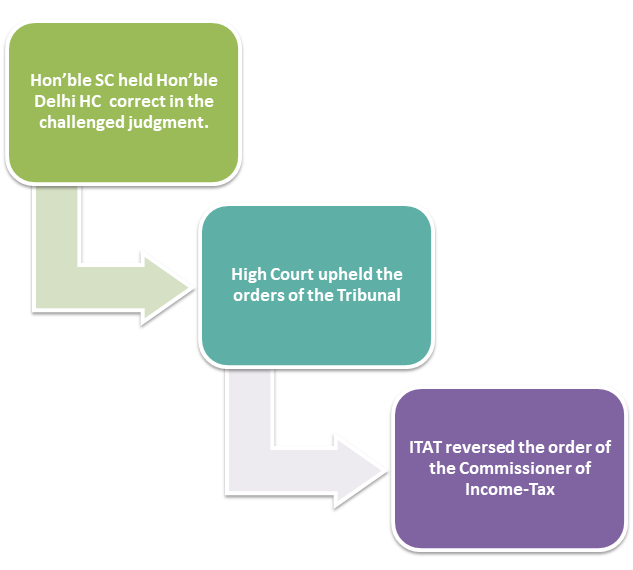

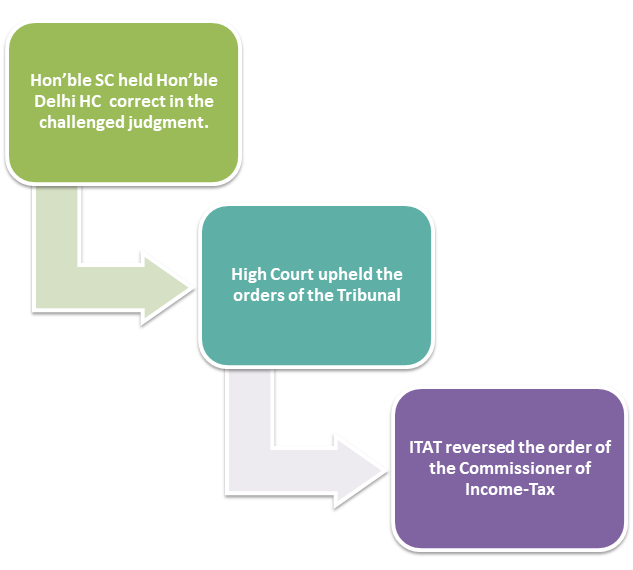

- The Commissioner of Income-tax contested that the documents on record do not satisfy to establish the genuineness of the activities of the society and present sufficient material to develop the charitable nature of the objectives. However, The Tribunal held that the registration under ‘section 12AA’ could not get rejected on the ground that trust has not initiated the charitable or religious activity.

- Considering all the deliberations, the Income Tax Appellate Tribunal, Delhi (“ITAT, Delhi”) reversed the order and commands of the Commissioner of Income-Tax. The Appellant addressed the High Court by way of filing an appeal. The High Court also confirmed and upheld the orders of the Tribunal. At last, it has decided that in case of a newly registered trust, even though there were no activities, it was reasonable to consider the trust getting registered under section 12AA of the IT Act, 1961[1].

Conclusion: – Brief of order passed by Hon’ble Supreme Court of India in the matter stated above-

Supreme Court Matter: – Civil Appeal No. 4702/2014 dated February 19th, 2020

- According to the Section 12AA of the Income Tax Act, 1961, it empowers the Principal Commissioner/Commissioner of the Income Tax on receipt of an application for registration of a trust. They need to request for such documents as may be essential to satisfy concerning the genuineness of activities of the trust or institution and make inquiries in that behalf.

- The same section necessitates the Commissioner to be so satisfied to confirm that the object of the trust and its on-going activities are charitable. It is a mandate since the significance of such registration is that the trust is allowable to claim benefits under sections 11 and 12 of the Income Tax Act, 1961.

- Moreover, it got contended by the Senior Counsel for the Appellant that the Commissioner of Income Tax is obligatory to be fulfilled with two specific things – (a) the objects of the trust (b) its genuine activities. The Commissioner cannot evaluate whether such activities are legitimate if there have been no activities undertaken by the trust. Therefore, the Commissioner is obliged to reject the registration of such a trust.

- The Hon’ble SC categorically held that the view of the Hon’ble Delhi HC in the challenged judgment is correct. Moreover, considering the case of ‘Allahabad High Court in IT Appeal No. 36’ of 2013 titled as “Commissioner of Income Tax-II vs. R.S. Bajaj Society,” It is liable to be upheld given the precedents set herewith as well as various other judgments.

Read our article:Setting off Excess Expenditure against Income of next year by Trust and NGO