A taxable person under GST is a person involved in business activities in India and is registered under the GST Act. Any individual involved in the trading of taxable goods and services is treated as a taxable person. Here the term “person” refers to a company, AOP/BOI, HUF, individuals, or a government-based corporation.

Entities required to get registered under GST

- Any business whose annual income/turnover surpasses the threshold limit of 20 lakhs (Rs 10 lacs for hill states and northern eastern). Note: This clause does not apply to the business engaged in the supply of exempted goods/services.

- Every person who complies with the earlier tax reform, such as service tax or VAT, should mandatorily opt for GST registration.

- A registered business transformed on amalgamation, merger, or demerger must opt for GST registration, w.e.f the date of transfer.

- Taxpayer dealing with inter-state supply of goods

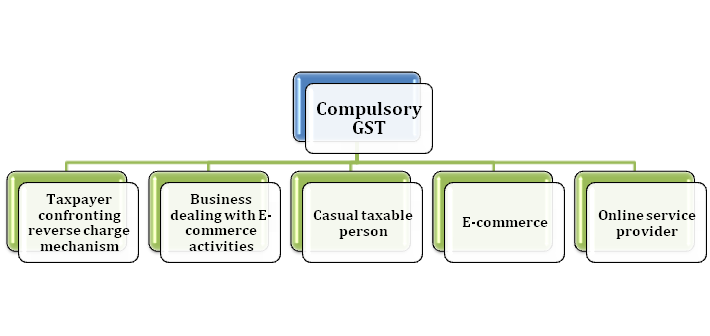

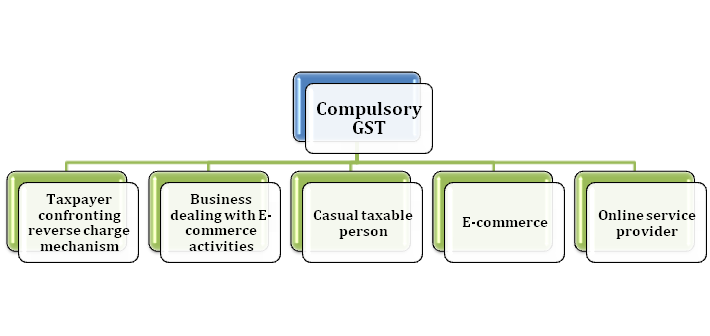

- Casual taxable person

- A taxable person from overseas

- Supplier’s agent

- Service tax holders

- Taxpayer confronting reverse charge mechanism

- Input service distributor

- Business dealing with E-commerce activities.

- A person selling goods via e-commerce aggregator

- The person conducting an online business of eBooks from overseas locations and rendering services to customers in India.

Latest Updates

The government offers additional relaxation of time to the taxpayer regarding GST compliance for the fiscal year 2020. Now the last date for completing the compliance for taxpayers has been extended up to 31st August 2020.

Read our article:A complete overview of GST Registration for Service Providers

Who is Casual Taxable Person from the GST perspective?

A taxpayer or Service tax holders involved in the supply of goods and services in the taxable territory without a permanent place of business is referred to as a casual taxable person under GST. For example, suppose a taxpayer is a prominent supplier of non-exempted services and has a business place in Ranchi. The taxpayer supplies its services in another state, i.e., Bangalore, where he doesn’t have any business place. As per the GST Act[1], the taxpayer, in such a case, will be treated as a casual taxable person in Bangalore.

Non-Resident taxable person under GST

A non-resident taxable person is an entity that operates from outside India and raises its income by selling goods and services to the customer living in India.

Input Service Distributor

Input Service Distributor is referred to as a business office that obtains a tax invoice against the input services and distributes the input tax credit to other branches. Although ISD and the branches have identical PAN information, they may possess different GSTIN details. ISD Mechanism typically used for the credit distribution on the common invoice in the context of input services and not on capital goods.

For example, firm A has a head office in the Hyderabad. It has its branches situated in a different part in India, let’s say- B, C, and D. The firm’s head offices availed the professional services and obtain a tax invoice on behalf of all the branches. Since the professional services received by the head office, it is equally accessed by all branches. In such a case, the head office is not liable to take advantage of the entire input tax credit. It’s a liability of the head office to distribute this tax credit to its branches, i.e., B, C, and D.

GST Registration based on the class of taxable person

- Every eligible taxpayer or Service tax holders must opt for registration in every state that comes under GST provisions, within the thirty days of commencement of its business activity.

- Casual/ non-residents must apply for GSTIN via an online portal at least five days before starting any business operation.

- The GST registration is PAN-based, so the taxpayer needs to keep PAN detail intact during registration.

- Since GST registration is applicable state-wise, the eligible taxpayers including Service tax holders must obtain separate registration for each state.

A Casual and Non-resident taxable person U/s 24

If a casual or non-resident taxable person is about to commence the new business, it’s mandatory to apply for GSTIN via an online portal within the threshold period, i.e., five days, or else it will deem as an offense. A special provision has been mentioned under section 24 for such entities.

GST also renders some additional relaxation to such entities in terms of temporary registration. In case of urgency, the taxpayers can avail temporary registration for a period of 90 days to avoid the conflict with the tax authority while commencing the business activities. Taxpayers that opt for registration u/s 24 should compulsorily make an advance payment on account of GST based on the estimated tax liability.

Collecting GST

The taxable person is the only entity accountable for collecting GST. As per the GST Act, such entities are required to mention the GST amount on tax invoices.

Returns

A regular taxpayer is under the obligation of furnishing one annual return & three returns monthly. The taxpayers under the composition scheme need to adopt a different approach in this aspect. ISD is entitled to collect tax at sources.

Conclusions

All the taxpayers must get registered for GST to avoid conflict with the tax authority. Those who want to obtain GSTIN without hassle need to head over to the GSTN portal and fill up the required form. If you are not accustomed to the online submission of the form, call CorpBiz experts for instant support.

Read our article: Step by step guide on how to check GST Registration Status