Capital gains tax of Charitable Institutions is a charge assessed on the difference between the ‘sale price’ of the asset and its ‘original purchase’ price. This context also speaks firmly on the Long-term capital gain tax, which is a levy on the profits from the ‘sale of assets’ held for more than one year. According to section 2 (24), the definition of income includes Capital Gains. Similarly, for section 11, Capital Gains must form part of the income, and accordingly, it should preserve as any other income under section 11.

It results in the depletion of the corpus by utilizing capital gains on the fulfillment of the objects and purposes of a charitable organization. Moreover, the need got manipulated to allow an option to the Charitable and Religious Groups, whereby they can re-invest the sale earnings from Capital Assets in new Capital Assets. It is to enable in the long run, where the corpus would remain intact.

What are the circulars concerned with charitable organizations in terms of their Capital Gains?

- In terms of the capital gains, the concerns of Charitable Organisations documented in the ‘Circular No. 2-P (LXX-5), dt.15-05-1963’.

- It specified that when the capital assets form part of the corpus, it gets transferred to obtain further capital assets for the benefit of the Trust. Then, the amount of Capital Gains should get considered as applied for charitable purposes.

- Additionally, as per the circular number “CBDT Circular No. 52, dt. 30-12-1970”, explained that the ‘intent of the legislature’ was not in favor of imposing tax liabilities in case where the ‘Capital Gains,’ applied for the acquirement of new ‘Capital Assets.’

- As per the orders of the board, fixed deposits with banks for a period exceeding ‘six months’ can be measured to be a capital asset. ‘(Instruction no. 883 – F. No. 180/34/72 –IT (Al) of 25.9.1975)’ Courts had that even ‘F.D. with banks’ less than six months are also capital assets, but F.D. with ‘company is not’ a capital asset.

- The provision does not mention any time limit for re-investment; it should be within the same year or the next year, as per the explanation of section 11(1). The reason for this time limit is that the capital gain considered to get applied for charitable purposes to the extent of the cost of the capital asset acquired. If so, the time limit should be the same as the time limit for the application of income under section 11(1). ‘CIT vs. East India Charitable Trust (1996) 206 ITR 152 (Kol)’ has established this view.

- Case- Asstt CIT v. Upper India Chamber of Commerce: –It was held that section 11(1A) is a complete in itself, and since it is a complete, the computation of eligible exemption is to be worked out within its framework.

What are the Provisions related to Capital Gains?

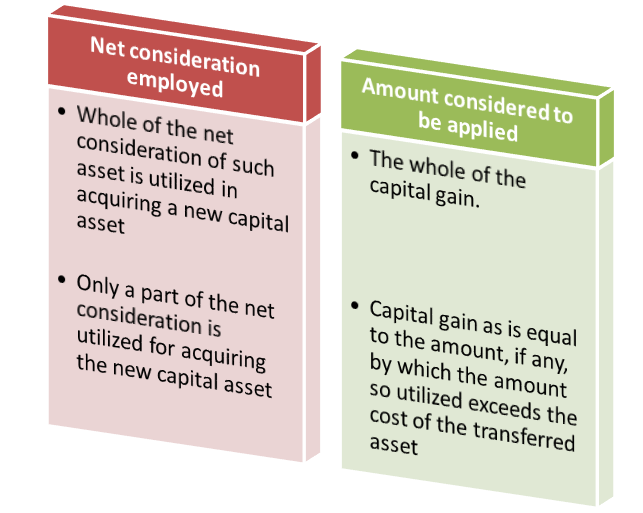

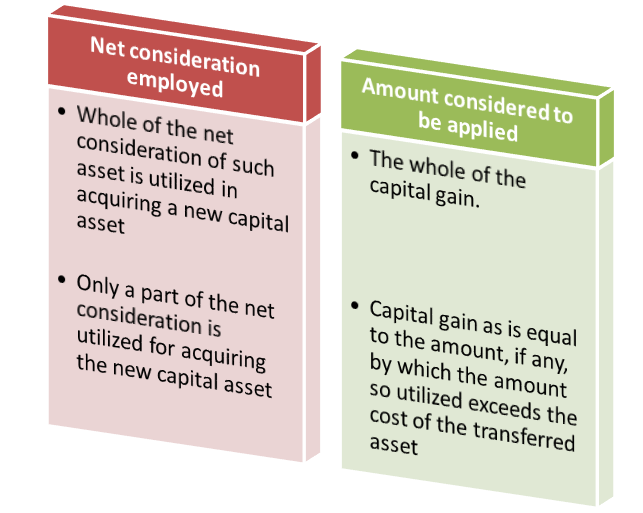

At the very outset, Section 11(1A) firstly provides two main situations.

The two main conditions are as follows:-

- 1st situation says that the capital asset is the property held under a Trust exclusively for charitable or religious purposes;

- 2nd situation says that the capital asset is held under a Trust in portion just for such purposes;

However, within these main situations, the provision also provides the following sub-situations.

The sub-situations are as follows:-

- 1st sub-situation says that the whole of the net consideration gets utilized in acquiring the new capital asset;

- 2nd sub-situation says that only a part of the net payment gets operated for attaining the new capital asset.

As a consequence, in respect of such sub-situations by following the main situations, the section spells out the importance of income, which will believe in applied to charitable purposes of such institutions.

Is it Possible for Capital Gains to get applied for charitable purposes?

- Capital Gains can also get utilized for charitable purposes. It is at the discretion of the organization to execute the Capital Gains for charitable purposes or towards the acquisition of a new Capital Asset. The determination of income under section 2(24), includes Capital Gains and accordingly, revenue for section 11(1)(a) includes Capital Gains.

- The traditional experience held under which section 11(1A) got enacted and the ordinance as it existed before 01-04-1971. It provides abundant testimony to the fact that capital gains form a part of the income accessible for application under section 11(1)(a).

- According to the ‘Circular No.2-P(LXX-5), dt. 15-05-1963′ and ‘Circular No. 72, dt. 06-01-1972′, it explained the problems faced before the insertion of section (1A) by the institutions and the gradual corrosion of the corpus factors.

- The intention behind the inclusion of section (1A) was to present an option to the assessee, to retain its corpus intact. However, the option mentioned above, did not imply the removal of the exemption of Capital Gains under section 11(1) (a).

- Therefore, an organization can utilize the Capital Gains for charitable objectives under section 11(1) (a). The division of Capital Gains, isn’t regarded as deemed to have been utilized for charitable purposes under section 11(1A), can also be used for philanthropic/charitable objectives under section 11(1) (a)[1].

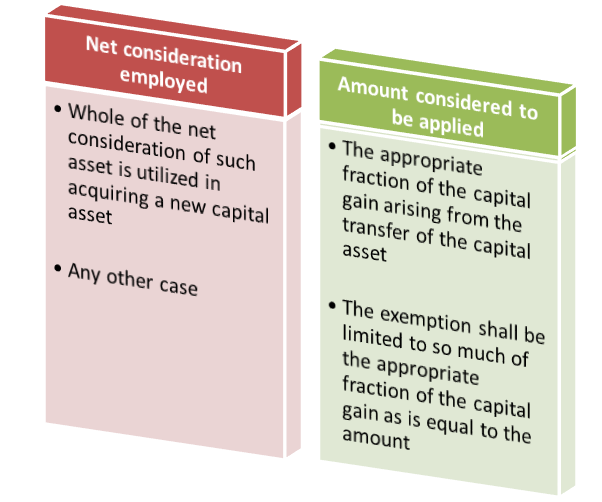

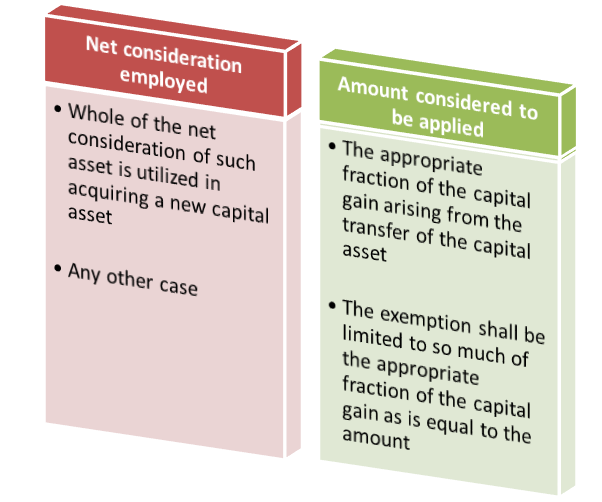

- Transfer or Giving away of Capital Asset operated under Trust in Part only for Charitable or Religious Purposes “Section 11(1A)(b)”:

What do you mean by Appropriate Fraction, Transferred cost, and Net Consideration?

- Appropriate Fraction: – It symbolizes the extent of income derived from the Capital assets before transfer applicable to charitable purposes of such institutions

- Transferred Assets: – It means the aggregate of the cost of acquisition for ‘section 48 and 49’ of the capital asset which is the subject of the transfer or Give away

- Net consideration: It means the full value of the reflection that is received or accruing as a result of the transfer of the capital asset. It gets as reduced by any expenditure experienced wholly and entirely in association with such transfer.

Example:-

|

Example: |

Rs. |

|

Cost of Asset transferred |

5,00,000 |

|

Net consideration of the Asset transferred |

8,00,000 |

|

Cost of new capital Asset acquired |

|

In the above circumstances, the capital gain is Rs. 3, 00,000 and the subsequent amount shall be considered to have been applied for charitable purposes hence exempt:

- A. Rs. 3,00,000 (Amount invested — Cost of Asset)

- B. Rs. 2,00,000 (Amount invested — Cost of Asset)

- C. Rs. 1,00,000 (Amount invested — Cost of Asset)

Exemption of balance capital gain in case of (b) and (c) above can also be claimed on sustaining the condition concerning application and gathering/accumulation given under section 11.

Example: An asset is held under Trust, and ‘60%’ of the income derived from such capital asset is being employed for charitable or religious purposes.

|

Example: |

Rs. |

|

Cost of Asset transferred |

5,00,000 |

|

Net consideration of the Asset transferred |

8,00,000 |

|

Cost of new capital Asset acquired (a) & (b) |

|

Case (a) Solution: Appropriate fraction is 60%

- Capital Gain =3,00,000

- Appropriate fraction of the capital gain by 60% of Rs. 3,00,000 = 1,80,000

- Therefore, Rs. 1,80,000 shall be considered to have been applied for charitable purposes and thus exempt

Case (b) Solution: Appropriate fraction is 60%

- The appropriate fraction of total utilized by 60% of Rs. 6,00,000 = 3,60,000

- The appropriate fraction of cost (60% of Rs. 5,00,000) = 3,00,000

- Therefore the amount deemed to be utilized for charitable purposes shall be an appropriate fraction of the amount utilized minus the appropriate fraction of cost, i.e., Rs. 3,60,000 – Rs. 3,00,000 = Rs. 60,000.

- Balance capital gain of Rs. 1, 20,000, can also get claimed for exemption on satisfying the condition regarding application and accumulation.

Treatment of Capital gain in case of application of 85% of Income to Charitable Trusts.

- Any profit or gain resulting from the transfer of capital asset being held under Trust shall get employed as capital gain. Subsequently, such capital gain, the short-term or long-term, is also part of the income as per section 2(24).

- If it is to a claim exemption under section 11, the Charitable Trust should also apply income from such capital gain for charitable purposes throughout the previous year like any other income. It means that Trust shall have to implement at least 85% of the income from this capital gain for charitable purposes during the preceding year subject to objection given under section 11(2).

Read our article:Accounting Treatment of Charitable Institutions under Microfinance

What are the Basics of Taxability of the Charitable Trust Income in terms of Capital Gains?

- Basics of Capital gains tax for Trust

Capital Gain Tax refers to trustees as a body of persons and owners of trust assets as it does to any other taxpayer. Nevertheless, any other consideration needs to give as to when a trust makes a disposal of assets. The law presents that trustees can make both actual and considered disposals of trust property. Any allocation occurs where trustees sell trust property to any third party who entirely is detaching with the Trust.

- Trust- Business asset Disposal Relief

In general, trustees can maintain business asset disposal relief on the transfer of business assets held by them in the same way that individuals can. Still, there are some notable differences that a trustee has to consider when making a disposal. Other Capital Gain Tax reliefs that may appeal to business assets include assistance on replacement of business assets, establishment of relief, and Capital Gain Tax, deferral reliefs etc.

- Private Residence Relief

The Capital Gain on the sale of a residential property maintained in Trust will be wholly or partly exempt if, throughout ownership by the trustees:

- the beneficiary of the Trust has invaded the property as their only or principal residence, and

- the recipient in question is authorized to hold the property under the names of the Trust

- Trusts for disabled persons

If any identical person of the trust beneficiaries is a weak person, the trustees may demand or take a request appeal as individual income tax and Capital Gain Tax treatment.

- Restructuring Trusts

A trust may be restructured or varied for various reasons, including changing the class of beneficiaries, create explicit trusts for particular beneficiaries, creating sub-funds or expand the trustees’ executive powers. The Tax execution of a variation to the Trust by the operation of an express power or a sanctioned power will depend on the character/type of Trust concerned.

The Capital Gain Tax position on restructuring a related property trust will depend on whether the trustees get deemed to make a disposal. If the property remains in the same settlement, the trustees do not create a disposal for Capital Gain Tax purposes.

The Capital Gain Tax position on restructuring a qualifying interest in possession trust would be similar to that outlined above. Where the assignment or promotion removes wholly or partly the entitlement to receive income, then the trustees’ rate(s) of income tax suitable to the appointed or advanced funds will vary due to the change in nature of the Trust.

- Trust tax return and Docility

The income and Capital gains of Trust get charged under the self-assessment administration. The trustees must perform a return, even if one has not declared, if they have received gains that do not get reported on any other return.

Conclusion

The most critical aspect of Trust is the Asset Maintenance and Administration. By inclining to its Standard Terms, Trust Capital Assets determines the assets used as a means to play a fiduciary relationship in connecting a trustor and trustee towards an assigned beneficiary as per the Deed. Moreover, Trust Capital Gains should include any asset which may be in kind such as cash, securities, real estate lands, or any security term strategies. These are termed as assets of the Trust or the ‘Corpus’ of the Trust.

Moreover, it has valuable contributions to the tax laws which are continuously changing and extending its scope. With this, we at Corpbiz have experienced legal specialists to help you manage all your Capital gain issues and Business investments. Our professional will ensure to mitigate all your interests on finances successfully as well as timely completion of your work.

Read our article: Application & Accumulation of Income by Trust: Case Laws