A payment bank is a new form of the financial institution conceptualized by the RBI. These banks are permitted to accept a deposit of Rs 100,000 per customer. These financial institutions don’t hold the right to issue credit cards or loans. However, they are allowed to issue debit or ATM card and render mobile banking. This article will unveil some facts related to documents required for Payment Bank license.

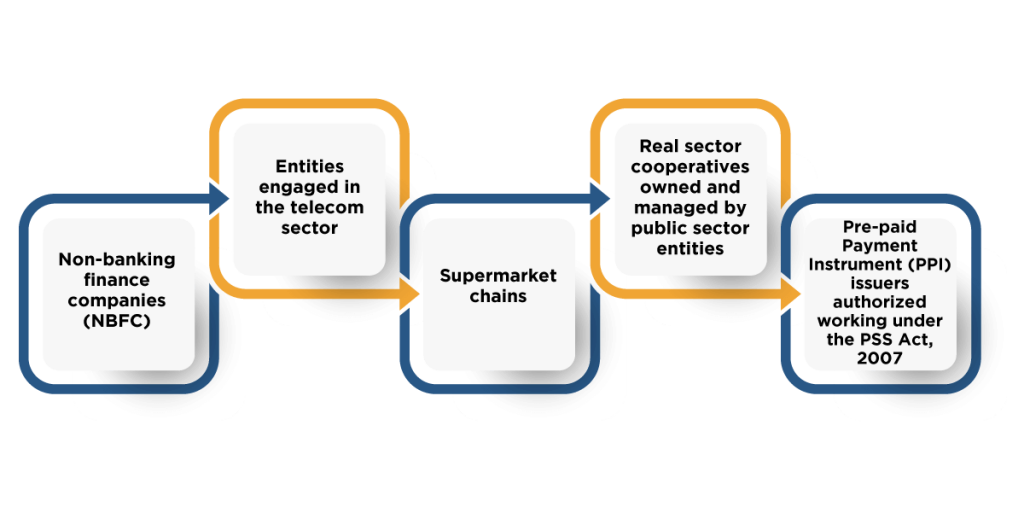

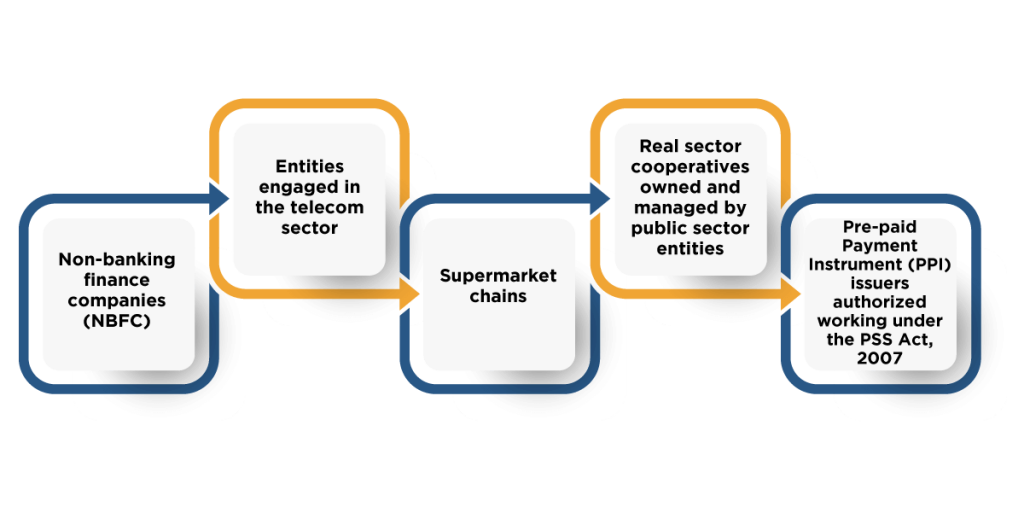

Who can Carry out Business Activities Related to Payment Bank?

The primary goal of these banks is to broaden the access of banking services to underprivileged individuals, low-income households, and small scale enterprises in a protected technology-driven environment. The RBI seeks to provide seamless financial services to all the remote areas of the country by underpinning payment banks.

It aims to revamp the existing economy by incorporating payment gateway for all sorts of transactions. These are the entities that can carry out Business Activities Related to Payment Bank. Those are as follows:-

Documents Required for Payment Bank License

Following are the documents required for Payment Bank License concerning Individual promoters, Company Promoting the Bank & companies and members in the promoter group.

Documents and Information on the Individual Promoter

- Promoter’s name, address, DOB, PAN Number, Guardian’s names, branch detail, Bank Details (such as account number, IFSC code), and credit facilities.

- Comprehensive details regarding the experience and working background of the individual promoter, the Company’s track record and financial standing, Information about the promoter’s interest in several companies/entities, etc.

Documentation And detail On The Company Promoting The Bank

- Memorandum of Association as well as Articles of Association,

- Income Tax Return for last three years,

- The financial statement of the entity for the past five years including the vital economic indicators

- Shareholding pattern of the entity.

Documentation and details on the companies and members in the promoter group

- Name of the members and companies, and corporate structure of all the companies, shareholding’s details.

- Names of the individuals and entities, management, and corporate structure of all the entities, details of shareholding, a pictorial representation of the organization structure, total assets, and shareholding of the companies possess.

- Yearly reports of the last five years of the group companies.

- Name of all the entities and individuals in the promoter group ( financial, non-financial, foreign entities) along with the following details

- Incorporation date,

- List of the activities performed by the entity,

- Address related to the Registered Office,

- PAN and TAN Number,

- CIN Number,

- Bank Account number,

- Tax liabilities encounter the entity.

- Branch detail of the entities as well as account information.

- Stock listing detail of all the entities.

After arranging the said documents, the applicant requires filling an application to the Chief General Manager of Reserve Bank regarding the issuance of the license. The application shall be examined by the External Advisory Committee.

During the evaluation process of application, the committee might ask the applicant to validate the authenticity of certain documents or details. After successful verification, the Reserve Bank shall give the Payment Bank License to the applicant. Also, the verified applicant shall be displayed on the RBI’s official website[1].

What are the Prime Features of the Payments Banks?

Payment banks and conventional banks are almost identical on several aspects, yet Payment banks work under certain limitations such as;

- The payment banks are allowed to accept a deposit of up to one lakh rupees. Keep in mind that this is the maximum threshold limit for these banks.

- Payment banks allowed to issue debit or ATM cards but cannot issue a credit card.

- Payment banks allow customers to open both savings and current accounts.

- Payment banks cannot offer a credit facility to the customers.

- Payment banks don’t have the authority to accept deposits from the individuals residing in an overseas location.

- Payment banks shall reserve the right to make a payment on a personal basis and receive remittances from the overseas location on the current accounts.

- Like traditional banks, Payment banks also need to procure a fund in the form of a Cash Reserve Ratio (CRR) with Reserve Bank.

- Payment banks are liable to invest a minimum of seven five percent of its demand deposit in security bill or government treasury with a maturity period of up to 1 year and possess a maximum of twenty-five percent in fixed and current deposits with other banks for operational banks.

- Payment banks allow customers to pay utility bills such as gas, electricity, and water bills through a secured payment gateway.

- Bifurcation of the payment banks cannot be possible, i.e. they have steak around with a single branch to carry on their activities.

- Payment bank under RBI registration can operate as a partner with other traditional banks and offer mutual funds, insurance products, and pension products.

- Payment banks are liable to add the term “Payment Bank” in their name as it is a legal prerequisite.

- Payment banks can provide services related to mobile and internet banking.

- Payment banks can represent any banks but under the strict guidelines of the Reserve Bank.

- The payment banks are legally eligible to accept remittances from many banks via payment mechanism such as NEFT/IMPS/NEFT

Conclusion

Payment banks are conceptualized by Reserve Bank a few years back to promote cashless banking in the country. The deployment of the payment banks requires the incorporation of information technology where the monetary transaction can occur can within a secured framework. The existence of a payment bank depends on the IT infrastructures. Payment banks breathe life into the Indian financial sector because more than 55% of India’s population still lacks access to banking services.

With such facilities at disposal, the Indian citizen can address the banking needs with ease as far as deposit or transaction of money is concerned. Connect with CorpBiz‘s expert in case you want some additional help regarding documents required for Payment Bank license.

Read our article: A Complete Outlook of Payment Bank License