The NBFC P2P lenders, which provide direct lending and borrowing via digitally-driven platform have seen a constant surge in business growth in the middle of the credit crisis across NBFCs. While P2P lenders’ activities are governed by RBI, the regulator keeps the lending data safe from being exposed to the general public. In this blog, we will look into some facts that provide a substantial reason why P2P lenders are witnessing rapid growth amid the NFBC crisis.

Infrastructure Leasing & Financial Services in 2018

The recent surge in the growth of these platforms has been led by borrowers of NBFCs who have lower down the fresh disbursement due to stringent liquidity conditions. Globally, Peer to Peer Lending skyrocketed after the 2008 recession when many institutions opt to fork out active lending from the small scale entities due to liquidity crunch. Since there is an identical scenario in our country, the P2P lending platform witnessed exponential growth in the preceding years.

The collapse of Infrastructure Leasing & Financial Services in 2018 has hit the NBFCs to the very core which eventually raised the condition of liquidity crisis for them. Since then liquidity via financial institutions and debt markets has been constrained. Lower credit disbursals from conventional NBFCs have benefits P2P platforms to a great deal that caters to specific areas such as asset-financial, consumer finance, MSME lending. The swift surge of growth in the P2P business models has not come due to stringent standards set by the well-established NBFCs, but because of the lack of credit in the system.

Read our article:An Overview on P2P lending Framework Impacts on Indian Economy

Scope of Supply

Since P2P platforms benefit individual’s borrower hunting for credit[1] from potential lenders, a surge in demand must be matched by the surge in supply to ensure volume growth. According to the sources, individuals with considerable capital may be prevented from invested funds into P2P platforms due to regulatory authorities and subpar experience with the asset class. The platform reportedly lures thousands of investors in the past few months that previously were inclined towards the mutual funds.

Similarly, many platforms have catered to retails investors through strategic collaboration with hundreds of wealth management players who considered P2P investing as an alternative to capital-market investments. Apart from straightforward lending, some of the P2P lending platforms, many have launched SIP and monthly income plans for investors. The experts of such a platform believe that such activities could generate ample funds for P2P businesses.

At present, RBI confined the loan disbursal limit for all the P2P platforms at Rs 50 lakh and the borrowing limit has been limited to Rs 50,000. RBI scales up the limit with an aim to broaden the access to the P2P platform that gradually cements their place in the financial market. P2P lending platform is still in the nascent phase and seeking an established model to ensure seamless growth. It will take time for this business model to scale up and offers any rivalry to mainstream lenders. The majority of the investor will not be attracted to this business model until it gains some credibility over time.

Unsecured loans

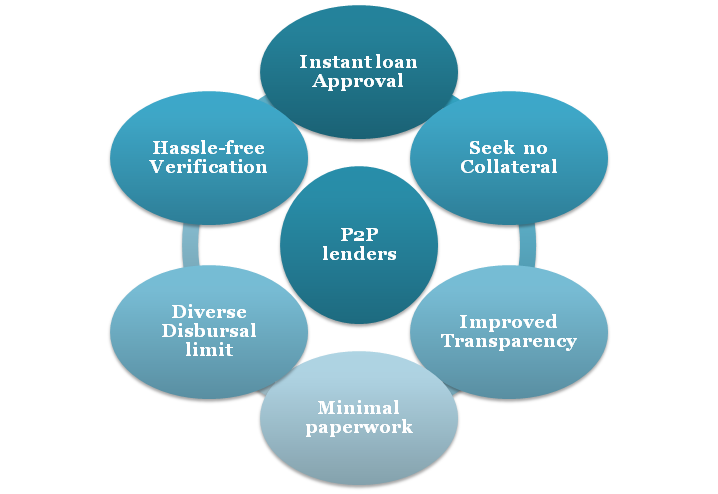

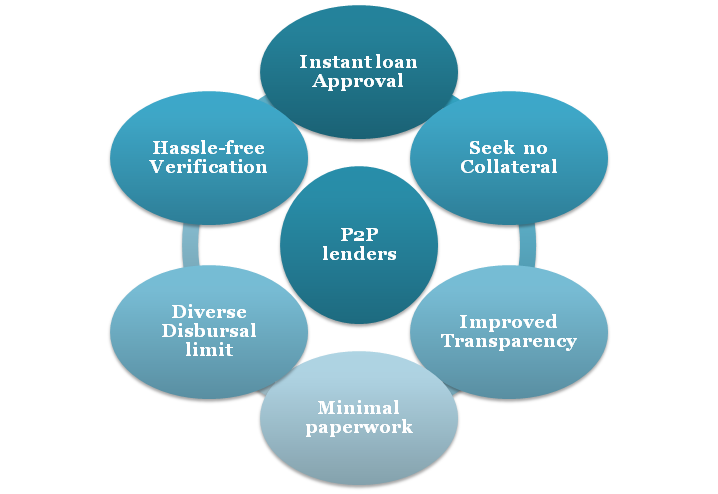

P2P lenders are often touted for providing hassle-free credit with no requirement of collateral. Now individual with poor financial background can approach these portals and apply for loan in no time. This is something that makes them really special as compared to conventional banks where availing loan is a tiresome process. In the purview of this capability, the P2P lenders might witness rapid growth in the upcoming times.

What are the Growth factors for P2P lenders?

P2P lenders are growing rapidly due to the following reasons. Those are as follows:-

Lower Interest Rates

P2P lending renders credit at a minimal rate of interest in a space wherein options for loans are limited. Therefore, it is a suitable option for small businesses located in rural areas. It also minimizes the scope of an intermediary to a great extent.

Alternative Supply of Credit

NBFC-P2Ps are empowering people to inject their savings into an asset-class that led them to earn more than from conventional banks and financial institutions. The formation of such a supply of credit is moving benefits to people residing in rural areas and it is discouraging them to avail credit from un-organized sector.

Better Accessibility

Undoubtedly, mainstream bankers have a better coverage pan India, but a limited reach in a rural area. This is where NBFC P2P lenders come into the picture. They can cater to such areas with proficiency and minimum constraint since they are capable of disbursing credit without collateral.

Easy Process for Lending

The element of ease linked with peer to peer lending is one of the prominent reasons for increasing its popularity in rural sections. On the contrary, conventional sources of financing are time consuming and tiresome. For entrepreneurs residing in rural areas, time is often considered as a primary criterion for obtaining funds. NBFC-P2P platforms get rid of unnecessary paper works and tiresome processes leading to faster and hassle-free. The demand for lending facilities like NBFC P2P lenders is pushed to increase landscape in upcoming years and it will attract more and more aspiring entrepreneurs.

Conclusion

The ongoing COVID-19 crisis has limited the scope of credit for the individual living in the unprivileged section of society. In the addition to that, NBFCs, which often regarded as the saviour of the lower-income group, also dealing with its loopholes and constraints. These are probably the reasons why NBFC P2P lenders are thriving like never before. Instant loan approval, hassle-free verification, and quick disbursal are the forte of these platforms.

Read our article:How to Avail NBFC P2P License in India?