EPF is a sort of secure investment that benefits the individual in the longer run. It typically supports the salaried class category who often struggle to procure ample fund for their post-retirement life. If you haven’t been registered to EPF yet, then probably you are making a big mistake. In this blog, you will become familiar with the various advantages of EPF registration, and you will learn why it is vital for salaried personals.

EPF is an abbreviated term for the Employee Provident Fund. This scheme laid substantial financial support for all salaried persons who need funds after retirement. The Employee Provident Fund Organization regulates the authority that governs the activity of the Employee Provident Fund in India. All firms or enterprises must register under EPFO if their existing workforce is more than 20.

This scheme is hugely beneficial for those seeking financial aid after the post-retirement. Under this scheme, the employer deducts a certain amount of funds from their employees and deposits in their respective EPF account. As soon as the employee retires, the fund in the EPF account transfer to the employee account.

Read our article:How to apply for EPF Registration online?

What is the Provident fund?

In 1952, the Provident Fund scheme was rolled out by the government under the Employee’s Provident Fund and Miscellaneous Act. This scheme is driven by specific rules and regulations rendered by the Employee Provident Fund Organization. The Ministry of Labor and Employment is accountable to govern the EPFO’s activities in the country.

In this process, the organizations deduct a certain amount of funds from the employer’s salary and then deposit it into the EPF account. To be specific is deducted fund is a 12% of basic remuneration of the employers which get mature with time and withdrawal anytime during post-retirement. The employers under the provident scheme would receive a fixed interest on the deductible amount based on the provisions under EPFO. One of the best things about this scheme is that it doesn’t attract any tax liability whatsoever.

For example, – an individual working in an organization earns a monthly salary of Rs 8000/. Under this scheme, the employers need to contribute 8.33% of this salary figure to the EPS. The remaining balance is credited to the individual EPF account. The registration under the EPF scheme is mandatory for individuals earning over Rs 15000/. As soon as the individual retires from the company, he/she can withdraw the entire fund without interfering with tedious obligations. If an individual dies due to any reason, the nominee can withdraw this fund on his/her behalf.

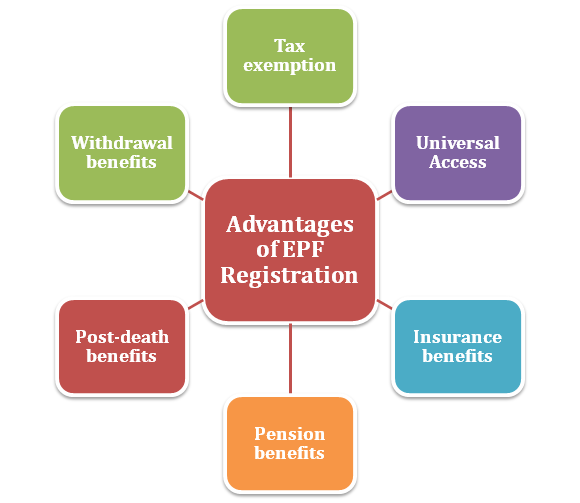

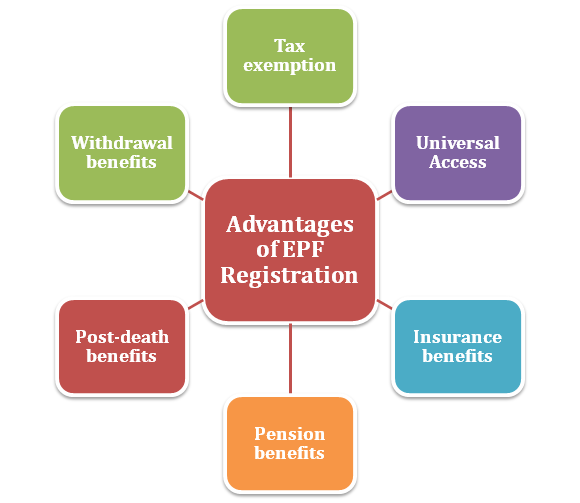

Advantages of EPF Registration

There are several advantages of EPF Registration, which are as follows:-

EPF Registration offers tax benefits

The interest rate earned on the EPF account is eligible for tax exemption. This relaxation is provided under Section 80C of the income tax act. Also, even multiple transactions from the EPF account would not lure any taxes for five years unless the employee voluntarily opts to resign from the job or terminate his/her tenure. Any contribution towards the EPF account doesn’t attract any tax liabilities.

The employee can avail the deduction of Rs 1.5 lakh as per Section 80C of the IT Act. But, in case you wish to discourage the EPF scheme, you have to make such a decision at the beginning of your employment.

You can use Form 11 to notify the company about such action. On the contrary, if you are already registered under this scheme, then there is no way you can avoid such a scheme. In that case, we suggest you stay with your EPF account as long as you can to avail future benefits.

Hassle-free pension for post-retirement

Procuring funds at the age of 50 or 60s could be a daunting task. Thanks to PF that can ensure lifelong pension under the Employee pension scheme. Although EPF discourages short-term fiscal benefits, it will ensure that you will get the money when you need it the most. The constant accumulation of funds towards the pension would prepare the substantial financial ground for the individuals for their phase of life after retirement. The advantages of EPF Registration are practically countless.

Funds for crisis management

The financial crisis could creep up anytime and squeeze out every bit of your savings. Thanks to the EPF account, that can act as an alternative source of funds to cater to fiscal obligations under the state of crisis. Whether you need to deposit for urgent medical bill or cater to education expenses, your PF is nothing short of savior in the demanding situation.

Easy transferability

With Universal Account Number (UAN) at the disposal, the employees would have access to their PF account through the online portal of EPF. This would let them coordinate their EPF account with different employees during their service life.

Cater urgent requirement

The service class individuals always had a tough time procuring funds in demanding situations. To cater to apparent expenditures such as weddings and education, employers can withdraw up to 50 percent contributions from their PF account. However, such benefits cannot be availed more than three times, and it is available to those who served at least seven years of service life as an employer under the Provident Fund Act[1]. Also, to claim such withdrawal, the employers need to submit proper documentation to the authority.

Conclusion

EPF is an excellent way of saving money for a demanding situation and future. The scheme also renders the insurance cover to the employee from EDLI. The employee does not need to serve any liabilities to avail such protection. This would result in higher returns as the interest rate is likely to crank up with time. Hence, investment in provident funds is not a costly affair as it would empower the individuals to reap monetary benefits in their demanding phase of life. Feel free to have a conversation with CorpBiz’s expert just in case if you want to avail more detail on the Advantages of EPF Registration.

Read our article:Comparison between EPF, GPF and PPF: Registration Process for EPF