NBFCs have to comply with the local bylaws to carry out their activities in the financial sector. While borrowing credit from the overseas location, an NBFC has to comply with the regulation of the Foreign Exchange Management Act (FEMA). FEMA’s regulation applies on NBFCs in case of Foreign transaction and Foreign direct investment (FDI). This article will make you familiar with NBFC compliance under FEMA.

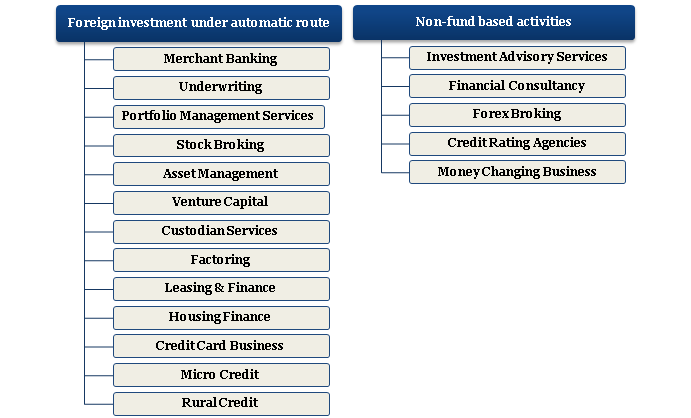

Generally, the foreign investment has two routes i.e. Government and Automatic route. Under automatic route, the overseas entities are allowed to put their funds in the NBFC sector. For NBFC compliance under FEMA, the activities related to foreign investment is regulated under the automatic route; henceforth, no permission from Reserve Bank is required. No limitation has been imposed on the foreign investors under the automatic route as far as the investment threshold is concerned. The engaged parties are not required to address legal formalities for such form of investment. They can put funds in the NBFC sector irrespective of the scale of investment.

Is NBFC Compliance Mandatory under regulations of FEMA and Reserve Bank?

RBI permission is mandatory for the establishment of Non-Banking Financial Companies. To engage with such form of business, there is a requirement of form a privately held entity which has minimum capital requirements. The formation of the company must adhere to the rules of company law. Likewise, the NBFC also required ensuring the conformity with FEMA laws. NBFC compliance, henceforth, is compulsory as per the regulations of FEMA and Reserve Bank. After amending Foreign Exchange Management regulation, 2000, RBI[1] enabled the overseas investors to put their funds in NBFC sector.

Read our article:A Complete Guide on Operational Manual of the NBFCs

Stipulates Applied on Overseas Investment in NBFC before 2016 Amendment

Prior to the 2016 amendment, the following stipulates regarding capitalization were applied on overseas investment. The following list shows the previous norms under the regulatory authorities:-

- USD 0.5 million for foreign capital up to 51% to be brought up front.

- USD $5 million for foreign capital more than 51% and up to 75% to be brought up front.

- Fifty million for foreign capital more than seventy five percent out of which seven and a half million dollor to be brought up front and the balance in twenty four months.

- The NBFCs having FDI more than 75% and up to 100%, and with a minimum capitalization of $50 million, can set up subsidiaries below them for specific private lender activities, without any limitation on the number of operating subsidiaries and without bringing additional capital. There is no particular restriction for the number of subsidiaries that are formed under this.

- Joint Venture based NBFCs that posses 75% overseas investment can also established subsidiaries for carrying out NBFC activities, subject to the subsidiaries also adhering to the applicable minimum capitalization norm mentioned above.

- Non- Fund based activities: The US $0.5 million to be brought upfront for all permitted non-fund based private lenders irrespective of the level of foreign investment.

Who Regulates NBFC Compliance?

Reserve Banks usually take care of the NBFC compliance. The NBFCs have to obtained permission from Reserve Bank to execute their business activities,

Eligibility Criteria for NBFC compliance

- Registering an NBFC/ NBFC Compliance with FEMA

- The NBFC must be permitted for securing foreign investment

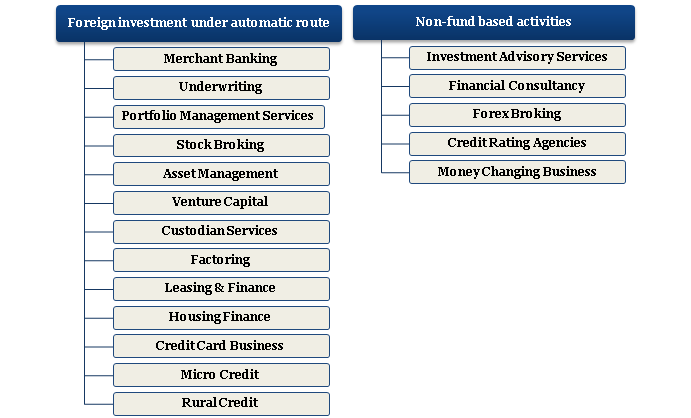

For an NBFC, Foreign investment is permitted under automatic route only in the following 18 prescribed NBFC activities. In the following sectors, Foreign Investment is allowed through the automatic route:-

Documentations for NBFC Compliance under FEMA

- Document related to KYC.

- Form-83

- Bank Statements of the company.

- Documentation related to NBFCs registration.

Procedure related to NBFC Compliance under FEMA

- Download Form 83 from RBI’s website

- Fill up the requested details. Add additional sheet, if necessary.

- Forward the completed form along with requested document to the Authorized Dealer

- Authorized Dealer will validates the request after detailed verification process and forward the form to Reserve Bank

- Reserve Bank after verifying the form will issues loan registration number to the borrower

After availing approval from Reserve bank, the following steps have to be followed

- NBFC must adhere to the compliances of Foreign Exchange Laws under FEMA Act 1999.

- Copy of the Form 83 to be submitted to the Authorized Dealer (AD) for any amount of external commercial borrowing.

- After examining conformity with existing guidelines under external commercial borrowing, the AD may provide essential information in Part F of the form and forward duplicate copy for the allotment of LRN i.e. loan registration number.

- The borrower needs to submit the duplicate of the same to Authorized Dealer (AD) regardless of amount of external commercial borrowing. Keep in mind that it should be submitted to RBI’s regional office situated in Mumbai.

- After availing the LRN number, a credit can be obtained.

Points to be remember while Filling Form 83

- All dates should in the format – YYYY/MM/DD

- Do not leave any of the field blank. Provide “NA” against the item which is not applicable in your case.

- Feel free to attach extra sheet if there is an inadequate space in the form for filling up the information.

- The borrowers must not forget to enclose the brief description of the business for the AD’s use.

Please make a note that Reserve Bank will not entertain the inappropriate or incomplete information provided in the form. The central bank reserves all the right to cancel such forms without even intimating the Authorized Dealer.

Conclusion

The lending services operate under the intricate and tedious regulatory environment. It’s literally cumbersome for the private lenders to ensure the conformity with compliances. NFBCs seeking funding from foreign territories have to meet the compliances drafted by the Reserve Bank. Fortunately, RBI has eliminated the hardship associated with the filing process by making it simple and as intuitive as possible. Avail spot on assistance on license and registration related issues from CoprBiz’s experts.

Read our article:Are you running an NBFC? Get updated about the list of Annual Compliances Prescribed by the RBI