merchant banker refers to a financial institution. Merchant bankers mainly provide business loans and underwriting services to the clients. Their services are largely confined to large enterprises and individuals of high net worth. They often regarded as unique combo of banking services & consultancy.

They render consultancy on affairs related to marketing, finances, law, and management. Such consultancy services help to commence a business, procure funds, expand or rejuvenate the existing business. They provide a helping hand to companies during the registration process or share trading.

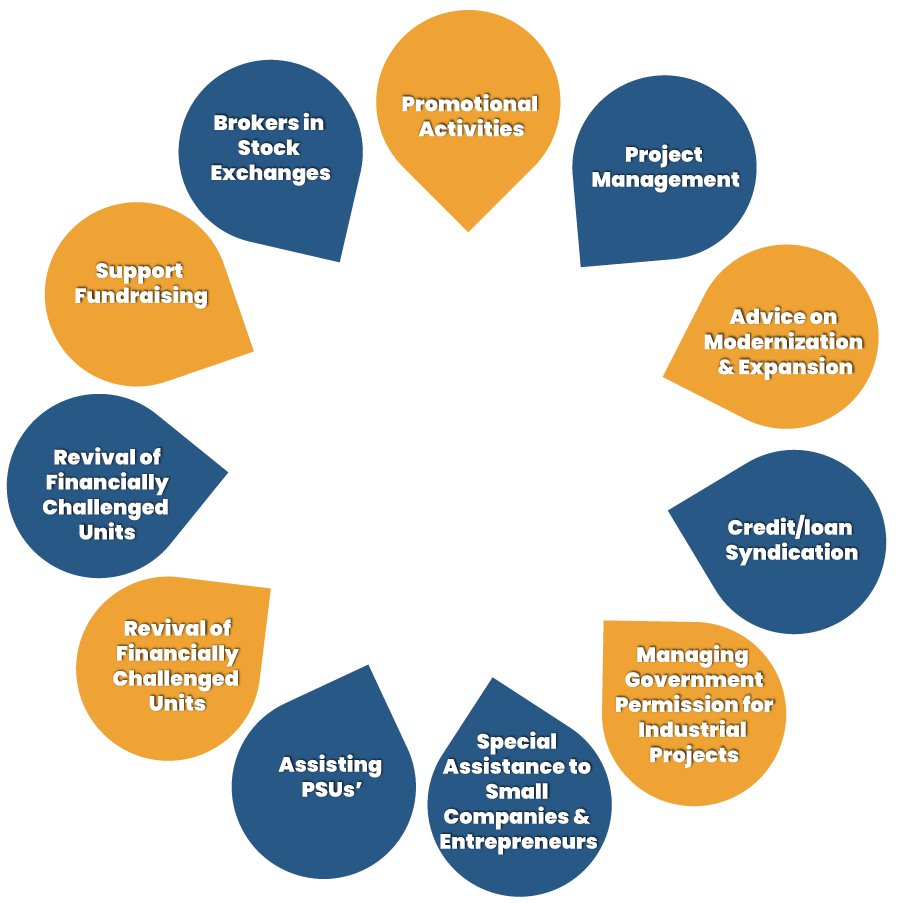

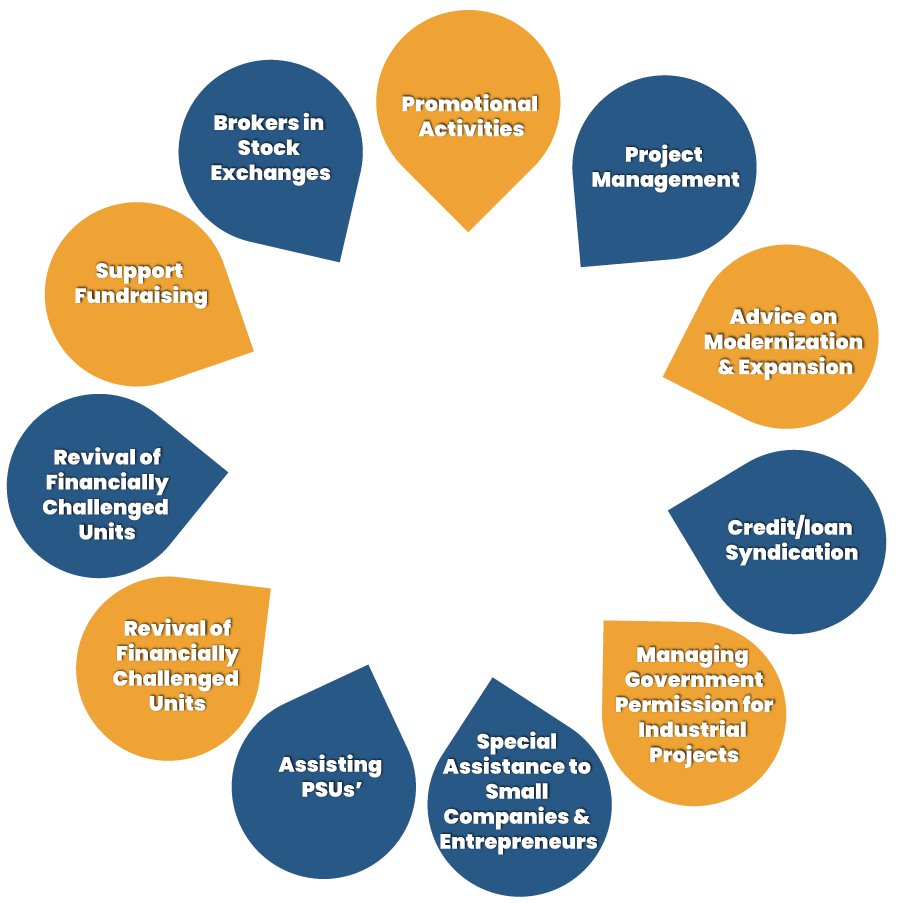

What are the Activities of the Merchant Banker in India?

The primary functions that a merchant banker carries out are like

- Stock Underwriting: This is one of the primary activities of the merchant bank.

- Issue Management: In this, a merchant bank renders support to the capital market to increase the securities’ supply in the market.

- Portfolio Services: – merchant bank also renders Portfolio Services to clients confronting fiscal crunch.

Underwriting is the process through which they increase and arrange to gather the fund from investors on behalf of governments and corporations issuing either debt securities or equity.

While serving as a banker, a merchant banker has to share details with Securities Exchange Board of India (SEBI). Fundamentally, they are not involved with the activities of lending institutions or depositories. Instead, they act as intermediaries.

National Grindlays Bank brought the notion of merchant banks in our country in 1967. Likewise, the State Bank of India (aka SBI) becomes the first Indian commercial bank to establish the independent Merchant Banking Division in 1972. Citibank establishes its merchant bank division in the year 1970.

Read our article:Synopsis on Exemptions from Registration as NBFC by Reserve Bank of India

What are the Attributes of Merchant Banker?

The following section depicts the very nature of the merchant bankers operating pan India, which are given below:-

Support Fundraising

Merchant Bankers (MB) supports their clients in procuring funds via the issuance of debenture, bank loans, shares, etc.

Brokers in Stock Exchanges

Merchant bankers also perform share trading on behalf of their clients. They often conduct researches on equity.

Promotional Activities

In India, Merchant Banker’s activities play a pivotal role as a promoter of industrial enterprises. They provide assistance to entrepreneurs in conceiving ideas, pinpointing projects, preparation of feasibility reports availing government permission, and incentive, etc.

Project Management

Merchant bankers use several ways to render their service to the client in financial related project management.

Advice on Modernization & Expansion

Further, Merchant bankers also provide clients with services on acquisitions, mergers, joint-ventures, amalgamations, diversification of foreign business collaborations, technology up-gradation, etc. Merchant bankers render the following on account of above-mentioned purpose:-

- Determining the public issue’s size

- The share pricing that yet to be issued.

- Acting in the manager’s capacity to the issue.

- Assist in receiving an allotment of securities as well as application.

- Appointment of underwriters and brokers for the issue.

- Listing shares on the stock exchange for the purpose of trading.

Credit/loan Syndication

A merchant banker assist clients during the project preparation, the loan application needed for procuring credit (either short term or long term) from various banks & financial institutions, etc.

Managing Government Permission for Industrial Projects

Merchant banker acts on behalf of the client to acquire government approval to expand the business and commencing a new business.

Special Assistance to Small Companies & Entrepreneurs

Merchant banker connects with small entities and business people and explains the accessibility of available avenues of business opportunities, incentives, incentives, and government-related policies and helps them leverage this.

Assisting PSUs’

Merchant bankers also furnish services to companies falling under the public sector category and their public undertakings.

Revival of Financially Challenged Units

A merchant bank helps compromised industrial units to come back on track. They set terms with several agencies, including long-term lending institutions, banks, and Board for Industrial and Financial Reconstruction[1] (BIFR).

Portfolio Management of Financially Challenged Units

Merchant bankers offer revival services to organizations issuing securities. Therefore, these bankers provide a wide portfolio of services to the capital market in India.

A Brief Note on Merchant Banks vs. Investment Banks

The line that separates the merchant and investment banks is very thin. The investment banks sell securities via IPO and underwrite as their primary function. The client of such banks is bigger organizations seeking to register securities for sale to the general public.

Investment banks also act as advisors for companies and guide them to tide over the difficulties that arise during significant business events such as mergers and acquisitions (M&A) and joint ventures. They also provide investment research to clients.

While merchant bankers are fee-based, investment banks possess a two-fold income structure. They may charge fees depending on the advisory services they render to the clients, but may also be fund-based- meaning they can reap income from leases and interest.

Irrespective of how a firm sells out its securities, there are minimum disclosure requisites to share with investors. Both private placements & IPOs require a firm audit by an external agency, which renders reports on the financial statements. Audited financial statements should enclose past year data along with disclosures. Potential investors can leverage this data to identify risks and advantages of purchasing the securities.

Conclusion

Merchant Banker plays a pivotal role in serving the corporate world. They act as a savior for institutions or companies who have issues in tiding over apparent business challenges. They have a wide portfolio of services designed to cater corporate needs regardless of their size or scale of operation. It’s worth noting that merchant bankers do not resemble commercial banks and largely remain inaccessible to the general public.

Merchant banks typically engaged in financing and underwriting services. They might provide services regarding the issuance of letters of credit and fund transfer. They may also consult on trading technology. They widely work with firms that operate in a limited market to raise funds from the public via IPO.

Merchant banks enable companies to issue securities via private placement, which require limited regulatory disclosure and are sold to investors. Merchant banks may assist their client with international transactions as well.

Read our article:Indian Depository Receipts: A Complete Checklist