Budget 2020 has amended certain provisions related to religious trust under the Income Tax Act. The amendment has a great impact on the functioning of the registered Trusts under NGOs. These religious/charitable NGO have been loaded with the setting an expiry date for registration, renewal of existing registration, filing of statements of donation receipts, as well as other formalities . Relaxation has been provided for registration of religious trusts formed for charitable purposes. In this particular blog an insight related to new era formed for Religious NGO under Taxation has been discussed in details.

Exemptions Provided for Religious NGO under Taxation

The Income Tax Act has allowed many exemptions to charitable organizations due to their social and charitable work that are subject to compliance in specific situations. Once a religious charitable organization obtains registration under the Income Tax Act[1], it is generally known as Religious Trust.

The Finance Minister Nirmala Sitaraman while presenting the Union Budget for 2020 on February 1st 2020 recognized the role of religious charitable organization in the society.

Initiative taken by the Government for Religious NGO under Taxation

New initiatives taken by the government for benefit of Religious NGO under Taxation are discussed below-

- In recognizing the essential role played by the religious charitable organizations in the society, the income earned by these institutions is fully exempted from tax liability. Additionally, the donation made to these organizations can be allowed as a deduction while calculating the taxable income of the donor of the religious trust.

- Presently, it is necessary for the taxpayer to fill in the complete details of the donee while filing for income tax return to avail deduction.

- In order to ease the course to claim the deduction in case of donation made, it is anticipated to pre-fill the information related to the donee in the return filed on the basis of information provided by the donee in relation to the donation made. This will result in comfortable claim of deduction for the donation made by the taxpayer.

- In order to avail the tax exemption, the religious trusts are required to be registered with the Income Tax Department. Previously, the registration process was totally manual and scattered all around the nation.

- In order to simplify the compliance for the new as well as the existing religious trust a Unique Registration Number (URN) should be issued. It is done to make the registration process totally electronic under which all new and existing religious trust will be registered. To assist the registration process for the new religious trusts which is yet to start their activities, a provisional registration for three years will be issued.

Read our article:Forfeiture of Exemption of Incomes of Charitable Institutions U/s 13

Amendments for Religious NGO under Taxation regime

The following Amendments have been planned by the Finance Bill, 2020 towards validation of provisions related Religious NGO under Taxation which is applicable from June 1st, 2020.

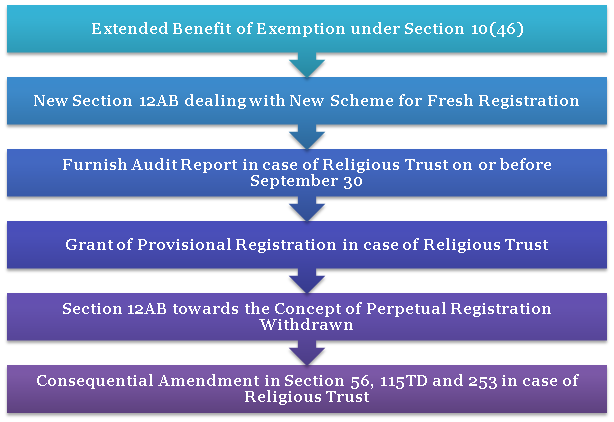

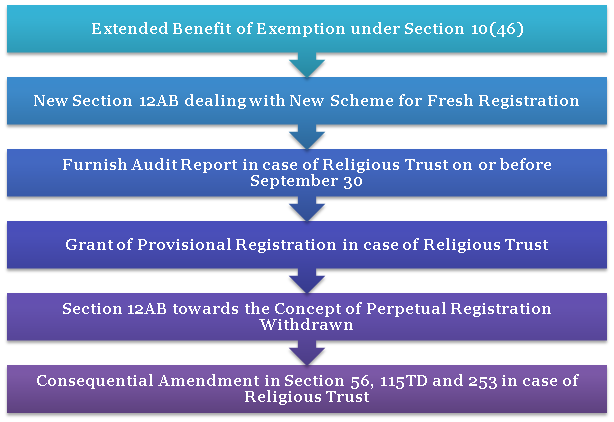

Extended Benefit of Exemption under Section 10(46) even if registered under Section 12AA

Entities that are registered under Section 12AA will not be allowed to any exemption under any provision of Section 10 other than exemption on agricultural income according to Section 10(1) as well as income exempted as per Section 10(23C).

The Finance Bill, 2020 has recommended to extend the benefits in Section 10(46) to such organizations. It has been anticipated that the exemption under section 10(46) will only be allowed to any organization even if it is incorporated under Section 12AA. The exemption will be subject to the situation that the registration under Section 12AA will be inoperative from the date on which the organization is approved under Section 10(23C) or (46) or 1st June, 2020, whichever is later.

New Section 12AB dealing with New Scheme for Fresh Registration of Religious NGO under Taxation

Section 12A recommends the conditions for applicability of Section 11 and Section 12 and Section 12AA deals with the process for registration of religious trust. Every application for registration has to be made in Form 10A along with the approved list of documents.

Furnish Audit Report in case of Religious Trust on or before September 30

If total income of the religious trust before exemption exceeds the maximum amount that is not chargeable for tax, the accounts of the religious trust for that year will be audited by a Chartered Accountant (CA). The audit report will be provided in Form 10B along with the Income Tax Return.

The Finance Bill 2020 suggested that audit report has to be provided by the assessee one month prior to the due date of Income Tax Return Filing. The due date of Income Tax Return Filing for audit is anticipated to be increased from 30th September to 31st October of the Assessment Year. Thus it is required to be furnished on or before September 30 of the year.

Section 12AB towards the Concept of Perpetual Registration Withdrawn in case of Religious NGO under Taxation

As per the prevailing provisions of act, the registration under section 12A is just a one-time registration process. Once registration is done, it will be valid till the cancellation of registration. There is no such provision that requires any renewal. Though, the newly anticipated section 12AB advises that the registration granted to religious trust will be valid for a period five years at a time and in case of provisional registration for a period of three years.

Grant of Provisional Registration in case of Religious NGO

The religious trusts are provided with registration on the basis of information as well as documents provided before the CIT. The registration is provided once the officials are satisfied about the authenticity of the activities of religious institutions.

The Bill proposes that the religious trusts or institutions will be provisionally permitted or registered for 3 years on the basis of application.

Consequential Amendment in Section 56, 115TD and 253 in case of Religious NGO under Taxation in Finance Bill 2020

After introduction of new Section 12AB in place of Section 12AA, all significant amendments have been anticipated in Sections 56, 115TD and 253 to bring the organization to be registered under section 12AB under their domain.

Conclusion

Amendments that are brought in by Finance Bill, 2020 will bring further burden of compliances for Religious trusts or institution. But it will certainly lead to better and transparent supervision of activities of the religious trusts. The aforementioned amendment appears to make the processes more translucent and unaffected by using of electronic means.

Therefore, it is necessary for Religious NGO under Taxation to allow them to stay engaged in social events rather than only doing the formalities. Contact our Corpbiz team if you need expert advice on the new process of Trust Registration.

Read our article:What is Religious Trust?