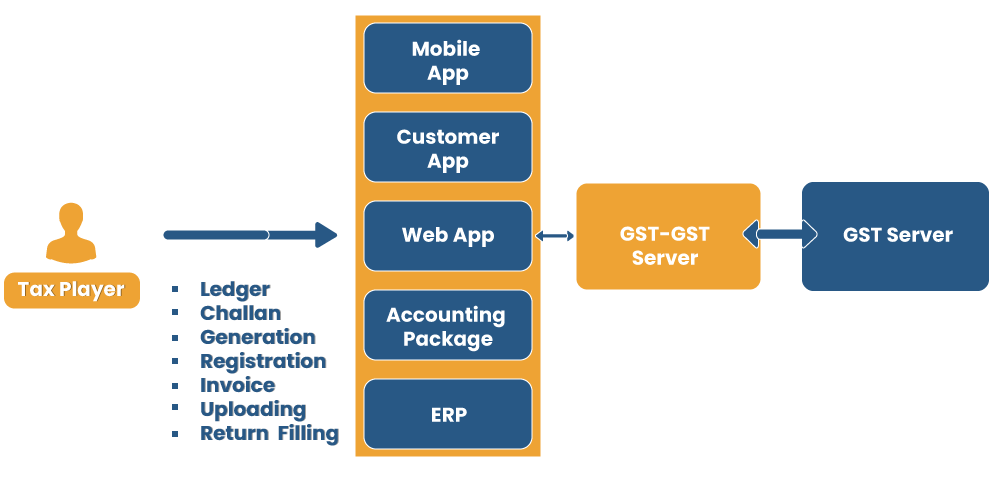

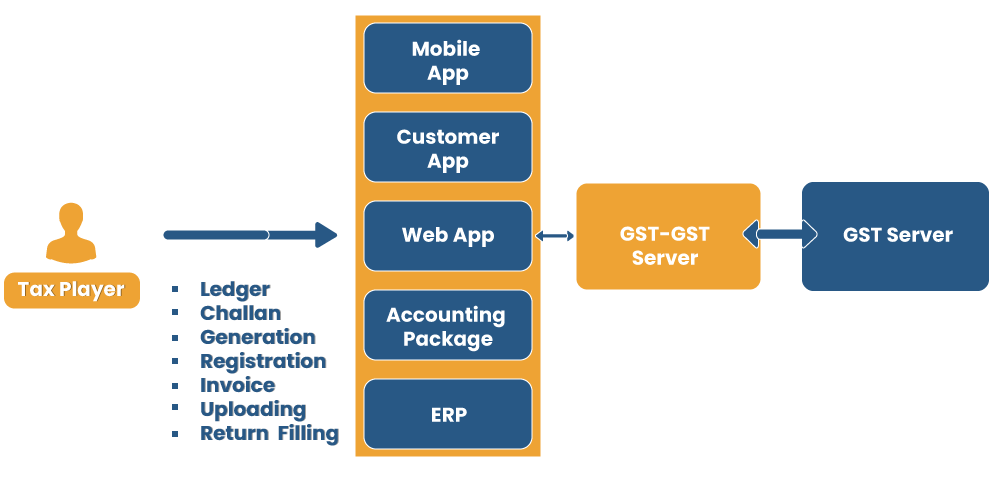

GST Suvidha Provider (GSP) is deemed as an authorised intermediary or an enabler for business entities to access the GST portal. It helps comply with the norms of GST law via their APIs* and software applications.

API*: API is an abbreviated term for the term Application Programming Interface, which refers to a software intermediary that enables two applications to sync with each other. Each time user uses an app like Instagram, share a photo, or check a follower‘s feed, you are using an API.

What is the role of GST Suvidha Provider?

GSP, aka GST Suvidha Provider, enables a taxpayer to align with all procedural norms of the GST law via its web portal. A GST Suvidha Provider provides end-users with unique methods to access Goods and services tax portal services, from invoicing and registration. Simply put, GSP refers to an ecosystem of service providers developed by the GSTN to render unique solutions either themselves or via its partners for making tax filing seamless and convenient to taxpayers.

Read our article:How to apply for GST registration certificate online?

Understanding Applicability of GST Suvidha Provider via Example

Suppose there is a company, namely XYZ Ltd., the company has a global footprint and is running its operation on SAP ERP. The entire data pertaining to sales and purchases are spared and managed in it.

At the end of every month, reports are delivered by ERP and used to prepare tax returns.

So, returns are uploaded electronically on the Government’s web portal. The Indian Government is not intending for a single, automated workflow wherein these entities can build an interface with such a portal & all the GST-based compliance can be done via their software. GSP has vast applicability, and it is not only available to ERP companies.

GSP – A Brainchild of GST Network

GST Suvidha Provider is a term originated from GSTN (Goods and Service Tax Network), the private entity without government backing that owns & administers the GST web portal.

It is a part of the ‘Digital India’ initiative that encourages paperless tax compliance that ensures reliability & transparency in performing business activities across India.

Three modes of Interaction with Goods and Services Tax Portal

Filing directly on the GST web portal

- A GST taxpayer will generally access the GST portal to avail of different services such as refund application, registration, GST return filing, & other similar compliances. But, for services like GST return filing, a taxpayer may encounter some technical issues while filing the return.

- Therefore, they may struggle to collate purchase & sales data from the accounting software or ERP system in the required GSTN format.

- A lot of manual efforts may be required for preparing the GST returns. Therefore, a GST Suvidha Provider is an indirect medium to get seamless access to the GST portal.

Indirect implies, there are two types of intermediaries between the GST web portal and taxpayer. They are as follows:

Application Service Provider who is not a GST Suvidha Provider

These entities facilitate productive third-party applications for GST compliance. In terms of accessibility, they are quite versatile and can be used on desktop, mobile, or any other interface.

Such an application developer can effectively coordinate with the GST portal via a protective GST system APIs (aka, Application Programming Interface) accessed via GST Suvidha Providers.

ASP, who is also a GSP

A government-backed application service provider is a trustable medium of completing GST compliances. They facilitate the application & are also capable of facilitating an intuitive platform to access the GST portal. Such an ASP who is also rendering a service of GSP can connect with the GST web portal & helps avert; any third-party dependency, thereby escalating the speed of data processing. Also, an ASP that can coordinate with multiple GSPs will ensure better uptime availability & scalability for the user.

Areas addressed by GST Suvidha Providers

- Upload invoice data (Business 2 Business & large value B2C).

- Upload GSTR-1 (return enclosing supply data), which will be prepared on the basis of invoice data & some other date facilitated by the GST taxpayers.

- GSTR-2A download & reconciliation with data related to purchases accounted on ERP.

- File GSTR-3B and availability of purchase data and GSTR-2A information

- Similarly, there are other returns for the casual taxpayer or composition taxpayers.

Till Nov 2019, the government[1] has completed the three rounds of licensing. In the first round of license’s allotment, 34 registered entities managed to acquire GSP licenses. In the subsequent round, around 40+ companies were granted GSP status. In the final round, ten companies have been provided with GSP status.

Pros of operating as GST Suvidha Provider

- Enables end-to-end integration with accounting software or ERP system that ensures seamless fetching of data

- Better & swift performance as compared to any other ASP not being GSP.

- The seamless integration with GSTN ensures uninterrupted data flow between the application & the GST portal, averting any third-party dependency.

- A single login enables uninterrupted access to different locations.

- Improved security ensured 100% adherence to all security standards.

Conclusion

Every GST taxpayer is required to comply with GST compliances to pay taxes & file returns at set intervals. To abide by the provisions of GST law, the taxpayers are mandated to file the return, apply for GST registration, generate challans, uploads legit invoices, etc., on the GST web portal. It’s a tedious affair for taxpayers to upload invoices on a monthly basis on the GST web portal. But, courtesy to GST Suvidha Provider (GSP), which has mitigated these obstacles by automating the key services.

Read our article:Get Your New GST Registration in Just Few Steps