The Bankruptcy of Yes Bank is yet another disgrace for India.Yes Bank of India is considered as India’s 5th largest private sector Bank. On Thursday, the disclosure of deteriorating financial position and crisis of the Yes Bank has put many questions in the mind of the public who are directly or indirectly involved in the Bank. The financial position of the Yes bank been subjected to constant failure, mainly due to its inability to raise capital.

Though Reserve Bank of India has taken over the affairs of Yes bank, the RBI has also come up with a recovery plan for the bank. On Thursday, The Reserve Bank of India has seized the control of the Yes Bank and imposed various restrictions on its operations which also cover restriction on withdrawal limits.

Reasons for failure of Yes Bank

Lack of accomplishments of the private sector banks has changed the mindset of the public that not too many entrepreneurs in India can be trusted to run their businesses and to build the same for a longer tenure. Most of the private sector banks not exactly covered itself with the success story and to an upright level which resulted in a big question in the minds of the public who are directly or indirectly are the part of it. Within 2 days, Yes bank has gone through many investigations and asked for the reasons for the crisis. Yes Bank has gone from gaze at a sudden fall to being revived with the help of SBI.

Here is the glance of what happened at Yes Bank

The Decline in the financial position of the Yes Bank

The financial position of Yes Bank has undergone a constant fall over the last few years. The reason for the decline in the financial stability is the inability to raise capital to the marked unrealized loan losses, which resulted in degradation, Prematuringthe acknowledgement of bond arrangement by investors, and withdrawal of deposits. In the last 4 quarters, Yes Bank of India was making losses and inadequate profits.

Governance Issue

In recent years, one of the reasons for the constant decline in the financial position of the Yes Bank is that the bank has experienced governance issue.

Unsound and erroneous Assurance

Yes Bank has given false assurance by making a statement that the management of the bank was in regular contact with the investors who will invest and put the kind of money that the banks require to survive. But in reality, there were no such proposals. Adding to that, Reserve Bank of India says they were in frequent contact with the management of the Yes Bank to find ways to build up the liquidity and for sound financial position.

Issue of Liquidity

Yes Bank was facing the regular issue of liquidity. i.e. the bank was observing the withdrawal of deposits from customers.

Less engagement of Investors to put the capital into the bank

The engagement of the investors was very less in putting the capital into the bank. The investors kept on discussing with senior officials of the Reserve Bank, but due to various reasons, did not infuse any capital into the bank. The reason behind not putting the capital was that the investors were not serious enough to put the capital into the bank.

Read our article:MCA Introduced LLP Settlement Scheme, 2020 for Defaulting LLPs

What steps are taken by the Reserve Bank of India and Enforcement Directorate to fight against the high level of bad loans battles of Yes Bank?

Reserve Bank of India has taken over the affairs of the Yes Bank of India and put restrictions on its operations. On the other hand, Enforcement Directorate registered a Money Laundering Case against Rana Kapoor, the founder of the Yes Bank.

On Thursday, Reserve Bank of India has taken below mentioned steps-

- Yes Bank lender under suspension,

- Suspension of the bank’s board for 30 days.

- Put the lid on the withdrawal limit at ₹50,000 for 1 month period.

Reason for suspension-

- Bank was facing a crisis of non-performing assets,

- Governance Issue

- Unreliable Revival Plan.

Reserve Bank of India has selected State Bank of India to lead an alliance that will help the Yes bank in injecting new capital. As per the latest report of Bloomberg, State Bank of India had been authorized to pick other members of the alliance in the plan approved by the government. Adding to that, once the capital will get infused, there is a possibility that the current management of the Yes bank may also get replaced.

Further, the Reserve Bank of India disclosed a draft revival plan. The Finance Minister Nirmala Sitharaman at the press conference addressed that the State Bank of India has expressed its interest in Yes Bank.

As per the Draft Plan, State Bank of India will invest money in the bank and own 49% of the Restructured Bank.

Data analysis related to RBI’S Revival Plan

Role of SBI in Draft Yes Bank Reconstruction scheme 2020

The Reserve Bank of India[1] said SBI has expressed its willingness and evaluating the draft Yes Bank Reconstruction Scheme to invest in the Yes Bank. As per the Yes Bank Reconstruction scheme 2020’.

- The authorized capital of Yes Bank will be changed to Rs 5,000 crore,

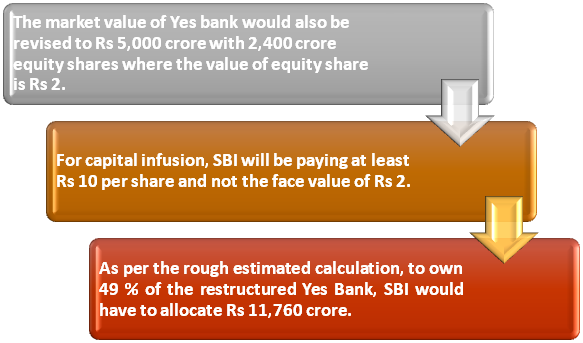

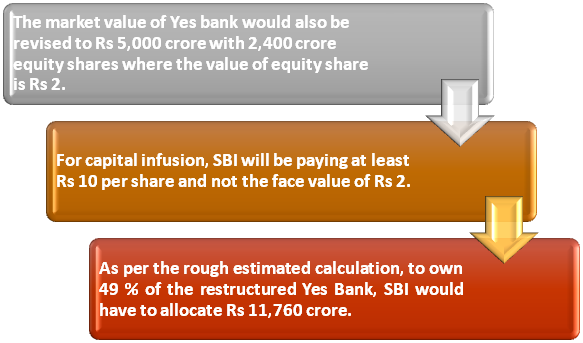

- The market value of Yes bank would also be revised to Rs 5,000 crore with 2,400 crore equity shares where the value of equity share is Rs 2.

- State Bank of India will have to buy 49% of restructured Yes Bank at Rs 10 per share, and it can’t cut down it’s holding below 26% before 3 years.

Further, In the Restructured bank’s Board members, SBI will have 2 nominees. SBI’s investment is not yet clear, But the estimate is varying in the range of Rs 2,450 crore to Rs 11,760 crore.

Takeaway

Reserve Bank of India has seized the control of the Yes Bank lender and imposed restrictions on its working. The crisis of the Yes Bank and the control of RBI signifies trouble for the customers, existing clients, and other stakeholders. The crisis of Yes Bank has resulted in a wave of fear across the domestic market and in general public who are somehow related to Yes Bank. Though the Reserve Bank of India has assured that it will come out with the Revival Plan for the bank’s recovery.

Read our article:EPFO Slashed Interest Rate on Provident Fund Deposits to 8.5%