The Peer-to-peer (P2P) is an online-based platform that aims to fill the gap between individuals who can lend and those who seek credit without collateral. The major transition of this industry occurs about two years back in the form of Reserve bank regulations which permits high-end investors to lend money to borrowers with a compromised fiscal background.

At present, most of the P2P platforms offer credit without any collateral to the salaried as well as a business person for growth, medical expenses, and marriage, etc. One of the ways Indian fintech continues to evolve as a major player in the world of finance is to enable fintech-based lending. P2P Lending is showing a sign of future potential in the country. There is no denying that such lending transactions are one of the significant developments of the decade.

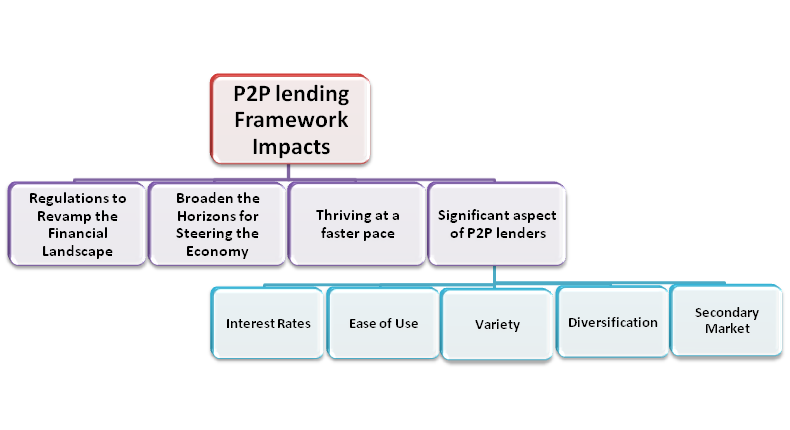

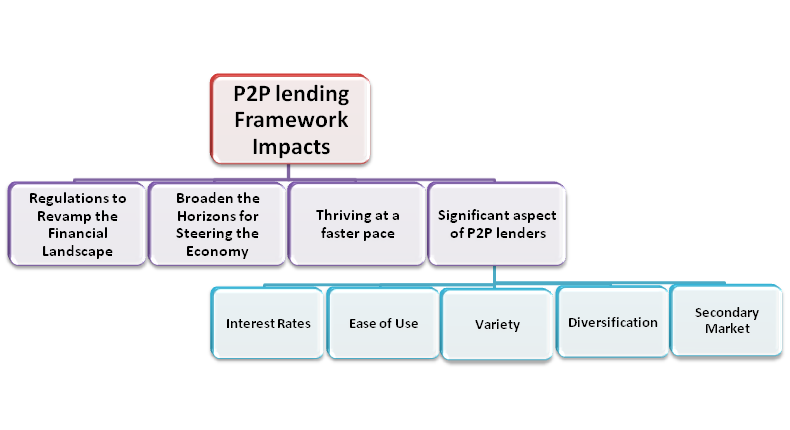

Regulations to Revamp the Financial Landscape

With the country showing a wide mobile user base of around 1.2 billion in 2019 along with a focus on financial inclusion,Peer to Peer lending has brought a major disruption in the way individuals avail loans and the role of the bank in this. With the Reserve Bank coming out with master directions related to peer in October 2017, the industry has a definite set of guidelines and regulations. The government took certain measures to revamp the financial landscape that govern this industry.

In 1982, the Reserve Bank Governor Implement a regulatory framework that formally connects the banking sector, unorganized sector, and NBFCs to estimate the country’s monetary system from a broader perspective

Read our article:Peer to Peer Lending; Easy Lending Online Platform for Borrowers

Broaden the Horizons for Steering the Economy

Accounting for the larger part of the population, this segment has been steering the economy considerably. Past economic crises and recent NBFCs issues have forced the authority and government[1] to look for another viable alternative. P2P lending platforms exhibited the enormous potential, primarily due to cramped interest rate, user-friendly application, and swift lending decisions.

The government further eases out the thing for P2P lending by announcing 5X lending-cap extension, which was previously limited at Rs 10 lakh. Considering the growing competition in this area, such an extension will help these platforms attract the attention of venture capitalists. The government’s decision to enlarge the portfolio of credit would let these platforms grow at a much faster pace.

The Reserve Bank has suggested all Peer to Peer operators to hire a trustee to securitize the pattern of transactions between the escrow account of lenders and borrowers. The RBI guidelines clarify that the P2P should procure at least two escrow account- one for funds coming from the lender and another one for the collections from borrowers. The account must be supervised by the trustee and such an individual must be promoted by the bank.

Thriving at a Faster Pace

In India, the P2P business till now depends on the development of the retail and MSME lending, which is overlooked by the financial institutions and NBFCs. The sector was a promising one and a money generator for privately held lenders, who are primarily informal lenders. On lending, it can substitute this informal lending by Reserve Bank specified entity. On the investment front Peer to Peer will cement its place in a financial market as a contemporary investment option, competing against the market-linked alternatives such as Stocks, as well as in Mutual funds.

Significant Aspect of P2P lenders

Here’s why P2P lending will be the next big thing in the fiscal market which emerges with these significant aspects of P2P Lenders. Those are as follows:-

Interest Rates: Investor to Reap a Good Interest Rate

Interest rate is probably the most significant aspect for peer to peer lenders. The P2P platform can allow the investor to reap a good interest rate on the yearly basis. Since conventional savings account doesn’t offer an optimal rate of interest, many individuals left with no other option than finding out a viable alternative to reap more benefit of their funds, including P2P investing.

Ease of Use with User-friendly Platforms

P2P platforms are user-friendly when contrasted with other investment options such as shares and stocks. P2P investment executes on online platforms with minimum jargon. Anyone can get started with a P2P platform including those who haven’t much of an experience in finance. Also, P2P platforms have a diverse portfolio of the investment plan that even attracts the lower-income group.

Variety to Serve Different Purposes

P2P lender’s norms are less stringent than conventional banks. The borrowers who raise money from these platforms can use it to serve different purposes. This indicates that as an investor you have ample choices for lending their capital. These loans are typically used for funding small scale enterprises, housing developments, or assisting borrowers to broaden their property portfolio.

Diversification on Profitable Opportunities

The majority of p2p lending hub renders a product that can diversify your invested money across different profitable opportunities. This diversification is profitable because it lowers down your risk since you are confining your funds into a single loan.

Secondary Market to Sell Parts of the Credit

While investing, you shouldn’t make an assumption regarding exiting the investment at the initial stage. But, a secondary market renders an opportunity to sell parts of the credit to other investors on the peer to peer platform. A secondary market renders liquidity to the person dealing in investment if they need to avail money in advance than planned.

Conclusions

Scarcity of funds and limited resources are the big factor that actually decides the fate of p2p lending in India. Since conventional banks restrained borrowers from availing a loan without collateral, these platforms could prove to be a game-changer in this aspect. In case if you seek some additional view on this very topic then do not hesitate to drop the queries at the disposal of CorpBiz’s experts.

Read our article:NBFC-Peer to Peer Lending Platform – Compliance and Registration