Ombudsman Scheme was introduced by the Reserve Bank of India on 4-April-2019 to curb the complexities related to the complaint redressal mechanism for specific services offered by NBFC. The scheme primarily encompasses the non-banking finance companies (NBFCs), and it is released under Section 45 L of the RBI Act, 1934. The ombudsman scheme for NBFCs is the apex level mechanism of resolving the issues of customers of NBFCs. This article will manifest some facts regarding the Ombudsman Scheme for NBFCs.

Who is the Ombudsman Scheme?

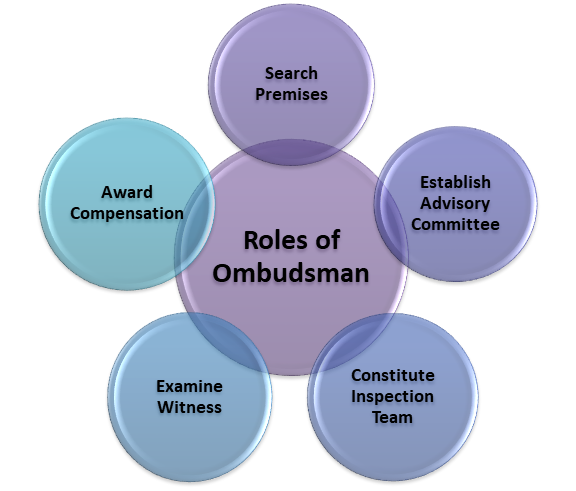

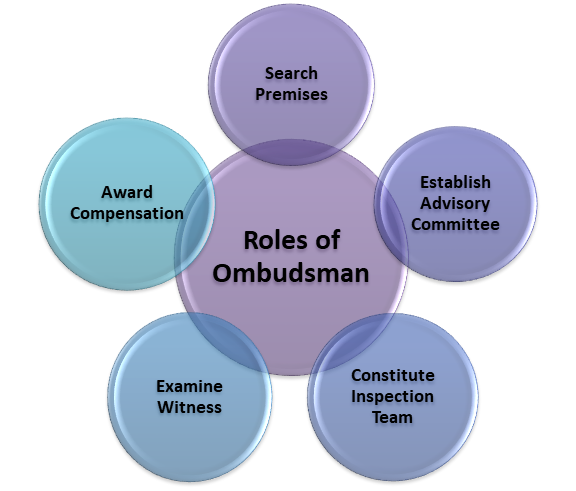

Ombudsman is a legal term that is referred to as public advocates which take charged to represent the interest of the public by probing complaints of maladministration. The general duties performed by the ombudsman[1] include:-

- Investigation of complaints regarding the service provider

- Provides reasonable solutions to the applicant’s complaints through conciliations.

At present, there are four Ombudsmen have been appointed by the Reserve Bank with their offices located in New Delhi, Kolkata, Mumbai, and Chennai.

Ombudsman Scheme for NBFCs

The scheme primarily covers the NBFCs having an asset size of 1 billion rupees and reserves the right to accept deposits. Such entities are defined in Section 45-I (f) of the RBI Act, 1934.

Ground for Grievances (Ombudsman Scheme for NBFCs)

Following are the list of grievances that a complainant can address to the Ombudsman regarding the maladministration of NBFC.

- Non-payment or unusual delay related to the payment of interest on deposits;

- Non-adherence to directives issued by RBI, if any, applicable to the interest rate on deposits;

- Non-repayment or unusual delay related to the repayment of deposits;

- Non-presentation or unusual delay related to the post-dated cheques furnished by the customer;

- Failure to render the writ statement regarding the loan sanctioned in addition to T&C regarding annualized interest rate and application method thereof;

- Failure to render a sanction letter or adequate notice in the language understood by the borrower;

- Failure or unusual delay in furnishing the documents or securities to the borrower on repayment of entire dues;

- Levying of charges without intimating the customers through writ notification.

- Failure to impart transparency in the loan agreement regarding (i) notice period before the acquisition of security; (ii) scenarios that support the forgo of the notice period;(iii) the method for acquisition of the security; (iii) the procedure of providing relaxation to the borrower regarding the repayment of a loan before the auction of the security; (iv) provisions for rendering repossession to the borrower; (vi) the procedure related to the sale of the security.

- Non-fulfilment of directives issued by RBI to the NBFCs;

- Non-adherence to guidelines issued by RBI regarding the Fair Practices Code for NBFCs.

The Ombudsman might confront such other matters as provided by the RBI from time to time. Upon receiving the complaints, the Ombudsman strives to promote the resolution of the dispute through mediation via an agreement between concerned parties. If the complainant accepted the term of settlement offered by the NBFC as a whole, then Ombudsman will issue an order in pursuant to the term of settlement which becomes binding on the complainant as well as NBFC.

If the NBFC is found to comply with extant norms and communicated the same to the complainant via appropriate means and the complainant register, no issues regarding the matter than the Ombudsman will pass the order regarding the closure of the complaints.

Grounds for the Rejection of the Complaints at any Stage

As per section 13 of the scheme, NBFC Ombudsman may reject complaints on the following grounds:

- The complaint made is not in the pursuant to a complaint referred to in clause 8 of the Scheme; or

- The compensation demanded by the complainant is beyond the scope of the pecuniary limit mentioned under the scheme.

- The complaint was made on false grounds.

- The complaint made does not have any association with the complainant with appropriate diligence required to be conducted.

- The complaint made needs consideration of extensive documents and oral proof and the proceeding

- In the opinion of the NBFC Ombudsman no inconvenience or damage caused to the complainant.

Grounds for the non-acceptance of complaint

NBFC Ombudsman may not accept the complaint under the following circumstances:

- If the complaint is lodged against the NBFC which is not covered under the scheme.

- If the complaint is not communicated with the NBFC against which the dispute was aroused.

- If the complaint lodged is not in the pursuant to complaint available under clause 8 of the scheme.

- If there is a significant delay in lodging the compliant w.r.t the date of receipt of reply from the NBFC.

- If the complainant fails to reply to Ombudsman within one year and one month from the date of registering the complaint to the NBFC.

- If the complaint has already been resolved at the consumer court or court of law.

- If the complaint has already been addressed via the office of the NBFC Ombudsman.

- If the complaint seems to be superficial or doesn’t hold any significant value.

Conclusion

The complainant can lodge a written complaint with the NBFC Ombudsman and send it to their concerned office via fax, post, or hand delivery. One can also use the email to serve the same purpose. To ease out the filing process, RBI has uploaded a complaint form on its official website, though it is not compulsory to use this format. Feel free to connect with Corpbiz‘s professional just in case if you need some help on NBFC registration or Ombudsman Scheme for NBFCs; we will be glad to assist you. We offer string of the cutting-edge services in the field of licensing, compliances, and government registration.

Read our article: Regulations governing NBFCs in India: A Complete Overview