The Insurance Regulatory and Development Authority (IRDA) governs and issues the Insurance Broker License and the services related to it. The rules and regulations associated with the Insurance Broker License are made under the Insurance Regulatory and Development Authority Act, 1999[1], in consultation with the Authority and the Insurance Advisory Committee. To supervise and watch the insurance brokers was the primary purpose of establishing the regulations.

The brokers suggest the common people about their insurance needs and then accordingly guide the people to pick the appropriate insurance product for them. The insurance brokers are a middle man between the insurance company and the common people who are in search of buying appropriate insurance policies. The insurance brokers have a good knowledge of insurance-related products and laws. In this article, we will discuss the step by step procedure for Insurance Broker License.

Who is an Insurance Broker?

Insurance Broker is a business/company or a person registered as an insurance advisor or qualified people or firm, which is acting through its Directors/Partners or employees having expert knowledge of insurance-related laws. The insurance brokers lead common people towards their insurance demands. Insurance brokers provide expert knowledge to their clients. The brokers mainly act as a mediator between the insurance company and the common people, asking people to buy an insurance policy.

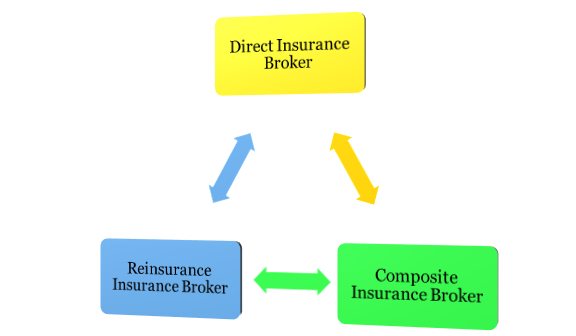

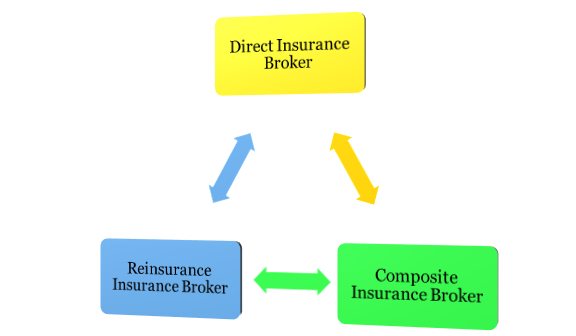

Insurance Regulatory and Development Authority of India (Insurance Brokers) Regulations, 2018, provides for the different types of Insurance Brokers.

The categorization of different kinds of Insurance Brokers are as follows:

Direct Insurance Broker

- The Direct Insurance Broker is responsible for procurement and solicitation of business.

- The Direct Broker allows the people to buy an appropriate policy from the website or computer software.

- The Company gives commission to the Direct Broker whose policy is sold by the broker.

Composite Insurance Broker

- The Composite Insurance Broker has a valid license for offering insurance services to the customers.

- The insurance services provided by Composite Insurance Broker are life and general insurance.

- The licensing process of Composite Insurance Broker is very selective by the authority.

Reinsurance Insurance Broker

- The Reinsurance Insurance Broker solicits and arranges the reinsurance of the customers who want to take the policy of the insurance company again.

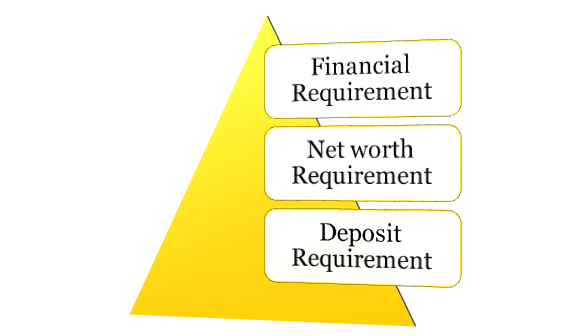

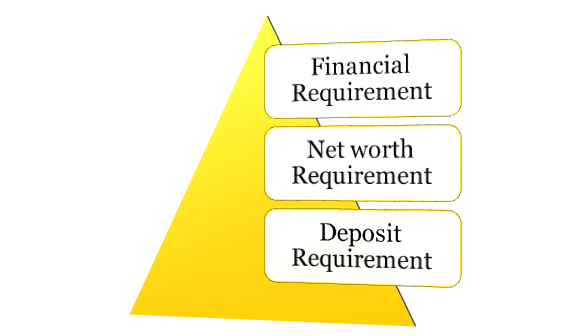

What are the requirements for Insurance Broker License?

Insurance Regulatory and Development Authority of India has set up certain basic requirements for Insurance Broker License. The basic requirements are categorized as follows:

Financial Requirement

The minimum financial requirement for applying for Insurance Broker License is as follows:

- Direct Insurance Broker- 75 Lakh Rupees.

- Composite Insurance Broker- 4 Crore Rupees.

- Reinsurance Insurance Broker– 5 Crore Rupees.

Net worth Requirement.

The Insurance Broker at the time of enrolment of the broker License should maintain minimum net worth:

- For Direct Insurance Broker- 50 Lakh Rupees.

- For Composite and Reinsurance Insurance Broker- 50% of Minimum Capital requirement.

Deposit Requirement

The Insurance Broker applicant is required to submit a minimum amount as a deposit in the bank while applying for Insurance Broker License.

The minimum amount required as deposits is as follows:

- For Direct insurance Broker- 10 Lakh rupees.

- For Composite and Reinsurance Insurance Broker- 10% of Minimum Capital requirement.

What is the checklist for Insurance Broker License?

The guidelines to be followed for obtaining the Insurance Broker license is as follows:

- The word ‘Broker’ or ‘Broking’ should be there in the name of the entity;

- The principle aim of the Memorandum of Association (AoA) of Company should be Insurance Broking;

- The least capital requirements should be satisfied by the Company;

- The foreign capital holdings of the Company should not exceed 26% of the total paid-up capital of the Company;

- A fixed deposit of 20% from first capital should be paid in a certified bank;

- The needed infrastructure and well-trained workforce to run the business of insurance broking should be thereof the Company;

- The person in securing insurance business should be trained and qualified;

- The principal officer of the Company should have the required qualification and should have passed the brokers exam;

- No person, connected directly or directly with applicant, should have been refused the grant of License by the concerned authority;

- The net worth and capital requirement as prescribed should be fulfilled by the applicant;

- The principle officer should maintain the required training for the business;

- The Registration Certificate should be granted in the interest of policyholders of the Company;

- There should be 2 persons engaged in the obligatory qualification and training.

Who can be the Applicant for Insurance Broker License?

The entity or people who can apply for the Insurance Broker License are as follows:

- The Company registered under the Companies Act, 2013;

- Any Co-operative Society registered under Co-operative Societies Act, 1912 or under any other similar law;

- An LLP (Limited Liability Partnership) under the provisions of Limited Liability Partnership (LLP) Act, 2008;

- Any other person who is approved by the authority.

The applicant applying for an application of Insurance Broker License is a registered Limited liability Partnership (LLP), then the following cannot be a partner of LLP:

- A Non-resident Entity;

- A person resident outside of India;

- LLP enrolled under foreign country laws.

What are the documents required for Insurance Broker License?

The application for Broker License is to be presented with some mandatory document and the information as specified in Form C of Schedule I of the Insurance Regulatory and Development Authority of India (Insurance Brokers) Regulation, 2018. The documents required are as follows:

- The application of a Broker License, with the essential information, is to be submitted in Form B;

- A true certified copy of Memorandum of Association (MoA) and Articles of Association (AoA);

- The detailed information of promoters, partners or directors, and key managerial personnel of Company;

- The list of at least 2 qualified insurance brokers with qualifications;

- The bank account details of present account;

- The detailed information of Principle Bankers;

- The detailed information of statutory auditors of principle banks;

- The balance sheet of Company;

- The complete list of current as well as proposed shareholders of Company;

- The Board Resolution passed by the shareholder company for investing and promoting the applicant company;

- The information regarding the Principal officer;

- The Principal Officers should fulfil the criteria of fit and proper as mentioned in Form G of Schedule I;

- The Principal Officer should fulfil the training compliances;

- The Principal Officer should give a declaration mentioning that he/she along with Directors or partners and other key managerial personnel of Company are not suffering any disqualifications which are mentioned in Section 42D of Act;

- The IT Returns of the shareholders for the last 3 years;

- The applicant company should have the required infrastructure for the Registration process;

- The applicant company should submit the detailed information of the infrastructure of the Company;

- Any other details as requested.

What is the procedure for obtaining an Insurance Broker License?

After the applicant accumulates all the required documents, the applicant can apply for the Insurance Broker License.

The procedure followed for obtaining Insurance Broker License is as follows:

Submission of Application

- The application form for Insurance Broker License is to be submitted in Form B of Schedule I as provided in the Insurance Regulatory and Development Authority Regulations. The non-refundable application fee with the required documents should be submitted.

Scrutiny of Documents

- The concerned authority will scrutinize the documents. The concerned authority can ask queries and can ask for more information if needed. The authority can ask for the submission of some additional documents also.

Submission of Additional Documents

- The additional documents asked by the concerned authority should be submitted within 30 days from the date of communication from the authority.

Issue of In-principle Approval

- After examining all the documents required to be submitted by the applicant, and the authority is satisfied that the applicant fulfils all the required conditions, the authority should issue the in-principle approval for Registration.

Additional Submission

- After the in-principle approval is issued, the applicant should comply with all the additional requirements and submit the license fees to the concerned authority.

Issue of Certificate of Registration

- Once the concerned authority is satisfied with all the requirements as prescribed in the regulation and the in-principle approval, the authority will issue a Certificate of Registration to the applicant. The Certificate of Registration should be issued in Form J as specified in Schedule I of IRDA Regulations.

What is the fee required for Insurance Broker License?

The applicant entity has to submit the mandatory fees for Insurance Broker License. The fee is prescribed under Form D of Schedule I of the IRDA Regulations.

The different fees required for Insurance Broker License are as follows:

Non-Refundable Application Fees

The Insurance Broker has to pay a non-refundable application fee at the time of submitting the application for Certificate of Registration. The fees to be paid is as follows:

- Rs 25,000 for Direct Insurance Broker;

- Rs 50,000 for Reinsurance Insurance Broker; and

- Rs 75,000 for Composite Insurance Broker.

Fresh Registration Fees

The Insurance Broker should pay the following fees for fresh Registration prescribed as below:

- Rs. 50,000 for Direct Insurance Broker

- Rs. 1,50,000 for Reinsurance Insurance Broker

- Rs, 2,50,000 for Composite Insurance Broker

3 Years Renewal Fees

The Insurance Broker should pay the following fees for the renewal of 3 years prescribed as under:

- Rs. 1,00,000 for Direct Insurance Broker

- Rs. 3,00,000 for Reinsurance Insurance Broker

- Rs. 5,00,000 for Composite Broker

What is the validity of the Insurance Broker License?

The Certificate of Registration for Insurance Broker is allotted for 3 years from the date of issuance of Certificate. For the renewal of the Insurance Broker License, the certified insurance broker is required to apply at least 1 month before the expiry of Registration in 3 years for renewal of Insurance Broker License. The certified Insurance Broker, do not apply for the renewal of License in time, the penalty will be imposed for the same. The delay in renewal is continued; then, the Insurance Broker has to apply for a fresh License.

Conclusion

We can conclude that the Registration of Insurance Broker is a mandatory permit. Every Insurance Broker Company should obtain the Insurance Broker License for commencing the Insurance business. Insurance Regulatory and Development Authority or IRDA is the body responsible for issuing a Broker License in India. The person willing to acquire the License for the Insurance Broker should submit the required documents to the authority in concern. The business of Insurance Broker is an ever-growing business. Hence, we can say that the failure of such a company is quite negligible if one proceeds with a good business plan. The process of Registration for Insurance Broker is long-lasting and time-consuming. We at Corpbiz have experts to help you with the process of Insurance Broker License. Our experts will assist you and will ensure the successful completion of your work.

Read our article:RBI Issues New Guidelines for Payment Aggregators