TDS means Tax Deducted at Source – “Collection of tax at the source from where an individual’s income has originated.” The government practices TDS as an instrument to collect tax to minimize tax evasion by taxing (partially or wholly) the income at the time created. TDS is pertinent to the numerous incomes such as salaries, interest received, commission/donations received, etc.

However, TDS is not applicable to all incomes and for all people. In this article, you will observe the extracts of Section 40(a) (ia) and Section 40a (3) of the Income Tax Act, 1961. It will explain the disallowance for non-deduction or non-payment of TDS under Section 40(a) (ia) and 40a (3).

What is Section 40(a) (ia) of Income Tax Act, 1961?

- According to Section 40(a) (ia) of Income Tax Act, 1961[1], 30% of sum payable of a person on which tax is deductible at source under ‘Chapter XVII-B.’ If this tax has not been deducted or paid after deduction on or before the due date specified in sub-section (1) of section 139, it may have severe limitations.

- 1st Position of law- In any such sum, taxes have to be deducted in any succeeding year. Or else it may be deducted during the previous year but have to be compensated after the due date specified in sub-section (1) of section 139. In such payments, 30% of sum shall be allowed as a deduction in calculating the income of the preceding year.

- 2nd Position of Law- It says that if an assessee fails to decrease by the whole or any part of the tax in agreement with the provisions stated above, without being default under sub-section (1) of section 201; it shall be considered deducted and paid on the date of furnishing of return of income.

For easy explanation, kindly draw your attention to the Info-Chart given below for this sub-clause:-

What do you mean by Disallowance for Non-Deduction or Non-Payment of TDS?

- Following section 40(a) (ia) of Income Tax Act, any payments made to residents, the deductor has the permit to claim a deduction for payments as per expenditure occurred in the previous year of payment. It can happen if the tax gets deducted during the last year, and the equal amount gets paid on or before the due date itemized for filing of return of income U/s 139(1) of Income Tax Act.

- In consideration with ‘non-deduction‘ or ‘non-payment’ of tax deducted at source from certain expenses made to the residents, herewith, the entire amount of expenditure is ‘overrule/disallowed‘ under section 40(a)(ia) for determinations of calculating income under the head “Profits and gains of business or profession.”

- It has been propounded to reduce the undue hardship. In such ordinances, the disallowance shall be ‘restricted to 30%’ of the amount of expenditure on which ‘TDS not deducted.’

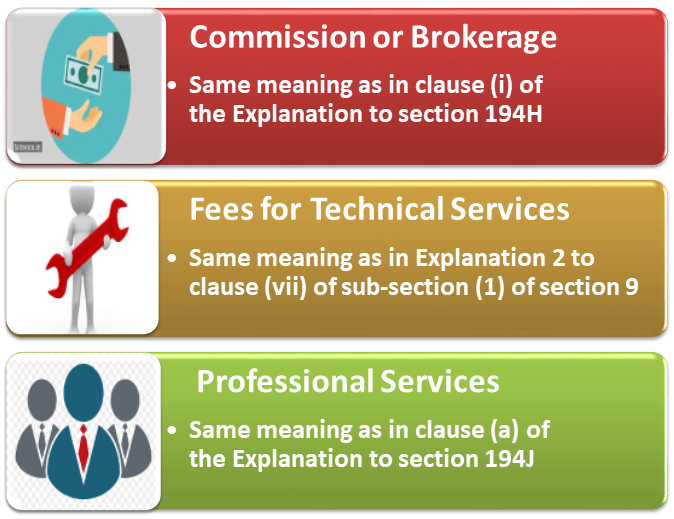

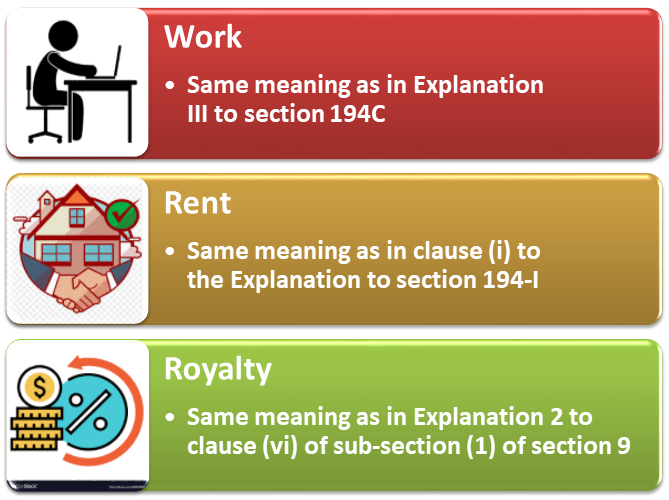

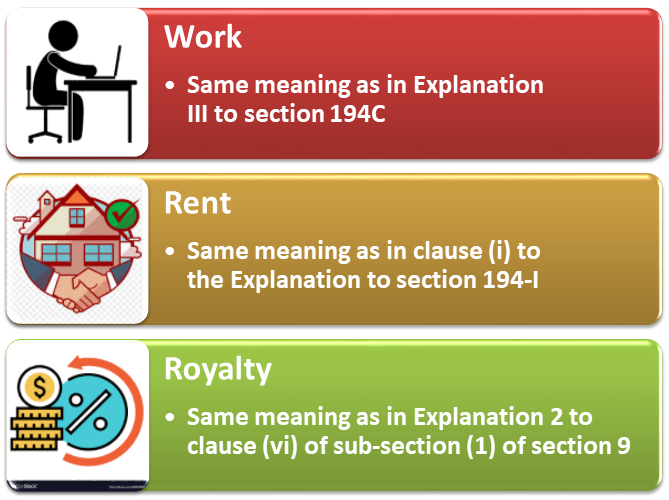

- Previous Position (100% disallowed): – The ‘non-deduction’ or ‘non-payment’ of TDS on payments made to residents results in disallowance only concerning assured/specific categories of payments. Such payments can include interest, commission, brokerage, rent, royalty, fee for technical services, or professional services, as stated above.

- Present Position: According to the present view, section 40(a) (ia) has increased the scope of disallowance to ‘all the Category’ of payment made to a resident. It schedules this parameter upon the tax, which is required to be deducted at source under ‘Chapter XVII-B’ of the Income Tax Act.

Sample Calculations for Tax Deduction under Section 194J at rate of 10%: Estimation of Disallowance

- 10% of ₹ 1, 00,000 is ₹ 10,000 – With no deduction

With this, no tax has been deducted and paid on ₹ 1, 00,000 and estimation of disallowance will be ₹ 30,000/- (30% of ₹ 1, 00,000)

- 10% of ₹ 1, 00,000 is ₹ 10,000 – Deducted and paid ₹ 1,000

With this, tax deducted and paid is ₹ 1,000/- on ₹ 10,000/-; therefore, tax is deducted and paid on ₹ 90,000/-. Estimation of Disallowance is ₹ 27,000/- (30% of ₹ 90,000/-)

- Assumption: – The final assumption is that there is a Proportional basis, in case of non-deduction and short deduction. The amount disallowed under section 40(a)(ia) will be 30% of the amount in which ‘TDS not deducted’ or ‘short deducted.’

Read our article:Business Income & Taxation of Charitable Institution U/s 11(4) and 11(4A): In-depth with Case-Laws

What are the relevant Case laws, Amendments& Circulars under the TDS Provisions? – Chronological Event

Circular No 8/2009 [F.NO. 385/08/2009 IT (B)], DATED 24- 11-2009

- The services offered by hospitals to various patients are mainly included as ‘medical services.’ Accordingly, the provisions of section 194J are duly applicable to such payments.

- Persons who are making payment on behalf of patients to hospitals for the expense of medical/insurance under various projects are accountable to deduct tax at source under section 194J.

Case Law: – Delhi H.C VipulMedcorp TPA (P) Ltd.v. Central Board of Direct Taxes 2011

- It held that Section 194J applies to the payments made by the petitioners to hospitals that are providing “professional/Medical facilities. Moreover, in light of various Central Board of Direct Taxes circulars and jurisdictional verdicts, TDA will be valid on all payments made to the Hospital for Medical amenities. The NPOS should make compulsory compliances to side-step any disallowances of expenses and TDS penalty requirements.

Case Law: – Mahatma Gandhi SevaMandir V. Deputy Director of Income-tax (E) 1(2), ITAT Mumbai 2012: Disallowances under section 40(a) not applicable to charitable trust/institution under section 11

- It held that Section 40 is applicable only when deductions under ‘Sections 30 to 38’ made calculating the income imputable under Section 28, under the head “profits and gains of business or profession.”

- The concession given under Section 40 has carved out. It is applicable only for ‘Section 28′ and not for calculating the exemption of income of a charitable trust under Section 11 of the Income Tax Act. It means that provisions of section 40(a) are not applicable in the events of charitable trust or institution where income and expenditure gets figured in terms of section 11.

Case Law: – Bombay Stock Exchange Ltd vs. Dy. DIT (Exp) (2014)

- In this case, the Bombay High Court has decided that provisions of section 40(a) (ia) do not apply to Charitable trusts as well as Non-Profit Organisations.

- On the other hand, there is no general exemption that Trust, Society, or Non-Profit Organizations are exempt from deducting and compensating TDS.

- It is generally subject to the Financial Transactions and restrictions of TDS stated every year in the Financial Act. As a result, if NGOs make payments to specific persons above detailed/prescribed limits, they need to deduct and pay TDS within an itemized timeline.

Case Law: – Nokia India Pvt. Ltd. Vs. DCIT ( Delhi ITAT) – ITA No. 5791/Del/2015– No Disallowance for non-deduction of TDS under section 194H/194J in the absence of ‘Principal-agent relationship’ and ‘technical services.’

- The disallowance under Section 40(a) (ia) for non-deduction of TDS u/s 194H as well as 194J on account delivered by the assessee to its distributors was not acceptable; as a ‘principal-agent relationship was absent.’

- As a consequence, benefit extended to distributors could not be preserved as commission under Section 194H. Moreover, A.O. had not given any reasoning or conclusion to the extent that there was payment for ‘technical service’ responsible for withholding under Section 194J.

Case Law- JCIT Vs. Karnataka Vikas Grameen Bank (ITAT Bangalore) – ITA No. 1391 & 1392/Bang/2016: No interest allowance under section 40(a) (ia) conditional for deductee to furnish Form 15G or 15H

- It has held that any disallowance of interest paid to persons who furnished ‘Form 15G and Form 15H’ should not be prepared u/s 40a(ia) for non-deduction of TDS.

- It is because of the requirement of filing of Form 15G and 15H with the approved authority i.e. CIT, which was only procedural, and that could not effect in a disallowance under section 40a(ia).

Case Law: – DCIT Vs. Murugarajendra Oil Industry (P) Ltd. (ITAT Bangalore) – ITA No. 2094/Bang/2017: No disallowance U/s. 40(a) (ia) if assessee complies with section 194C (6)

- In this case, the assessee claimed on the basis of obtaining either the declaration anticipated under second proviso of section 194C (3) or the PAN details under the present section 194C(6). As a result, the assessee required not paying tax deduction at source on the payments made to the contractor and sub-contractor.

- It was irrespective of the fact whether or not such data was furnished to the authorities as approved under the third proviso to the amended section 194C(3) or the current section 194C(7). Therefore, it can be said that if Assesseefulfils as per the provisions of section 194C (6). Disallowance under section 40(a)(ia) does not stand up just because there is an infringement of provisions of section 194C(7).

CBDT Circular on TDS Obligation-When Payment Made To Entities Exempt U/s 10 2017

- This circular state about the ‘requirement of Tax Deduction’ at source in case of entities or Non-Profit organizations whose income gets exempted from section 10 of the Income Tax Act, 1961

Case Law: – A.K. Industries Vs. ACIT (ITAT Kolkata) – ITA No. 665/Kol/2018: – Disallowance under section 40(a)(ia) not applicable to ‘Short-Deduction’ of TDS

- This case proceeds to disallow the sum under section 40(a) (ia) in respect of which TDS gets deducted. During the appellate proceedings, it holds that TDS got deducted at a lower rate; hence, it means that provisions of section 40(a) (ia) are not appropriate in respect of the appellant.

- It was sufficiently clear from the examination of the lower appellate discussion that this is not an instance of ‘non-deduction of TDS’ per se. The assessee had certainly deducted TDS u/s.194C, although at a lesser rate followed by three other head(s) of 194-H, 194-I, and 194-J concerning zero deduction.

- At the least, the Assessing Officer had disallowed, and calls the sum into question under the first head only. As a result, the end of the impugned disallowance u/s 40(a) (ia) does not apply to the ‘short deduction’ of TDS.

Case Law: – Sri. SingonahalliChikkarevannaGangadharaiahVs. ACIT (ITAT Bangalore) – ITA No. 785/Bang/2018:- No Section 194C TDS on ‘reimbursement’ of vehicle expenses.

- In the presented case, a vehicle was provided by the assessee to the concerned parties, and the assessee was to accept the vehicle expenses essentially incurred by the cab owners who will be ‘reimbursed’ by the concerned parties.

- It was held that reimbursement of actual expenses incurred by assessee could not be considered as payment subject to TDS under section 194C of the Act.

Case Law:-Pediatric Infectious Diseases Academy Vs. ITO (ITAT Kolkata) 2018: Section 40(a)(ia) not applicable to charitable or religious trust before 01.04.2019

- In the present case, it was not justified in holding that the fact of the assessee being the charitable organization is of no significance for the applicable consideration of section 40(a)(ia). As per the wording of learned counsel for the assessee, this opinion has been contrary to the decision of the Hon’ble Bombay High Court (Explained Above) in the case of ‘Bombay Stock Exchange vs. DDIT 365 ITR 181’.

- Additionally, the Finance Act, 2018, has inserted the explanation 3 to Section 11. It is to make inter-alia the provisions of Section 40(a)(ia) applicable in case of charitable or religious trust or institution with effect from 1st April, 2019.

- It further shows that section 40(a) (ia) up till now was not applicable in calculating the income of entities registration u/s 12A of the Act. For that reason, it holds that the disallowance made by the A.O. under section 40(a)(ia) was correct, and confirmed by the Ld. CIT(A)

Latest: – Amendment for Trusts and NGO from FY 2020-21 onward

- It has propounded that the donors will get deduction only based on TDS return filed by trusts, NGOs. It allows meaning that it will be almost like the same as 26AS TDS credit (annual tax credit statement). There is a responsibility on Trust or Institution to file the Annual Statement of Donation with effect from 1st June 2020.

Conclusion

When the revenue beats the NGO’s expenses, it gets considered that such an organization earns profit. It can’t be implied from the nature of a charitable organization that carries out social, economic or developmental programs to reach those people; even the government cannot reach. The government should encourage the unfolding of subsequently TDS schemes recognition to an independent intervention by opening it up to more meaningful public investigation.

Hereafter, this blog was being entirely for informational purposes after deliberating minute due care. Besides, it does not convey any expert advice or formal preferences. Kindly consult our Corpbiz team if you need expert advice. We will help you to ensure complete TDS Compliances as per your income tax exemptions, ensuring the successful and timely accomplishment of your work.

Read our article:Paid Donations: Guide on Tax Treatment for Charitable Purpose