Form 15G is an essential document for Indian taxpayers, mainly intended to alleviate onerous tax deductions at source (TDS) on specific income levels. It acts as a declaration that the taxpayer is not subject to TDS because their total income is less than the taxable limit. Gratitude for people who wish to avoid unwarranted deductions from interest on fixed deposits, dividends, or other investments, Form 15G for Indian taxpayers is crucial, especially for those with low incomes.

By preventing money from being locked up in TDS, this Form provides a helpful tool for managing cash flows, particularly for people with lower income levels. To get the most out of it, though, and to avoid penalties for inaccurate submissions, it’s essential to understand its subtleties and eligibility requirements.

Who is Eligible to Claim the Benefits of Form 15G?

The persons eligible to claim the benefits of Form 15G are as follows –

- An individual, a Trust, or a Hindu Undivided Family can claim the benefits of Form 15G (However, a company or a firm is not eligible to claim such benefits).

- The claimant should be a resident of India.

- The claimant’s age must be below 60 years. (For individuals above 60 years, Form 15H is used)

- The income tax for the financial year should be none.

- The maximum taxable income (i.e. 2.5 Lakhs) should be more than the annual income from the interest at any cost to claim benefits from Form 15G.

Features of Form 15G for Indian Taxpayers

The main features of Form 15G for taxpayers are as follows –

- Form 15G can be submitted by an individual (aged below 60 years), a Hindu Undivided Family, or a trust.

- Form 15G for Indian taxpayers should be submitted by the taxpayer before getting the interest paid by the bank.

- This Form needs to be submitted to every banking or non-banking institution where the taxpayer has an interest-bearing account.

- If your annual taxable income doesn’t lead to any tax liability, then only this Form comes into the picture.

- The applicability of this Form is limited to Indian citizens only.

- The maximum taxable income (i.e. 2.5 Lakhs) should be more than the annual income from the interest at any cost to claim benefits from Form 15G for Indian taxpayers.

- Form 15G should be submitted at the beginning of the financial year, making sure that the annual income of the taxpayer so that there are no discrepancies.

- For senior citizens above the age of 60 years, Form H is used.

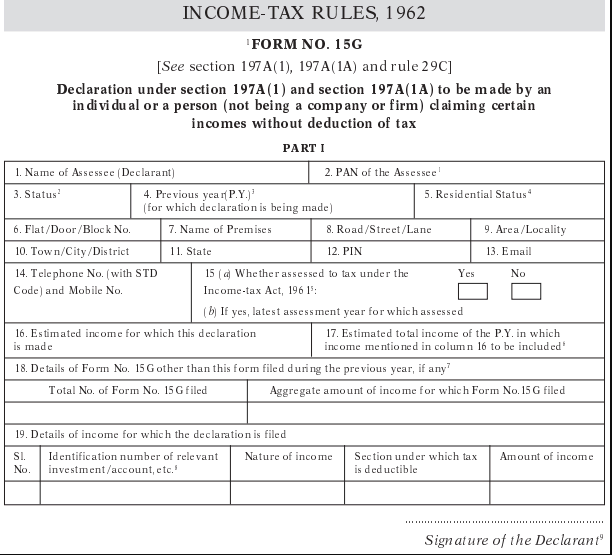

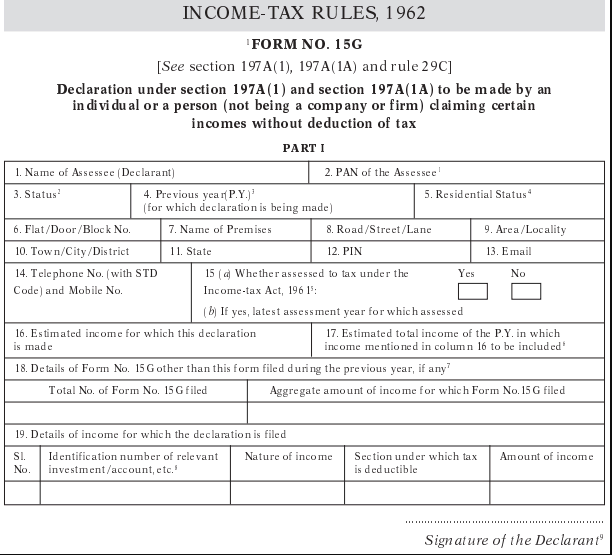

Form 15G Sample

Have a look at the sample of 15G for your reference.

Where to Submit Form 15G for Indian Taxpayers other than Banks?

Form 15G for Indian taxpayers of the Income Tax can be submitted to many other institutions besides the Banks. TDS deductions are made for various incomes, and these forms can also be used there. These institutions are as follows –

1. Tax Deductions on EPF Withdrawals

TDS on withdrawals from EPF accounts can be made if you are withdrawing the amount before completing five years at the service, and upon that, the withdrawal amount is more than Rs 50,000. EPFO makes sure that the EPF is deducted from such accounts to maintain transparency. The TDS rate on such withdrawals is 10% in the case of PAN card submission and 34.6% when not. However, Form 15G for Indian taxpayers and 15H submissions make sure that TDS is not deducted from the EPF withdrawals of the individuals.

2. Interest Payments on Corporate Bonds

If corporate bonds’ annual interest exceeds the limit of Rs 5,000 in that financial year, a TDS will be applicable to that account. To avoid such deductions at source, you can use Form 15G for Indian taxpayers and 15H by submitting them before such deductions are made.

3. Tax Deductions over Deposits in the Post Office

If the interest received over deposits exceeds the limit of Rs 50,000 in a senior citizen’s account, a TDS might be imposed on that account. To avoid such deduction, Form 15H can be filled out and submitted to the department.

4. Tax Deductions made over Rental Income

Rent received from the association of persons or firms from the property is also subject to tax deductions at source. The lessee is entitled to deduct a 10% tax over the rent payment if such amount exceeds Rs 2.4 Lakhs over 12 months. However, if such rent payment is your only source of income in the financial year, then you are eligible to claim exemption by filling out Form 15G for Indian taxpayers and 15H.

What are the Components of Form 15H?

Form 15H is divided into two essential parts that need to be filled correctly –

- Part A of the Form contains these details –

- Applicants’ names and details like PAN card and Aadhar Card.

- Financial Year details

- Contact and residential details

- Applicant’s income details, including the source of income along with the deductions that are claimed under the Income Tax Act of 1961.

- A signed declaration form stating the genuineness of all the pieces of information provided in the Form.

- Part B of the Form contains these details –

- Applicant’s name along with their tax liabilities for the financial year.

- Details like PAN and TAN, along with Aadhar card

- Contact and residential details

- Interest amount paid

Basic Things to Follow while Filling out the Form 15G

Before filling out Form 15G for Indian taxpayers, the applicant must ensure some basic things to avoid mistakes and neglect of exemptions claimed. These details are as follows –

- Form 15G has to be filled by individuals aged less than 60 years only; for above, Form 15H is used.

- All the details have to be checked before submitting the Form.

- The applicant should mention the assessment year correctly.

- Estimated income should not be well over the actual limit.

- While submitting Form 15G for Indian taxpayers, a PAN card copy of the applicant is required.

- The applicant must ensure that he/ she has collected the acknowledgment slip after submitting the Form.

Situations when TDS is not Applicable

There are certain situations where TDS is not even applicable to be deducted from an individual’s account. These are as follows –

- If an individual has transferred his EPF account to another one.

- In cases where the employee is terminated due to reasons that are not under his control, like ill health condition, closure of business of the employer, project completion, etc.

- In the case where the employee has withdrawn money from his EPF account after the completion of a 5-year term, even including past service.

- If the EPF withdrawal amount is less than Rs 50,000 but the employee has not completed five years of service.

- If the EPF withdrawal amount is less than Rs 50,000 and the employee has not completed five years of service, he/ she has submitted Form 15G for Indian taxpayers or 15H with PAN to the authorities.

The Process to Fill out Form 15G for Indian Taxpayers

Individuals/ Entities are required to go through a set process to fill out Form 15G in the correct way. If the process laid down by the authorities is not followed in the right way, then the form might be rejected by them, and the employee might not be able to claim benefits from it. The stepwise process to fill out Form 15G for Indian taxpayers is as follows –

- Initially, you need to mention your name as per records along with the PAN number as stated on your PAN card.

- You need to input under which category you are filling the Form, like an individual, HUF, or an entity.

- The current financial year has to be mentioned when you are filling out the Form for an income tax deduction.

- Then, the claimant’s residential details have to be mentioned as per the records. These details should include things like address, area PIN code, email address, and phone number.

- If your income in the past six years ever fell into the tax bracket, then you have to mark the question as ‘Yes’.

- The estimated income of the financial year needs to be mentioned irrespective of whether it is above the taxable limit. The income must include interest received and income of the current financial year.

- An estimated income of the previous year, which includes income in column 16.

- All the details of Form 15G for Indian taxpayers filed in the previous year, along with the total number of Form 15G for Indian taxpayers filed in that period.

- The total income needs to be mentioned, and the applicant has to fill out Form 15G.

- In the declaration that is filed, precise identification numbers of pertinent investments or accounts, the type of income received, the appropriate provision of the Income Tax Act for tax reduction, and the corresponding amounts earned must all be included. This means giving details like life insurance policy numbers, National Savings Certificates (NSCs), recurring deposit information, and fixed deposit account numbers. It’s important to remember that Section 56 of the Income Tax Act applies to several of these income sources. Therefore, full disclosure of this information guarantees adherence to tax laws and enables precise liability assessment and computation of tax.

- At the end of the Form, you need to make your signature. If the applicant is signing on behalf of the Hindu Undivided Family or Association of Persons, you need to mention your capacity.

Note: The Form should not be submitted if there are clubbed incomes of two or more individuals. The individual income from the interest should be clubbed with the interest received from various sources of a non-working spouse or children.

Conclusion

To sum up, Form 15G for Indian taxpayers is essential in helping eligible Indian taxpayers with the burden of tax deduction at source. It makes cash flow management more accessible by allowing for a declaration of income below the taxable threshold, especially for those with low incomes. To avoid fines, you must, nevertheless, proceed with caution and make sure that all requirements and laws are met. Investors can maximize their financial plans and make well-informed judgments if they have a comprehensive understanding of Form 15G and its ramifications. Adopting this technology enables people to reduce needless tax costs and optimize their savings while adhering to the law.

Corpbiz can provide expertise to applicants while filling out Form 15G since many technical details have to be followed, and it is very difficult for individuals who don’t have much knowledge about them. We have a team of experienced employees who can give you the required services at a low cost and in a quick duration.

Frequently Asked Questions

What is the use of Form 15G?

Form 15G for Indian taxpayers is submitted under section 197A of the Income Tax Act of 1961 for making a declaration that your annual income is under the threshold limit of exemption, so no financial institutions should apply TDS for the interest received in the account.

What is the difference between Form 15G and 15H?

The main difference between these two forms is that 15G is used for individuals who are below the age of 60 years, and 15H is used for individuals who are above 60 years of age. This is so because the income exemption limit is different for different age groups.

Is TDS deducted if EPF withdrawal is made of less than Rs 50,000?

In the case where the EPF withdrawal amount is less than Rs 50,000, and the employee has not completed 5 years of service, however, he/ she has to submit Form 15G or 15H with PAN to the authorities.

Can a NRI fill out Form 15G?

No, NRI cannot fill out Form 15G since it applies only to Indian citizens.

Is it required to submit Form 15G to the Income Tax Department?

No, Form 15G does not have to be submitted to the Income Tax Department directly. They have to be sent to the financial institutions, and they send it to the department after aligning them.

Where should Form 15G be submitted?

Form 15G should be submitted to all the financial institutions from where you receive the interest amount.

Is there any penalty for making a wrong declaration?

Yes, making a wrong declaration amounts to Tax Evasion and is punishable under section 277 of the Income Tax Act of 1961. The punishment involves –

-Imprisonment ranging from 6 months to 7 years if the amount exceeds Rs 25 Lakhs.

-Imprisonment ranging from 3 months to 2 years for lower amounts.

Read also about: What is Tax Deducted at Source & TDS Certificate?