The Union Budget 2021-22 has seemingly growth-oriented with a sharp rise in CapEx* allocation up to 26% YoY & emphasizing manufacturing as a pivotal part of the economy while allowing for a higher fiscal deficit, considering the low-interest scenario. In this article, we will examine the Underlining Importance of Budget 2021 for NBFCs and Bank.

Union Budget has pegged fiscal deficit at 9.5% for the financial year 2021-22 of the Gross Domestic Product (GDP) & 6.8% for FY 21-22. The fiscal deficit target has been higher than the market expectation for either fiscal year. The anticipation for the financial year 20-21 was 7.5%, whereas, for FY21-22, it was around 5.0%-5.5%.

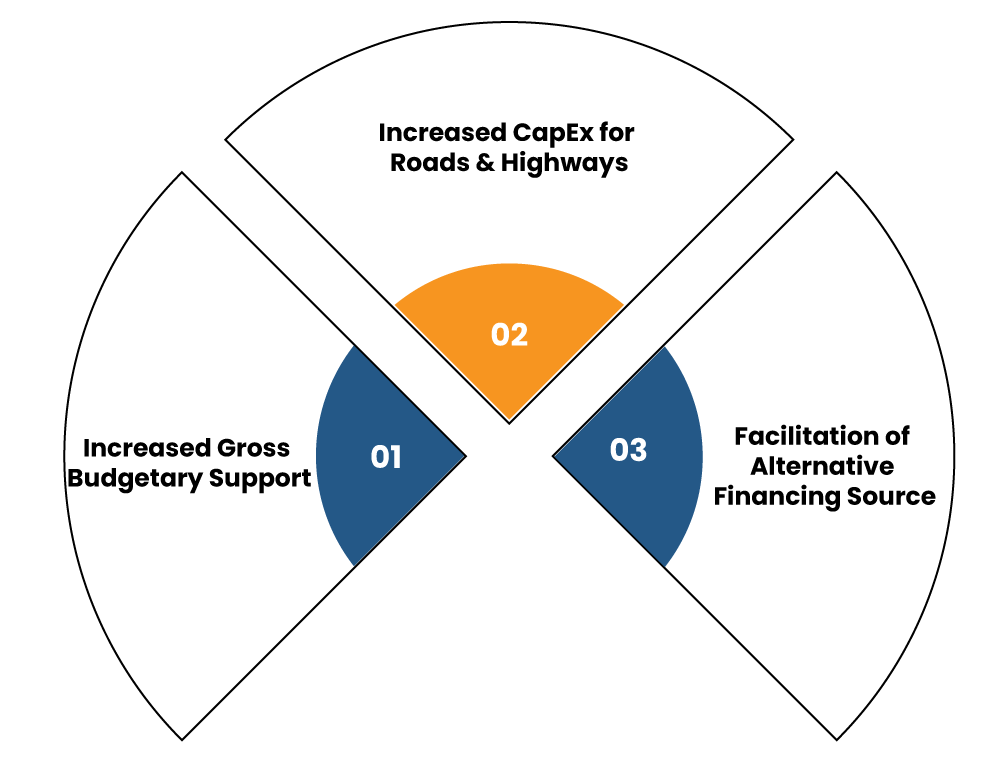

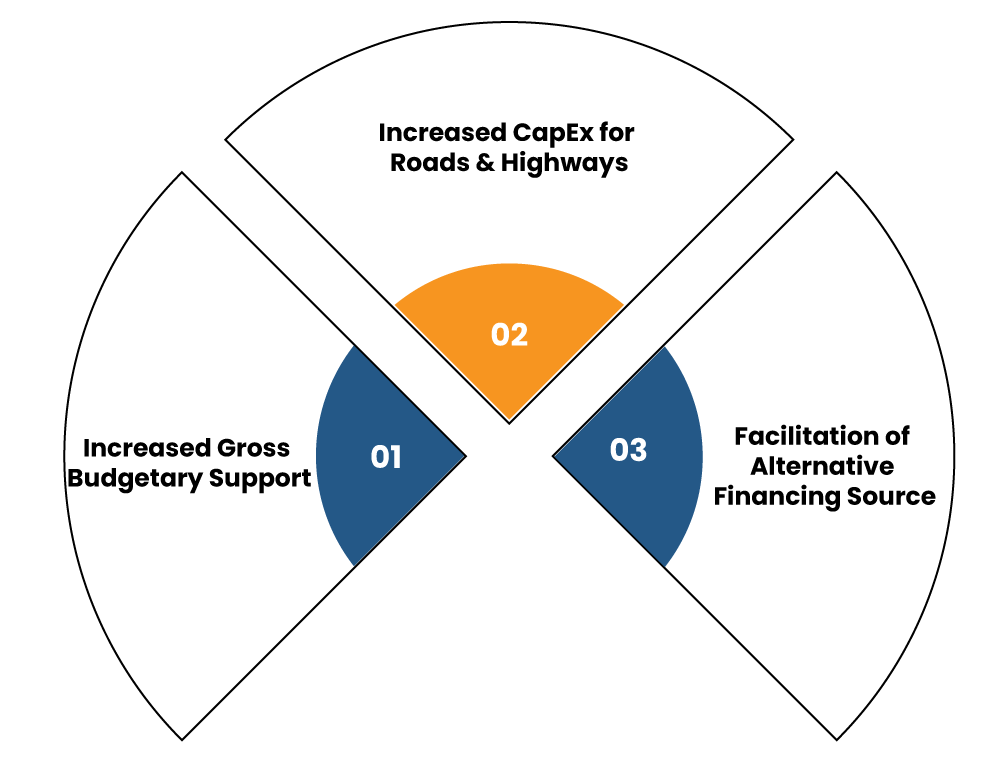

Infrastructure Measures Proposed in the Union Budget 2021-22

The Union Budget 2021-22 seeks to address the following areas of infrastructure to ensure financial well-being of the nation:-

Increased Gross Budgetary Support

As expected, the Government of India has increased its expenditure gross budgetary support (aka GBS) allocation by 26% YoY to INR 54 lakh crore to expand infrastructure spending for economic revival. Moreover, INR 2 lakh crore towards additional CapEx, allocation of INR 20,000 crore toward establishing DFI to procure lending portfolio of worth 5 lakh crore over the span of the three years.

This will help mobilize funding to meet NIP and create growth opportunities in vital sectors such as roads, defense, infrastructure power, railways, etc.

Increased CapEx for Roads & Highways

Roads & Highways were the two most important segments of infrastructure. On the CapEx front, for roads & highways, the revised estimate is pegged @ 12% at 92053 crores compared to budgeted estimates of 81975 crores.

Even for FY22E, the Indian Government has set out the road CapEx at INR 108230 crore. The decision will likely to benefits NBFCs and Banks on account of providing finances for commercial vehicles.

Read our article:Fintech Startups Aiming for NBFC License Despite Several Challenges

Facilitation of Alternative Financing Source

The Indian Government envisaging facilitation of alternative financing source by funding five operation project worth around INR 5000 crore via NHAI inVIT

Bringing PSU Banks to the Center Stage

Establishing Asset Reconstruction and Management Company (aka ARC) or bad bank to acquire prevailing stressed assets for resolving recovery issues still remains optimistic for the banking sector, particularly PSU banks. Moreover, INR 20,000 crores capital infusion to improve PSU banks’ balance sheet & trigger growth.

After this, the Government of India announced a merger of 13 PSUs into five central banks, supporting the privatization of state-run banks. Additionally, the Government also announced two Public Sector Banks’ divestment to speed up expected banking sector reforms.

Impact on NBFCs and Bank:- Decision would definitely enable stressed NBFCs to cope up with surging collection issue.

Augmentation of Farm Income

The Government has remained proactive to increase farm income with record-breaking procurement of farm produce for domestic agriculturists and farmers for FY 21. Rice and wheat procurement for FY 21 stood at INR 1.72 and 75,000 crores, respectively.

For Micro-finance, it also provided a doubling of fund under NABARD for FY 22 at INR 10,000 vs. INR 5,000 crores in FY21. Union Budget 2021-22 has provided a target for agriculture credit at INR 16.5 lakh crore. It also provides detail about the inculcation of agricultural infrastructure & development cess on certain products.

Impact on NBFCs and bank: The decision would provide major relief to the stressed microfinance institutions that largely depends on rural section of the nation to provide financial services.

Commercial Vehicles Space to Witness Momentum in the Budget 21-22

For Automotive space, the Union Budget 2021 has announced a voluntary vehicular scrappage policy related to commercial vehicles older than 15 years & personal vehicles for older than 20 years. Firms in a value chain such as tire chemical suppliers, OEMs, and forging stand to gain as an outcome. Other initiatives in infrastructure and agricultural space are favorable for various automotive OEMs.

Budget Developments on Direct Taxes for Individuals

- No considerable changes in IT rate for corporate or individuals

- Unit-Linked insurance products (aka ULIPs) with premiums higher than INR 2.5 lakh/annum will be subject to tax on maturity. It will ensure the arrival of taxation on higher-level Unit-Linked insurance products at par with mutual funds.

- Tax exemption on interest availed on employee’s contribution towards various PFs has been limited to the yearly grant of INR 2.5 lakh.

- Additional deduction of INR 1.5 lakh on housing loan’s interest for affordable housing has been extended up to 31st March 2022. The scheme came into existence in the 2019 budget.

Disinvestment Agenda Receives A Momentum in Budget 21-22

- In the Union Budget 21-22, the Finance Ministry unveiled the ₹ 1.75 lakh crore for investment. It’s important to note that the already announced strategic stake sales would be completed in FY22E. Furthermore, the Niti Ayog has been assigned to work on a given list of PSUs for disinvestment.

- Companies in which stake of the Government would be monetized next year have included a general insurer and two banks. The LIC India would also form a part of the disinvestment agenda for Financial Year 22.

- The Government of India[1] has unveiled an asset monetization plan for monetizing various operational assets such as, NHAI toll roads, power transmission projects, warehousing assets, oil & gas pipelines, sports stadium, 2/3 airport assets, etc.

Unexpected Surge in Fiscal Deficit & Government Borrowing

Owing to a higher deficit, the borrowing rate would be higher from the bond market. The finance minister has rolled out an additional INR 80000 crores of market borrowing in the existing FY; meanwhile, for the financial year 2021-22, an overall market borrowing is pegged at INR 12 lakh crore.

The bond market was anticipating the gross borrowing of around INR 10 00,000 crores for FY 21-21. Accordingly, the bond market has been disappointed with on announcement on the inclusion of Indian Sovereign bonds in worldwide bond indices, thereby ensuring significant inflows.

Conclusion

Financial Sector provides much-needed resilience to the nation’s economy. It has been one of the vital areas in the overall scheme of routing back demand and strengthening the NBFCs and Bank operating pan India. Faineance Ministry has announced INR 1 lakh crore fiscal aids during the prevailing financial year.

This would act as an additional fiscal source for the Non-Banking Financial companies across India. So clearly, it would resolve the liquidity crisis for the NBFCs in the future. However, according to the FM, importance will be given to the fundamentally-sound NBFCs

Read our article:Filing & Exemptions Related to NBFC and Housing Finance