As per the latest notification rendered by the Central Board of Indirect Taxes and Customs (CBIC), businesses intend to register under GST can opt for Aadhaar authentication. But in case of the unavailability of Aadhaar, the registration would be granted only after Physical verification of Biz place.

Key Pointers of CBIC Notification

- The CBIC has clearly mentioned that applicant seeking GST registration can opt for Aadhaar authentication, w.e.f 21/08/2020 while submitting the application.

- The notification further states that where a business owner fails to provide the Aadhaar number for the GST registration then in that case GST registration would be granted only when a relevant officer inspects the place of business on the basis of given criteria.

- Therefore, any individual opting for GST registration can choose the Aadhaar authentication. The authority, in such an event, would grant the GST registration within 3 days. On the flip side, in the absence of the Aadhaar Card, the authority might take up to 21 days to serve the same purpose. During the course of the registration process and validation, the authority might send an authorized person for the physical verification of business place.

Previous notification issued by CBIC mandated the use of Aadhaar authentication for GST registration, which was become effective from 1/4/2020.

Read our article:GST Registration Documents: A Complete Checklist

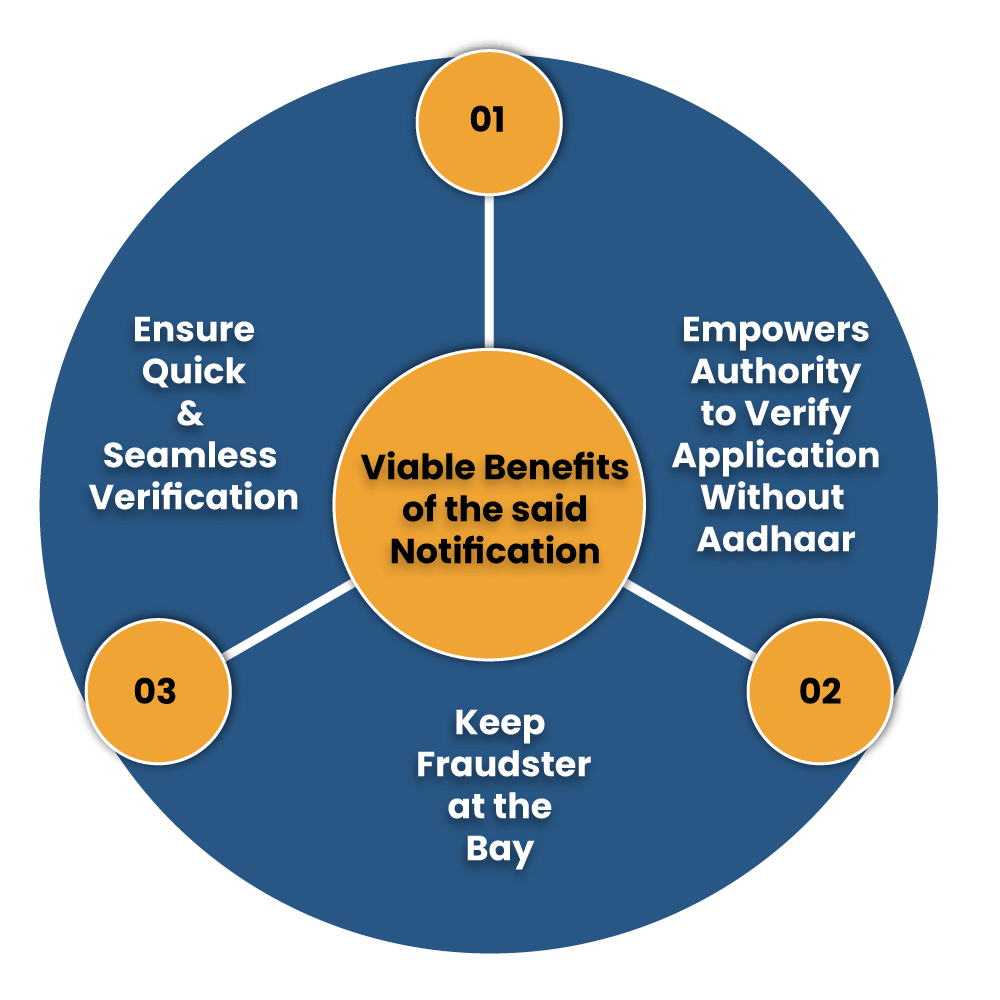

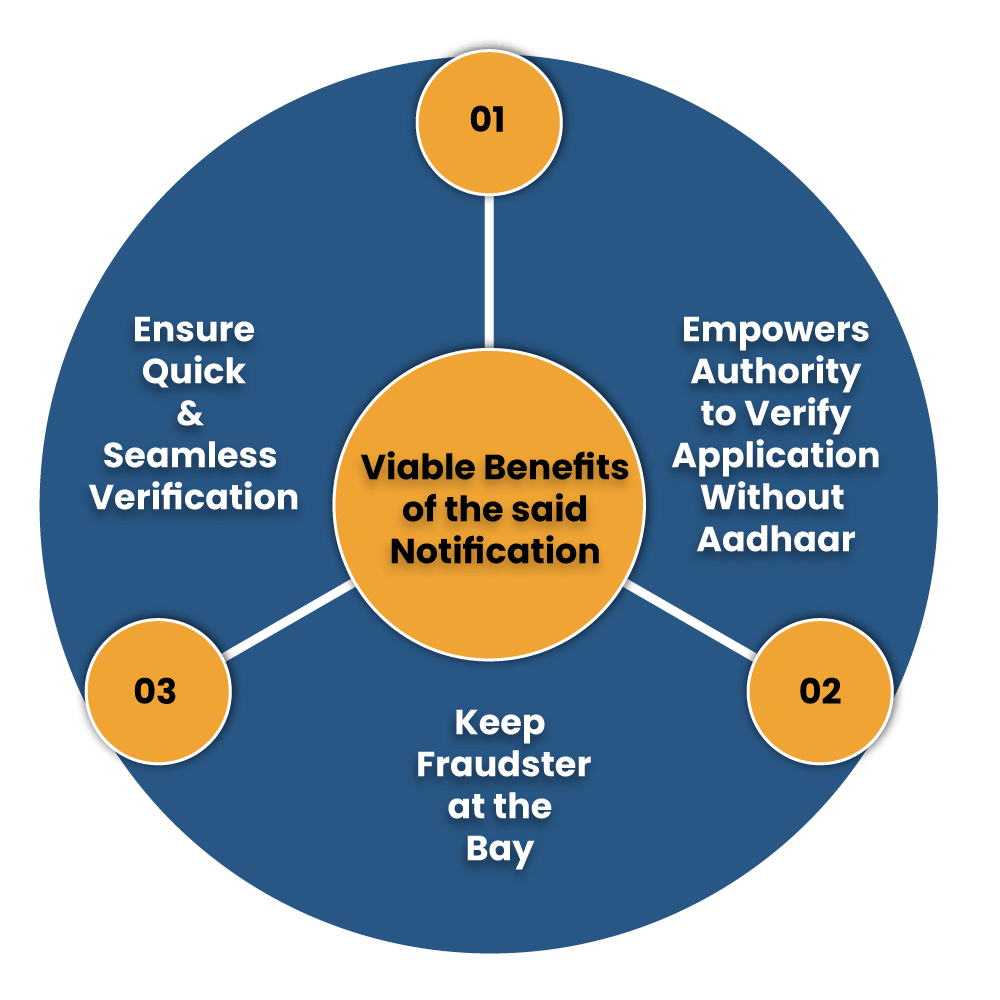

Viable Benefits of the said Notification

The following section manifests the viable benefit of the CBIC notification regarding GST registration:

Ensure Quick and Seamless Verification

Aadhhar authentication is indeed a most secure and agile method for the issuance of GST registration. By doing so, government can empower tax authorities to avert various complications regarding the verification process and impart transparency at the same time.

Empower Authority To Verify Application Without Aadhaar

Aadhhar authentication is not the only way for obtaining GST registration. The recent CBIC notification now allow tax authority opt for physical verification of biz place as the criteria for granting the GST registration. New businesses can now opt for a prompt validation of their credentials using Aadhaar[1] and obtain GST registration.

Keep Fraudster At The Bay

With Aadhaar Authentication in place, the authority can easily keep the fraudster at the bay who illegally avail the input tax credit.

Procedure to avail GST registration Through Aadhaar Authentication

The given instructions would help those opting for Aadhaar authentication for GST registration:

- While applying for GST registration, the applicant will come across the option to choose if he/she wants to authenticate Aadhaar.

- To opt for Aadhaar Authentication, choose YES.

- The portal will then send the authentication link to the mobile number of the applicant registered with the GST portal.

- Upon opening the said link, a dialog box will prompt on the screen asking the applicant to enter the Aadhaar number & select “Validate”

- On successful cross-referencing of details in the form with the UDAI, the portal will send one time password (OTP) on the registered phone number provided by the applicant.

- Applicant is required to enter the OTP in the given box to complete the validation process. The portal will then send the confirmation regarding the successful e-KYC authentication to the applicant’s phone number.

- The concerned authority would hardly take around two to three days to deliver the GST registration to the concerned applicant after the completion of the aforesaid process.

Alternative Method for Obtaining GST Registration

In case if the applicant opts for an option other than Aadhaar authentication then the applicant would be routed to the jurisdictional tax authority who will be accountable for verifying necessary documentations and place of business before approving the registration. In case if the tax authority fails to physical verification of biz place within 21 days then the application will be considered as approved.

Procedure to Avail of the Facility

- Visit the GST portal and head over to the Services section.

- Next, select Registration>New Registration

- Alternatively, the applicant can also for REGISTER NOW link

- Choose Aadhaar authentication.

Who are Eligible to avail such a Facility?

The facility of prompt approval via Addhaar authentication is available to all Indian nationals. But, such a facility is not yet available to tax collectors, tax deductors, or OIDARs and foreign taxpayers. In either case, the investigation officer is required to respond within a specific timeline, i.e. three days for individual selecting for Addhaar authentication and 21 days for those not choosing the same.

How to Download GST Registration Form?

- Visit to the GST portal from your web browser

- On the home page, go to the top section and then click “Services”.

- Next, opt for “User Services” > “View and download Cerificate”

- A small table will appear on the screen. Go to the right section of the table and click on “Download”.

The certificate encloses all the information of the business. On the first page, you will come across basic elements like name, address, & registration date are displayed. On the second page you will find the ‘Annexure A’ that talk about the additional place of business. And in the last, on the third and the last page you will find ‘Annexure B’ that holds the details regarding the person-in-charge of the business.

Conclusion

The new guidelines issued by CBIC are considered to be a proactive step to limit the activities of tax evasion. It also speeds up the registration process amidst the ongoing pandemic by permitting verification via Aadhaar when a physical inspection of biz place is next to impossible.

Moreover, linking Aadhaar, PAN, and GST, will allow the authorities to eliminate the intricacies with the verification process which in turn makes the registration process swifter and more seamless. Physical verification of Biz place could be smart move in case if tax authority perceived the taxpayer’s credibility with suspicion.

Read our article:How to apply for GST registration certificate online?

notfctn-62-central-tax-english-2020