The Duty-free shops are mostly noticed at the departure area of the International airports. They are kind of retails outlets that produce the goods locally and are exempted from payment of the local taxes. In the system, one condition has to be fulfilled that such goods can be sold only to the tourists who will take and use those goods outside India. Since there is the tax exemption applicable to the international passengers, they tend to buy goods from Duty-free shops at the airport. Lets discuss about GST at Duty-free shops.

In accordance with GST Laws, an outgoing international tourist is that person who is not an ordinary resident of India however comes to India for the stay not exceeding six months for the purpose of legitimate non-immigrant purposes.

An Inverted Tax Structure of GST at Duty-Free Shops

The supply only which is outward at the duty-free shop will get exempted from tax. However, these shops have to pay the GST on the inward supply of the goods. It further creates an inverted tax structure. This type of structure occurs when a rate of tax in the inward supply is more than a tax rate of the outward supply.

For Instance, if a duty-free store at the airport sells the handbag made of fabric at Rs. 1500 (without GST Tax) to the foreign passenger. In case if a person has bought the same bag from the wholesaler, then the will be Rs 1000 that includes 5% GST. In this case, he only pays the GST at duty-free shops on the inward supply, but there will be a tax-exempt on an outward supply. In accordance with the notification no. 31/2019 issued by the government, the taxpayer can claim a refund of Goods and Services Tax paid on the inward supplies.

Refund of GST at Duty-free shops accumulated ITC

Under GST law, the registered taxpayer will be eligible to get the refund of an unutilised (ITC) Input Tax Credit on basis of the Inverted tax structure. All details are required to be fulfilled to claim the GST at Duty-free shops and procedure must be fulfilled are as per the the GST registration.

Conditions must be fulfilled for a Refund of GST at Duty-free shops

A retail outlet which is situated at departure area of an International airport can declare the GST refund which was paid for the purchases of goods only if the below-mentioned conditions are fulfilled:-

- The products that are supplied must be domestically produced and has to be ingenious.

- Where an inward supplies are received from the taxpayer, who must be registered against the tax invoice.

- If at any time goods are being sold to an outgoing foreign tourist without charging any tax and further sold against the foreign exchange.

- The GSTIN & the name of the retail outlets are cited on a tax invoice of the Inward supply.

- Any other conditions that may be specified from time to time.

Procedure to Claim Refund GST at Duty-free shops

A Duty-free shop is eligible to claim refunds of the accumulated ITC by registering in form GST RFD- 10B on the quarterly and monthly basis solely dependent on frequency of furnishing GSTR – 1 at the retail outlets.

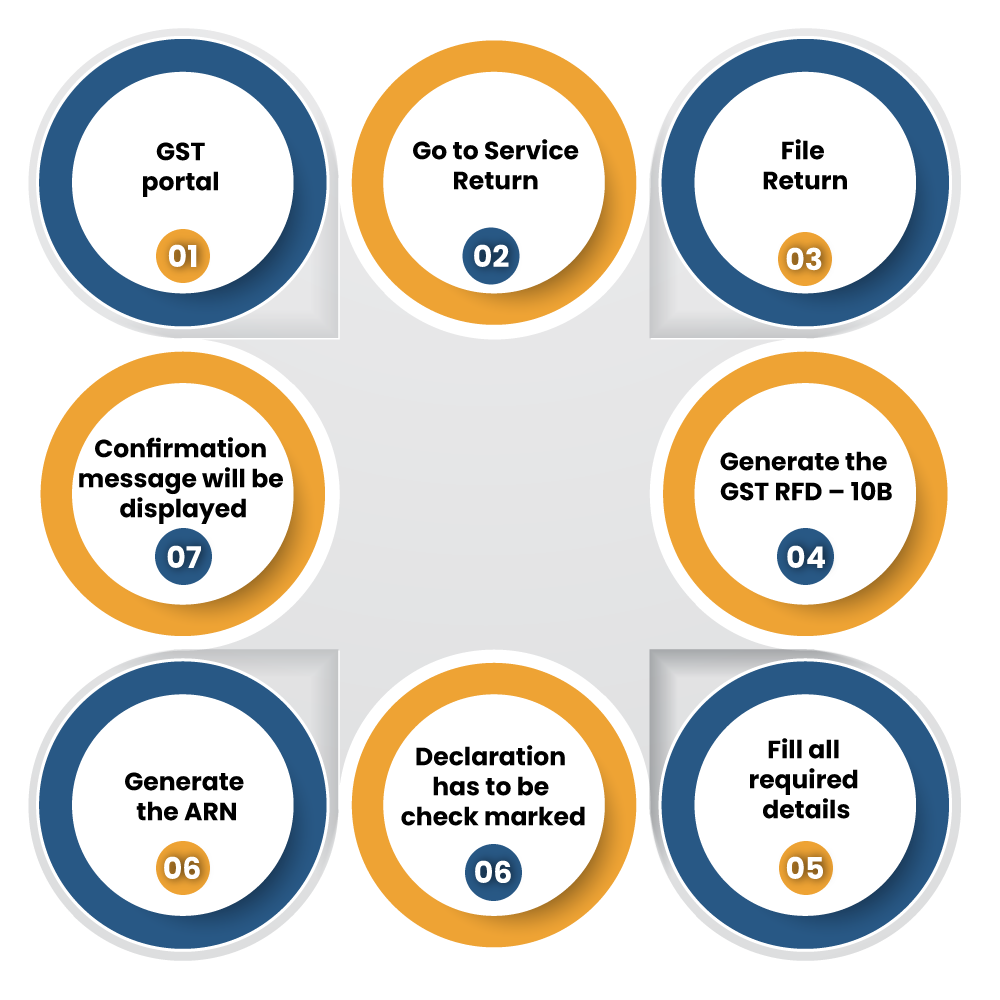

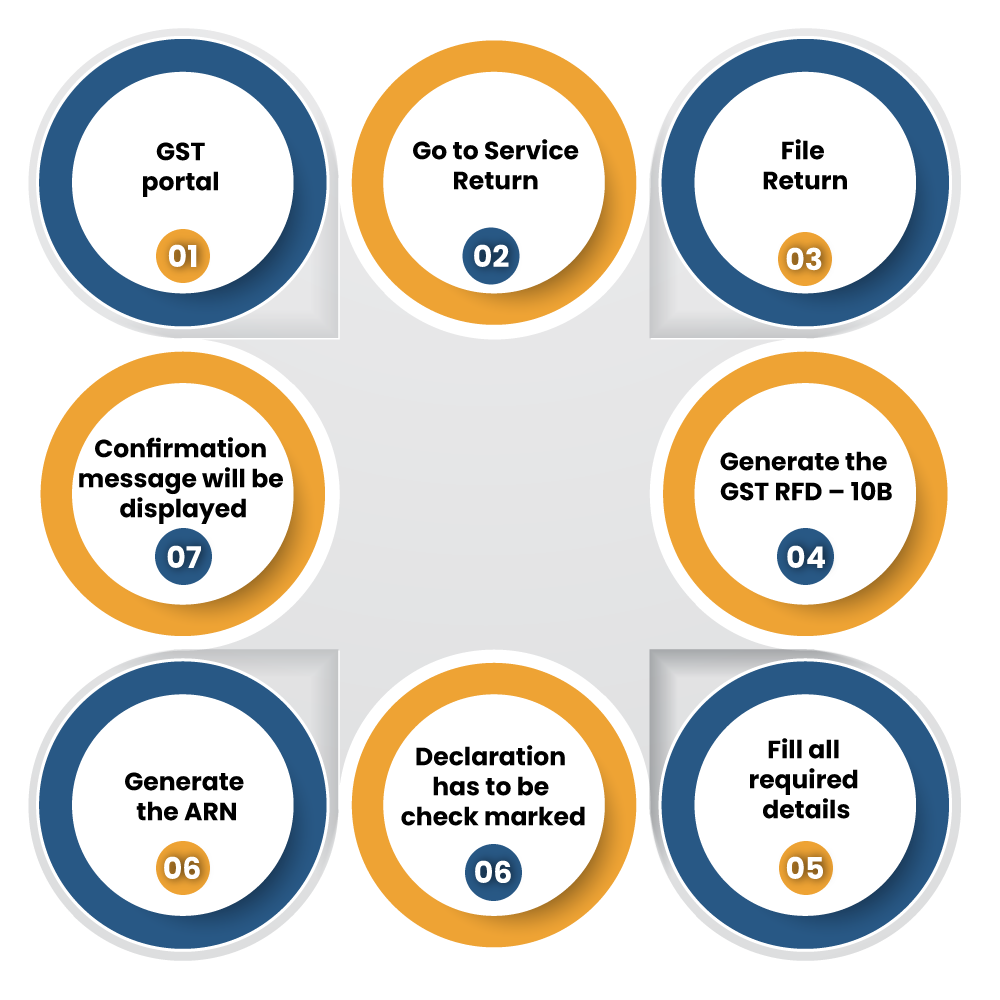

The following procedure to claim a refund-

- The first step log in to GST Portal[1].

- Then, Go to Service -> Return Dashboard -> File Return.

- After this click the search button to generate the GST RFD – 10B.

- Fill all required details such as name, address, GSTIN, amount of refund claim and the tax period. The details of the supplies must be provided and its refund.

- Fill all bank details, including the name of a bank, type of bank account, address of the bank, IFSC code, MICR code, etc. to receive the refund.

- After that, a declaration has to be check marked and further submit after attaching a certified signatory.

- On successful submission, the system will further generate the ARN; after that, the message of confirmation will pop up. The taxpayer can check their refund status by using the track application under the refund tabs.

Landmark Judgment on GST at Duty-Free Shops

In a matter of Krishna V. Union of India, the Division Bench of Hon’ble High court of Allahabad consist of Justice Rajnish Kumar and Justice Pankaj Kumar Jaiswal have clarified that the supply or sale of goods at the Duty-Free Shops at the departure and the arrival terminals of international airports can be considered as exported goods under customs laws in India and will be regarded as the exported goods under the GST Act. Hence, any purchase made from the Duty-free shops cannot be taxable, and no tax shall be levied.

Conclusion

Hence, it is clear that the goods can be called exported only when they cross territorial waters of any domestic country. However, they cannot be called the exported goods by just merely crossing the Custom frontier of a country. The benefit of tax exemption will only be obtained by an international tourist who is going outside India. Further, all the conditions have to be fulfilled to obtain the benefits of the GST exempt.

Read our article: GST Exemption on Satellite launches for Encouraging the Domestic Launch