The claiming concerning the GST Refund on exports would witness a revamp under the new GST Return system. Under goods and service tax regime, exports get considered as zero-rated supplies. The special category of supplies under GST are- exports, deemed exports, supplies to SEZ units, and zero-rated supplies. Since zero-rated supplies fall under the section of the special form of supplies under GST, they are liable to enjoy certain benefits as well. Table 6A of GSTR-1 demands the reporting of export details.

Before moving to the procedure of the GST Refund on exports, we will introduce you to the concept of exports under GST.

Concept of Exports under GST

The concept of export of goods revolves around taking goods out of India to a location outside the geographical boundaries of India. On the other hand, the export of services means when the location of the service’s supplier is within India, and the place where the supply of services takes place is outside Indian boundaries.

Mandatory Conditions to get fulfilled for Export of Services to Take Place

The essential conditions mentioned below should get fulfilled for the export of services to take place under goods and service tax regime-

- If the location for the supplier of services is within India

- If the location for the recipient of service is outside the Indian borders

- If the place of supply is somewhere outside India

- As specified by the GST law, the relationship between the recipient and the supplier of service should not be that of a distinct person

The procedure of the GST Refund on Exports of Goods and Services

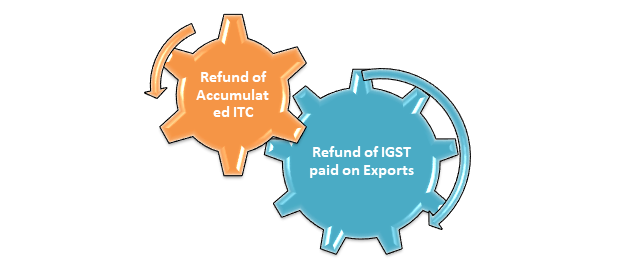

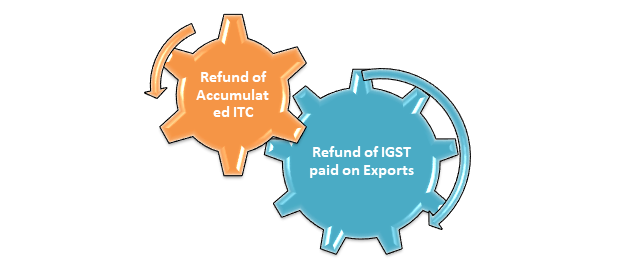

The taxpayers can go with any one of the options for GST Refund on exports of goods and services-

- Refund of IGST paid on Exports in the wake of setting off the ITC without the shade of Letter of Undertaking or Bond, except in the cases given below-

- If a claim is against the drawback concerning the taxes paid for the goods or services exported

- In the matter of export of goods outside India get subjected to export duty

- Notification 48/2017- Central Tax- dated October 18, 2017- All the deemed exports except those capital goods that get exported under the scheme of Export Promotion Capital Goods

- Notification 40/2017- Central Tax- dated October 23, 2017- Exporter of goods as well as services on which concessional tax would get paid for purchases with regard to intra-state and is helpful in making such exports as well

- Notification 78/2017 & 79/2017– customs, dated October 13, 2017– If the IGST got exempted for export of goods or services from the specified areas such as Software Technological Park or Export Oriented Unit or Hardware Technological Park in the same way as stated under the customs law.

2. Refund of accumulated ITC that didn’t get used where export of goods or services took place without IGST payment and under the roof of Letter of Undertaking (Also referred to as LUT in short) and the bond.

In the cases mentioned above, the claim for GST refund on exports can happen by filing the required details in Table 6A- GSTR-1 and after that, by filing the summary return every month in GSTR-3B.

Read our article:A Brief Coverage on the Difference between VAT and GST

Additional Steps Regarding GST Refund on Exports

- In the matter of goods to get exported with IGST payment, the Shipping Bill or Bill of Export would get considered as the application for IGST Refund.

- The Shipping Bill details that the exporter states in GSTR-1 would get verified by the GST Officer. Also, the GST Officer is responsible for the verification of the details coming on the ICEGATE portal.

- In case if the GST Officer gets satisfied with the declaration made in GSTR-1, he will credit the refund amount into that bank account, which the taxpayer has declared during GST registration time.

- Nevertheless, refund claims must get completed by the services exporters who paid IGST on exports by going on for applying in RFD-1 Form on the goods and service tax portal along with GSTR-1 and GSTR-3B.

- Another essential requirement is to report the BRC/FIRC, also known as Bank Realisation Certificate Number, for the export invoice. After the process of online submission comes to an end, an application reference number would get generated, and after the due verification, the GST Officer needs to process the refund claim.

- The same process follows for claiming the accumulated input tax credit refund without payment of IGST on the export of goods and services. It initiates with the exporter filing the LUT before leading to any effect on the exports, within settled deadlines. At the time of making the declaration in Table 6A as well as Table 6B of GSTR-1, the exporter needs to fill Tax Amounts as Zero.

- After the export gets completed, the information regarding the accumulated ITC must be reported to the goods and service tax portal by filing the form RFD-01 to apply for the GST Refund on exports of goods and services.

Benefits that Exporters get Under GST

- The refund of IGST paid would get claimed by the exporters on exports of numerous types except where specifically unavailable.

- Exporters may also claim the refund in cases where IGST got unpaid on exports under the LUT or bond cover. In a case like that, the accumulated ITC on input services or raw materials used in such exports would get refunded.

Relevant Time Table for Several Types of Exports

The time table for different types of exports are-

| Sr. No. | Type of Refund | Details of the Relevant Date |

| 1. | Goods Exported by Sea or Air | The date on which the aircraft or the ship wherein such goods get loaded leaves India |

| 2. | Goods Exported by Post | The date when the goods get dispatched by the post-office to a destination out of India |

| 3. | Goods Exported by Land | The date on which such goods cross the frontier |

| 4. | Services Received in Advance Before the Invoice Issuance Date | Date of invoice issuance |

| 5. | Completion of Supply of Services Prior to Payment Receipt | Payment receipt date in convertible foreign exchange |

| 6. | Refund of Unutilized ITC in Case of IGST remains Unpaid During Export Time | Financial Year End |

Take Away

As there is no single process concerning GST Refund on exports, it is a lengthy as well as a complex process. Furthermore, it varies from one case to another. In order to deal with the complexities associated, you must have in-depth knowledge about refunds and exports. If you face issues in handling matters concerning the GST Refund on exports and GST Registration, you must get in touch with Corpbiz professionals.

Read our article: Synopsis of the Entire Mechanism of Advance Ruling under GST