A significant amount of medical consciousness has been expanded and gained a remarkable drive in the past couple of years. The original question that got inspected in this context is whether charitable institutions involved in such medical reliefs would be permitted to tax benefits under the Income Tax Act 1961.

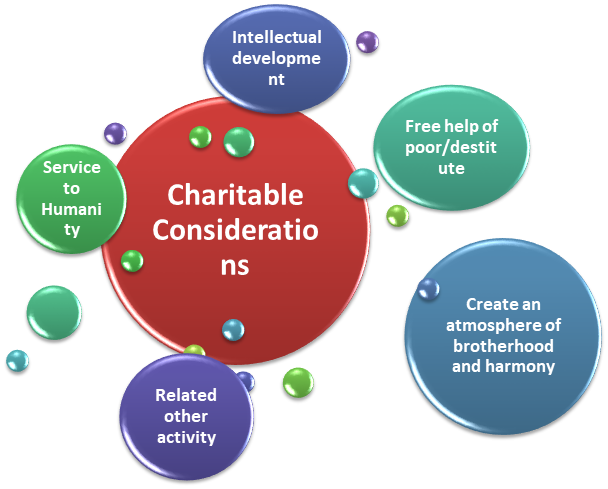

In the present scenario, The Income tax act is a primary piece of legislation for trust, society, or a company. Let us understand “What charitable purpose is?” defined under Section 2(15) of the Income Tax Act[1]. There are six branches of charitable purposes which are: – (a) relief of poverty (b)education (c) Medical Relief (d) environment protection (e) conservation of monuments or any additional objective of (f) ‘general public utility’ of the society.

What is the Legal Interpretation of Term Medical Relief?

- The term ‘Medical Relief’ has been described as ‘Aim and object of assessee-society was to set up, run and maintain dispensaries and hospitals for general public” under section 2(15).

- It got propounded in the case ‘AnandIsher Amar Charitable Cancer & Multi-Specialist Hospital Society v.Commissioner of Income –Tax (Exemptions), Chandigarh- (2019) 104/369(Amritsar-Trib)’.

- In furtherance to the above, bench of Income Tax Appellate Tribunal – case DivyaYogMandir Trust vs. JCIT (TS -459 –ITAT 2013(Del) has taken stand that Yoga can be recognized as description of ‘medical relief.’

- It also says about the Rejecting the Revenue’s stand that Yoga – unlike other medical systems, is not a curative system for relieving diseases, but merely a spiritual co-ordination. The ITAT Bench has reserved its reliance on the ‘Clinical Establishment act 2010’, where Yoga is standardized as a system of medicine under section 2 – clause (h).

- Moreover, the ‘medical relief’ can also be connoted by the establishment and conduct of clinical laboratories, hospitals, nursing homes, dispensaries, and institutions of similar nature.

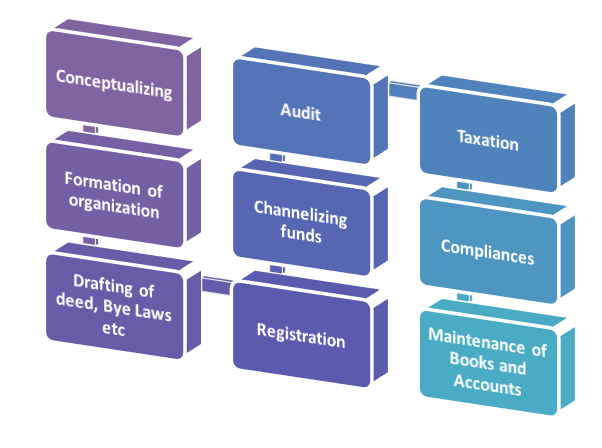

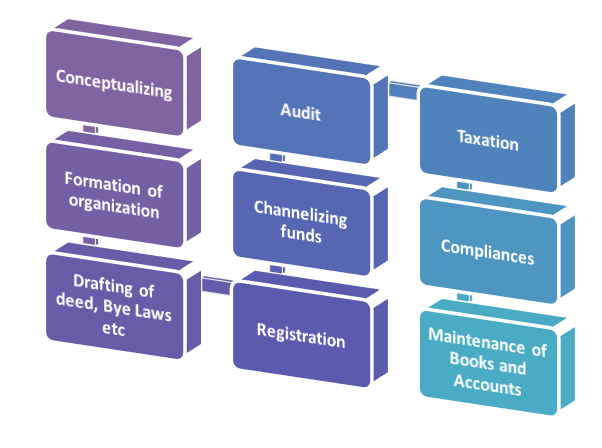

What are the Professional Opportunities in the Medical Charity Sector?

What are the dimensions underlined upon ‘Medical Relief’ by Indian Legal Fraternity?

- In case of“Samarpan Blood Bank,” their charitable purpose was providing blood after adequate examination, to the needy patients, on an exchange basis. They submitted that in due course of time, the society enlarged its actions to following medical services:

- Provide blood/components, packed cells, FFP, and platelets.

- Provide free blood to the patients of ‘Thalisemia’ and ‘Haemophilia.’

- They Run X-ray centers, Physiotherapy center, Homeopathic dispensaries, where all the services provided at considerably low prices.

- Deliver free medical Oxygen to the deprived patients and Conduct re medical checkup and operation camps for the patients for various severe illness

- Run of medical health care centers where facilities of expert ‘Orthopaedic,’ ‘Gynaecology,’ and ‘ENT’ doctors are delivered only at Rs. 30/-.

- The cases after consideration, the objects of the Samarpan Blood Bank remain the same since the grant of registration was done under section 12A/12AA of the Act.

The following factors held qualifying elements –

- According to the ‘C.B.D.T.Circular No.11/2008 dated 19.12.2008’ wherein the inclusion of ‘the commercial activities in respect’ of charitable purpose has clarified.

- In the case of ‘Addl.C.I.T. v. Surat Art Silk Cloth Manufacturers Association [1980] 121 ITR1’, the Hon’ble Supreme Court of India held that where the purpose of a trust or establishment is ‘medical relief,’ the requirement of definition ‘charitable purpose’ would be completely satisfied.

- Moreover, in the case of ‘ChaturvediHar Prasad Educational Society v. C.I.T. [2010] 134 TTJ 781/[2011] 45 SOT 108(U.R.O.)’ it has clearly stated that a registration granted to any trust or organization under section 12A/12AA can get annulled under section 12AA (3), only on circumstance that the C.I.T. is satisfied. C.I.T.has authority to refuse renewal of exemption under scion 80G of the Act

- Furthermore, Clause 3of the Finance Bill, 2008 strived for to amend the definition of ‘charitable purpose’ of trust. It has excluded any activity in the ‘nature of trade, market or business, for a cess or fee or any other consideration.’

- Referring to the ‘C.B.D.T.Circular No.11/2008 dated 19.12.2008’ wherein the applicability of the commercial activities in detail of charitable purpose has explained.

What do you mean by Medical Relief in terms of Relief of the Poor? How it goes parallel to Income Tax Eligibility?

- The ‘Medical Relief’ in terms of ‘Relief to the poor’; encompasses a wide range of objects for the well-being of the economically and socially underprivileged or disadvantaged. Therefore it will include within its ambit purposes such as ‘relief to poor,’ orphans or the disabled, deprived women or children, small and negligible farmers, needy artisans, or senior citizens in need of assistance.

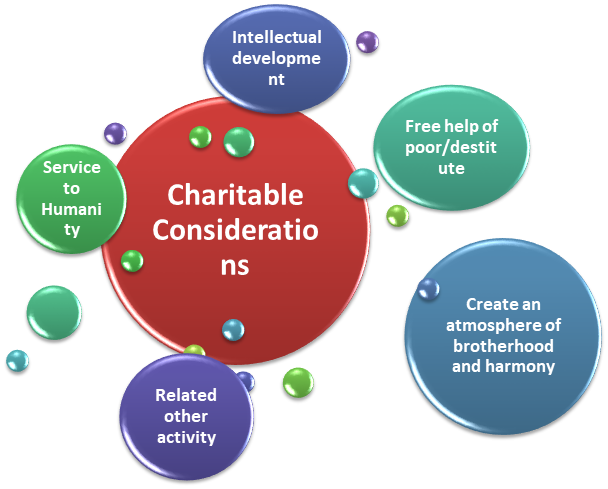

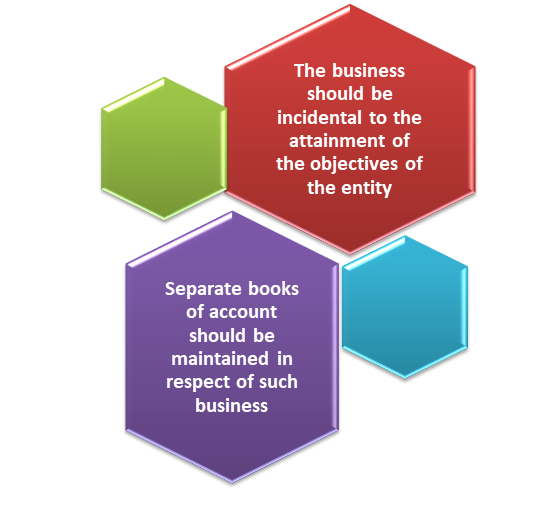

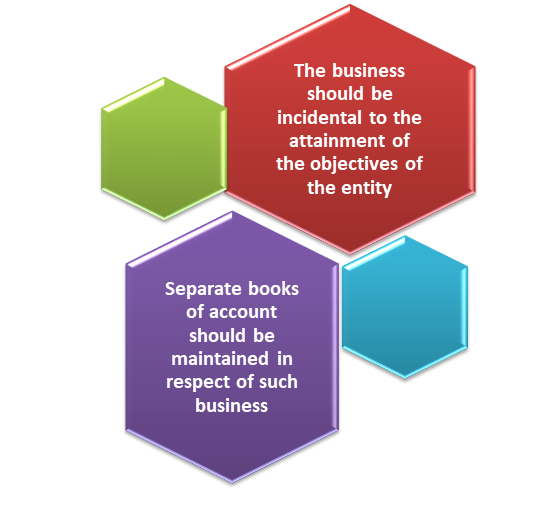

- The Non Profit entities, who have such objects, will still continue to be eligible for exemption even if they carry on a commercial activity. However, subject to the conditions stipulated under section 11(4A) or the seventh proviso to section 10 (23C) which are as follows –

- Consistently, entities whose object is ‘medical relief’ would also be eligible for exemption as charitable institutions, even if they carry on a profitable activity subject to the situations stated above. Therefore, such entities will not qualify for exemption under section 11 or under section 10(23C) of the Act, if they carry on commercial activities without the purpose of ‘medical relief.’

- As the mainstream of the charitable trusts run charitable hospitals or health centers, this is a relevant section from their outlook. In addition to this, an important section is Section 80G of the Act under Medical Reliefs. It grants tax exemption to the donor in terms of the donation given by him to a trust acknowledged under this section. It makes it more comfortable for a trust to get donations for the fulfillment of purpose when recognized under Section 80G of the Act.

- In consonance with the above said, Section 35(1)(ii) allows the deduction of expenditure on scientific research under ‘Medial Relief.’ Whereas, section 35AC authorizes expenditure on eligible projects or schemes related to the medical relief.

Read our article: Yoga as a Charitable Purpose – Get In-Depth Jurisprudential Scope Right here!

What are the minimum Licenses, permits, and other legal documents essential to operate a charitable hospital?

There are many supervisory clearances required to create and operate a charitable hospital. However, the below-listed requirements may not apply to specific hospitals, depending upon the scope of service, type of set-up, site, etc.

Legal documents required for establishing Hospital

- Registration under the ‘clinical establishment act’ (Registration and Regulation) Act, 2017 (if applicable)

- Society Registration under the societies registration act, 2001

- Registration of nursing home under the ‘Delhi Nursing Home Registration Act, 1953.’

Legal documents required for the hospital’s building and its installations

- NOC from fire safety

- Electrical installation certificate

- License for operating lift

- Building occupancy certificate

- NBC Permit:- Hospital building must get built as per National building code issued by Bureau of Indian Standards

- Layout approval for radiation departments area

Legal documents required for the equipment, machines, vehicles etc.

- Type approval certificate of radiation-emitting equipment

- License for using Boilers under the Indian Boilers Act, 1923

- Ambulance vehicle registration

- PNDT registration of Ultrasound machines under the PCPNDT act, 2015 –

- Certifications on Arms licenses under Arms act 1959: – If arms get possessed by the hospital or its staff (such as by security guards), a permit for the same must be available.

Legal documents related to medical professionals and employees

- Qualification certificates of doctors

- Registration of doctors

- Qualification certificates of nurses

- Qualification and certification of Dentists

- Qualification and licenses of clinical

- Qualification certificates of therapists

- Technician’s qualification certificate

- Registration for EPF: This one-time registration is required for hospitals to employ with Employee Provident Fund Requirements.

Legal documents for environment protection

- NOC from pollution control board

- Authorization for generation of Bio-medical waste

- Radiation protection certificate

Legal documents for storing and usage of medical and non-medical products

- Drug sale license for medical store

- Consent for storing and usage of Narcotic Drugs and Psychotropic Substances (NDPS

- Excise permit to store spirit

- License for radioactive substances

- Permit for storing Diesel

- Permit to store LPG cylinder

Legal documents related to other specific services offered by the hospital

- Registration under MTP act

- License for operating blood bank

- Registration for transplantation of human

- License for provision of Psychiatric services

What does the World Health Organisation pleads for Medical Relief on Corona Outbreak?

- World Health Organization has categorized the picturization of coronavirus outbreak as a global health emergency. All the governments around the world are taking action to control the virus from diffusion. The infection caused by the virus, COVID-19, has demanded the lives of thousands around the globe and has shocked thousands of people in more than 100 countries, including China, Italy, Spain, and the United States of America.

- According to the stats available, several highly-rated charities have donated funds to support communities around the world affected severely by the corona outbreak. World Health Organization has requested the philanthropic institutions to execute their considerable supports for the emergency by providing medical relief to these trustworthy organizations. Their aid will help individuals and communities battle the coronavirus outbreak around the globe.

- World Health Organization welcomes the interested institutions in funding and recovery efforts for those affected and for all responders worldwide.

What do you mean by ‘Medical Relief’ under Advancement of any ‘other Object of General Public Utility’?

- The assessment year 2009-10 says that the “advancement of any other object of general public utility shall not be a charitable purpose under section 2(15), only if it includes any kind of practice of trade, commerce, or occupational, for any means of profit-making. It will not get the purview of exemptions under Medical Relief on the name of establishing the business of Hospital under the Act.

- Nevertheless, this restriction is not applicable if the total income receipts from any activity executing like trade, commerce, or business, does not exceed the limits of 15 % of total income revenues. Those income receipts obtained out of medical relief purposes shall be of the relevant previous year. It got enabled from the assessment year 2016-17.

- It will only be applicable if medical reliefs are the activity undertaken in the sequence of actual carrying out of such ‘advancement’ of any other object of ‘general public utility.’ Irrespective of the nature of usage, retention of the income expected from such acts of the trust, as charitable purposes under the same.

What are the limitations related to the elements Mitigating Medical Reliefs as Charitable Purpose?

- No commercial concern should be an object. The purpose must provide medical relief only in a direct form.

- The objects of trust must be specific to sanction the obligation of income tax law. In such cases where the ambits are too comprehensive, the Trust ‘may not be suitable’ for the said exemption.

- Whenthe Trust/Society of commercial concern sees a profit-making achievement under the purview of trust, it cannot be considered to be a charitable purpose. Moreover, it ‘cannot operate’ in the ground that it will ‘deliver employment’ to poor persons as medical relief in the context of the charitable purposes under- section 2(15).

- In the cases where societies run charitable hospitals under the ground of medical relief for training, and student’s to perform at examinations after taking fixed fees, then it is not a charitable purpose of the society.

- It would be sufficient if the intention to benefit a segment of the public, as prominent from a stated individual. On the contrary, the particular section of the people sought to get profited must be adequately well-defined by some ‘sufficient common quality’ of a public or objective nature of the society.

- If a society set up with the object of approving trade or commerce, it can be a charitable institution, as it endorses common good over and done with the ‘enrichment of occupational labels.’ Nonetheless, an institution that normalizes the business of its members of the society is not a charitable purpose at all.

What is the Short term Critiques prevailing for Quality of Medical reliefs?

- Charitable Critiques on short-term medical reliefs suggest numerous opportunities for improvement. For instance, emphasizing quality over quantity of care will help ensure that physicians have adequate time to explain treatment options and allow patients to make informed decisions.

- Charitable Medical teams often measure their impact on the number of patients, the number of medications prescribed, and the number of groups per year. Perhaps additionally measuring qualitative aspects such as patient outcomes and perceived improvements in health would help enhance continuity of care.

- These assessments could get performed by physicians or even non medical volunteers of the society. Also, creation of medical relief guidelines for humanitarian medical groups will help new physicians agreeing to avoid the pitfalls of their predecessors.

Conclusion

Despite criticism of these trips, there have been promising steps towards creating culturally appropriate and sustainable improvements in health care in developing countries. These improvements are all grounded in good physician-patient relationships. The World Health Organization (WHO) created a set of drug donation guidelines to ensure Charitable organizations only provide high-quality, unexpired, and appropriate medicines to places in need (WHO, 1999).

Indian medical experiences can be life-changing and highly influential in providing physicians with a deeper awareness of global health disparities and the motivation to continue working with underserved populations. However, patients treated by volunteer medical groups deserve the same standard of care that physicians provide their patients at home—including a considerate and respectful physician-patient relationship. Together with this, we at Corpbiz have skilled professionals to aid you with the process of registering your charitable hospitals or centers, ensuring the successful and timely accomplishment of your work.

Read our article:Know all the Restrictions on the Charitable Trust