Transactions among related persons and other activities of the ‘GST Schedule I’ will be treated as Supply even if made without consideration. GST will apply to the transaction. These are registered in the Schedule I of the CGST Act.

The businesses are conducted generally between parties that are associated or between any agent and a principal. The party pay GST and can later claim it as an input tax credit.

Supply Under GST

Supply under GST is considered as a taxable event for charging of tax. The liability to pay tax rises at the ‘time of supply of goods and services’. Therefore, determining whether or not a transaction falls under the meaning of supply, is important to decide GST’s applicability.

Concept of Supply of Goods and Services Before GST

Under the previous Indirect Tax Regime, there was no idea of the Supply of goods and services. The phase at which indirect tax are levied are wide-ranging under different laws. The ‘excise duty’ charged on goods produced when they are taken out of the workshop. ‘Service Tax’ were levied based on rules known as the ‘point of taxation’ rules, for services reduced.

A VAT arise on the value of the sale of goods and provision of services. The current systemmerged all taxes to maintain a single taxable event known as GST.

Read our article:How to apply for GST registration certificate online?

Transactions between Related Persons

Transactions between related parties are of particular importance under any law as the pricing practices and arriving at them are interesting. When parties are linked, the prices are precise, and they will not sometimes be the price that would have then been charged, if the transaction has taken place between two unrelated parties.

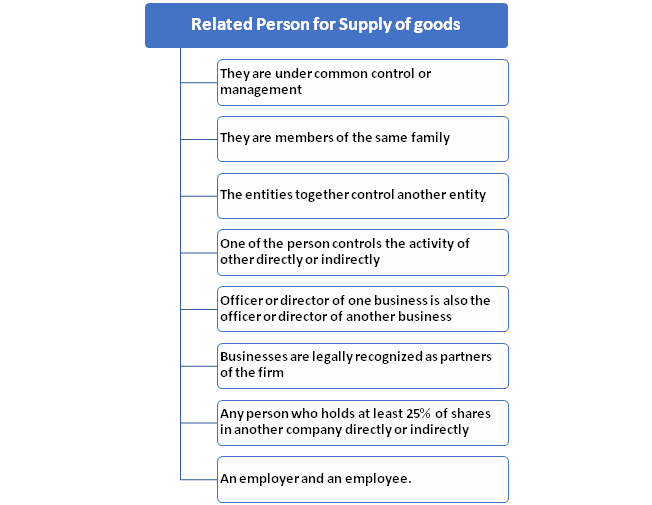

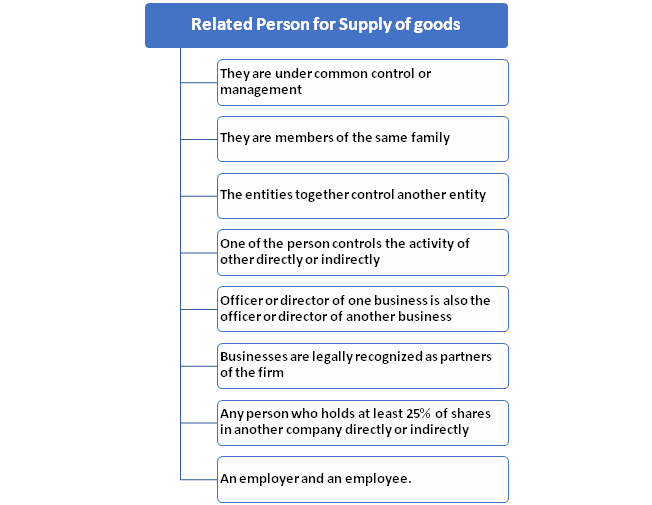

Let’s now understand how to treat transactions between related personswhensuch a supply under GST will be taxable, and how it is calculated under the GST laws. Associated persons are defined under Section 2(84) of the GST Act[1].

Related Person for Goods Supply under GST

Persons can be a legal person who can be individuals, HUF, company, firm, LLP, co-operative society,body of individuals, local authority, government, or any artificial juridical person. It can also includesbusinesses incorporated outside India. Persons that are associated with another’s business or are any sole agent or sole distributor or sole concessionaire should also be deemed to be related person.

What is the taxability of Supply under GST made between related persons?

Supplies between the related persons with consideration should be treated as ‘Supply’ like any other transaction of the goods and services. While, the Supply made between any related persons for insufficient or no Consideration is covered by Schedule I of the GST Act. Such businesses shall be treated as ‘Supply’ only if it happens in the course or continuance of business activities.

Additionally, when any entity makes an import of service from a related person or establishment outside India without any consideration but for the persistence of business, it will be considered as supply under GST.

Valuation of transactions between related persons

Value of Supply between any related persons other than where the supply is made through an agent is determined as below-

- The open market value of such Supply- Open market value is the value of the Supply between two unrelated entities. When Supply is between two related entities, there is a high possibility that their relationship will influence the prices.

- If the open market value cannot be decided, then the number of goods of the same kind and quality shall be considered for valuation.

- If both the above methods do not give any appropriate value then the value based on cost or total cost of production or under the residual process will be considered.

Taxable Person Importing Services from any Related Person

Transaction related to Import of services by any taxable person from any related person or any of the other corporation outside India for business purposes will be treated as Supply.

Permanent transfer of goods where Input Tax Credit has been utilized

Permanent transfer or sale of business of goods on which input tax credit has been avail can also be treated as Supply even if there is no consideration received. GST applies to the sale of business assets only. It does not apply to the acquisition of personal land or building and any other personal asset.

“Permanent transfer” indicates transfer without any intention of receiving the goods and services back. Goods sent on job work or products sent for testing or certification will not qualify as Supply as there is no permanent transfer of goods and services.

Donation of business assets or scrapping or distribution in any other manner other than as a sale – i.e., for consideration will qualify as ‘supply,’ where input tax credit has been claimed.

Conclusion

This blogs deals with transactions between related persons and other such activities that are treated as Supply under GST even if it is made without any consideration. Supply under GST is considered as a taxable event for charging of tax. The liability to pay tax rises at the ‘time of supply of goods and services’. Therefore, determining whether or not a transaction falls under the meaning of supply, is important to decide GST’s applicability. Consult with CorpBiz’s expert if you want to avail any services concerning GST Registration with ease.

Read our article:What do you mean by TCS under GST?