A Non-Banking Financial Company, aka NBFC, is primarily a money lending entity that operates as per the guidelines of Reserve bank. These entities are registered under the Companies Act 2013. The primary business area of NBFCs is credit lending. In addition to that, they also engaged in the business of shares, securities, leasing, and hire purchase. However, there are some exceptions for NBFCs as far as their scope of business is concerned. They are not permitted to serve business areas like agriculture, industry, trading of goods, or construction. Apart from this, NBFC also focuses on the business of accepting deposits. In this write-up, we will talk about RBI’s role in the Acquisition/Transfer of Control in NBFC.

First Step towards the Incorporation of the NBFC

Forming a company is the first step toward the incorporation of the NBFC. Some of the documentation which is needed for forming a company are as follow:-

- Article of association

- Memorandum of Association.

- Director’s identification and address proof.

Article of Association

The Articles of Association enclose rules and regulations that govern the company. Moreover, it also includes the percentage of ownership as well as ownership structure. Any change in the ownership of NBFCs seeks permission of ROC i.e. Registrar of Companies. It means that – if the company member seeks transfer of control within the company, then ROC’s intervention is compulsory for the completion of the process.

But before approaching ROC for approval, the shareholders must convene a general meeting to take a collective decision on such a matter. In the same scenario, NBFCs also require to obtain prior permission in the event of a transfer of control within the company.

RBI is the regulatory authority of the NBFCs. The Reserve Bank on regular intervals rolled out various circulars regarding the activities of NBFCs in India. One such notification is the approval needed from the Reserve bank for Acquisition/Transfer of Control in NBFC.

Circular Released by RBI for Acquisition/ Transfer of Control in NBFC – 2014

A few years back, the Reserve Bank rolled out a notification “CC.No.376/03.10.001/2013-14” regarding the acquisition/transfer of control in NBFC. According to the notification, the members seeking alternation in the company’s control are required to avail prior permission from Reserve Bank.

Section 45 IA (4)(c) of the RBI Act[1] states the NBFC registration certificate cannot be granted to the company if the character of the new promoter hinders the interest of the depositors or public status in any sense. Before the release of this notification, the Reserve Bank rolled out a circular in 2009 that addressed the same area of interest. But it only addressed the deposit-taking NBFCs operating across the country.

In the purview of the above notification, RBI in 2013-14 released another circular that stressed the same area of concern. According to the notification, the prior approval of RBI shall be needed in case of-

- Acquisition of shares of an NBFC in the event of the takeover

- Merger/amalgamation with another entity serving the same business area.

- Any merger/amalgamation that results in the acquisition of shares over ten percent of the paid up capital.

- Addressing the tribunal u/s 391-394 of the Companies Act, 1956 or under Section 230-233 of Companies Act, 2013 to avail order for the merger.

The circular further gave the reference of previous notification (released by RBI on May 26, 2014) that directs that NBFCs follow the guidelines under Section 45K and 45K. Any transfer of shares in contravention of the respective sections shall attract severe penalties.

RBI’s Circular released on 2015-16 for Acquisition/ Transfer of Control in NBFC

The Reserve bank brought out a new update regarding the acquisition and transfer of control for an NBFC in the year 2015. The circular seeks to replace the previous notification that was promulgated in 2014. The Reserve Bank examined the previous guidelines on acquisition/transfer of control for NBFC released in the year 2014.

During the assessment, the Reserve Bank laid down the process of acquisition/transfer of control in NBFC in the purview of the notification released in March 2015. While certain recommendations were identical to the past notification, the Reserve Bank made several changes. The given list exhibits the series of recommendations made by the Reserve Bank:-

- The Reserve Bank emphasized the requirement of writ approval from the NBFCs in case of acquisition/transfer of control in NBFC.

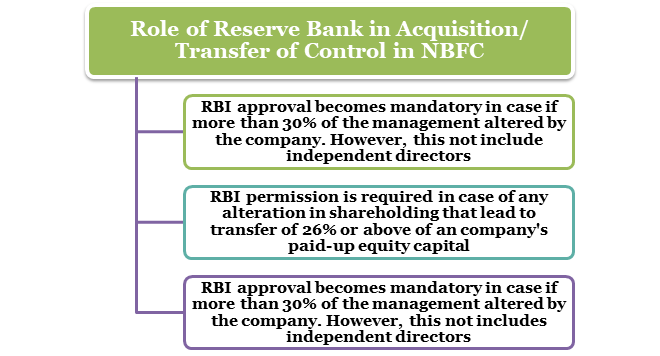

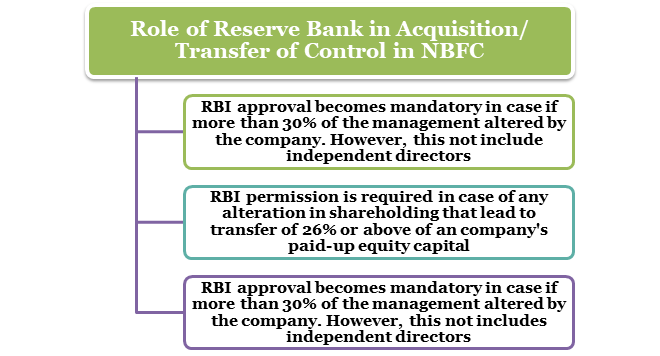

- Writ approval is needed for any acquisition, alteration, or transfer of control in the Non-Banking Financial Companies. The RBI’s permission is mandatory regardless of whether there is an alteration or not in the NBFC’s management.

- Any change in control of the company must reflect in the shareholding pattern as well. If the shareholding pattern alters over time, then writ permission is needed from the Reserve Bank.

- Writ permission from Reserve Bank is vital in case if the shareholding pattern changed in the excess of 26%. However, this rule would dissolve in the event of the change of shareholding occurs due to buyback of share or in the situation where there is a legitimate capital reduction procedure.

- Directors cannot be replaced without Reserve Bank’s approval. If a significant change occurred in the management by replacing more than thirty percent of members (excluding independent director) then RBI’s approval becomes mandatory in such an event. However, RBI does not intervene in the matter of re-election or retirement of the directors.

Alteration on the Management

Apart from the aforesaid guidelines, the NBFC has to consistently intimate the Reserve Bank in case of any alteration on the management and shareholders in the company. This would also be compulsory under NBFCs acceptance of Public Deposits Direction, 1998.

Apart from that, the regulations like Systemically Important Non-Banking Financial (Non-Deposit Accepting or Holding) Companies Prudential Norms (Reserve Bank) Directions, 2015 and Non-Systemically Important Non-Banking Financial (Non-Deposit Accepting Holding) Companies Prudential Norms (Reserve Bank) Directions, 2015 directs NBFCs to reveal the change of ownership.

Procedure for Prior Approval from the Reserve Bank regarding Acquisition/ Transfer of Control in NFBC

NBFCs are required to follow the given procedure for filing an application related to change in control:-

- The NBFC should make a writ application on the company’s letterhead for availing permission from Reserve Bank for NBFC takeover. While applying, the NBFC must add the aforesaid changes of control in the NBFC.

- The given documentations have to furnished by the applicant along with an application

- Detail info regarding the proposed directors or shareholders. This will enclose information related to key management executives serving the company.

- Information regarding the source of funds in the Non-banking finance companies.

- A written declaration is prepared by the shareholders regarding their non-association with companies that accept the public deposit.

- A declaration prepared by shareholders and director regarding their non-association with any form of companies

- The written declaration from the director regarding their non-involvement with any nature of offense and bankruptcy.

- The declaration from directors showing that they have no pending cases u/s section 138 of the negotiable instruments act.

- A banker report

- The application needs to be submitted at the RBI’s regional office where the NBFC is carrying out its operation.

Role of Public Circular related to Share’s Acquisition

If the NBFC has made some alternation in the management or transfers their shared to other entities, an application has to file with the RBI regarding the same. But before applying, the NBFC must share the matter with the general public through a notification.

The NBFCs are required to follow the given guideline regarding the promulgation of the public notice.

- The issuance of the public notice must be done only in the event of a transfer of ownership or sale of a share in the NBFC. Internal trading of shares does not play a pivotal role in the transfer of control. Parties involved with the transactions are also accountable for sharing the matter publicly via notification. But before the promulgation of such a notice, the parties must avail permission from the Reserve Bank.

- The public should reflect the seller’s intention. In addition to that, the public notice must enclose the nature of the transaction, market strategies that help the management in decision–making, and the factors that influence the management for changing the ownership. The notice must be promulgated conventionally i.e. via the national and local newspaper.

The 2015 directions came up with significant changes when contrasted with previous directions. These provisions would only come into effect in the following events:-

- Transfer of control

- Alteration in ownership and shareholding pattern of NBFC.

- Selling of shares

Post-Public Notice Procedure

After the expiration of the notice period, the company has to hold a board meeting to draft a resolution. The resolution must enclose the agenda related to the appointment of new shareholders and Directors for the NBFC.

After drafting the resolution, the company has to apply Form – DIR 12 (2) with the ROC within thirty days of the resolution. The company must also adhere to the compliances related to the transfer of shares. After this, the external advisor would conduct a valuation procedure for a change in the share value. Respective stamp duties apply to the shares that have to be paid with an exception.

RBI Notification

After the successful completion of the procedure, the NBFC would have to formally inform the Reserve Bank with documentations like the ROC form, DIR 12 Form, resolution passed in the board meeting regarding the share transfer of the company.

Conclusion – Acquisition/Transfer of Control in NFBC

The Companies Act requires companies to avail prior approval from the ROC in the event of a transfer of control in the company. After availing of the mandatory approval, the company is permitted to deploy these changes. Likewise, prior approval is needed from the Reserve Bank to complete the aforesaid tasks.

The NBFC must adhere to the compliances and bylaws regarding the shareholding status and change in the top management, directors, and shareholder in particular. After availing RBI’s approval, the NBFC is liable for sharing the matter via notification with the general public. Overlooking such a requirement would land the NBFC in the vicinity of the legal penalties that also includes the revocation of Certificate of Registration.

Read our article: Growth Prospects for NBFC P2P Lenders in 2020 amid NBFCs Crisis