Finance and credit are crucial for the prosperity of low and middle-income groups. Unfortunately, the majority of the population that resides in this income group does not have an access to proper banks or financial houses from which they can avail easy credit. Stringent RBI’s guidelines have made these financial institutes inaccessible to these people. But the advent of the non-banking financial institution and MFIs resolve this problem to some extent. Now the people with low income can avail the hassle-free credit from these institutions. Here will be going to discuss NBFC MFIs Registration and requirements.

Comparative Study Recognising MFI as NBFC

Micro Finance Institution is a form of Non-Banking Financial Company (NFBC) which offers financial services to the individuals and small scale enterprise. It is also recognized as Micro Finance Institution (MFI). Micro-finance activities in our country is performed by the business models such as NGOs (Society, Trust, Section 8 companies) and Profit oriented companies like NBFC MFI.

Non-Banking financial companies provide specific types of financing services but do not possess the banking license. Such companies are registered under the Companies Act and involve in the business of credit and advances, acquisition of stocks, share, and debentures issued by the local authority or Government. It does not serve any activities related to industrial, agriculture, or trading of goods.

Microfinance companies on the other hand is deemed as secondary banking structure which aims to render financial services to the lower strata of the society, who do have access to financial services.

Objectives of the Microfinance Company

- To render financial aid to the needy people to meet their basic requirements and improve their standard of living.

- To keep leveraging the financing scheme that can benefit the lower strata of the society.

- To extend their credit portfolio that even covers the scope of loans for small businesses, so that they can ramp up employment within the region where they are operating.

- To advocates the sense of self-employment in the rural and backward areas.

- To launch schemes that provides vocational skills.

Read our article:Types of NBFCs in India – An Overview

Guidelines Complying NBFC and Micro Finance Institution

- NBFC-MFIs needs to hold a minimum net owned funds of Rs Five crore. For NBFC-MFIs working in the North-Eastern region requires maintaining a minimum NOF of up to Rs two crore.

- NBFC MFIs must fulfill the minimum criteria of Qualifying Assets which is capped at 85% of the net assets.

- The income generated from the remaining 15 percent of assets should be in pursuant to regulations set up by the concerned authorities.

- An NBFC not working as an NBFC & MFI shall not provide loans extension to microfinance sector.

Document required for NBFC MFIs Registration

The following list encloses the type of documents required from all the members of the company:-

- Incorporation Certificate (Certified copy)

- Memorandum of Association (certified copy)

- Article of Association (certified copy)

- Banker’s report

- Copy of board resolutions

- Auditors report displaying the minimum net owned fund of the applicant.

- Certificate sanctioned by the CA showing detail of companies along with investment particulars made in other NBFCs as per the given format.

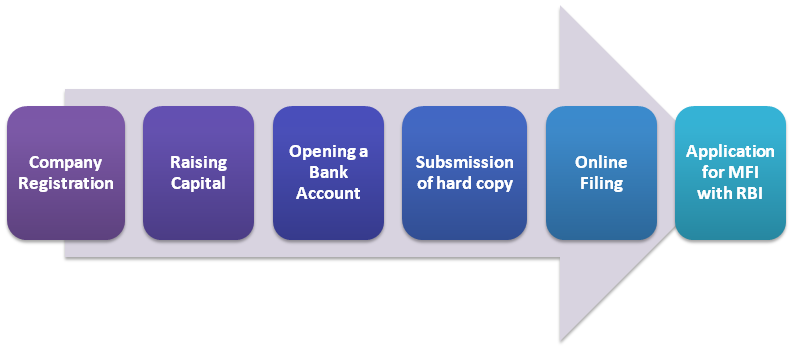

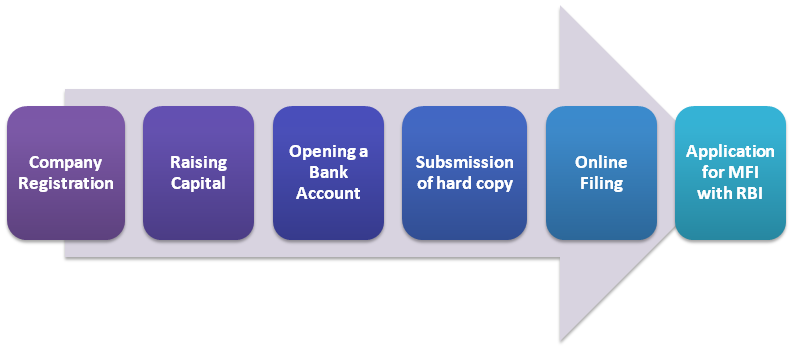

Procedure for the Microfinance Company Registration

Step 1: the first and foremost step in the registration of such institutions is to get a company required either as a private limited company or public limited company as per regulations of the Companies Act, 2013[1]. Initially, the capital of one lakh can be sufficient to incorporate micro finance companies. Once you are done with this step, you can proceed to the next step.

Step 2: The next stage is to raise a paid-up capital of up to 2 crores or 5 crores as the case may be. Furthermore, capital ought to raise only in the form of equity share capital

Step 3: Once the incorporation is done, the next step to submit the received amount in the form of a fixed deposit in the bank account. Then a certification of the no dues will be obtained from the bank. The applicant needs to annex the said certificate with an application and forward it to the Reserve Bank.

Step 4: The last step in the process to arrange the following documents and submit them to the RBI for executing business activities.

- Bankers certification regarding NOF, aka no lien certification.

- Copy of Memorandum of Association

- Copy of Article of Association

- Bankers report.

Step 5: In this step, the applicant requires to file an application with RBI on a dedicated online portal. Upon the completion of the application, the applicant shall receive an application reference number that helps them track the application’s status.

Step 6: After applying, the applicant requires to submit the hard copy of the application at the regional office of the Reserve Bank. Upon acceptance of the application, RBI will check the same on the predetermined ground and will finally issue the commencement certification to the application.

Conclusion

NBFC-MFIs are nothing short of a savoir for those who often fail to avail credit from banks due to tons of compliances. They are extremely necessary for lower and the middle-income group that doesn’t have an access to mainstream finance houses. If you ready to keep up with RBI’s compliances, then executing such a business could be a profitable proposition for you. Feel free to contact the CorpBiz team for the NBFC MFIs Registration and requirements. With years of expertise in finance and licensing fields under the belt, Corpbiz believes in providing unparalleled services to its customers.

Read our article:NBFC Registration: Step by Step Procedure