India is the fastest-growing country and one of the fastest developing countries worldwide, making it a suitable place for investments from non-resident Indians. India is actually a center; performing business activities as the expense of manufacturing in India is reduced, which eventually increases the Demand curve of a product or service.

With each year passing, the foreign establishments are coming and performing business activities in India. Now the question arises how a foreign establishment runs a business in India. There are several options through which investment can be made in India by NRIs.

What do you Mean by Foreign Company?

U/s 2(42) of the Companies Act, 2013, a “foreign company” means any company or body corporate established outside India which:-

- Foreign companies shall have a place of performing business activities in India by itself or through its agent, physically electronic mode;

- Foreign company can conduct any business activity in India in any other way.

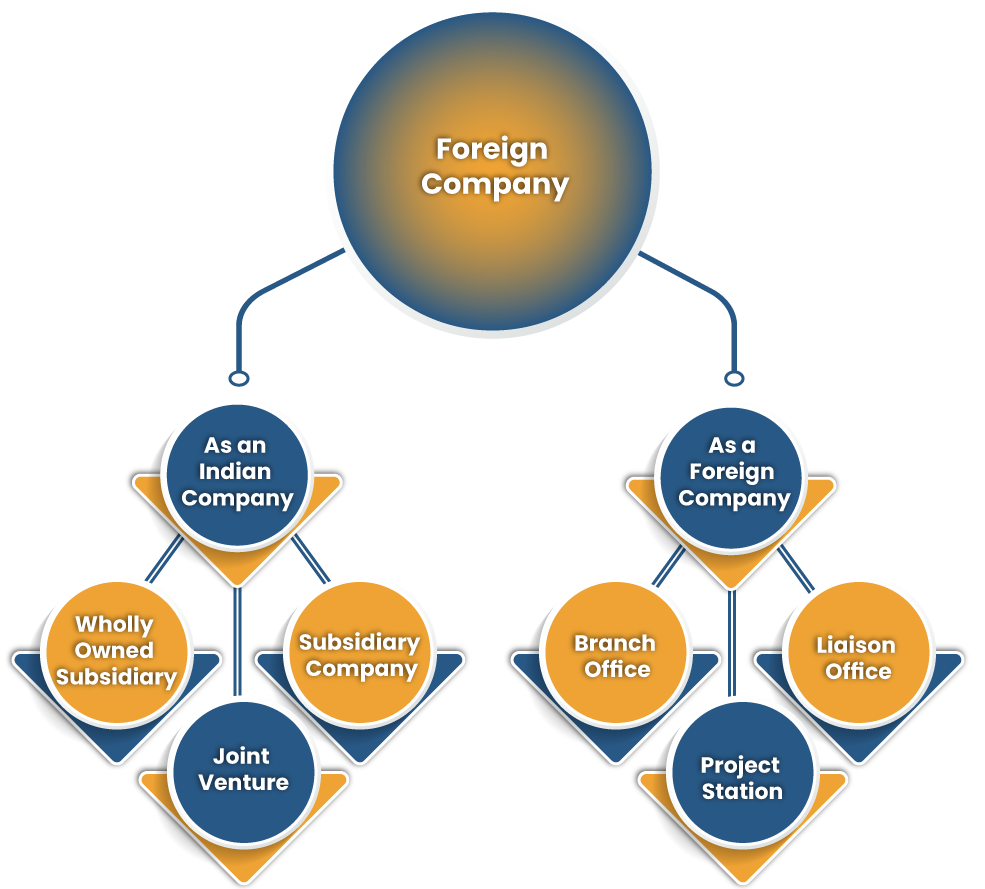

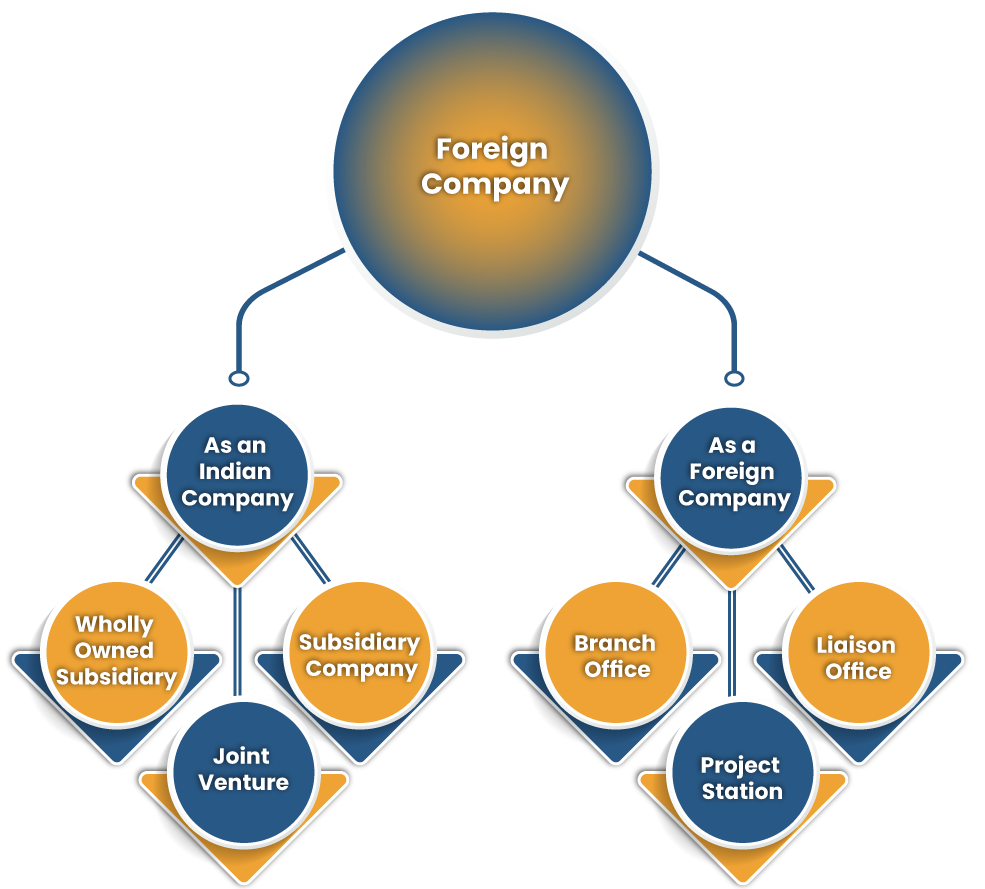

A foreign company which is aspiring of embarks and performing business activities in India, the foreign entities can enter in any of below-discussed ways:-

As an Indian Company

An Indian Limited company is registered in India and the shares posses by NRIs in below stated ways.

Wholly Owned Subsidiary

For an Indian company to evolve into a Wholly Owned Subsidiary Company of a Foreign entity, a foreign company requires to devote its 100% Foreign Direct Investment (FDI) in a particular Indian company through an automated avenue of foreign entities incorporation in India.

Joint Venture

It is influential for the foreign establishments to appoint a local partner with whom it desires to embark under the joint venture. A Memorandum of Understanding/Letter of intent shall be signed, which will show the joint venture agreement’s grounds

Subsidiary Company

In this foreign establishment grasp the shares of the Indian company up to the extent of 49.99% of the total shares of the Indian Subsidiary company.

As Foreign Company

The settlement as a foreign entity the Branch/Liaison/Project Offices in India is managed in conditions u/s 6(6) of Foreign Exchange Management Act, 1999 by Notification No. FEMA 22/2000-RB on dated 03rd May 2000, can be amended from time to time if needed.

A foreign establishment is mandatory to incorporate under the Companies Act, 2013 to start performing business activities in any of the below-stated ways:-

Branch Office

A foreign establishment in India must settle a branch office. Foreign company must be a goal to invest on a large scale and provide shreds of evidence on profitability.

Liaison Office

The liaison office can be settled to perform all the activities related to liaison in India. All the expenses of the liaison office shall bear through foreign remittance from the parent company.

Project Station

This office can be settled to behead projects conferred to a foreign establishment by an Indian Company. Authorization from the Reserve Bank of India may be needed to do the same. To start, India’s private limited company by the foreign establishment is the fastest way to create set up in India. FDI up to 100% public or private limited is allowed under FDI policy.

Read our article:Merger or Amalgamation of Company with Foreign Company: Complete Overview

Is RBI also Taking Part to Incorporate Business Activities of Foreign Establishment in India?

- The Reserve Bank of India governs the Foreign Direct Invest Policy.

- Foreign-controlled and regulated entity shall be treated as “Foreign Banks” within the cord ad arena of DIPP under the press notes 2, 3 and 4 (2009 Series) read with A.P. (DIR Series) Circular No. 01 on dated 04th July 2013, and A.P.(DIR Series) Circular No. 44 on dated 13th September, 2013

- Under the condition of accepting a company by a non-residents‘ expedient to an Indian company on a 50% capital is in the hands of non-residents and/or “controlled’’ by non-residents.

- The term “control” is explained in A.P. (DIR Series) Circular No. 44 dated September 13, 2013, as listed below:

The term ‘Control’ defined as the right to appoint the majority of directors or control management or policy decisions included the virtue of their shareholdings or the managing rights or agreements related to voting and shareholders.

Notwithstanding, a above said national treatment to WOS of foreign banks shall consider the financial stability. The Financial Stability downside risk may arise if the foreign banks, i.e., WOSs of the foreign banks along their branches together, came to control and influence the domestic financial structure. To detect the risk, a rule of binding restrictions mandates imposed on the further entry of new WOSs of foreign banks and branches within India exceeds 20% of the capital & reserves banking system.

In such cases, there is adequate obligation of prior approval of RBI, required for capital infusion into the existing WOSs of foreign banks. In respect to the foreign banks according to the WTO commitments, licenses for new foreign banks may be denied if the maximum shares of the property in India both on and off-balance sheet of foreign banks’ branches to total assets both on and off balance sheet if the balance sheet of the banking system exceeded more than 15%.

How to Incorporate a Foreign Company in India?

Incorporating foreign companies in India became quite easy after several amendments under the Company Act 2013, and the government made many schemes in favor of it. If an NRI person wants to incorporate India’s land, firstly, he must establish a legal presence in India by registering his business as a private limited company (Indian Subsidiary) or as a foreign company.

Documents Needed For Incorporation Of Foreign Company In India?

The document’s requirement may vary on the way a foreign entity wants to run business in India. The below mentioned are the documents required to perform business activities on the land of India.

Documents Needed for Wholly Owned Subsidiary Company

The below listed are the documents needed for wholly-owned subsidiary foreign entity incorporation in India:

- Proof of address which he wants to register his company (In case of a rented property, the latest electricity bill of the property)

- In the case of Indian citizen

- PAN Card

- Proof of address

- ID card which posses the photograph of the individual (Aadhaar Card)

- In the case of Non-Resident of India

- Passport

- Proof of Address

- ID card which posses the photograph of the individual (Driving license)

- The documents given must be declared as true by the Indian Consular or consulate.

Documents Needed for Joint Venture Incorporation

Under the joint venture incorporation, the contractual agreement must be drafted. The below-listed points must be taken care of by the parties involved.

- There must be a Dispute Resolution agreement signed by the parties before incorporation.

- All the provisions must be applied of constitution, laws, statutes, ordinance rules, treaties, interpretations and orders of courts or Governmental Authorities and all orders and decrees of all courts and arbitrators

- The parties must be holding the shares of the company.

- There must be a provision for transferring shares.

- For a transaction that is carried out by the company’s board of directors to breach the provisions of contractual obligations.

- There must be a clause of confidentiality followed by all the members of the company.

Particulars Needed for Liaison Office or Representative Office

Reserve Bank of India recommended the benchmark for setting up a Liaison office or Representative Office in India, which are as follows:

- It is important to have a profit-making record in the prior 3 financial years in the native nation, and the net value should be more than USD 50,000.

- If the subsidiary company does not fulfill the aforesaid condition, a letter of aid is provided by the parent company that fulfills the aforementioned conditions.

- Particular Authorization of RBI under FEMA 1999 and Insurance Regulatory and Development Authority (IRDA) is needed.

- A certified Dealer Category–I Banks requires submitting an application to the RBI for constituting an office.

- The office will be provided a Unique Identification Number by RBI.

- The Indian Embassy shall attest the English version of the certificate or MOA/ AOA of Incorporation and application in support.

- The latest Audited Balance Sheet of the applied entity shall also be provided in the Country of Incorporation.

Particulars Needed for Project Office

If the foreign entity willing to establish an office in India’s land, then the foreign company must be signed a contract with the Indian company to carry out India’s business activities. Earlier approval from the RBI is not mandatory.

- Funds without deviation by inbound indemnification from a foreign nation ; or,

- Funds can be given by a bilateral or multilateral International financial institution; or,

- It shall be certified from the appropriate authority.

- The foreign company in India must be provided a contract that has been sanctioned Term Loan by a bank of India or a public financial agency for the project,

- In the case, the aforesaid conditions do not satisfy by the foreign entity, it can approach to the RBI for approval.

Particulars Needed for the Branch Office

After opening the Branch Office, a foreign establishment can administer business activities in India’s region with the prior permission of RBI.

- The foreign company must be involved in production or trading enterprises in India.

- Profit in immediate previous 5 financial years is mandatory.

- The net value should not be less than USD 100,000 in foreign company home country.

There are many chances to grow on India’s land as a foreign entity, even in the E-commerce sector; the government has recently allowed 100% FDI under the E-commerce sector.

Statutes Governing the Foreign Company in India

It depends upon the business entity set up that which law shall apply. The below listed are the statutes engaged in governing the foreign company in India.

- The Companies Act, 2013 provision helps the foreign entity to incorporate & set up their business activities in India.

- Foreign Direct Investment scheme helps foreign establishment related to their investment by the RBI.

- Whereas the Foreign Exchange Management Act (FEMA), 1999 regulates India’s foreign company business activities.

Compliance Required By Foreign Company in India after the Incorporation

Compliances requirement varies depending upon the nature of business the foreign entity is performing in India’s territory

Wholly Owned Company/ Subsidiary Company

- All the compliances needed under the Companies Act, 2013[1].

- FEMA compliances by the FEMA Act, 1999

- Director General of Foreign Trade compliances required.

- Annual compliances under the Goods & Services Tax ACT, 2017

- Tax filing under Income Tax Act, 1961

- Other specific regulatory Act, regulations depending upon the entity type of company

Joint Venture

- Terms upon which RBI or FIPB (Foreign Investment Promotion Board) authorization is provided.

- Continuing by Terms & conditions which are said under the Joint Venture.

- Annual Compliances under GST Act 2017

Liaison Office/ Branch Office /Project Office

- Submission of E-form FC-1 to Registrar of Companies within the time limit of 30 days from initiating office in India.

- Submission of E-form FC-3 for Annual accounts along with the list of all particulars places of business in India initiated by foreign entity.

- Submitting of E-form FC-4 for Annual return of a foreign entity.

- Branch Offices / Liaison Offices shall submit the activities on yearly basis.

- Certificates (AAC) and Annual return on Foreign Liabilities and Assets has been notified under FEMA 1999

- Compliances on annual basis under GST Act shall be completed

- Tax filing under the provisions Income Tax Act, 1961 should be done.

Penalties for Non-Compliances by Foreign Company

It depends upon the non-Compliance and its related penal provision, penalty, fine or other fees are levied upon the foreign company as per the provisions of laws.

Conclusion

The Companies Act 2013 and recent amendments in it have clarified the purview of the foreign entity’s definition to a large extent. But still, many gaps exist under the provided definition.

In its report in the year of 2016, has noticed that the word ‘foreign company’ in the Companies Act, 2013 r/w the definition of ‘electric mode’ could consequently be insignificant based on electronic transactions of an establishment registered outside India. The recent changes under the Companies Act will attract foreign investors to incorporate India’s foreign entity, contributing efficiently to India’s GDP growth.

Read our article:Indian Subsidiary Company Registration