Section 194M exhibits about taxing high valued transactions that occur at a personal level introduced by the government with an aim to cover said transactions under TDS. In this blog, we will be providing a brief explanation about section 194M deducting Taxes on Payment to Professionals and Resident Contractors.

What is Section 194M?

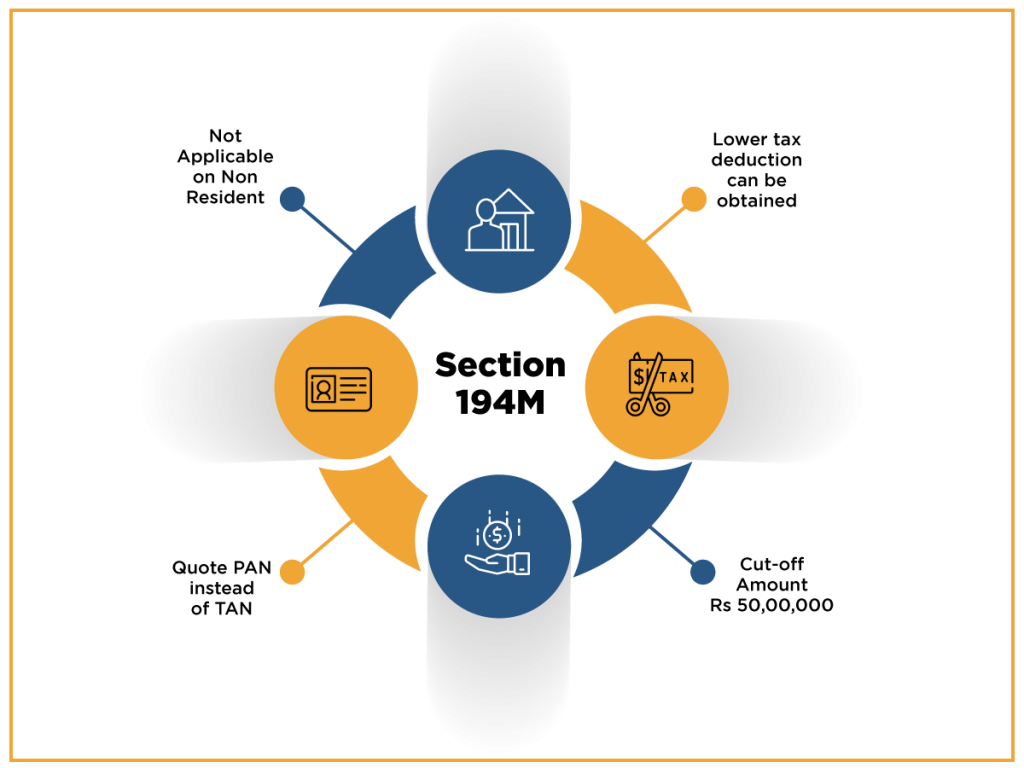

An individual and/or Hindu undivided family has to deduct TDS u/s section 194M. Such individuals are not under the obligation to audit their account book. The requirement for audit only come into the existence when the turnover of the business surpasses the one crore mark or where the profession’s receipts exceed the limit of fifty lakh rupees.

It becomes applicable when the annual expenditure related to contractual work and professional services surpasses the minimum threshold limit i.e. Rs 50,00,000.

If these individuals are directed to audit their book of accounts, TDS deduction is applied as per the provisions under Section 194C and 194J. Moreover, the individual or HUF[1] who are liable to deduct TDS on payment to a contractor u/s 194C and 194J on payment on professional fees are not liable to deduct TDS u/s 194M.

The individual or HUFs who are legal boundation to deduct tax can pay the tax to the government by mentioning the PAN only. Also, they do not need TAN for TDS deduction. Payment to an overseas individual is not covered under this section.

Read our article:All about Benefits of TDS Return Filing in India

Section 194M on Services or Contractual Work for Personal Use

The finance bill, 2019 has unveiled the Section 194M, regarding TDS related to expenses bear by individual or HUF against the services or contractual work for personal use. Thus, this section applies to personal and business-related payments.

Before the arrival of the aforesaid section, there were no obligations on a person or HUF to deduct TDS in the scenarios mentioned above.

Also, the person or HUFs engaged with business activities or any line of work were also no deducting TDS, even when they are reaping monetary benefits. Earlier tax reform didn’t have the provision for taxing payment made to professional fees and contractual works.

Meaning of Professional Services, Contract and Work u/s 194M

Work: the term work under this section used in the context of:

- Advertising, Broadcasting & telecasting

- Carriage of passengers & goods regardless of any transportation mode, other than railways.

- Catering.

- Manufacturing or supplying of a product as per the recommendation of the customer. This may include raw material purchased from the customer as well.

Professional services: The term Professional services in this section cover:

- Professional fees

- Fees related to technical services

- Remuneration paid to directors (omitting salary) for instance: fees to get involved with board meetings

- Royalty

- Payments in context of non-compete fees, meaning- expenses paid to not to perform any business activities for a specific period of time and within limited geographical boundaries or fees paid to not to reveal any technical knowledge.

Contract: This term includes sub-contract

What is the Eligibility Criteria for Deducting TDS under section 194M?

Any citizen being an individual or HUF bear certain expenses against professional services or contractual works has to deduct TDS under the said Act.

In the view of Union Budget 2019, any person (individual/HUF) addressing expenses against professional services or contractual work during the financial year, surpassing fifty lakhs in a year must deduct tax at source @ 5 percent. The TDS rate capped at 3.75 percent for transactions from 14 May until 31 March 2021.

- Scenarios for the deduction of TDS u/s 194M

TDS amount will be deducted:

- At the time of paying out expenses against services availed.

- At the time of cash transfer or issuance of cheques as payment.

- TDS Rate structure under Section 194M

TDS @ 5% shall be deducted u/s 194M if the total cost paid to a resident surpasses the minimum limit i.e. fifty lakh in a given financial year. The TDS rate is capped at 3.75 percent from 14 May 2020 until 31 March 2021 In the absence of a PAN card of a deductee, TDS will be charged @ 20%.

Timeline for Depositing TDS

When any expenses are addressed by on behalf of the government- The TDS amount must go to the department on the payment day. Where any payment bears by any other individual apart from the government, the TDS must be paid if the following conditions are satisfied:-

- If the amount is credited before 30th April of the next financial year. For instance: if the amount has been credited in March 2021, the TDS will be credited to the department by 30th April 2021.

- In any other month – within 7 days from the end of the month in which the tax deduction is made. For instance, if the amount has been paid in the month of October 2019, then the TDS will be deposited by 7 November 2019.

Conclusion

Section 190M plays a pivotal role in taxing the high-value transactions that occur at a personal level. It certainly helps the tax authorities to curb the flow of the transactions that were previously get escaped easily. Consequently, it will help the authorities to increase the revenue consistently.

In case if you still have some room for complaints regarding the topic, don’t hesitate to talk to our experts on the same. CorpBiz’s experts have in-depth knowledge and experience on tax-related matters. Also, this platform provides class-leading services related to government licenses, registrations, and tax-based errands. Even if you have some issues in filing your return, you can give a call to us.

Read our article:Form 26Q: TDS Return filing for Non-Salary Deductions – Know the Online Procedure