P2P lending is a digitally-driven platform that allows the credit seekers to obtain loans from potential lenders in the absence of the intermediary. Peer to Peer lending linked the borrowers to lenders in no time. It forms a connection between the credit seekers who want unsecured loans and investors who wish to lend their fund to reap higher ROI. The P2P portal helps the participants to narrow down their search option through a data-driven interface and cutting edge technology. In this article, you will come to know everything about the NBFC P2P License.

Registered Financial Platforms

Such a platform is backed by the exhaustive list of registered borrowers so that lenders can choose them accordingly. It permits lenders to extend the portfolio of investment by disbursing funds to multiple credit seekers in small amounts.

P2P creates a win-win situation for both lenders and borrowers. P2P lending is an instrument of credit financing that permits persons to borrow and lend funds in the absence of financial institutions. P2P portal doesn’t take advantage of intermediary which inherently saves a lot of money for the involved participants.

Who Regulates the P2P Lending Platform?

Reserve Bank regulates the P2P lending platforms to protect the interest of lenders and borrowers. Entities that is willing to carry such a business activity need to avail of a license from the concerned authority without exception.

As per Reserve Bank guidelines, a lender is only allowed to invest up to Rs 50 lakh across Peer to Peer platform. Similarly, a credit seeker cannot avail more than 50,000 across P2P platforms according to RBI[1] set a loan disbursing limits.

Eligibility Criteria for Obtaining NBFC P2P License

- A P2P lending platform can only be set up by registered organizations and active NBFCs.

- A company must secure a minimum net owned fund of worth Rs 2 crore to avail the COR for Peer to Peer lending business.

- If an organization was already engaged with such a business before the registration certificate was made mandatory, then the organization shall satisfy all requirements as drafted by the Reserve Bank.

Read our article:NBFC Registration: Step by Step Procedure

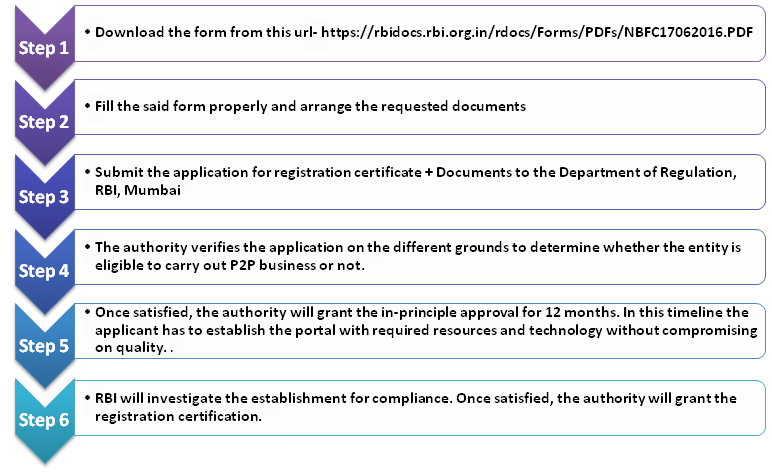

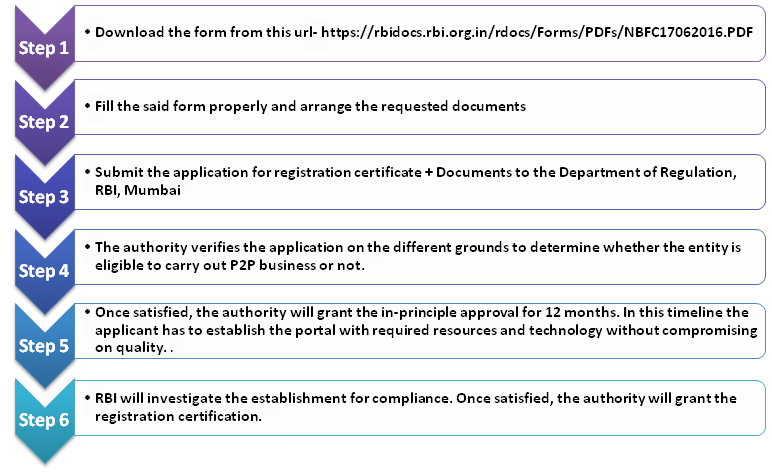

Registration Process & Conditions for NBFC P2P License

NBFC P2P platform before starting the business activities must apply for a license to DNBR of Reserve Bank, Mumbai, in the predetermined application. While evaluating the application, Reserve Bank determines whether the applicant meets the following conditions or not:-

- The company is an Indian-based entity and holds the incorporation certificate.

- Directors of the organization meet the fit and proper criteria as laid down by the Reserve Bank. They must not be unbiased to the interest of the public and the company.

- The company is underpinned by the required technological resources to renders services to the participants on the portal.

- The organization must reserve an adequate capital structure to carry out P2P lending activities in India.

- A secure & robust IT system has already been deployed or a plan for the same has been outlined.

- A viable business plan has been underpinned to conduct business activities

- Meet all the relevant stipulated as mentioned by the Reserve bank.

Once Reserve Bank completes the verification process and ensured all conditions are met then it grants the in-principle approval. The validity will remain in existence for 12 months only from the date of the grant. Now within this timeline, the organization must deploy the technology platform, prepared all the legal documents, and report the authority regarding compliance. Then Reserve Bank, after being satisfied with the applicant’s response, grant Registration certification as an NBFC-P2P.

RBI made it mandatory for all the peer to peer companies to obtain a license for the P2P platform, to safeguard the interest of the participants. Since the provisions were drafted by RBI in October 2017. All new applicants need to obtain a provisional NBFC Peer to Peer Lending License from Reserve Bank to initiates operations in this sector. This will help to curb the P2P player’s activities.

NBFC P2P Lending Business Features

Following are the key features of NBFC P2P lending that you must know before obtaining an NBFC P2P License

- NBFC p2p lending is a technology-driven platform that is registered under the Companies Act, 2013.

- They form a bonding between the borrower and lender in which benefits goes to both of the participants with the business activity of peer to peer lending.

- To carry out business activities like NBFC P2P in India one has to register themselves on the RBI’s official website to get the NBFC P2P license.

- A detailed application needs to be filled by the applicant to grant the NBFC P2P license.

- P2P lending is purely an online activity where a data-driven framework is used for the verification of the involved participants.

- P2P has overcome the constraints related to paperwork, direct negotiation, and disbursement.

- This platform allows the lenders to choose the borrowers from an exhaustive and verified list.

Conclusion

P2P certainly got the potential of being the best investment platform than its counterparts. Although it lacks on some fronts such as recovery mechanism and disbursal limit, it still has the potency to turn around the things in upcoming years. Contact the team of CorpBiz if you are willing to get started with such a business model. Our professional will ensure faster turn-around-time and seamless filing for an NBFC P2P License.

With years of experience at the disposal, our experts can help you overcome apparent obstacles that usually sneaked in while encountering the registration process. We will also make sure that your application gets approved in one go instead of several attempts.

Read our article:NBFC-Peer to Peer Lending Platform – Compliance and Registration