Every passing day business world is getting competitive. In such a situation, your firm needs practical solutions to improve the services & stand out from the rivals while also cutting costs. Outsourcing Accounts payable is a feasible option for firms wanting to do just that.

Managing AP in-house is often a cumbersome task. The more you expand your business, the more daunting it becomes for the employees to manage the AP process effectively. Apart from that, the prospect of appointing an additional workforce to oversee accounting functions is seemingly a costly affair.

Ensuring Stable Organizational Growth by Outsourcing Accounts Payable

Many firms opt for outsourcing services to solve their staffing issues in the first place. That is one of the pros of outsourcing. However, you shouldn’t perceive outsourcing as a mere shift of labor. Under the right circumstances, outsourcing will let you reap consistent benefits and ensure stable organizational growth.

Most companies are reluctant to outsource their financial process to third-party service providers owing to compatibility issues. Outsourcing is meant to add value to the business. Adequately considering the pros and cons of outsourcing will put you in the commanding position to make a call for the future.

Read our article:An overview – Outsourcing of Accounts Payable Services

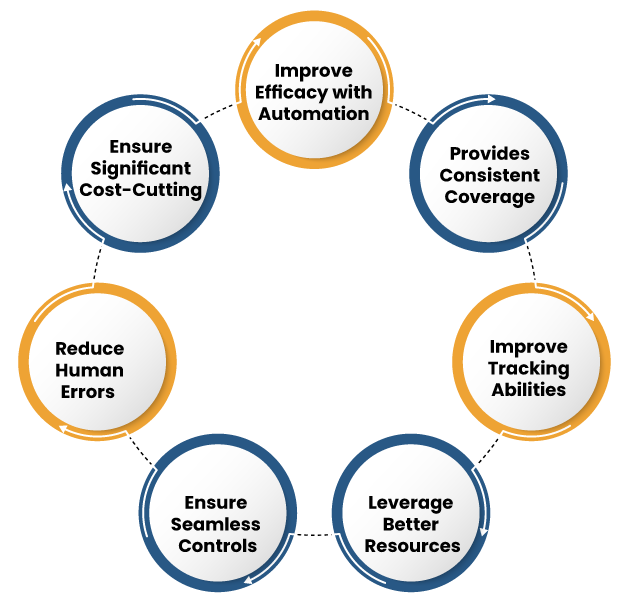

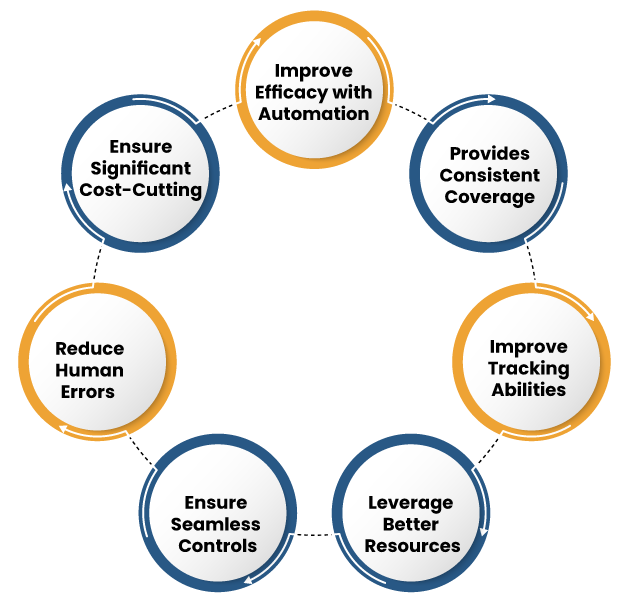

The Pros of Outsourcing Accounts Payable

Outsourcing isn’t about shifting accountability. Generally, deciding to work with a BPO provider will strengthen your company’s reputation and improve your AP process. It satisfies the below mentioned outcomes, which are as follows:-

Ensure Significant Cost-Cutting

Appointing experienced professionals and inculcating the latest technology adds to the company’s hardship when it comes to handling the Account payable function. On the contrary, outsourcing helps companies cope with those problems at an incredibly lower cost. You will minimize the transactional cost related to AP processing because you pay by the invoice with such a service, not by the hour. Outsourcing account payable is inherently beneficial both in terms of managing and costing standpoint.

Improve Efficacy with Automation

Outsourcing account payable to a third-party is beneficial because they have access to the latest processes & a wealth of experiences. That means your statement and invoice copies will be processed promptly without any delays. Modern-gen outsourcers leverage the latest technologies, which let them complete the task more promptly and precisely.

Provides Consistent Coverage

With an in-house facility, a supervisor would be accountable for overseeing scheduling and handling problems if employees are out. Third-party companies are very good at filling those gaps. Also, they strive to maintain common standards and stay intact even in the most demanding situation.

Improve Tracking Abilities

Although outsourcers do the work off-site, the latest technology enables you to monitor each step of the AP process instantly. You will have real-time access to your AP details. With this advantage under the belt, you can expect your AP processing function remains transparent and seamless throughout the service life.

Reduce Human Errors

Human error might have costly repercussions at times. If you are leveraging spreadsheets to monitor the AR process, there might be the possibility of errors. But, the automated process & well-versed experts that service providers use can reduce common issues and focus on what is important.

Ensure Seamless Controls

Outsourcing Account Payable ensures seamless management of the invoicing system. Your provider should have the latest system in place to keep track of your paperwork. Partnering with legit BPO providers should also reduce the trouble of document handling and systematic research.

Leverage Better Resources

A legit partner can take on your Account Payable operations and provide data-driven analytics for further improvement. They also have a broader bandwidth to add more volume, making them less vulnerable to seasonal increases and year-end crunches. And if you work with partners who leverage bleeding-edge technology, you will be able to get accustomed to the latest tools & have personalized improvement opportunities available.

Potential Downsides of Outsourcing Accounts Payable

Well, every business model carries some downsides, and outsourcing is no different here. The following section comprises possible risks that are inherent to outsourcing:-

Dilution of Power

When you have a workforce carrying invoice processing function, the control is much more direct. But when you hand over the task to a third-party, you shift a degree of control and visibility. Your power would get diluted as you lose the authority to interfere in the third-party workflow.

Unparallel Audit Protocols

Many outsourcing firms have their own audit protocol which is totally unknown to the outsiders. This may acts as a disadvantage for your firm since you have no control over their work. If something terrible happens, you are not sure how to counteract the issues. Your management might struggle to identify the primary source of the issue that is hindering the overall efficacy.

Duplication Submissions

If your outsourcing partner charges by the invoice, you need to remain extra cautious while avoiding duplicate submissions. And because various outsourcing providers don’t have the programs to tell you how duplicated submission comes into existence, it can leave you helpless to solve the problem. You will need to get your AP employees/vendors all on board with the change in system to avert such issues.

Conclusion

While there are severe disadvantages to outsourcing accounts payable, most of these cons are minimal with the right provider. In a nutshell, outsourcing account payable is productive both in term of efficacy and long-term growth. It is apparent from the above that cons of outsourcing account payable unable to outshine the positive sides. So, it can be concluded that outsourcing account payable is beneficial for the organization in every possible sense. Outsourcing account payable enable firms to reduce costs, decrease labour costs, increase efficiency, reduce risks[1], minimize upfront costs etc. Make sure to share your views with us by commenting below; we would be glad to hear from you.

Read our article:Understanding the Concept of Account Payable