A charitable donation is a commonly known fact that an individual or an organization offers to a non-profit institution, charity or private organizations. The charitable donations are usually in the form of cash; however, they can also get the receipts in the form of real estate, motor vehicles, appreciated securities, or other assets or services.

Charitable donations generally are the primary source of funding for many charitable organizations and non-profit organizations. In most countries, an individual’s charitable donation provides the donor with an income tax deduction.

Does the Commission Income of Trust get taxed?

- Generally, the commission income only derives from insurances falls under the head of income, which will base on the kind of such earnings. More0ver, the Commission income of trust falls under the residuary head of income, which is known as Income from Other Sources.

- Yet, if a trust is involved in the only ‘commission business,’ then only the income derived from commission business shall be presented to tax under the head “Income commencing from business and profession,” and not under ‘Income from Other Sources,”

- Moreover, there is no need for any license for such accomplishments. According to the procedural aspects, you need to show it as your income while filing income tax return. After that, pay whatsoever tax will get allocated to pay.

- The itemized deductions must be submitted with tax filings to get a claim upon deduction for the donation. The Internal Revenue Service needs such contributions to be made to organizations that meet the requirements under the tax code as a charitable institution.

- Keep the records of charitable donations for cash or other monetary contributions only if the donation is to be claimed for tax deductions under the Income Tax Act. It may consist of a receipt or written communication from the charitable organization that quotes the amount contributed to the date, and the name of the institute or organization.

What do you mean by donations which are Eligible under section 80G?

Someday or the other, few of us have thought to give charity and to work dedicatedly towards the society. With this thoughtful gesture of notability, the Indian government and legislature also show support towards this Nobel gesture. With this, Section 80G of the Indian Income Tax Act[1] permits you a tax deduction on donations made to any charitable institute.

Section 80G

- Donations made to certain ‘relief funds’ nature of charitable institutions can get claimed as a deduction. It is allowed under Section 80G of the Income Tax Act. However, all the donations are not qualified for deductions under section 80G. The said donations made can get the deduction claimed by any taxpayer, such as individuals, companies, firms, etc.

Mode of Donation

- To get the deduction get claimed for the contribution/donations, it has to get made via a cheque /a draft or in cash only. In this case, all the ‘In-kind’ contributions included matters such as food, measurable, clothes, drugs that do not qualify for a deduction for the donations made under section 80G.

Cash Limit

- Previously, all the donations made in cash exceeding Rs 10,000 were allowed. If done now, it would have in the revocation of a permitted deduction for contributions made.

- As well, after the financial plan of 2017, any donations provided in cash more than Rs 2,000 will not be allowed as deduction. From Financial Year 2017-18 onwards, the donations above Rs 2,000 should be made in any mode other than cash to qualify as a deduction under section 80G.

Total Adjusted income

- Adjusted gross total income is the total gross income reduced by the aggregate amount deductible under Sections 80CCC to 80U, which includes Exempt income, Long-term capital gains, Income Us/ 115A, 115AB, 115AC, 115AD, 115D relating to non-residents and foreign companies.

Percentage of Donation

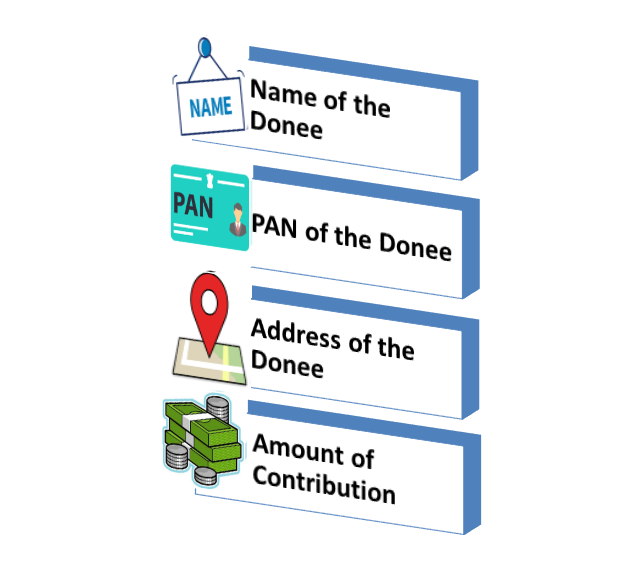

Numerous donations specified in section 80G are entitled to a deduction for 100% or 50% ‘with or without’ restriction as per section 80G. To be able to claim this deduction, the subsequent details have to get attached with your Income Tax Return file:-

What are Donations that provide 100 % and 50% Deduction Qualifying-eligibility with No Limits?

The donations given to the following Fund Relief Organisation will allow 100% Deduction Qualifying-eligibility with No Limits-

- National Defence Fund

- Prime Minister’s National Relief Fund

- National Foundation for Communal Harmony

- National Eminence Institute

- ZilaSakshartaSamiti

- State Government funds medical relief to the poor.

- National Illness Assistance Fund

- National Blood Transfusion Council

- State Blood Transfusion Council

- National Trust for Welfare of Persons (Autism, Cerebral Palsy, Mental Retardation, and Multiple Disabilities)

- National Sports Fund

- National Cultural Fund

- National Fund for Technology Development/Application

- National Children’s Fund

- Chief Minister’s Relief Fund

- Lieutenant Governor’s Relief Fund

- The Army Central Welfare Fund

- The Indian Naval Benevolent Fund

- The Air Force Central Welfare Fund,

- Andhra Pradesh Cyclone Relief Fund

- Maharashtra Chief Minister’s Earthquake Relief Fund

- Gujarat Relief Funds to the victims of the earthquake

- Prime Minister’s Armenia Earthquake Relief Fund

- Public Fund Contributions India to Africa

- Swachh Bharat Kosh

- Clean Ganga Plan Fund

- National Fund for Control of Drug Abuse

The donations given to the following Fund Relief Organisation will allow 50% Deduction Qualifying-eligibility with No Limits-

- Jawaharlal Nehru Memorial Fund

- Prime Minister’s Drought Relief Fund

- Indira Gandhi Memorial Trust

- Rajiv Gandhi Foundation

What are Donations that provide 100% and 50% Deduction with Its 10% of Adjusted Total Income?

Donations that provide 100% Deductions with Its 10% of Adjusted Total Income are as follows-

- Any donations given to the government or similar approved local authority, organization, or association should get utilized to endorse schemes or works towards family planning.

- Any Donation by a Company to the ‘Indian Olympic Association’ or similar approved association or institution established in India for the expansion of infrastructure for sports and games, or the protection/endorsement of sports and tournaments happening in India.

Donations that provide 50% Deductions with its 10% of Adjusted Total Income are as follows-

- Donating to any other fund relief organization or any institution which gratifies the conditions stated in Section 80G (5) of the Act.

- Donating to any Government or any local authority meant to be utilized for any charitable purpose- other than the objects of endorsing family planning.

- Donating to any authority established in India to allocate the need for ‘housing accommodation.’ It may be for planning, improvement or advancement of cities, towns, villages, etc.

- Donating to any corporation mentioned in Section 10(26BB) for endorsing the interest of the ‘minority community’; Donating to any organization to repairs or renovation of any registered Temple, Mosque, Gurudwara, Church, etc.

What do you mean by donations which are Eligible under section 80GGA?

Section 80GGA

- According to the Section 80GGA, it allows deductions for donations made headed for ‘scientific research’ or ‘rural development.’ This deduction is entitled to all assesses such Charitable Organisation. But it does not include those people who have an income from any business or occupation.

Cash Limit & Mode of Donation

- After the financial plan of 2017, any donations provided in cash more than Rs Two thousand will not be allowed as deduction. Financial Year 2017-18 onwards held that the donations above Rs.2,000 should be made in any mode other than cash to qualify as a deduction. (under S. 80GGA)

Classifications of Donation

Donations need to get paid to ‘research association,’ which embark on scientific research. Any contributions paid to a college, university, or any other institution that is all approved by the prescribed authority for the said purpose would also constitute the same under section 35(1) (ii).

Few agendas towards the said purpose are as follows-

- Commences any program of rural development approved under section 35CCA

- Commences training of person(s) for implementing programs of rural development

- Carries out missions or schemes approved under section 35AC

- Carries out missions for Rural DevelopmentFunds

- Carries out missions for Afforestation

- Carries out missions to accomplish National Poverty Eradication

Read our article:Guide: Registration Aspect of Educational Trust

What are the donations get classified as income to charitable/religious trust?

Voluntary Donations under Section 11(1)

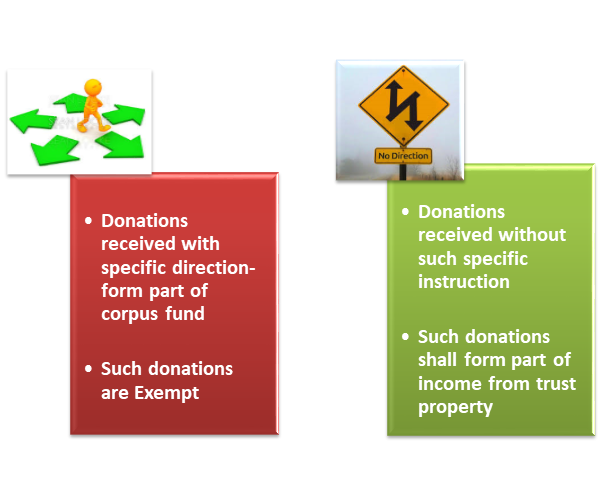

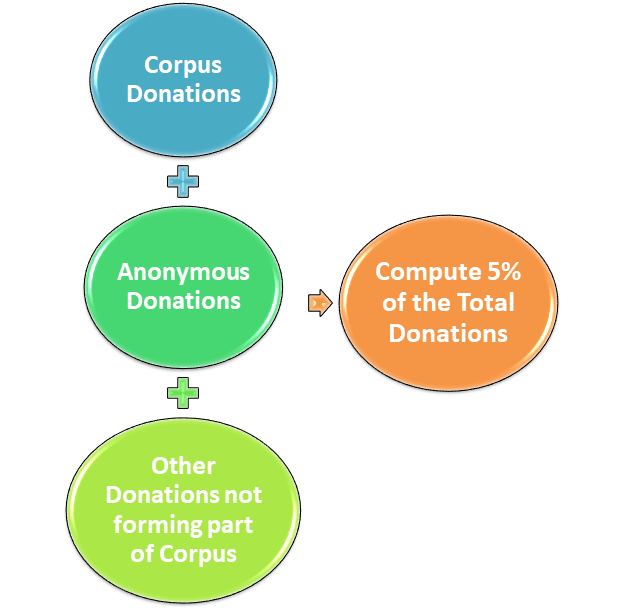

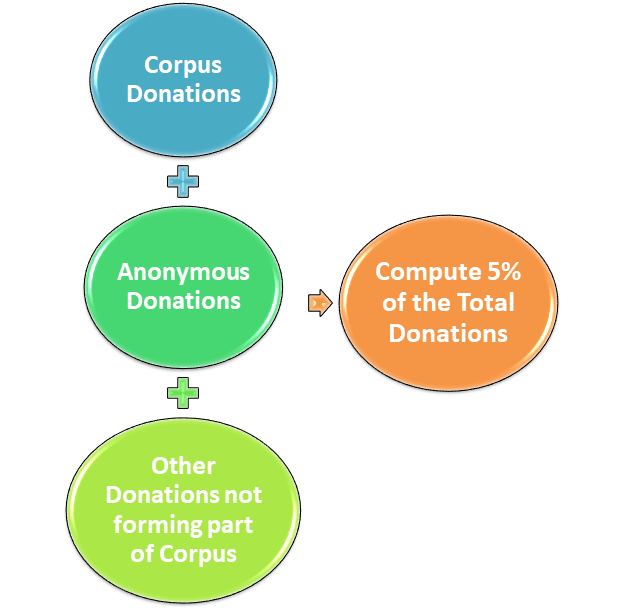

- Voluntary donations are received by the charitable/religious trust, which forms a part of income of the trust. There are two types of Voluntary Donations, those are:-

Corpus donations S.11

- Any donation by a charitable or religious trust or organization to any other trust or institution; registered u/s 12AA, with a detailed direction to form part of the corpus of recipient trust, will not be considered as application of income in place of the donor trust/institution.

Anonymous Donations

- Anonymous donations are fundamentally known to be the donations where the person in receipt of the donations doesn’t uphold any record of the person compassionating the donation. It may include the Offerings given in the temple-donation box or any other similar way.

- Taxability- The amount computed in the following step shall get exempted. Moreover, the remaining amounts of anonymous donations are taxable in the hands of such charitable/religious trust at the rate of 30% under Section 115BBC.

What are the Relevant Cases laws delivering basic nuances of Donations?

Case: – Dharmaposhana Co v. C.I.T.

It has noted that the main objects of the company itself is, inter alia, to raise receiving donations, subscription by lending money on interest. By such other means, it may deem fit for the promotion of charity, education, industries, etc. and the public good.

Case: – Parichchan Das v. Bihar State Board of Religious Trusts and Others

It has noted that the donation of lands by members of the public to the institution and the location of the temple at a place freely accessible (convenient to the public) are essential circumstances.

Case: – Trustees of Sri Kot Hindu StreeMondal v. C.I.T

It has noted that “Voluntary contributions” means ‘proper donations’. It includes money gifted or given gratuitously and without consideration. However, entrance fees and subscriptions paid by entrants to a society or an institution as a condition precedent to their membership or as the price of admission are not part of voluntary contributions.

Case: – ShriDwarikadheesh Charitable Trust v. I.T.O.

It had said that donations to the assessee trust with the specific direction should constitute part of the corpus or capital of the donee trust. Moreover, the donee trust needs to get accepted by the donations subject to that condition.

Case: – PrabodhanPrakashan v. ADIT, &ShriDigambar Jain NayaMandir v. ADIT

It is not necessary to identify the contributors to box collections in the case of a temple. It is to comply with the provisions of section 115BBC on anonymous donations at a flat rate of 30% (plus applicable surcharge and education cess) only in the case of charitable trusts, and not religious trusts. The Finance Act, 2006, has inserted section 115BBC with effect from 1st April 2007.

Case: – C.I.T. v. Trustees of the Jadi Trust

The Bombay High Court held that when a charitable trust hands over a donation to another charitable trust, it will amount to the application of income for charitable purposes by the donor trust.

Case: – C.I.T. v. Pittie Charitable Trust

The Court held that if a trust receives as donation fixed deposits in a company, there is no lending of income, funds, or property of the trust within the meaning of section 13(2)(a).

Case: – Kirti Chand Tarawati Charitable Trust v. Director of Income-tax (Exemption) and others

The Court found that the assessee trust having received donations for charitable purposes. Instead of being spent on charity, they were utilized for investment to earn returns thereon and use the same for purposes other than charitable purposes viz. construction of the temple. Therefore, the Court upheld the order passed by the authority, denying renewal of recognition under section 80G of the Act.

Conclusion

There has been relevant public discussion on the voluntary sector, principally its governance, accountability, and clearness. It understood that the voluntary sector must address critical issues on donations through proper self-regulation. Moreover, the government should encourage the evolution of, and subsequently agreement recognition to, an independent, nation-wide level, self-regulatory intervention by opening it up to more significant public inspection.

Up till now, we understand that these issues are quite complex. Therefore, this blog has tried to give you a basic understanding of items based on the latest amendments and decided decisions. We at Corpbiz, have professionals and legal expertise to mitigate your Trust donations and taxability issues as per your business targets.

Read our article:Business Income & Taxation of Charitable Institution U/s 11(4) and 11(4A): In-depth with Case-Laws