Choosing the right insurance plan won’t be an easy undertaking for the customer, particularly when the market is already flooded with plenty of options. This is where Insurance Broker comes into the picture. An insurance Broker dealt with the selling of insurance plans of the company to the customers.

They usually represent themselves as an integral part of the organization and their jobs is to help the customers to pick the right insurance plan that fits their budget and needs. To carry out such a task in India, one has to steak around with legal obligations and avail the Insurance Broker License.

Who Governs the Insurance Broker License in India?

At present, there are two authorities who are responsible for handling and regulating the Insurance Broker License in India. These are:-

- Insurance Regulatory Development Authority Act, 1999;

- Insurance Regulatory Development Authority of India (Insurance Brokers) Regulations, 2018.

Read our article:Know about Insurance Web Aggregator License; Benefits, Eligibility and Registration Process

Eligibility Criteria for Insurance Broker License

The following are the eligible for carrying out the insurance brokerage-related activities in India

- Any entities working under the canopy of Companies Act, 2013[1];

- Any co-operative societies (registered) adhere to the guidelines of the Co-operative Societies Act, 1912;

- Any LLP registered under the LLP Act, 2008.

- Authority certified individual.

Capital Requirements

The applicant should meet the minimum capital requirement for obtaining a broker license. Those are as follows:-

- Direct Broker- Seventy Five Lakhs

- Re-insurance Broker- Four Crore

- Composite Broker- Five Crore

(Note: the given amount is in INR)

Net Worth Requirements

The applicant should meet the minimum requirement regarding for obtaining a broker license. Those are as follows:-

- Direct broker: Fifty lakh rupees

- Composite and re-insurance broker: fifty percent of the capital

Deposit Requirements

Every applicant prior the commencement of broker activities should maintain the given threshold of deposit with the schedule bank. Those are as follows:-

- Direct Broker : Ten lakh rupees

- Re-insurance / composite broker: ten percent of the capital.

Office Space/ Facilities

The applicant seeking Insurance Broker License should meet necessary infrastructure requirement such as equipment, adequate office area, skilled workforce, and IT infrastructure to efficiently address the project.

In case if the applicant is a partner in a registered LLP firm then the following individuals are not eligible to be a partner

- Non-Resident Entity.

- Any foreign LLP registered under the law of that foreign country;

- Any person from an overseas location.

What is the Classification of an Insurance Broker?

In our country, the Insurance Broker is classified as Direct Insurance Broker, Reinsurance Broker, and Composite Insurance Broker.

Direct Insurance Broker

Direct Insurance Brokers engaged with direct selling of the insurance product. They approach the prospect and provide them support in choosing the right policy depending on their needs. They also assist clients when it comes to paying the premium or opening the e-insurance account.

Reinsurance Broker

A Reinsurance Broker acts almost similar to the Direct Insurance Broker. Below are the tasks they perform in general:

- Handling market statistics related to the reinsurance market.

- Selling reinsurance-based products to the prospects.

- Deal with negotiations affairs.

Composite Insurance Broker

A Composite insurance broker renders insurance oriented services to the prospects on the behalf of the client. The insurance services rendered by these individuals are associated with the life and general insurance. But, the IRDAI has some tight compliance for such scope of work. This is the reason why the issuance of such a license is not as simple as that of other types.

Documentation for Obtaining Insurance Broker License

The given list exhibits the type of documentation required to avail the Insurance Broker License in India. The applicant seeking such a license requires filing an application in Form C of schedule I and forwards it to the authority along with the given documents.

- Form B to file in application.

- Copy of MOA and AOA.

- Particulars regarding the Principal Officer in Form G of Schedule I. The said individual must pass the insurance examination prior to the submission of the application.

- A declaration stating that the Principle officer and other key personals of the company such as director and partners are included as per the direction of Section 42 D of the Insurance Act;

- Complete particulars of the directors and other key managerial personnel.

- Complete details of 2 eligible agents plus their qualification information.

- Detail regarding the bank account of the company.

- Details related to the principal bankers and statutory advisors.

- Shareholder’s list.

- Board resolution copy passed in the board meeting of the company for promoting and investing in the company.

- Company’s Balance sheet (audited one).

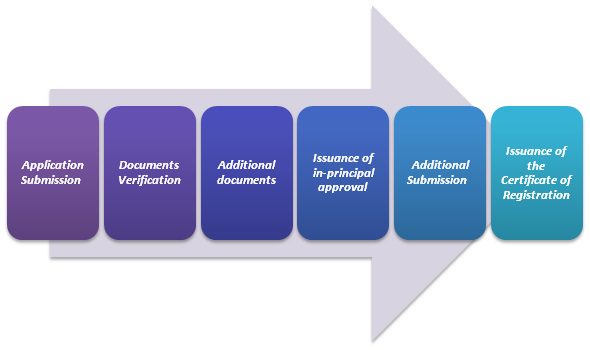

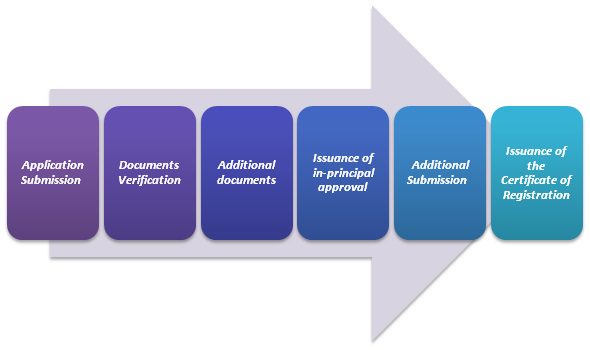

Detail steps for obtaining the Insurance Broker License

Following step-by-step instructions can help you avail Insurance Broker License in India. Make sure to follow them with the deliberate approach.

Application Submission

To get started, the applicant company needs to take advantage of Form B for filing an application along with a prescribed fee. The applicant must go along with the requested document to the Insurance Regulatory Development Authority of India (IRDAI).

Documents Verification

The authority will then do the in-depth examination of the submitted paperwork along with the application. During the investigation phase, the authority might call the applicant for questioning upon pinpointing the errors in the submitted documents. Moreover, the authority might intimate the applicant for the submission of additional documents.

Additional documents

Upon receiving the notification regarding the submission of the documents, the applicant must submit the requested documentation within thirty days of intimation.

Issuance of in-principal approval

As soon as the authority completes the validation process and approves the submitted docs, they will grant in-principle approval related to the Insurance Broker License.

Additional Submission

In this step, the applicant needs to deal with additional requirements and submit requested the fee as prescribed by the authority.

Issuance of the Certificate of Registration

Once the authority finds the candidature of the applicant legitimate on all ground, they will issue the COR (Certificate of Registration) without any further delay. The applicant will receive the certification in Form J as specified in Schedule I of the Insurance Regulatory and Development Authority of India regulations.

The Fee Structure for Insurance Broker License

The fees related to the Insurance Broker License needs to submit to the authority in Form D of the schedule. The following table illustrates the fee structure related to the Insurance Broker License.

|

|

Non-Refundable Application Fees (INR) |

Registration Fee for Fresh Application (INR) |

Renewal Fee for a period of 3 years (INR) |

|

For Direct Broker |

25,000 |

50,000 |

75,000 |

|

For Reinsurance Broker |

50,000 |

1,50,000 |

2,50,000 |

|

For Composite Broker |

1,00,000 |

3,00,000 |

5,00,000 |

Expiration and Renewal of Insurance Broker License

Technically, the Insurance Broker License serves a validity period of three years. The renewal application can be submitted to the authority before one month of the expiration of the license.

Conclusion

The role of the Insurance Broker License holders is to sell a wide variety of insurance plans to the different customers, based on their requirements. They help the customer to make informed decisions and pick the right policy through precise guidance. There are several delicacies that one encounter while availing of this license. If you wish to skip these obstacles and obtain a license without legal complexities, connect with CorpBiz’s professional without any second thought.

Read our article:Step by Step Procedure for Insurance Broker License