Being a salaried individual, you must be having a habit of saving a certain percentage of your salary in the Fixed Deposit account, Recurring deposit account, or in mutual funds. But what if this habit is not inculcated within the other individuals? To benefit employees, government of India launched the scheme of EPF (Employee Provident Fund and Miscellaneous Provision act,1952 ).Under the this act, both employee and employer contribute 12% of their basic salary to the EPF account. The most significant advantage of having an EPF account is that despite changing jobs, the EPF number remains the same. Here, We will have an in-depth understanding of difference between the EPF and EPS scheme and how can you apply for EPF Registration Online.

What is EPF?

Employees Provident Fund [EPF] is a government scheme under Employees’ Provident Funds and Miscellaneous Provisions Act, 1952. Rules and regulations of EPF are regulated under the purview of Employees’ Provident Fund Organisation (EPFO. Basically, EPF is normally like a benefit to an employee during the retirement provided by the organization, and is mandatory for the company where numbers employee working is more than 20.

Latest Update – The interest rate that is applicable to the EPF contribution is 8.5% for Financial Year 2020-21.

Which Act regulates the EPF?

The act that regulates the EPF account is Employees’ Provident Funds and Miscellaneous Provisions Act, 1952[1]. It mainly strives to maintain a healthy employee-employer bond. An EPF scheme is an initiative designed to offer social security benefits to the employees at the time of his/her retirement.

Who all are exempted from the EPF?

The Employee Provident Fund is maintained and looked at by the EPFO (Employee Provident Fund Organization). Any organization whose employee strength is above 20, is required to register with the EPFO. However, the exemption in this category is provided to the organisation with less than 20 employees. Such organisations are not required to maintain EPF account.

How does the EPF work for an employer and the employee?

You are overjoyed when your employer adds 12% of your basic salary in your EPF account. Let’s see how exactly it works.

The employee and the employer both contribute 12% of the basic salary into the EPF account. The only difference is that employee’s 12% of the contribution goes into the EPF account whereas the 8.33% from the employer side is diverted into the Employees’ Pension Scheme (EPS) and the remaining 3.67% is diverted into the EPF account.

What is the difference between EPF and EPS scheme?

The full form of EPF is Employee Provident Fund whereas EPS is abbreviated as Employee Pension Scheme. Both EPF and EPS Scheme are the initiatives by the government of India to help individuals save money for their future needs in their old age.

Comparison Chart between EPF and EPS

| Parameters | EPF | EPS |

| Contribution by the employee | 12% | NIL |

| Contribution by the employer | 8.33% | 3.67% |

| Deposit Limit | Predetermined Fixed rate | Maximum – INR 1250 |

| Age Limit for Withdrawal | No such age limit | A minimum service period of 10 years and 50 years of age for an early pension. |

| Interest Rate | 8.65% p.a for the FY 2018-19 | No interest rate |

What is EPF UAN Number?

The UAN Number acronym as Universal Account Number is a 12 digit number allotted by the EPFO. The UAN of an employee remains the same throughout the lifetime of an employee despite they change in their job profile or company. The only thing that changes is the Identification Number (ID). The EPFO allots a new member ID every time employee switches his/her job, and this unique member ID is linked to the UAN. After this member ID is created, it is linked to the UAN.

What are the Documents Required for the online EPF Registration?

The employer of an organisation is required to furnish the following documents for the online EPF registration –

- A Copy of partnership deed in case it is a registered partnership firm.

- A copy of the Certificate of incorporation (Public or Private Limited Company). The Registrar of Companies should issue this

- A copy of their registration certificate in case of society.

- A copy of MOA and AOA in the case of Public and Private Limited Companies.

- A copy containing the rules and objects of the society.

- Legal documents required under the Income Tax Act.

- A copy of the PAN Card details of the company.

- Partition Deed of the Company.

- Incorporation Proof –Salary details of employees

- Details of the Balance sheet.

- Provident Fund statement and salary statement.

- The number of employees working in the organisation within a month.

- GST certificate, if the organisation is GST registered.

- First sale bill

- Cross cancelled cheque

- Details of the Bank such as Bank Name, IFSC code, and Branch address.

- Machinery and raw material

Read our article:How To Obtain GST Registration in India?

What is the procedure for Online EPF registration?

In this tech-savvy world, we prefer everything to be online, and thus every employer prefers the online mode for the EPF Registration.

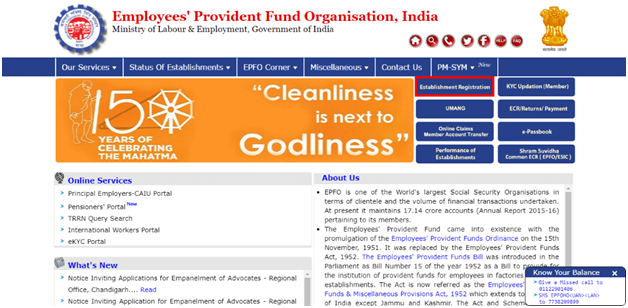

- Register your Organization with EPFO

Visit the EPFO portal and register yourself there. On the home page, click on the option “Establishment Registration.”

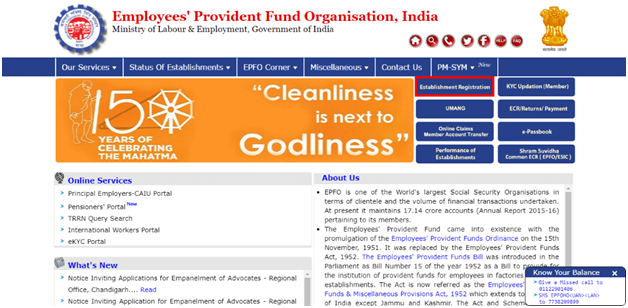

- Read the User Manual

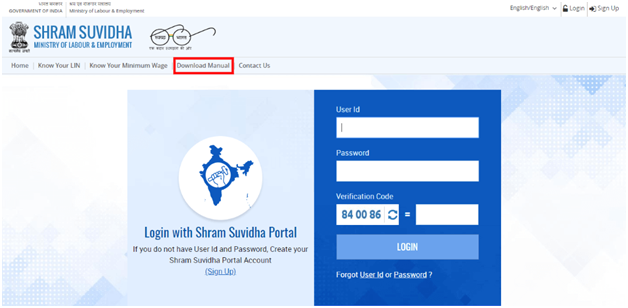

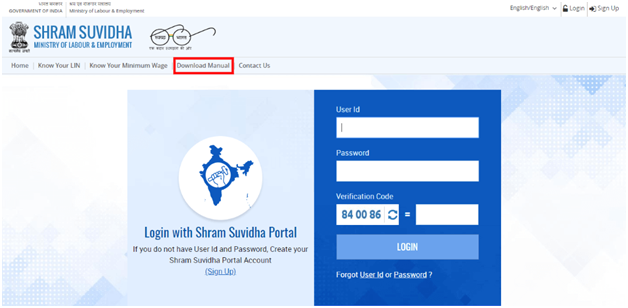

After clicking on the “Establishment Registration,” it will navigate you to the next page, “Shram Suvidha,” where you can download the User manual. Any new user must read the manual entirely before the registration.

- Register the DSC (Digital Signature Certificate)

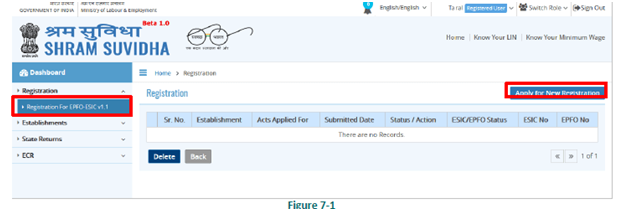

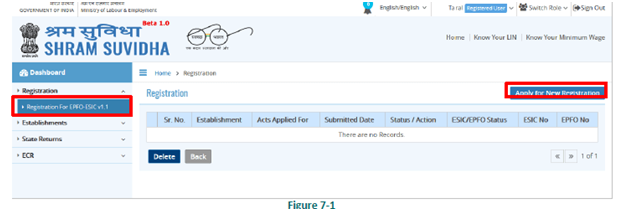

Here, on this page, at first, click on the “Sign Up” button. Sign up with the credentials such as Name, Email, Mobile Number, and verification code sent to the mobile. The instruction manual will explain you the process of online Employer Registration, after which you will get an option called “Registration for EPFO-ESIC”.

- Apply for New Registration

On clicking the option ” Apply for the New Registration”, you will see two options

“Employees’ State Insurance Act, 1948’

‘Employees’ Provident Fund and Miscellaneous Provision Act, 1952”.

After this, click on the “Submit button”.

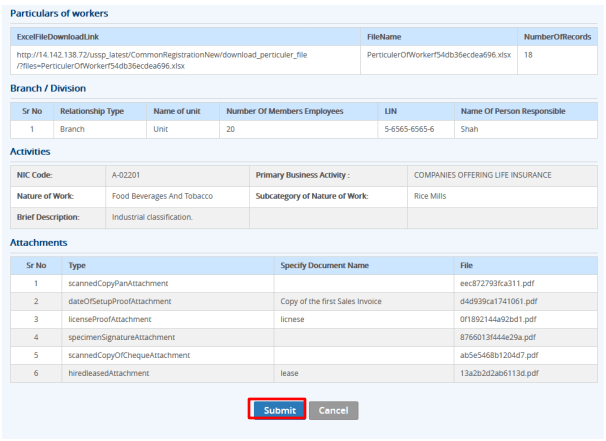

- Fill in all the details

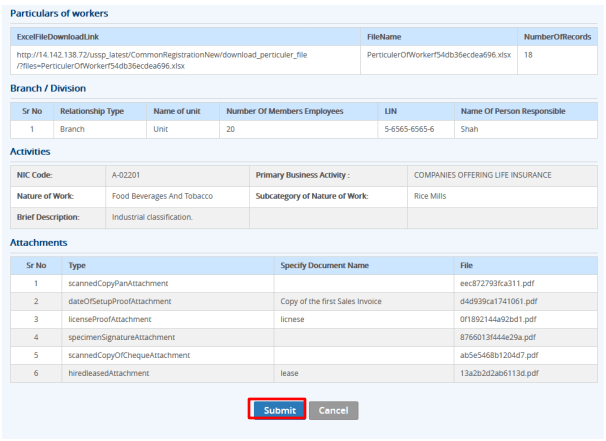

You need to fill the following details of the employer such as

- Establishment Details,

- contacts,

- Contact Persons,

- Identifiers,

- Employment Details,

- Particulars of workers,

- Branch/Division,

- Activities,

- Attachments

- Now, Click on the button ‘Submit’.

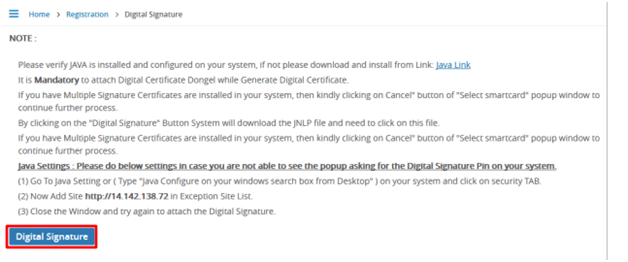

- After this, you need to apply for Employer’s Digital Signature Certificate[2] (DSC) Registration. DSC Registration is mandatory for new EPF Registration application.

Contribution Rate – EPF

The rate of contribution differs which depends upon the number of an employee who are employed in an establishment. Finance Ministry announced regarding the reduction in the statutory EPF contribution of the private sector employees and employers from the earlier compulsory 12% to now it is 10% for the forthcoming three months. The purpose behind this is that Government plans to give relief due to the outbreak of Covid –19 pandemic.

The contribution of employers in case of government PSUs shall remain at 12% whereas the employees of PSU can pay 10%. The advantage and purpose behind the reduction in the employee’s contribution from 12 % to 10% is that it helps in escalating the cash-in-hand or the take home pay of the employee.

Mandatory Compliance

There are certain mandatory provisions to be followed once the establishment gets registered with EPFO. There is certain compliance with as prescribed under the act:

- The monthly return is filed by uploading the ECR sheet online through the establishment login.

- With the 15th day of the succeeding month the return is filed online.

- Also the ECR sheet can be downloaded via EPFO in the XML sheet that has the name & UAN of each and every employee who are registered with the organization throughout the month when the return is filed.

- There can be conversion of the XML sheet into a Comma-dilemma file for the purpose of uploading the same for return filing.

- The return filing can be completed by contributing in online payment gateways.

Final Thoughts

Final thoughts suggest that it’s a wise option for an employer to have EPF registration done. The current interest rate is 8.65% for the FY 2018-19, which is ten basis points higher than 8.55% provided in the previous FY 2017-18. Under Section 80C, interest rate earned on the amount in the EPF account is exempted from the tax. Also, the employees are assured that their money is in the safe hands as the government has launched the EPF facility. In case the employee changes their jobs, they can transfer the EPF amount from one account to another

Read our article:Steps Involved In Private Limited Company Registration In India