A web aggregator is a company, registered under the companies act[1], approved by IRDA [Insurance Regulatory and Development Authority]. IRDA maintains and owns the website, provides information with respect to insurance products of different insurance provider companies. Insurance Web Aggregator works as an online platform for providing information related to financial and insurance products. Consumers can seek quotations from different insurers only on one platform.

With this blog, we will discuss Insurance Web Aggregator, how to get an Insurance Web Aggregator license, and it’s eligibility, and other benefits.

What is an Insurance Web Aggregator?

Web Aggregator is an online insurance platform; activities are governed by the Insurance Regulatory and Development Authority of India (Insurance Web Aggregator) Regulations, 2017. Web Aggregator works as an intermediary, maintaining and supervising the website along with comparing the price and features of different insurance products being offered by the different insurers available in the market.

Who is the insurer?

According to Section 2 (9) of the insurance act, 1938 insurer is:

- Individual or a corporate body incorporated under the law governing insurance business, which

- carries on that business in India, or

- has his or its principal place of business or is domiciled in India,

- with the object of obtaining insurance business, employs a representative, or maintains a place of businesses in India

- Any corporate body not carrying on the business of insurance, which is a body corporate incorporated under any law for the time being in force in India;

- or stands to any such body corporate in the relation of a subsidiary company within the meaning of the Indian Companies Act, 1913

- any person who in India has a standing contract with underwriters who are members of the Society of Lloyd’s whereby such person is authorized within the terms of such contract to issue protection notes, cover notes, or other documents granting insurance cover to others on behalf of the underwriters.

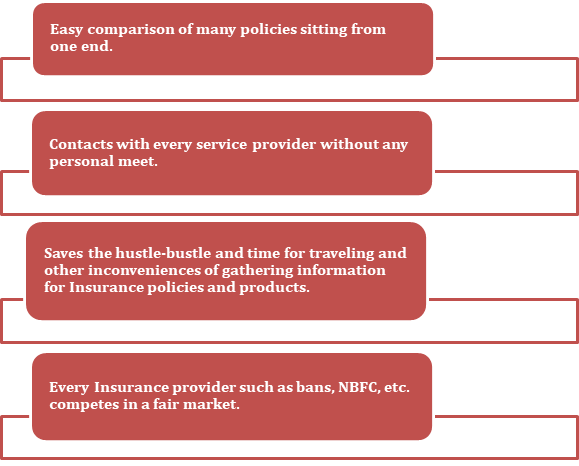

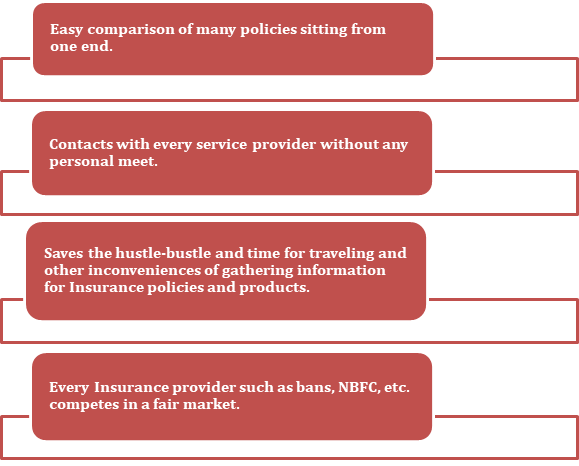

What are the benefits of using Web Aggregators?

What is an eligibility criterion for registering as an Insurance Web Aggregator?

Minimal Criteria for Insurance Web Aggregator license applicant shall fulfill the following conditions;

- Applicant Company shall be incorporated and registered under Companies Act, 1958. Company shall comply with all the FDI norms as applicable for insurance sector at the time of submission of application and shall continue to comply with them during the course of their business as Web Aggregator ;

- Memorandum of Association of company shall mention it’s main object as web aggregator;

- Further, the applicant shall not be engaged in any other business other than a mention in the object of the company’s MOA

- The applicant should not be registered or licensed as an insurance agent, corporate agent, loss assessor, micro-insurance agent, TPA, surveyor, or as an Insurance Broker under the important Regulations framed by the Authority.

- The applicant should not have any referral settlements with an Insurer.

- To manage company affairs, company shall appoint a designated director as principal officers for full time.

- Education qualification of principal officer shall be as prescribed in Schedule V of the act.

- Also, the principal officer shall fulfill the FIT and PROPER criteria set by the Authority, as mentioned by the Authority.

- Principal Officer shall not violate the obligation and code of conduct of web aggregator as specified in schedule VI and VII respectively to this regulation;

- The Authority, under its opinion, can grant an Insurance Web Aggregator license, which will be in the interest of policyholders.

What are the Eligibility criteria for the employees of Web Aggregator?

- The employee of Web Aggregator Company is required to complete the fifty hours of theoretical and practical training from an authority recognized institution.

- After the completion of training, exam is conducted by the National Insurance Academy, Pune, or by any authority, which an employee is required to pass.

- Telecallers employed by the Web Aggregators to promote the business should be enrolled as the Web Aggregators employee and should have completed the statutory training as prescribed by IRDA.

- Web Aggregators are responsible for all kinds of acts and omissions performed by it’s deployed employees.

What is the Annual license fee for Web Aggregator?

- An annual License fee of Rs. 5,00O shall be paid annually by every Web Aggregator;

- The fee shall be paid before the expiry of 15 days from the finalization of annual audited accounts of Web Aggregator or till 30th September.

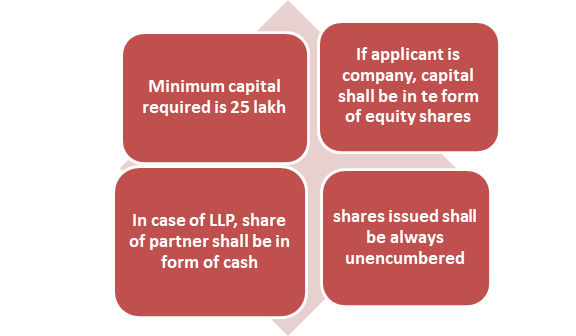

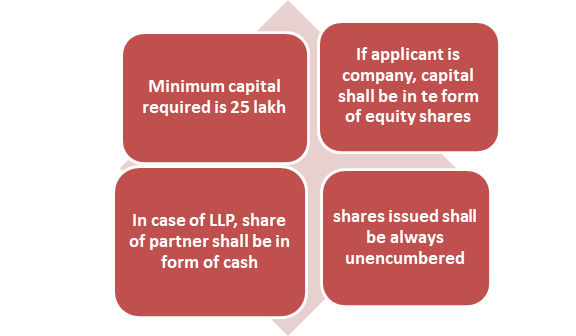

What is the total capital requirement?

- In the case where an applicant is a company minimum paid-up share capital should or where the applicant is an LLP, the minimum capital requirement is 25,00,000/-.

- Further, when the applicant is a company, paid-up share capital has to be issued and subscribed in the form of equity share.

- LLP’s minimum contribution has to be bought in cash only.

- The share issued in the form of capital for doing business of web aggregation shall remain unencumbered. This means issued shares cannot be pledged to secure any kind of credit.

Net Worth Requirements

- Net worth prescribed for an Insurance Web Aggregator shall not at any time fall below 100% of the minimum capital requirement.

- Status of its net worth shall be reviewed by every 30th September and 31st March.

- The net worth certificate shall be duly certified by the Chartered Accountant and shall be submitted to the Authority every year after the finalization of books of account.

What can be the ground of rejection of an application?

An application can be rejected due to the following grounds;

- If the application has been presented without furnishing complete information. That means incomplete information can lead to rejection of application;

- In case where an applicant fails to provide the information asked by the Authority within the given time frame of 30 days.

What is the procedure for the grant of certificate of registration?

- An applicant seeking grant of Insurance Web Aggregator license shall be made applicable to Authority in Form as shown in Schedule I – Form A as prescribed in the act.

- The payment shall be made in the form of Demand Draft or through electronic fund transfer

- Application for registration shall be accompanied by a non- refundable fee of Rs. 10,000/- in favor of ‘Insurance Regulatory and Development Authority’ payable at Hyderabad.

- For the purpose of carrying the functions/ facilities of Outsourcing and Telemarketing, application for seeking permission for the same shall be mentioned specifically in the application form.

- The applicant seeking the grant of License as Web Aggregator shall fulfill all the eligibility criteria as mentioned under relevant sections of the act.

- The applicant seeking the grant of License as Web Aggregator will be dealt with by Authority as per the provisions applicable under Regulatory and Development Authority regulation.

- Once the applicant fulfills all the eligibility criteria and requirements asked to furnish by the Authority, it shall grant Insurance Web Aggregator license to the applicant as Web aggregator.

What is the validity of the Insurance Web Aggregator license?

A license is issued with the validity of three years from the date of issuance unless the same is suspended or canceled.

What are the duties and functions of Web aggregator?

Insurance Web Aggregator license shall perform the following functions and duties;

- Web aggregator is required to display the information pertaining to the insurers, who are the parties to the agreement signed with the web aggregators;

- Web Aggregators shall not;

- Display any information in regard to the product and services of other financial institution/ FMCG, any other product or service in the website;

- Display advertising of any kind, either in relation to any product or service, which can include insurance and service, other financial product and service, or any other product or service in WEB Aggregators Website;

- Promote various websites or tie-ups with other approved, unapproved website lead generation, unlicensed entities, comparison of product, etc.

- Operate the websites of other Financial, commercial or sales service or also uses social media platform for comparison of products, etc.

- Operates any other medium for transmitting leads to and company engaged in the business of insurance except as provided under the regulation of the Insurance Act.

What should be the display of product comparison on Web Aggregator’s website?

Following should be the display of product comparisons on the web site:

- Prominently should disclose on the home page, a notice that that the client or visitor’s information can be given to insurer;

- The product displayed on the website should be authentic and shall be based on the information shared by the insurer;

- Web aggregators are not allowed to display ratings, ranking, advertisements or promote best seller of insurance;

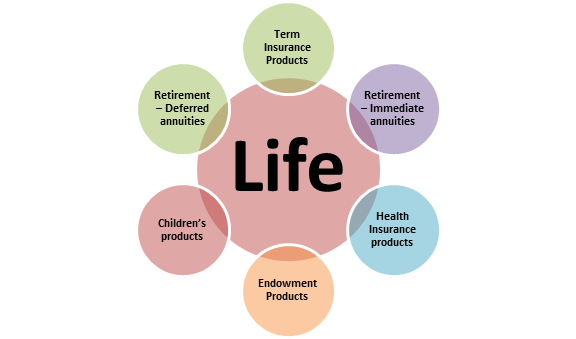

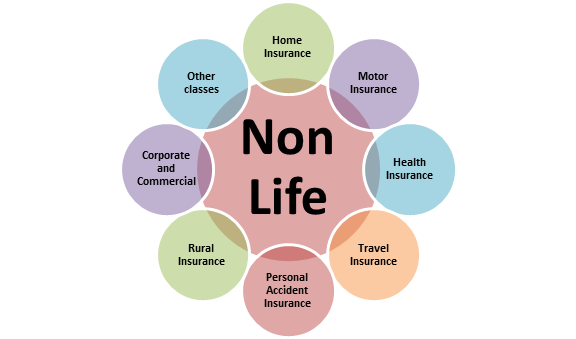

- The product can be categorized as followings ;

- Comparison of basic product features shall be on the basis of;

- Eligibility criteria;

- Plan, Policy Term, Premium term, Min and Max SA, Age, Min & Max Maturity, etc. have to be compared.

- Inbuilt benefits, riders can be compared Premiums for different age groups can be compared.

- Surrender benefits, Loans, etc

- Benefits such as Survival advantages, Maturity Benefits, Death benefits, etc. are to be compared

- Returns – 6 % and 10 % s approved by IRDA to be compared

- Any other additional figures, special product features relating to the products under comparison can be compared.

- Online Sale;

- Registration of Customer data or Proposal Form;

- Online Underwriting decision;

- Web aggregators shall not Templates can be collective worked out between the Web Aggregators and Insurers whose products are compared.

- Product comparisons that are displayed shall be up to date and reflect a correct picture of the products.

- Web aggregators shall show product information purely on the basis of the information furnished to them by insurers.

- Web Aggregators can use issued data for “Additional Information to Customers” based on IRDA Data.

- Web Aggregators can merge their websites with the insurers’ website for

- carry any notice or sponsored content on their websites.

Take away

We at Corpbiz will help you through the end to end process for obtaining the Insurance Web Aggregator license.