There is no prevention on a charitable trust carrying on any business, where business is a concern that can be held as property under trust. Even a legitimate claim can be made to uncertain business income not to get involved in the application of such receiving income. However, the Assessing Officer shall have the power to decide the income of such undertaking and determines the income in excess of it, as per the data shown in the accounts of the business.

Therefore, such excess shall be considered to apply to purposes other than charitable or religious purposes. This article will answer the legal analysis of Business Income of Charitable trust and its Tax treatment (under section 11), showing how the ownership of the trust upturns the relation connecting the owner and owned person.

Overview on Two Prime Edges on Business Income-Tax Treatments

No amendment has proposed in sections 11(4) and (4A), stating that the trust for the first three objects of relief of poor, educational, and medical relief will get the benefit of section 11(4) and (4A). No amendment even on the provisions of these sections.

Business Income of a Charitable Institute

- As per Section 11(4) of the Income Tax Act[1], the difference between incomes so determined and the income shown in accounts shall not be considered to be applied towards religious or charitable purposes.

- With this, it is to be noted that the income of the business has to be determined under the general provisions contained in ‘Chapter IV-D’ instead of Chapter III of the Act, which is relevant to the income of charitable trusts and organizations.

Incidental Business Income of a Charitable Institute

- Section 11(4A) of the Income-tax Act has provisions associated with the income of a trust or institution employing a business, which is incidental to the achievement of its objects. The income of such a business will be granted exemptions u/s 11 only if separate books of account are secured.

- Contrarily, the income will not be allowed to benefit of exemption under section 11 and section 12. Therefore, it shall not involve concerning any income of a trust being profits and gains of business, unless the business is related to the attainment of the intentions of the trust.

What is the base of ‘Business as Property’ under Trust profits?

- Following the said above, the result would be that the provisions of section 11(1) will not be relatable to such excess, and the similar will get indicated to tax rates. Moreover, it is now well-established that “property” is a word of most extensive import and business, unless there is something to the conflicting in the enactment.

- The Privy Council in re-The Trustees of the Tribune did not interrogate the view conveyed by the Bombay High Court regarding the business of running the channelized newspaper. Therefore, “Tribune” was property held under trust meant for charitable purposes of the trust.

- In the case of J.K. Trust v. C.I.T and C.I.T. v. P. Krishna Warrior, Supreme Court has sanctioned the said view and held that “Business” is ‘Property’ and could keep under trust for charitable and religious purposes.

- This illustration is now evident from a scrutiny of section 11(4) of the Act, which expresses that the “property’ would now comprise the business responsibility of trust.”

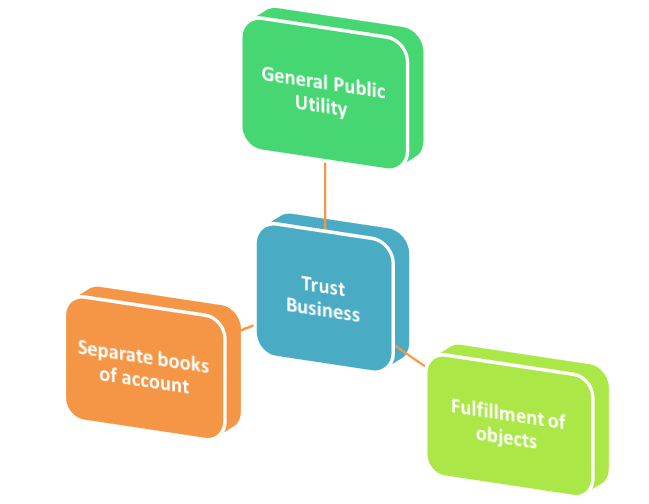

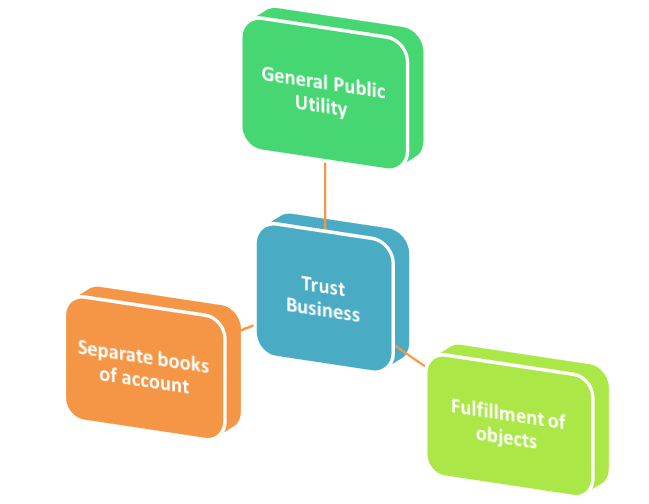

What about the maintaining Separate Books of Account?

- Remarkably, to get the exemption, circumstances regarding separate books of account should be maintained in respect of such business have complied.

- In the case of ‘Thanthi Trust (2001) 247 ITR 785 (SC)’ the Supreme Court held that, even if the business believed as property in trust for a charitable purpose under section 11(4), it has the ‘obligation to comply’ with the conditions of the profit or gain of the business.

What is General Public Utility in terms of Carrying on Trust Business under Income Tax?

- In the meanwhile, a question stands up from the above analysis, whether business for General Public Utility needs to get established in trust under section 11(4)? Yes, it is essential to carrying on activities that are to fulfill the objects of the trust that can acquire exemption and not be hit by the provision under section 2(15). It is for consideration whether section 11(4) will supersede the proviso added in section 2(15) for the trust for the observance of general public utility.

- In the same way, a question stands up whether a trust for general public utility can get the claim of exemption under section 11(4A) if it fulfills the conditions of section 11(4A). Is it possible even by employing the income from such business activities on its substances of general public utility and when separate books of account are maintained? Yes, it is for the consideration whether section 11(4A) can override the proviso to section 2(15) or not.

- Following the case ‘C.I.T. v. Birla Education Trust,’ the Court held under sub-section (4), that the Assessing Officer could govern the income and compare it with the income acting in the accounts statements. The income spoken of in sub-section (4) is the gross income of the business undertaking and not the net income.

- It comes as a process to get claims made where the income of a business undertaking doesn’t get comprised in the total income of the person. When such a claim gets made, the Assessing Officer has authorized to regulate the income. As only the income revealed in the account will be eligible for exemption under section 11(1), the permitted accumulation of 15 % will also get calculated concerning this income.

- In the case of D.I.T. vs. Bharat Diamond Bourse (2003) 126 365 (S.C.), the Supreme Court has held that the primary or central/main purpose of the institution should be charitable. If another, which by itself may not be charitable, but incidental to the primary object, it would not stop the institution from validly being renowned as a charity.

Read our article:Accounting Treatment of Charitable Institutions under Microfinance

What about the discussed Restrictions on carrying Business under Trust? – Inclusive of Amendments and Case Laws

- The new clause (bb) got introduced in section 13(1) of the Act by the Taxation Laws (Amendment) Act, 1975. It provides that if a trust or institution carried any business for the relief of the poor, education or medical relief, then the income from such business would not enjoy an exemption for tax only on condition. It will not get exempted unless the business gets carried in the course of actual carrying out of the primary purpose of the trust or institution.

- In the case of ‘Thanti Trust v. Assistant Commissioner,’ Court held that business should get supported by the assessee trust in the course of actual carrying out of the purpose of the trust. As a result of this, section 13(1) (bb) of the Act held to be not valid and propounded as not correct.

- Any business which did not directly accomplish wholly or, in part of the trust’s objectives, they cannot get held to be carrying on any other business in the course of the actual achievement of its objectives of education and relief of the poor.

- On the other hand, Dasa Balinjika Seva Sangam v. C.I.T. in the Madras High Court has correctly held that the chit business got hit by section 13(1) (bb) of the Act and not entitled to claim exemption under section 11 of the Act. It got actualized for not being supported by the assessee of the trust in course carrying out the objects.

- Afterward, the said section 13(1) (bb) has been omitted by the Finance Act, 1983, with effect from 1st April, 1984. The Finance Act, 1983 also eliminated with effect from the said date. Moreover, the provision stating “not involving the carrying on of any activity for profit,” added by the Act of 1961 as “the advancement of any other object of general public utility.” It appears in the definition of the expression “charitable purpose” under section 2(15) of the Act.

- The Allahabad High Court took the same interpretation in Commissioner of Income-tax v. RadhaswamiSatsangSabha by the Learned Judges.

- The Bombay High Court has monitored these decisions in the case of J.K. Trust v. Commissioner of Income-tax. With this, the learned judges observed that the true scope of section 4(3) (ia) includes within its scope of income from business carried on behalf of a religious or charitable institution. Irrespective of any trust either concerning the business or concerning the institution.

- After that, the Supreme Court has affirmed the judgment of the Kerala High Court in C.I.T. v. P. Krishna Warrior. It observed that ‘business is property,’ and if a business is held in trust wholly or partly for religious or charitable purposes, it falls clearly under the substantive part of section 4(3)(i). Therefore, in that event, clause (b) of the proviso cannot be involved as that clause applies only to a business not held in trust but carried on behalf of a religious or charitable institution.

- Meanwhile, in the case of C.I.T. v. Dharmodayam Co, the Court once again distinguished business held under trust for charitable or religious purposes, and one carried on behalf of a charitable or religious institution. Despite the change brought about by the 1961 Act, it has apprehended that charitable trust cannot lose the exemption if the business is held under trust and is not started by it to advance an object of general public utility,

What about the Taxation of Non-exempt Income of a Charitable Trust? Section 164 on Section 11(4A)

- Sub-section (3) of section 164 of the Act stresses itself with the method of charging tax from the income derived from property held under trust. It involves only in part for charitable or religious purposes as also the income of the nature of voluntary contributions. These get referred to section 2(24) (iia) of the Act, and business income referred to in section 11(4A) of the Act.

- It delivers the rate of tax for that portion of the income from property held under trust in part only for charitable or religious purposes as well as the income of the trust by way of specific voluntary contributions. It concerns the taxation referred to section 2(24)(iia) as well as business income referred to in section 11(4A) of the Act.

- The Whole– The tax which would be chargeable of the Whole of the relevant income (as reduced by the income), which is eligible to get exempt under section 11, is meant to be the total income of an “association of person,” and;

- The aggregate–

- Condition A: the tax part of the income refers to charitable or religious purposes gets as reduced by the amount to be exempted under section 11 as if the entire revenue was the total income of the trust/institution; and,

- Condition B: Taxes on other parts of income which relates to purposes other than charitable or religious and changes on the shares of beneficiaries are visibly unknown; then, the charges will be at the maximum marginal rate of tax.

Conclusion

So far, the taxation policy has proved to be the growth of the charity sector. It is equally valid that the taxing jurisdictions have been able to detect the misuse of provisions to a large extent. However, it should be taken care of to secure more severe penalties for violation, which will act as a deterrent device for the business under charities.

Indeed, these evaluations will always inspire our readers to examine the issue in-depth based on the stated case laws and Illustrations given above.

At your disposal, the group of Corpbiz has experienced In-house Professionals and consultants to help you with the process of establishing Business under Charities, and Tax parameters. Our expert will ensure the successful and favorable completion of your work.

Read our article: Accounting and Tax Treatment of Inter-NGO (Trust/Society/Company) donation