Digital transactions have completely revolutionized the way we will deal with our payments today. After demonetization, the Indian government pays extra attention to digital payment to strengthen the economy. It’s safe to say that at present our economy and banking services have now become nearly cashless. The payment banks are referred to as a source of payment gateways that allow the user to complete the money transaction in a cashless way. These payment gateways are highly-secured as they are protected by military-grade encryption. Having said that, we will explore in this blog everything related to the Payment Bank license.

Payment Banks as Finance related Services

The RBI suggested the notion of a specialized bank model in 2013, known as a Payment bank. Like other conventional banks, the payment bank offers a plethora of finance related services except for facilitating credit cards and loans. The main goal to deploy such a bank was to provide easy access to payment facilities to underprivileged groups and support small enterprises. Through the swift deployment of Payment banks, the Reserve bank wishes to broaden the access of finances to remote areas. Bharti Airtel was the one who takes the initial step to launch India’s first payment bank. Those who want to indulge in such a business model need to avail of the Payment Bank License in the first place.

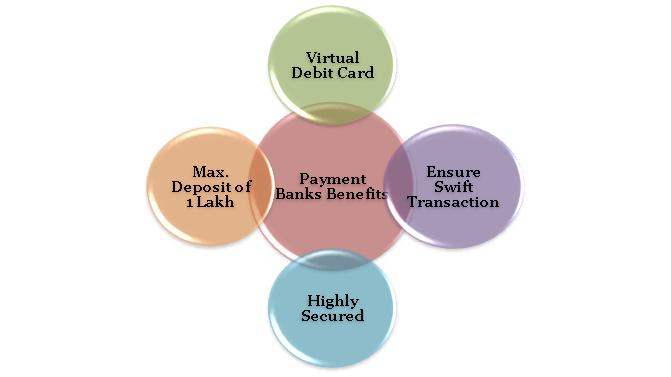

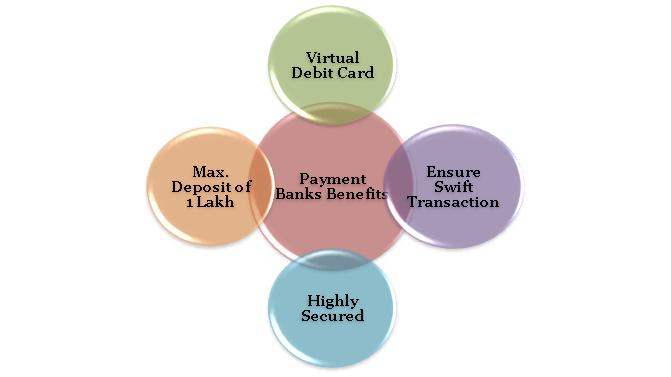

Payment Banks are swift, secured, and sensible when it comes to the online fiscal transaction. They have rejuvenated the way we handle our finances and day to day operations. They allow users to avoid apparent hindrances that they often encounter whilemaking payment through conventional means.

Read our article:Guide on Small Finance Bank license

What are the Basic Characteristics of Payment Banks?

It’s important to note down that conventional banks and payment banks are not alike. The services like credit cards and loans aren’t available at Payment bank. But despite this, these banks offer a string of productive benefits to the customers, which are as follows:

Deposit of 1 Lakhs

The Payment banks account holders are only allowed to deposit of One Lakhs rupees in their account. Remember, this is the maximum threshold limit for the account holders. The Reserve Bank has imposed this limitation in the purview of protection of customer’s interests. Such banks also render the leverage when it comes to depositing the amount. Now up to the users to deposit their amount either wholly or partially.

No Constraints on Minimum Account Balance

One of the prominent benefits that customers avail from Payment Banks is that they can hold a minimum account balance, unlike regular banks. The concept of zero balance fits here.

Operates both Current and Saving Accounts

Payment Bank License holders are eligible to offer both current account and saving account facilities to the customers. The savings account will allow the customers to attain the quarterly benefits; meanwhile, the current account doesn’t offer such a benefit to general customers. This benefit is only available to the merchants. The standard savings account offered by Payment Bank furthers gets bifurcated into multiple tiers, depending on the customer’s account balance.

Availability of Physical and Virtual Debit Card

The Payment Banks offers physical as well as a virtual debit card to the customers to ensure a swift and seamless transaction. The virtual debit card is free from additional charges, meanwhile, the physical card attracts annual service charges from the customers.

Online Fund Transfer

As the Payment Bank function utilized the digital centralized platform to operates, they offer plenty of services related to the online fund transfer. Its customers have access to online services such as IMPS, NEFT, etc.

Who are the Eligible Applicants for Payment Bank License?

The RBI has drafted a long list of the contenders who are eligible to avail Payment Bank License.

- NBFC i.e. Non-Banking Finance Companies.

- Companies working in a public sector

- Telecom companies

- Supermarket chains

- Group of promoters having a joint venture with a commercial bank.

- Corporate Business Correspondents (BCs)

Governing Bodies

- Companies Act, 2013[1].

- Banking Regulation Act, 1949.

- FEMA (Foreign Exchange Management Act, 1999).

- RBI Act, 1934.

- Payment and Settlement System Act, 2007.

- DICGC Act, 1961.

What is the Procedure to avail Payment Bank License?

- To avail such a license, the applicant must turn its business entity into a public limited company as per RBI regulation and Company Act, 2013.

- In the next step, the applicant must submit a written application to the RBI’s Chief General Manager regarding the issuance of the Payment Bank License. The applicant will then verified by the External Advisory Committee (EAC). During the verification process, the authority may call the applicant for further questioning regarding the legitimacy of the application.

- Once satisfied with the given information, the RBI shall validate the application and finally grant the license to the applicant. The information regarding the grant of the license will be displayed on the RBI’s official site. Upon issuance of the license, the applicant must lay the foundation of the bank and initiates the services within eighteen months.

Conclusions

The Government of India under the Digital India initiative constantly striving to broaden access to online banking for Indian customers and corporate. Unfortunately, setting up such a business model is not an easy undertaking as it lures a significant amount of funding and a minimum paid up capital of 100 cr.In case if you aren’t accustomed to legal obligations for obtaining Payment Bank License then our experts can help you out. All you need to connect with one of the team members and get precise guidance on the same. The CorpBiz experts will deal with your queries on a priority basis.

Read our article:A Complete Outlook of Payment Bank License