GST was implemented from 1st July 2017, but there are still many topics that need further clarification. One of the common phenomena in any business is the change in a contract price. The change can be a result of any escalation clause inserted in any contact. A few common reasons for the change in contract price under GST can be changed according to prices of input materials or input services or any other change in contract price of the market situation.

The change in contract price after the implementation of GST is provided under the provisions of Section 142, Sub-section 2 of Central Goods and Service Tax Act, 2017. The section deals with miscellaneous provisions regarding the transition from the very old laws to new Goods and Services Tax.

For understanding the implications of it, we know that such change can either result in an increase in the contract price or a decrease in contract price. The treatments of such increase or decrease or change in contract price are provided in Clause (a) & (b) of Sub-section 2 of Section 142.

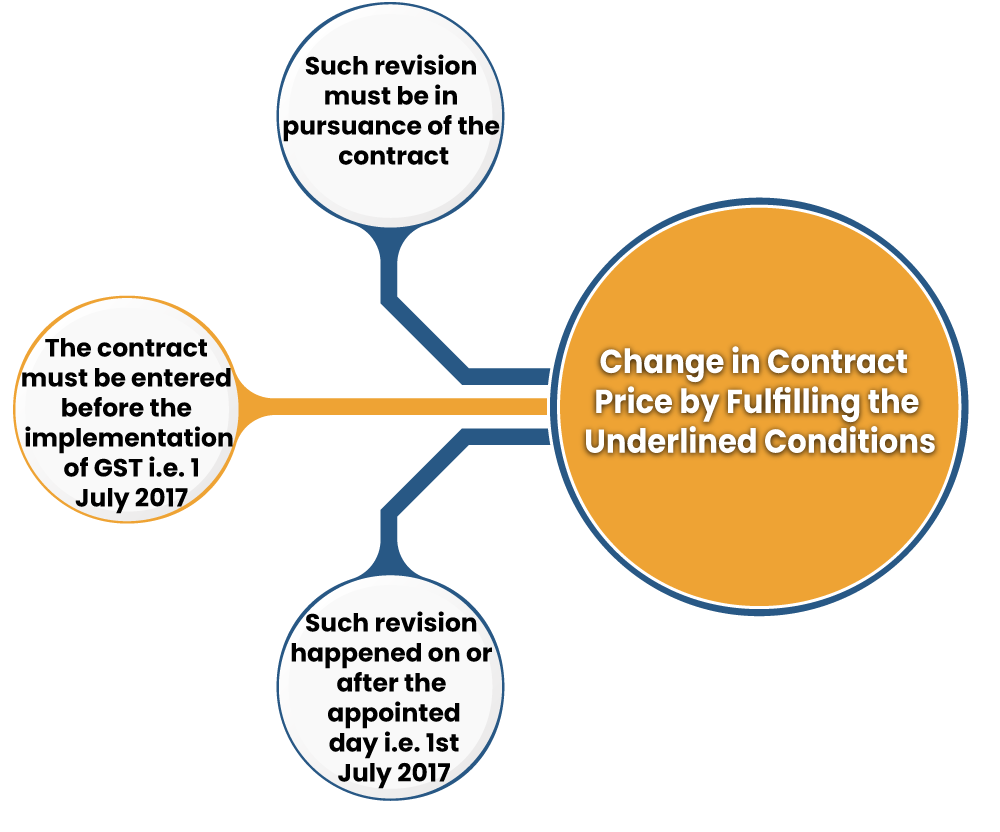

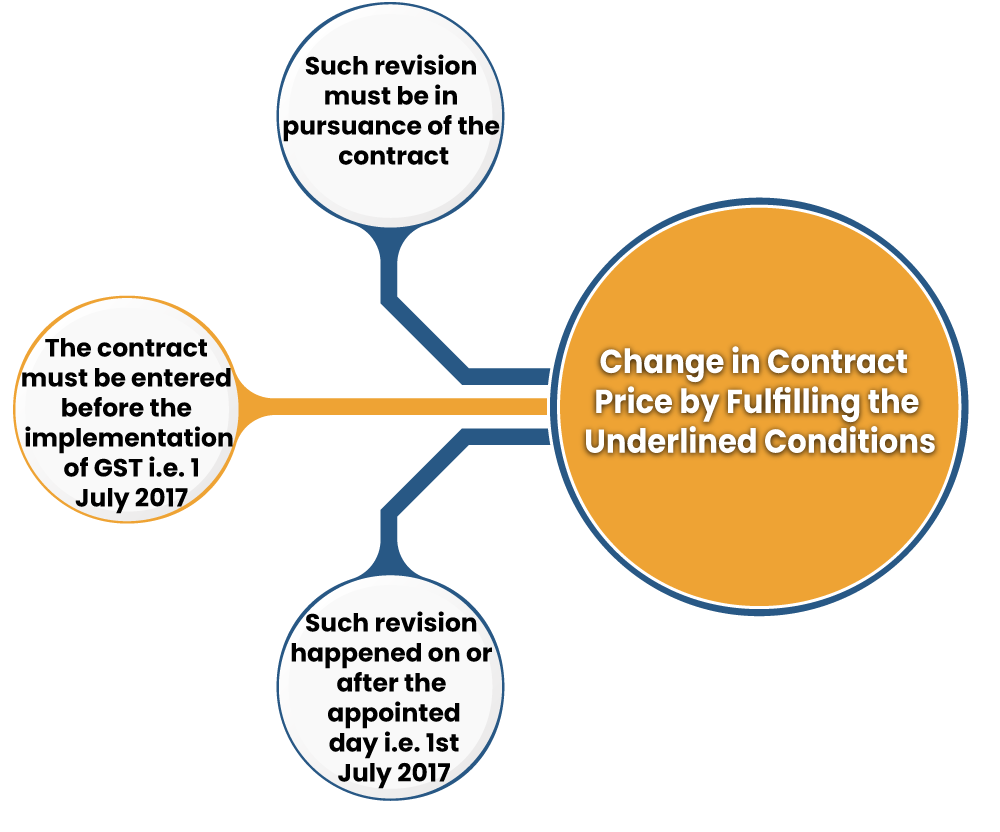

Change in Contract Price by Fulfilling the Underlined Conditions

Read our article:The Migration to the New Tax Structure under GST Transition Process

Contract Price when Revised Upward

If there is a change in contract price is in an upward direction on or after implementation of GST, then the taxpayer who has removed or provided the goods or services or both will require issuing either the supplementary invoice or the debit note for such an increased amount of contract price.

The supplementary invoice or debit note must contain all such particulars as may be prescribed. It has to be issued within 30 days from the date of that revision/change in contract price. The supplementary invoice or debit note is deemed to be issued under GST law against their outward supply.

Understanding with an Example

Mr. A entered into the contract with Mr. B for selling goods worth Rs.50, 000 on 21st June 2017. Later on the 14th July, he revised the contract price to Rs.70, 000. In this given situation, the contract price was revised after an implementation of GST, which was on 1st July 2017. Hence, Mr. A will issue a supplementary invoice or debit note for such an increased amount of Rs.20, 000 (70,000-50,000). The supplementary invoice or debit note is to be issued within a month of such revision

Tax Implication in the Above Case

In the above case, the tax implication shall depend on the two factors:

- If payment has been made before an implementation of GST

If payment is already received before GST implementation by Mr. A, then he had to deposited the tax applicable on the same. The GST will only apply to an additional cost of the contract, i.e. Rs.20, 000.

- If payment has NOT been made before an Implementation of GST

In this case, when a payment was not received before an implementation of GST by Mr. A, then he does not have to deposit the tax applicable, the GST will apply on an additional entire revised cost of the contract, i.e., Rs.70, 000.

Contract Price when Revised Downward

If there is a change in contract price is in a downward direction on or after the date of an implementation of GST, the following provisions apply the taxpayer who has removed or provided goods or services or both will be required to issue the credit note for such an increased amount of contract price.

The credit note must contain all such particulars as may be prescribed. It has to be issued within 30 days from a date of such change in the contract price. The credit note is deemed to be issued under GST law against the outward supply made by them.

Understanding with an Example

Mr. A entered into the contract with Mr. B to sell goods worth Rs.50000 on 21th June 2017. Later, on 14th July, he revised the contract price to Rs.30000. In the present situation contract price was revised after an implementation of GST on 1st July 2017. Hence, Mr. A must required to issue the credit note for the decreased amount of Rs.20 000 (30,000-50,000).

Tax implication in the Given Case

In the above case the tax implication shall depend on two factors:-

- If taxes have been paid According to Old Laws

In this case, when a payment is already received before the implementation of GST by Mr. A, then he had deposited the tax applicable on the same, he can revise his tax return and claim tax refund[1] paid on reduced contract price. The Mr. B will also be required to revert the ITC claimed on such tax paid if carried forward under GST.

- If taxes have NOT been paid according to Old Laws

In this case, where the payment was not received before an implementation of GST by Mr. A, then he had not deposited the tax applicable on the same. Mr. A can only reduce his tax liability if Mr. B lets go of his ITC by the same amount.

Conclusion

In an ongoing business, while dealing with contracts, the change in contract price is highly common. After the GST implementation, many are worried about how it will impact the price revision. One is advised to go through the government GST website for more info and more clarity on GST related laws.

Read our article:Implementation of GST in place of VAT in Indian Economy