Are you aware that charitable institutions may be impacted by loss or giving up something as a penalty for wrongdoing? Yes, it may consider as any part of the Income of Trusts for ‘Private Religious Purposes, ‘ which does not guarantee for the advancement of the public as per Section 13(1) (a).

In general, it speaks relatively if the Income of Trusts established on or after 1.4.1962 for the Advantage of Religious Community or Caste as per Section 13(1)(b). The Income of Trusts for the Benefit of Involved parties as per subsection 13(3) [Section 13(1)(c)], and fund not Invested by Trusts in Section 11(5) may also depict the similar notion. The exception to these notions can be judged if funds are invested contrary to the Modes specified in section 11(5) following Section 13(1)(d)]. Charitable Trusts do not lose on Forfeiture of Exemption if Educational or Medical Facilities have granted to Specified Persons [Section 13(6)].

We understand that these issues are quite complex. Therefore, this blog will provide you with all learning’s on the Forfeiture of Exemption of Incomes of Charitable Institutions U/s 13 based on recent amendments and circulars.

What are the Income of Charitable Institution doesn’t Qualify for exemption U/s 11 & 12?

Income not for Public Benefit, except Trusts for Private Religious Purposes

- If the element of public benefit has been satisfied, Section 13(1)(a) shall not be applicable. If the interest accumulates to the public at large, and the power is with a particular group of persons, in that case, section 13(1)(a) will not be considerable.

- Concerning the Forfeiture of Exemption, income from a property held under a trust for private religious purposes- without benefit to the public is not qualified for exemption under section 11 or 12.

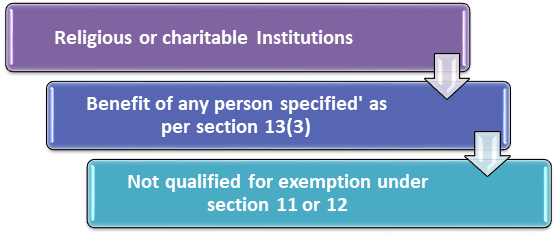

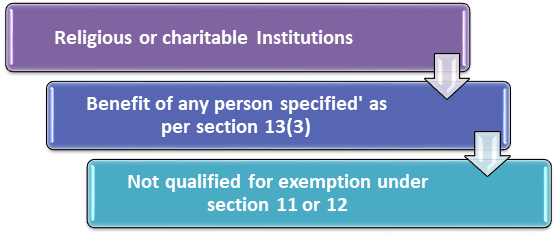

Trust created for the Benefit of Interested Persons as per sub-section 13(3) following Section 13(1) (c)

- If religious or charitable institutions founded for the ‘benefit of any person specified’ as per section 13(3), then the total income of such trust is not qualified for exemption under section 11 or 12 of Income Tax Act.

- Charitable institutions established after March 31, 1962, is also not qualified for exemption under section 11 or 12 if the assets/resources are used for the direct/indirect advantage of the founder of the trust and other persons mentioned under section 13(3).

Trusts recognised on/after 1.4.1962-Benefit for Religious/ Caste Community

- Any trust got recognized on or after 1.4.1962 for the benefit of any particular religious community or caste [Section 13(1)(b)] is available for exemption.

- However, concerning the Forfeiture of Exemption, those trusts for the benefit of Scheduled Castes, backward classes, Scheduled Tribes, or women and children will not be considered for the benefit of a religious community or caste within the application of clause (b) of subsection (1).

Investments of Funds trust other than the specified mode in Section 11(5)

- The income of a charitable trust/institution is not qualified for exemption under section 11 or 12, conditioned on investing funds or deposited otherwise than in the forms detailed in section 11(5).

- The charitable trust should apply at least 85 % of income for charitable/religious purposes during the year. The ultimate remaining amount should be as specified under section 11(5). It means that both criteria should be fulfilled so that the trust can gain/claim against the Forfeiture of exemption under section 11(1)(a).

- Charitable Institution will decide on the Forfeiture of exemption from tax if any capitals or funds get invested or deposited later February 28, 1983, in other ways or additional of the modes as detailed in section 11(5).

Income applied not for Public Benefit, except for Private Religious Purposes

- If the element of public benefit has been satisfied, Section 13(1)(a) shall not be applicable. If the interest accumulates to the public at large, and the power is with a particular group of persons, in that case, section 13(1) (a) will not be drawn.

- Moreover, income from a property held under a trust for private religious purposes– without benefit to the public is not qualified for exemption under section 11 or 12.

No Forfeiture of Exemption, even if funds are invested otherwise than in the Modes specified in section 11(5): [Section 13(1) (d)]

Under the mentioned events, provisions of section 13(1) (d) will not apply.

Those are as follows:-

- The exemption claimed by the charitable institution will not get denied concerning any addition to the assets, as portions of a company forming corpus as on June 1, 1973, where such accumulation occurs by way of the distribution of bonus shares.

- The exemption claimed by the charitable institution will not get forfeited concerning debentures established by the trust or institution before ‘March 1, 1983’. If the trust or institution receives debentures after February 28, 1983- before July 25, 1991, the exemption under section 11 will be rejected concerning investment on such debentures.

- The exemption claimed by the charitable institution will not be forfeited concerning any funds serving the profits and gains of a trust if it keeps separate books of account in regards to such business.

- The exemption claimed by the charitable institution will not be forfeited in the acceptance of donations in genus/kind or obtaining any asset, not adhering to Section 11(5).

- In such cases, the trust or institution shall be required to place or convert the asset not conforming to the provision of section 11(5) into legitimate investment within one year from the end of the financial year in which such assets are acquired on March 31, 1993.

Read our article: Audit of Charitable trust or NGO under section 12A (b)

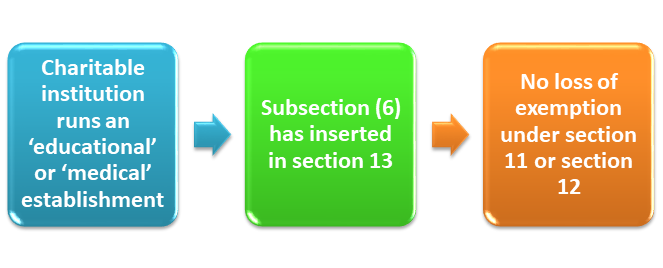

No loss/ Forfeiture of Exemption when Educational or Medical expenses specified to Particulars

Following Section 13(6) following Sections 12(2) and 13(6):-

- Any revenue or income generated from the charitable trust will lose its exemption if it is applied to the Undue benefit of private person related to the trust/institution or any person who concedes Substantial Interest

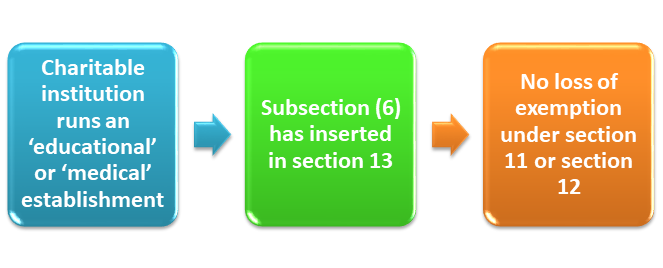

- From the assessment year of 2002, the Subsection (6) has inserted in section 13, which delivers the fact that any there will be no loss/ Forfeiture of exemption under section 11 or section 12 if the Charitable institution runs an ‘educational’ establishment or a ‘medical’ establishment/hospital. It shall be in consonance where it will be concerning any income on condition that such trust has delivered educational or medical facilities to involved or interested persons.

What do you mean by an Interested Person under Section 13(3) of the Income Tax Act?

- Founder of the trust

- Person who made Contribution more than ₹ 50,000

- Person-member of Hindu Undivided Family/Relatives or any considerable contributor

- Trustee, Secretary, President, Manager who seeks Interest

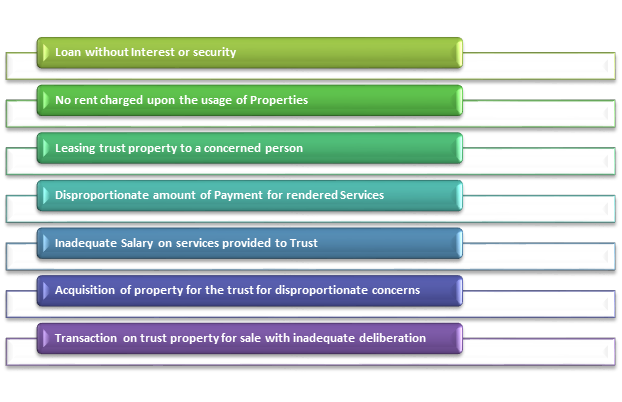

Property or Income considered its usage for interested Parties U/s 13(3)

There are few circumstances related to the above stated. Those are as follows:-

- Loan without Interest or security: – Income of the trust which carries on loan to any person U/s 13 (3) with no security or substantial interest rate for any period during the previous year.

- No rent charged upon the usage of Properties: – If no rent charges upon the usage of Properties, land, or building of charitable trust continues to be accessible for interested parties as specified U/s 13(3) during any previous year of computation.

- Infringement of specification–section 13(2) by Leasing trust property to a concerned person– In circumstances where the trust property is leasing out to a colleague of trust with inadequate rent, it is a violation of specifications prescribed under section 13(2)(b)

- Case: – ‘Ram Bhawan Dharamshala v State of Rajasthan (2002) 258 ITR 725 (Raj)’- It says that Leasing trust property to a concerned person without rent is a clear violation of section 13(2).

- Disproportionate amount of Payment for rendered Services: – If any quantity/sum is paid out of the members of the trust or institution to any of the persons for services rendered to a charitable trust or such amount is more than a reasonable sum billed for such services.

- Inadequate Salary on services provided to Trust: – If the service stations of the charitable trust or institution are made accessible to any person mentioned under section 13(3) without adequate remuneration or other compensation as per section 13(2) (d).

- Acquisition of property for the trust for disproportionate concerns [Section 13(2) (e)]: – If any portion of share, security or additional property is acquired by or on behalf of the trust or organization from any person mentioned as per section 13(3) during the previous year which is not suitable.

- Transaction on trust property for sale with inadequate deliberation [Section 13(2) (f)]: If any portion of share, security or additional property is sold by or on behalf of the trust or establishment to any person mentioned to in section 13(3) during the previous year for a consideration which is less than satisfactory.

- Alteration of income or property more than Rs. 1,000 [Section 13(2) (g)]:- If any property or income of the trust or institution is diverted during the previous year in good a turn of any person mentioned in section 13(3), provided the aggregate value of such income and property altered exceeds 1,000.

- Investment deposited in substantial interest considerations Section 13(2) (h)]: In cases where any funds of the charitable trust or organization continue to remain, invested for any period during the previous year (not before 1.6.1971) in any apprehension as referred to in section 13(3) has a significant interest.

What do you mean by ‘Relative’ and ‘Substantial Interest’ determining the Exemption of Income?

Few norms speak the terminology ‘Relative’ and ‘Substantial Interest’ with individual meaning.

Those are as follows:-

Term –Relative: Explanation-1 to Section 13

- Any spouse

- Any brother or sister

- Any brother/sister of the spouse

- Any lineal ascendant

- Any descendant

- Any lineal ascendant/descendant of the same spouse

- Any spouse of a person mentioned to in (b), (c), (d) or (e) said above

- Any lineal ascendant/descendant of a brother/sister of either the individual or of the same spouse

Term Substantial Interest: Explanation-3 to Section 13

In cases for Company-

- Shares: -Shares not being entitled to a fixed rate of dividend, whether with or without a further right to participate in profits, carrying not less than 20% of the voting power during the previous year owned by interested parties as mentioned sub-section (3).

- Entitled Person: – Those who are such persons which entitled or more of the other persons as mentioned in sub-section (3) is entitled in the combined income, at any time during the previous year not less than 20% of the incomes/profits of such considerations.

What are the updates from Finance Act 2020 concerning reduced tax rate for Charitable Giving?

Intended For Individual

- According to the Finance Bill 2020 (Act), there is no alteration in the current income-tax slab rates for Individual Persons and (HUF) Hindu Undivided Family.

- Nevertheless, a new income tax scheme has been projected under which ‘individuals and Hindu Undivided Family would be taxed at a concentrated/reduced rate provided they give up exemptions and deductions which are otherwise permissible under the Act.

- All exemptions and deductions that would have to be inevitable must include, ‘normal deduction, house rent grants, leave travel reduction, interest on loan borrowed for self-occupied house possessions, deductions under section 80C[1].

- This may also include Provident Fund/Public Provident Fund Contributions, Life Insurance premium, etc. Moreover, section 80CCD included NPS contributions by other than employees), 80D (medical premium insurance), 80TTA (interest by bank), and 80G (donations to charitable establishments).

Intended for local Companies

- In accordance with the Taxation Law Amendment Act, 2019, the new income tax system will permit companies to be taxed at a reduced income tax rate, provided they give up exemptions and deductions which are otherwise permissible under the Act.

- Companies which choose for reduced tax rate will be exempt from compensation of ‘Minimum Alternate Tax’ (MAT). The reduced specified rate of tax will be 22% in its place of tax rate fluctuating from 26% to 29.12% depending on gross revenue of the company

- The operational tax rate under the new system will be @ 25.168% for local companies, provided they give up exemptions and deductions which are otherwise permissible under the Act.

- It will include deduction u/s 80G for donations and endowments to charitable trusts and establishments. Corporations will be set with an option to select the regime for payment of tax. Though, once an option is implemented, it cannot be withdrawn in following years.

Conclusion

In general, it is the bigger experiment under Finance Bill 2020. These are online application procedures which will be delivered by NGOs to their chartered accountants and tax consultations for remuneration. The greater test may essentially be around fundraising for the organisation. Our Corpbiz group will be at your disposal if you want expert advice on any aspect of Charitable Trust issues. We will help you to ensure complete compliances concerning all the forfeiture of exemption-based as per your desired activities, ensuring the fruitful and well-timed completion of your work.

Read our article:Taxability for Co-operative Societies: A Complete Outlook on Annual Returns