Tax Collected at Source (TCS) under GST states the tax collected by any e-commerce operative from the consideration established by it on behalf of the provider of goods or services who make materials through the operator’s online stage. TCS can be charged as a proportion of the net taxable supplies of goods.

Who can be liable to collect TCS under GST?

An individual operative who owns, operate, and manages the e-commerce platform are responsible for collecting TCS under GST. Tax Collected at Source is applicable only if the operatives collect the amount from the customers on behalf of vendors or dealers. When the e-commerce operators pay the compensation received to the sellers, they have to deduct an amount as TCS and then pay the remaining amount.

Few exceptions to the TCS requirements for the services provided by any e-commerce platform are as follows:

When the liability for collecting TCS under GST arises?

TCS has to be collected by e-commerce operatives while making a payment to the seller. This payment will be the consideration received on the retailer’s behalf for the goods sold by him online. The tax will be collected on the net value of taxable supplies of goods.

What is the rate applicable under TCS?

The dealers or traders supplying goods and services through e-commerce operators will receive payment after the deduction of TCS at the rate 1%. This rate is informed by CBIC in Notification no. 52/2018 under CGST Act[1] and 02/2018 under IGST Act. Which states for an intra-state supply of goods, TCS at 1% will be collected. Likewise, for a transaction between the states, the TCS rate will be @ 1%, i.e., under the IGST Act.

Registering requirements for TCS under GST

The e-commerce operative liable to collect TCS have to register under GST compulsorily, and there is no beginning limit exception for it. Similarly, the sellers supplying goods online of any e-commerce platform are compulsorily required to get registered under GST except for a few exceptions.

Registration conditions are as follows:

- Every e-commerce operative who is obligatory to collect TCS must be registered under GST;

- Any person who supply goods through any e-commerce platform, but those who make supplies are informed under section 9 (5) of CGST Act.

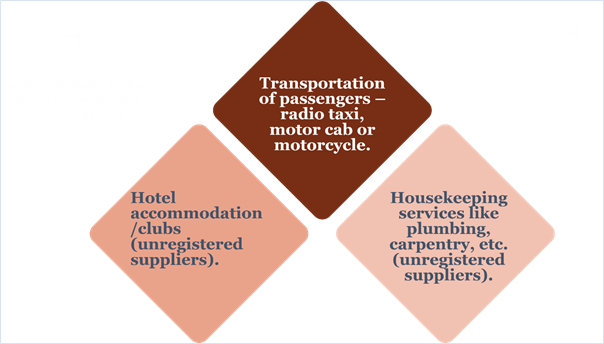

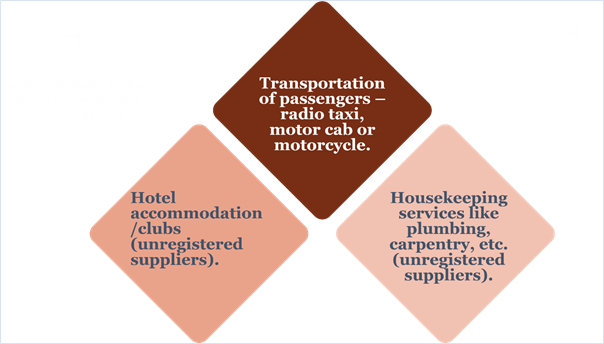

Under Section 9 (5) mentions the following supply of services – Transporting passengers by a radio-taxi and motorcycle OR providing accommodation in hotels, guest houses, for residential or lodging purposes (unregistered suppliers) OR services of house-keeping, such as a plumber, carpenter, etc. ( or any unregistered supplies of services). In all cases, the e-commerce operative should pay GST, meet the agreements. So, suppliers don’t have to register if they provide these services listed in 9 (5), provided they do not cross the INR 20 Lakhs beginning for registration.

- Suppliers of services making a supply through any e-commerce portal are exempted from registration under GST if their aggregate turnover is less than INR 20 Lakhs (assuming they do not make inter-state supplies of services).

- Suppliers of goods supplying through any e-commerce portal are not exempted from registration under GST.

- Any e-commerce company must register itself under GST in every state it provides products or services.

Due date for depositing TCS

TCS will be deducted in the month in which the supply is completed. It has to be deposited within 10 days from the end of the month of the amount to the credits of the governments. Compensation of the tax collected will be made in the following manner:-

Read our article:A Complete Overview on GST Registration for Service Tax Holder

Which form can be used to file TCS return?

E-commerce operatives have to file GSTR-8 by the 10th of the next month in which the tax is to be collected. This return will only be submitted once the tax collector has deposited the respective credit to the government. For example, the due date for GSTR-8 for September 2019 will 10th October 2019.

Using GSTR-8 data by e-commerce suppliers in GSTR-2A

The details that are submitted by the operatives in GSTR 8 will be accessible to all the suppliers in GSTR 2A. The goods will be accessible to GSTR 2A after the due date of filing of GSTR-8. The tax collected will be replicated in the electronic cash ledger of the respective dealers. The contractors can claim the credit consequently after matching and reconciliation their supplies of services with the details given in GSTR 2A.

GSTR 8 cannot be reviewed once it is filed. Any inconsistency found while matching and reconciliation of the supply data and GSTR 2A will be linked to the operator and the supplier of services. If the difference is not corrected within the given period of time, then the tax amount will be further added to the liability of the supplier of services. The supplier of services will have to pay the difference amount along with interest.

Impact of the TCS provisions

From the e-commerce operator’s viewpoint, they must register under GST in every state in which they operate before 01st October 2018, which is the operative date of executing TCS provisions. The ERP schemes have to be well combined to apply these provisions in the day to day businesses. Additionally, the working capital of the suppliers selling through an e-commerce operator will be blocked until they file their return and claim the excess taxes paid. This can prevent SMEs vendors from selling goods or supplying services on the online portal.

From the government’s viewpoint, tax evasion will significantly reduce since the tax will be collected at every transaction.

Conclusion

As per the GST law, the e-commerce operators are not allowed to get TCS registration in some States/UTs, where they do not have any physical presence, and this became a challenge to few taxpayers.

To overcome this challenge, from 01st April 2020 onwards, the e-commerce operators not having a physical presence in any particular state/UT has been allowed to apply for TCS registration based on their registered head office/premises address.

Read our article: A Complete Guide on Eligibility Criteria for GST Registration