Cancellation of GST registration isn’t a daunting task anymore for the applicant, as the online GST portal gets the job done in a few clicks via newly embedded features. GST bought vast improvements over the old tax regime. The implementation of GST discouraged tax leakage and sorted out the complexities of the previous tax reform. The business units are generating more than Rs. 20Lacs, of yearly turnover, are exempted under GST provision. On the contrary, the firms over this threshold limit need to register under the GST.

What exactly the cancellation of registration means from the taxpayer’s perspective?

As the term suggests, the cancellation of GST registration means that taxpayers would no longer be eligible for collecting or paying GST once the authority has approved the application for the same.

Cancellation Consequences

The taxpayers will not the avail exemption under GST, and neither will he/she pay GST. For certain businesses, GST registration is an absolute necessity. If the GST Registration is revoked due to any reasons and concerned entity still carry on their business’s operation, this could lead to substantial penalties. In short, it’s an offense to conduct business after the revocation of the GST registration.

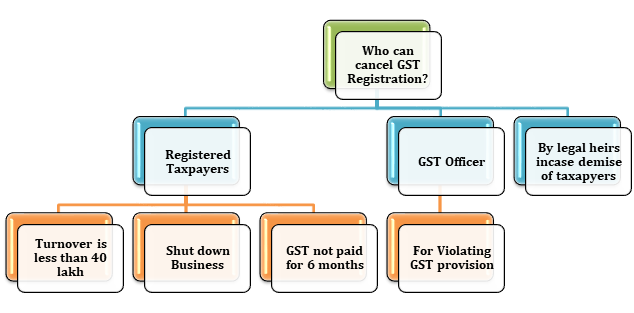

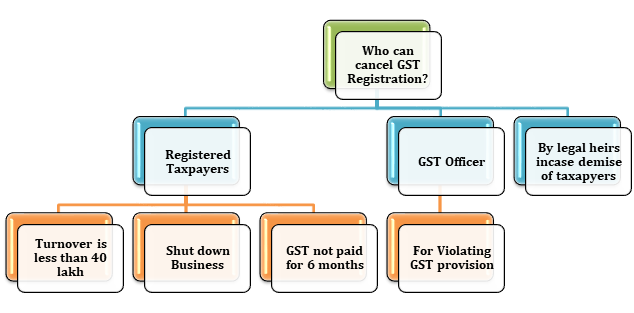

Which authority or personal are liable for canceling the GST registration?

Any business owners seeking cancellation of the GST registration need to head over to the GST portal and opt for the cancellation feature. However, due to tight compliances, the authority of the cancellation has been furnished to only three entities. Those are taxpayer seeking cancellation, a legal heir of the taxpayer, and GST officer.

Conditions that support the cancellation of GST registration

- The concerned taxpayers opt to shut down the business.

- A taxable person no longer intends to comply with GST provision.

- Taxpayers chose to transform their business on account of merger or amalgamation.

- Amendment in the business’s constitution is resulting in a change in PAN.

- The taxpayer failed to start the business for which he/she availed the GST registration.

- Any registered person fails to furnish returns for a continuous period of six months.

Non-eligible persons for Cancellation of GST Registration

- Taxpayers registered under GST as Tax collectors.

- Taxpayers with UIN.

Read our article:A complete overview of GST Registration for Service Providers

How to use the GST portal to cancel GST Registration?

The GSTN portal[1] works day in and day out for the taxpayers. It is outfitted with cancellation features for GST registration, which can be used at any point in time. All the taxpayers who have not furnished any invoice after the registration are eligible to avail of such service. In addition to that, if the taxpayer has filled the tax invoice, he is qualified to address the form like GST REG 16.

Steps regarding GST registration cancellation (migrated taxpayer)

- Login to the GST portal with the accurate account credentials.

- Head over to the right section of the screen and select ‘Cancellation of provisional registration.’

- A pop up will render on the screen seeking clarification from the taxpayer regarding the tax invoice raised in the serving period.

- Click on the ‘NO’

- Next,complete the verification process and submit all the necessary details. (Note: do not forget to furnish your digital signature while wrapping up the proceedings)

Type of form used for GST registration cancellation

There are few types of forms used for GST registration cancellation. Those are as follows:-

GST REG 16

The applicability of the forms is limited to those who opt for the cancellation of registration and elapsed one or more years since the day of GST registration.

GST REG 17

An authorized GST officer can use the REG 17 form the serve the purpose of GST registration cancelation. To trigger the cancellation process, the authorized GST officer issues the GST REG 17 form to the concerned entity. This form has been outlined in a simple format, used for notifying taxpayers regarding cancellation by incorporating reasons for the same.

GST REG 18

The applicant must confront show-cause notice with the aid of the GST REG 18 form. This mandatory form needs to be furnished within seven days of the issuance of the notice intimating clients about protecting the cancellation.

GST REG 19

The GST REG 19 issued by the GST officers to the taxpayers stating confirmation regarding the cancellation of GST registration. This form acts as an order for cancellation of GST Registration. The issuance of this form shall be done within 30 days from the date of application.

GST REG 20

As soon as the GST officers put the authentication stamp on the response against the show-cause notice, the order of cancellation activated by the authority.

Conclusion

GST registration is mandatory for all the taxpayers who are generating more Rs 40 lakh of yearly turnover. If some entity seeks swift cancellation of GST registration, then he can fill up the required form on the GST portal and wait for the approval. As soon as the concerned signatory approved the cancellation, the taxpayer would no longer have to comply with tax liabilities under GST. At CorpBiz, we are committed to render top-notch compliance and registration services to the taxpayer. If you have any concerns related to GST registration, feel free to contact us anytime.

Read our article: Actionable Strategies to avoid GST Registration