The retail industry includes supermarkets that are engaged in the process of selling consumer goods and services to customers in order to receive profit. A grocery store comes under the domain of the retail industry as they sell a variety of food as well as non-food goods. Grocery stores are the most admired type of retail business in India.

No matter what is the condition of the economy in a particular region, grocery is an important part of one’s daily life. In this Blog we are going to discuss about the FSSAI Registration for Grocery Store in India and the steps you need to keep in mind before starting a grocery store.

Now as the ultimate significance of grocery stores in India has been recognized, there are a few steps that you need to keep in mind before starting a grocery store so you do not run into a legal predicament. Running a grocery store is similar as running a large industry when it comes in complying with the law.

Important Things to keep in mind before Starting a Grocery Store in India

The steps you need to keep in mind before establishing a grocery store in India are as follows-

Business Structure

- Business structure refers to the kind of ownership the business possesses. It is very important for the grocery store owner to formulate a wise decision regarding the business structure as it will determine the growth of the store in long term.

- Sole proprietorship is the simplest business structure to establish a grocery store and it is a popular choice among those who wants to establish a grocery store in India. Opting for this type of business structure will signify less legal compliances so making it easy for the owner of the grocery store to handle the store on his own.

- Registration of the grocery store as sole proprietorship firm at the nearest Municipal Office. There is no extra cost implicated and only opening of current account is required to register grocery store with the bank. Commercial tax rates will not be charged on the grocery store in case of sole proprietorship firm.

Contract of lease

One needs to adhere all the implications to manage a shop to start a grocery store. The owner has to prepare an agreement of lease with the landlord. Proceeding without entering into contract with the landlord is inviting trouble from the legal department. This type of contract is administered by the Rent Control Act passed by different states. A lease contract for a grocery store in India is basically different from that made for a residential house.

It must contain the following clauses-

- Working hours on the property

- Terms and conditions of renewal

- Right to sublease

- Name & Address of both tenant & landlord

- Consequences of breach of contract

- Code compliance

- Base rent, deposit, maintenance charges

- Amount of payment

- Alteration of structures

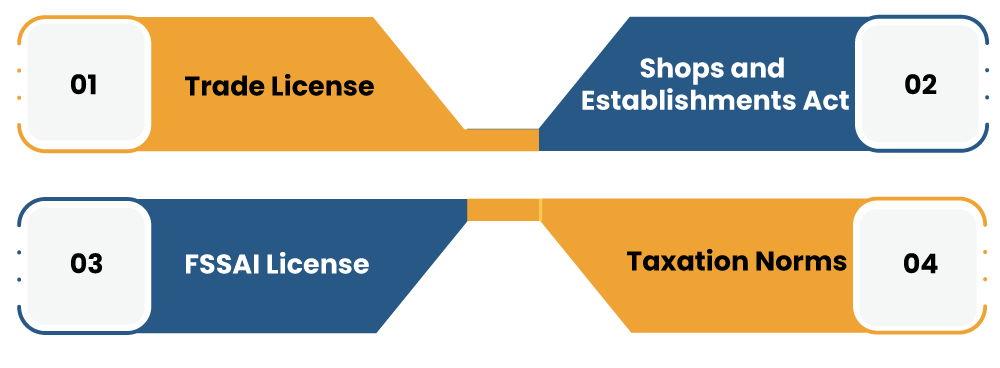

Licensing and Registration for Starting a Grocery Store

The various License & Registrations required for starting a grocery store are as given below, which are as follows:-

Trade License

A trader is bound by law to get hold of a trade license before commencing their trade and as the owner of a grocery store in India you need to obtain Trade license to make sure that your store is abided by all principles, regulations and ethical & safety norms. The authorization should be approved by the local municipal authority.

There are 3 types of businesses and trade for which a trade license is mandatory, they are as follows-

- Any business that is dealing with hotels, bakeries, restaurants, grocery stores, canteens & food stalls.

- Any trade that uses motives like factories, manufacturing industry, power looms, flour mills etc.

- Any trade that is offensive & dangerous such as sale of timber wood and firewood etc.

Legal Procedure of Trade License

Each state has their legal rules related to trade license. The Municipal Authority provides the Trade License. Some states provide a 30-days time after commencement of trade to obtain from the municipal authority.

The process isn’t monotonous one as it takes around 8 days to obtain a license but the process can be longer if the documents are faulty. The license can be revoked or canceled if the seller violates any conditions laid down in the trade license.

Documents Required for Obtaining Trade License

- Pan Card;

- Bank statement related to establishment of the trade;

- Certificate of establishment;

- Address proof in the form of electricity bill, water bill or sale deed;

- Photograph, ID proof & Address Proof of the owner or partners;

- Front facing photo of the trading business with the products.

A trader should make sure to renew the trade license from the period of 1st January to 31st March of a financial year. The provision of trade license are also provided in The Shop and Establishment Act, certain rules and work conditions should be abided by the seller to obtain a Trade license-

- Allowable working hours have been specified in the act and this limit should not be exceeded by any trade.

- Opening and closing hours, holidays, policies related to overtime, non-working days are dealt with by the act. A trade should not exploit its workers by breaching any of the above mentioned provisions.

- Employment and termination circumstances.

- Policy related to maternity leave and paid leave should be there.

- Employment of women should be regulated properly at the workplace.

The Shops and Establishment Act, 1953

- As an owner of a Grocery shop, the first thing to do is to register the shop under ‘The Shops and Establishment Act, 1953’.

- This act describes ‘shops’ as any premise where goods are sold by retailer or wholesaler and where services are rendered to customers.

- The owner of a shop should submit an application with the required legal fee to the Inspector of the local area.

- The approved time for submission of the application and the legal fee will differ from state to state.

- The application includes the owner’s name, number of employees, shop address and other required details. The chief commissioner after being satisfying with the application will issue a certificate of registration.

- The shop owner is required to considerably display the certificate at their shop and should guarantee periodic review of the certificate.

- The shop owner can make certain amendments to the certificate by informing the inspector within 15 days of the change.

- The relation between the inspector and the shop owner doesn’t end with the institution of the shop and its registration. The owner has the obligation to notify the inspector of the closing of the shop within an approved time to get the certificate cancelled.

- To ensure the registration of shops in the country, the Indian Government has facilitated online Shops and Establishment registration. The owner of grocery store for any state can easily find an online registration portal by visiting the webpage of their local municipal corporation.

FSSAI licensing

A large amount of the items sold at grocery stores is the fit for human consumption. Any business in India which deals with food products is required to be registered under Food Safety and Standard Authority of India (FSSAI).

FSSAI during the classification require various legal compliances to be followed for starting a grocery store, the non-compliance of which will lead to penalty.

Below are a few factors necessary to the process of licensing under FSSAI

- The Food Business Operator needs to realize the ‘capacity’ of the shop or the food business to apply for a specific category of FSSAI license. The turnover is the determiner for the kind of license granted to a Food Business Operator by FSSAI.

- If any food business has its division in more than one state then it is required to get hold of a ‘Central FSSAI License’ for its head office. A Food Business Operator with an annual turnover of INR 20 Crores is eligible for a central license.

- If a food business such as Grocery store operator has an annual turnover of INR 12 to 20 Crores, then it is required to obtain a ‘State FSSAI License’. License once obtained under FSSAI is valid for 1 to 5 years & after expiry renewal is mandatory.

- Though, one category of Food Business Operators exempted from this obligation is ‘Petty Food Manufacturers’ that has an annual turnover of less than INR 12 Lakhs.

- Petty food manufacturers are small-scale producer with a capacity of 100 Kg of production of food materials in a day or are temporary vendor. They are required to register themselves by filling Form A under Schedule II of FSSAI and do not need to obtain a license.

- A food business operator can obtain a central license by applying on http://www.fssai.gov.in[1]. After applying you are required to send a copy of the required documents with the prescribed legal fee to the Central Licensing officer within 15 days of filing of the application.

- Form B in the Scheduled II is to be filed to acquire a State License and should be submitted to the nearest selected officer with the necessary documents and approved fee.

Taxation norms

Goods and Services Tax has altered the taxation norms for grocery stores all over India. Every business owner is required to pay tax and register themselves under GST. Starting a grocery store after GST registration will get a GSTIN, a 15 digit code that is a unique number to identify GST number.

Registration is obligatory when the business crosses a precise annual turnover. If the annual turnover of a grocery store is lesser than INR 20 lakhs, it can register itself under GST laws but an annual turnover more than INR 20 Lakhs; it is mandatory to obtain GST registration. Due to the appearance of GST, businesses avoid dealings with unregistered companies as the whole thing is acknowledged and that will result in reverse taxation. Under GST returns a shopkeepers needs to file GST Return for 3 monthly returns and 1 annual return.

Is there any Legal Compliance to follow for Starting Home Delivery Services by Grocery Stores?

If you consider starting a home delivery service for groceries from your store to nearby customers, then it will make shopping convenient for the customers and will also increase your profits ultimately.

Here are a few things to keep in mind before staring home delivery service-

- A motorbike used for delivery purpose cannot be registered privately. A privately registered vehicle cannot be used for commercial purpose;

- RTO has the right to seize any private motorbike used for commercial purpose;

- No regulations relating to use of bicycles for purpose of home delivery by grocery stores is given.

Conclusion

Importance of acquiring licenses cannot be overlooked in any business and starting a grocery store is no different. The legal process isn’t as burdensome as other business owners have it. For the small scale industry on which a grocery store works you should know the law and gather its benefits.

Read our article: FSSAI Rolled out SOPs for the Refund of Erroneous Payments for Licenses or Registration