Having a bevy of insurances at the disposal is a boon to a person who belongs to the lower or medium strata of the society. They not only provide complete protection but also eradicate the risk of being penny less in the most demanding situation. People nowadays are keener to route some of their earning towards insurance products. At present, almost every medium-class family prefers buying medical policies owing to the ever-rising expenses of medical treatments. These policies are meant to give pre-determined coverage for medical expenses with other benefits like cashless treatment, and tax exemption on premium paid on them. For the most part, the insurer doesn’t deviate from what they claim under the policy. But it seems that things are not going as expected in the present scenario, as thousand of insured are confronting trouble in availing cashless treatment in hospital, especially in the treatment of Covid-19 virus.

Cashless treatment is one of the major selling points of the majority of medical policies. But in the past few months, it has been noticed that the majority of the insurer were failing to render this facility to the needy ones. If you are confronting the same problem, then there is a way out.

How Insurer facilitates Cashless treatment under a Medical Policy?

First, an insured visit to the empaneled hospital, get a cure for a disease covered under the policy and then seek a cashless treatment facility by providing details of the policy to the hospital.

Once the insured gets discharged from the hospital, all the medical bills are routed to the insurance provider. The insurance provider, in response, computes the expenses and settles the payment.

The claim regarding cashless treatment varies in accordance with the type of treatment-planned or unplanned. Unplanned medical treatment usually comes into existence in a state of emergency.

Read our article:How to Establish Insurance Brokerage Company in India?

The process regarding the planned treatment at the cashless network

Typically, the insured has to intimate the insurer regarding the treatment required before claiming the cashless treatment. The company ought to be intimated at least 4 days before the treatment begins. The insured must submit the cashless claim request at the relevant address of the insurer via, fax, email, or post.

For more clarification, you can get in touch with the customer care of the insurer company. Once you meet these requisites, the insurer will communicate with the insured as well as the concerned hospital regarding the eligibility and policy cover. On the day of visiting the hospital, the insured has to facilitate the confirmation letter along with a health insurance card. The insurance provider will finally reconcile the medical expenses, by making payment to the concerned hospital.

Claims Process regarding the Emergency Treatment at the Cashless Network

The policyholder can get in touch with the insurance provider via customer care number to avail detail regarding the nearest network hospital. By sharing your policy details, you can avail cashless treatment. After registering the claim request, the hospital forwards the cashless claim request form to the insurer via post, e-mail, or fax.

In response, the insurance provider will issue an authorization letter to the hospital, reflecting the terms of policy coverage. The insurer will make the payment regarding medical bills on the behalf of the insured to the hospital. In case of claim denial, the insurer will communicate with an insured via a letter, reflecting the reasons for the same.

Process of enrolling complaint regarding Cashless Transaction

Legally, you are allowed to lodge a grievance against the hospital in case they deny rendering cashless treatment. But, it is advised that you must figure the solution with the Third-Party Administrator (TPA) for prompt reconciliation before taking such an action.

But, if the thing doesn’t work out with TPA, then go ahead and follow the process below.

- You can lodge your grievance by way of the insurer’s Grievance Redressal Mechanism. The insurer is liable to reconcile the matter within 15 days of registration.

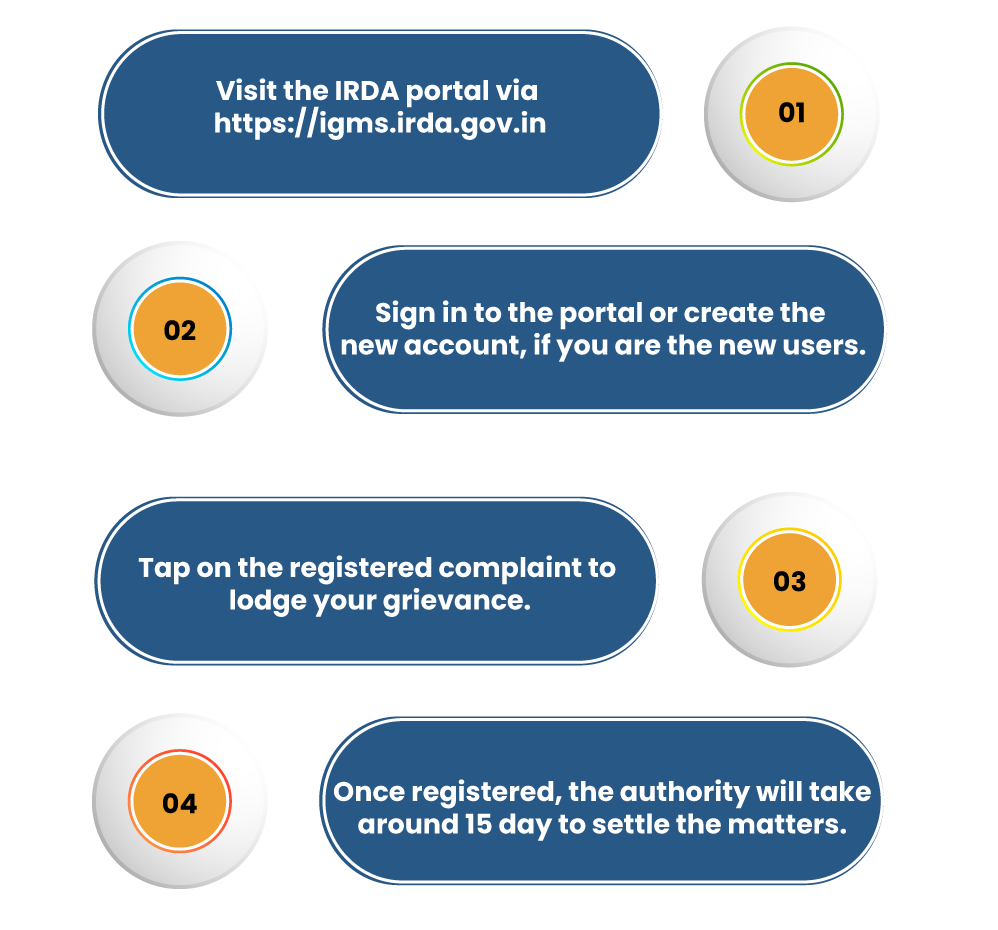

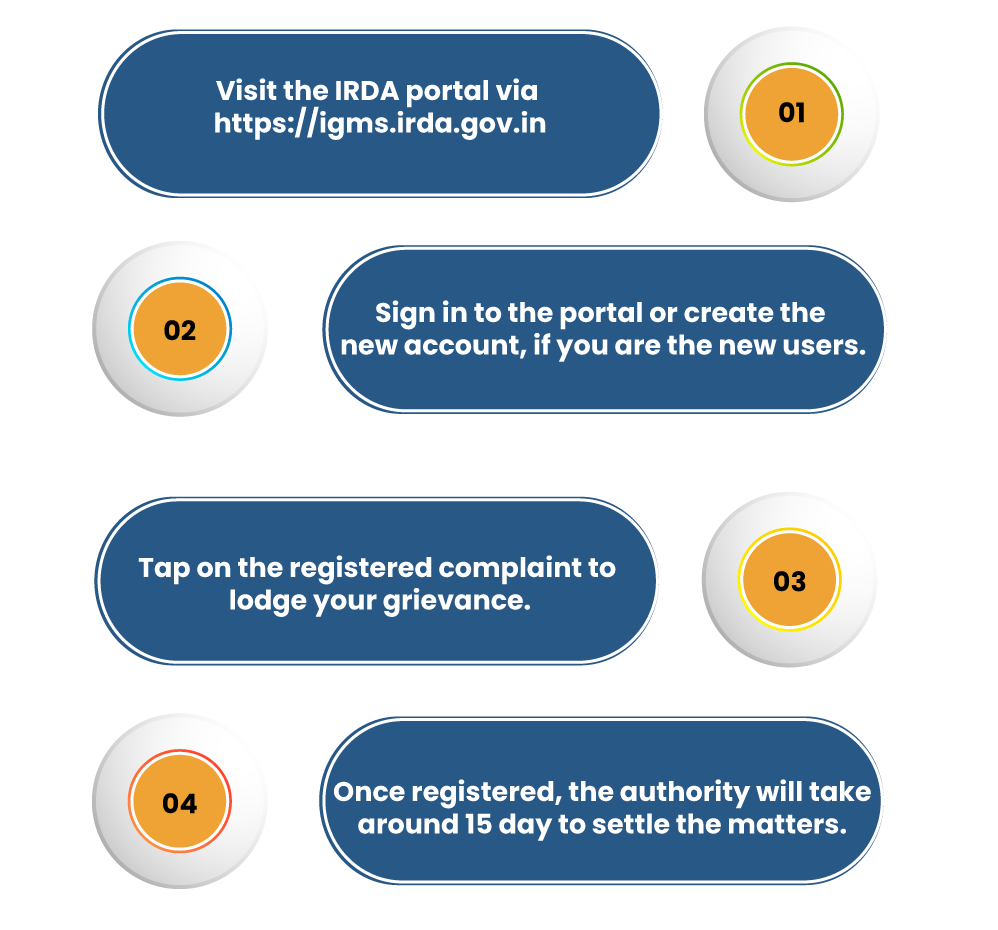

- In case of a non-satisfactory response, you can head to the Integrated Grievance Management System (IGMS) option. IGMS enables policyholders to lodge the grievance and keep the constant tracking of the same till the point of complete reconciliation.

- To lodge the grievance, you need to head over to the official portal by using the following URL. https://igms.irda.gov.in

- If you are new to this portal, you need to establish a brand new account by entering the basic information. The old user can directly hop on to the home page by entering their credentials on the login page.

- Once you visit the home page, tap on the registered complaint to lodge your grievance against the insurer/hospital.

- You can also enroll your concern via an email by using the following email address. complaints@irdai.gov.in

IRDAI has mandated all the insurers to stay connected with hospitals so that the clients do not encounter any nuisance while claiming cashless treatment.

Moreover, IRDAI has directed all insurers to remain in touch with hospitals so that its customers don’t face issues in claiming cashless treatment.

Conclusion

The policy is all about securing individuals from potential risk by the means of funding and other benefits. The same fundamental applies to medical policies as well. A consumer[1] has every right to enrol complaint in case these policies fail to render any predetermined benefits. The individual who is encountering issues regarding the cashless treatment can lodge the complaint in the aforesaid manner.

Read our article:An Overview of Insurance Broking opportunities and Critical Aspects