The advent of Goods and Services Tax has impacted many sectors across the country in one way or another. It has also triggered the changes in the finalization of the account. Unlike older regimes, account treatment of GST is easier and less complicated due to the presence of fewer taxes. However, institutions are required to adopt a cautious approach when it comes to handing the GST record keeping to maintain compliance. This write-up will brief you on everything regarding GST accounting and the finalization of account.

Overview of Finalization of Account

The finalization of account refers to the closure of entry in the book of account for a particular financial year. The process of finalization of account initiates with the preparation of Trial Balance based on the ledger account. The trial balance is further used to prepare the final account i.e. Profit and Loss account and trading account. The income and the direct expenditures are then routed to the trading account.

Given the above, the gross profit is calculated which further carries forward to the Profit and Loss account. The P&L also encloses indirect expenses and gross profit. The next step is to calculate the Net profit which can be obtained by subtracting indirect expenses from the indirect income. The net profit is meant to be transferred to the balance sheet along with the capital account.

This is what the finalization of account is all about. In this blog, we would take a look into finalization of account from the GST perspective. Let’s move to the following sections to obtain information regarding GST accounting and the finalization of account.

Accounts and Other Records

Every taxpayer under GST registration is required to maintain the accounts and other important records at the principal place of business.

Who will be Accountable for Maintaining the Accounts under GST?

It is the accountability of the following individuals to handle specified records-

- The owner

- Operators working in the warehouse or any other place where goods are being stored.

- The owner of the transporting company.

- Every taxpayer whose annual turnover surpasses the threshold limit (2 crores) should handover their account credentials and records to the Charted account for auditing.

Records under GST

Every registered individual ought to maintain the record of the following components, which are as follows:-

There different types of accounts to be managed that companies require keeping under GST. For instance, under Goods and Services Tax, a trader is responsible for maintaining the given account except for accounts like sales, purchase, and stock.

- Input CGST account

- Output CGST account

- Input SGST account

- Output SGST account

- Input IGST account

- Output IGST account

- Electronic Cash Ledger (maintained on the GST portal)

Read our article:Everything you Need to Know about Benefits of GST Registration

Accounting Entries under GST

Despite initial transaction hurdles, Goods and Services Tax would impart transparency in a different part of the business including bookkeeping and accounting.

While the majority of the accounts are under GST, record-keeping for accounting entries has now become considerably easier. This allows the traders to set off the input tax with the output tax on the sale.

Electronic Cash and Credit Ledger

Every registered person has to maintain three ledgers under GST which is typically generated automatically during the registration time.

Electronic Cash Ledger

The ledger act as an electronic wallet, where the taxpayer must deposit money to the wallet – electronic cash ledger. The funds in the wallet will be used to make payment.

Electronic Credit Ledger

The input tax credit (ITC) on purchases will be shown here, particularly under IGST, CGST & SGST. The registered person can easily use the balance reflected in this account for the payment of tax only. Please note that the said payment cannot be used for interest or penalty.

E-Liability Ledger

This ledger meant to reflect the total tax liability of a taxpayer after netting off for the specific month. This ledger is generated automatically.

Period for Retention of Accounts under GST

Under the GST regime, every taxpayer supposes to maintain the account books and record for a minimum period of 6 years (72 months). The period would be started from the last date filing for yearly return for that financial year. Keep in mind that the 31st of December is the date of filing the yearly return.

If the registered person has faced any proceedings in the past before First Appellate or is under legal scrutiny then he is liable to maintain the books for one year after the order of said appeal has been passed.

Consequences of Not Maintaining Proper Records

In case of the violation of the record-keeping norms, the registered officer can consider the unaccounted goods/services as part of a successful supply. In such an event, tax liabilities will be imposed on the said goods and services according to the slab rate.

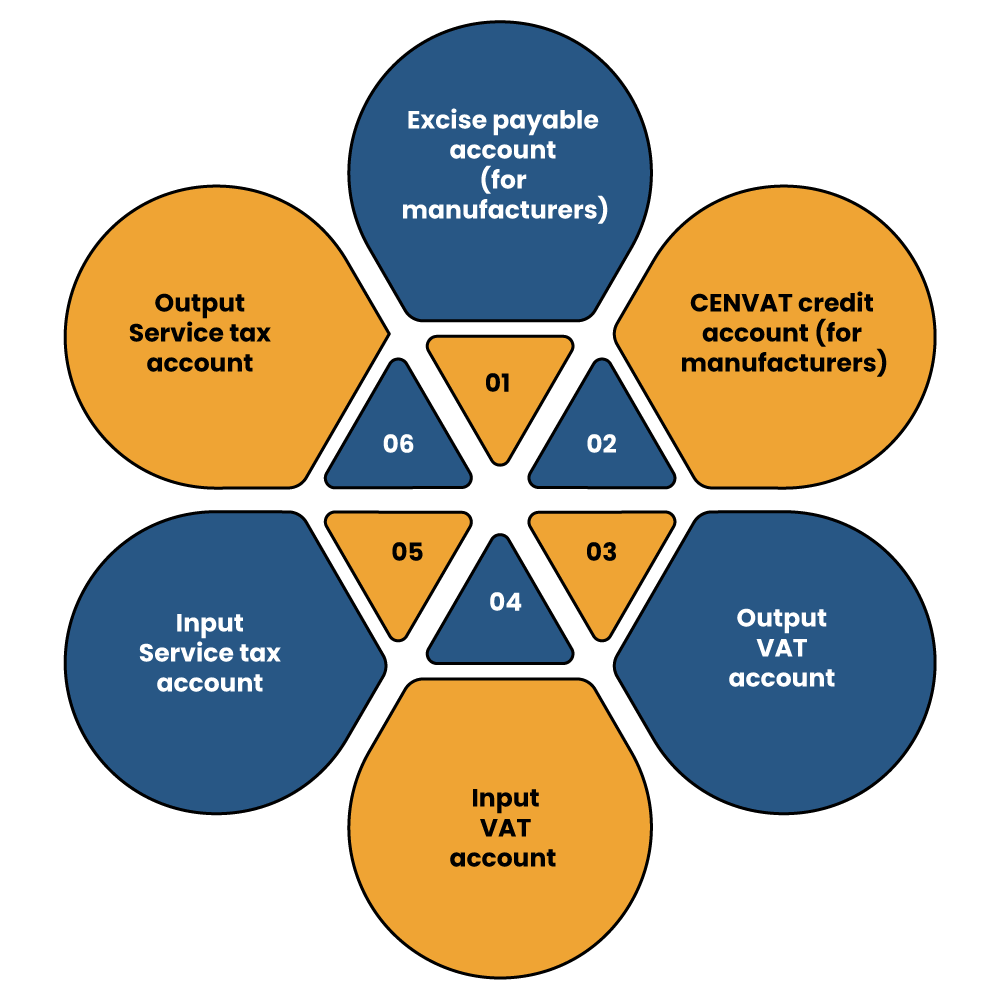

The scenario under VAT and Excise

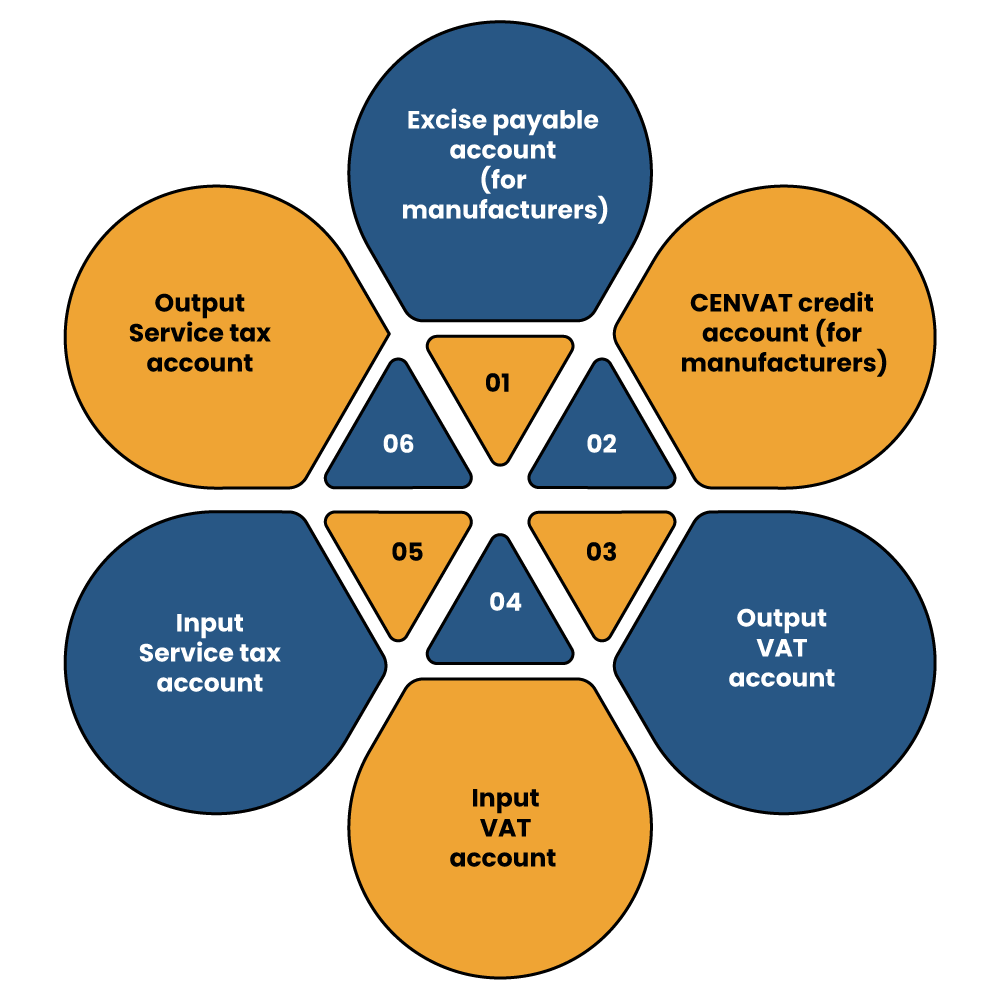

Individual accounts had to be maintained under CST, excise, VA, and service tax. The following list shows the different account that businesses were liable to maintained under the old regime (this doesn’t include sales, purchase, stock)

Calculation of GST in Accounting

At present, there are seven slab rates for good under the Goods and Services Tax method, with each securing a particular schedule for itself. As per the GST regime, there is 5 slab rated for various services. Tabular Representation of GST Rate

| Schedule Number – Service Number | GST Rate |

| I – I | Nil |

| II | 0.25% |

| III | 3% |

| IV-II | 5% |

| V -III | 12% |

| VI – IV | 18% |

| VII – V | 28% |

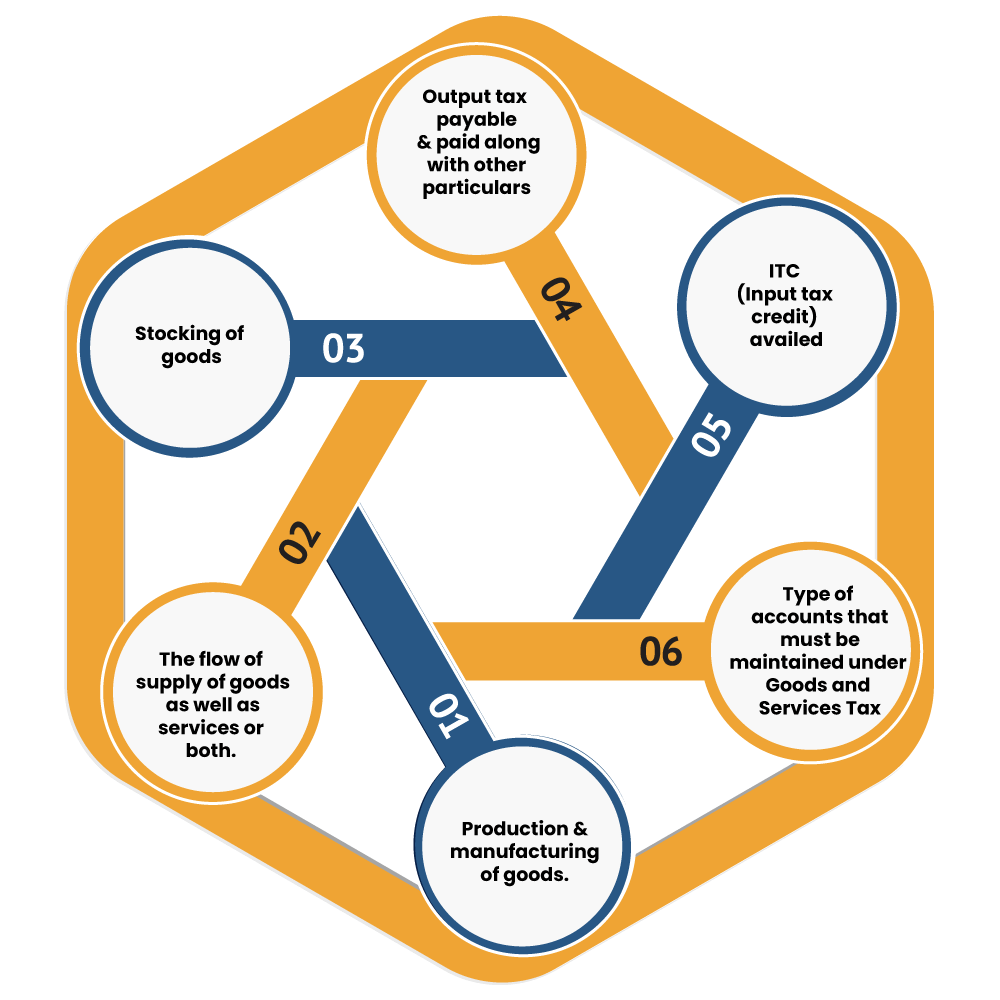

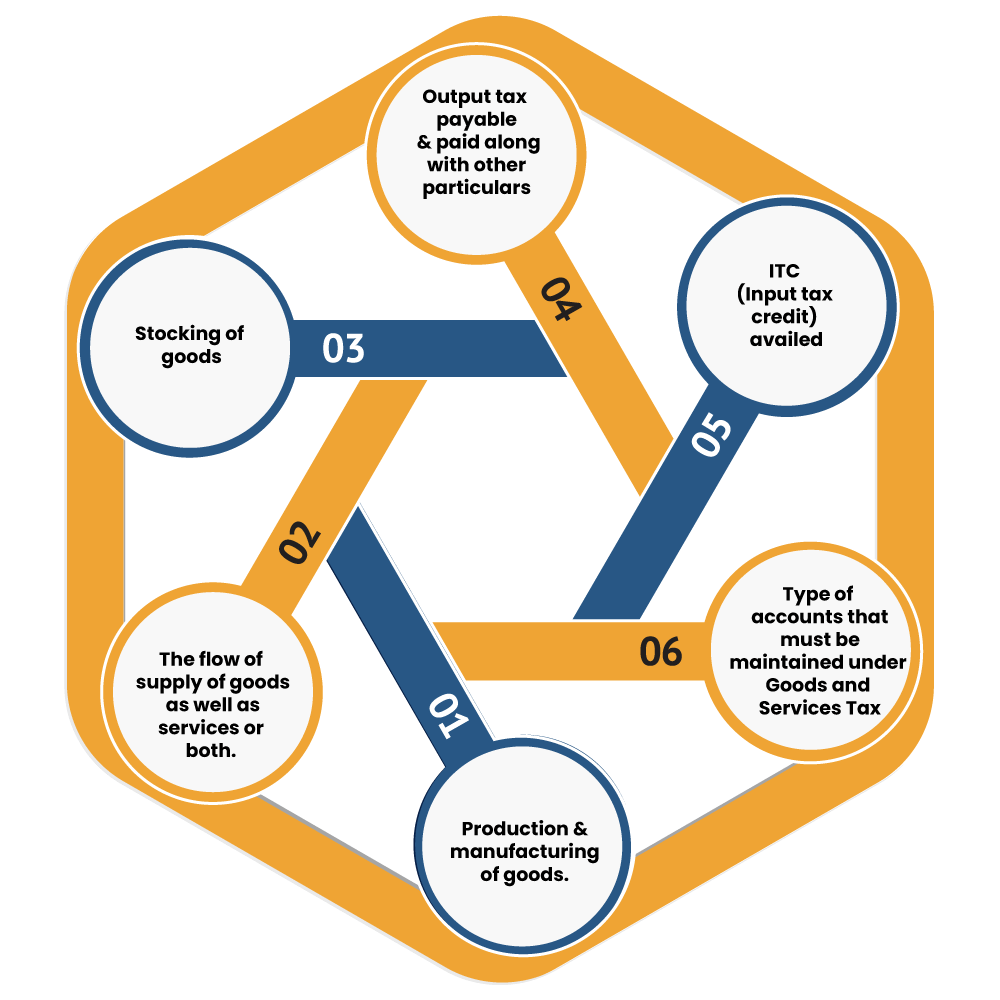

Procurement of record under GST (from finalization of the account perspective)

The following taxpayers are liable to maintain records under GST law;

- Owners of the company

- Warehouse operators

- Owner of transporting company.

- Registered taxpayer with an yearly turnover more than INR 2 crore

Following records must be maintained the above individuals:-

- Production of goods

- Transaction of goods or services

- Goods available in the warehouses or in the internal facility.

- Availed ITC, i.e. Input tax credit

- Output tax payable

- Output tax paid

- Other particulars

GST Turnover Reconciliation Vs Revenue Recognition

Examination of turnover rate wise to ensure correctness of GST liability, which are as follows:-

- Determine if HSN and rates are accurate.

- GST impact on year end discounts

Volume discounts passed on end of the year decreases the taxable value as well as GST liability. Auditor to make sure that an agreement was entered into prior supply started and the discount can be linked to relevant invoices. If not, discount will not affect the taxable value.

Examining other income to Evaluate GST Liability scrap sales

Whether GST has been charged on the sales of fixed assets, where income tax credit has not been availed, GST liability would be imposed on the gross sale consideration. However, in cases where income tax return has been availed and the asset is sold in the time span of five years, the GST payable will be greater than (a) sale consideration and (b) reversal of proportionate ITC claimed.

GST liability = higher of (a) and (b)

Settle the income tax return claimed on expenditure with the amount debited to P&L account. For companies following Indian Accounting Standards, having lease rental payablesØ for long term lease (> 1 year), there will not be a line item in P&L as “Lease charge”, as the same is accounted under Financial cost. This will form a line item in settlement of expenses debit in regards the ITC claimed.

- Evaluation of expenses heads for the accounting of Reverse Charge Mechanism (RCM) liability and payment thereof.

- Check whether Accounting for TDS receivable has been accepted online and return filed.

- Determine whether the claims regarding the return have been registered in time, as per the RBI’s guidelines.

- Analyze payables to make sure that all invoice on which income tax return has been claimed have been paid within eighty days. Else liability plus interest to be rendered and ITC to be reversed.

- Go through the export receivables w.r.t supply of service to determine the presence of any amount outstanding for more than one year from the date of export.

- In such conditions, GST is payable on the liability is to be provided or on amounts not realized along with the interest.

- Status of refund claims (pending ones).

- Consolidation of GST based figures in financials.

- Net off ITC/TDS and GST liability excess cash paid- Final balance to be mentioned under other current liabilities or assets.

Conclusion

The finalization of the account refers to the closure of entry in the book of account for a particular financial year. The process of finalization of account starts from the preparation of Trial Balance[1] based on the ledger account.

So this is all about the finalization of account. If you still have some issues in relating GST accounting aspect with the said topic, drop queries in the comment section. The CorpBiz’s professional will responds to your queries in no times.

Read our article:Interest on the Late GST Payment would imposed on Net Cash Tax Liability