The term “NBFC DSA Registration” implies the registration of an individual who undertakes tasks as a referral agent for banks and NBFCs. However, in rural areas, these personals are being regarded as Business Correspondent. The primary job of a Direct Selling Agent is to identify the potential clients for NBFCs or Banks they represent.

Moreover, the leads generated by these individuals further send to the concerned NBFC or Bank. In this article, we would render explanatory information on the paradigm of Registration of Direct Selling Agents and the positive outcomes of becoming an NBFC DSA.

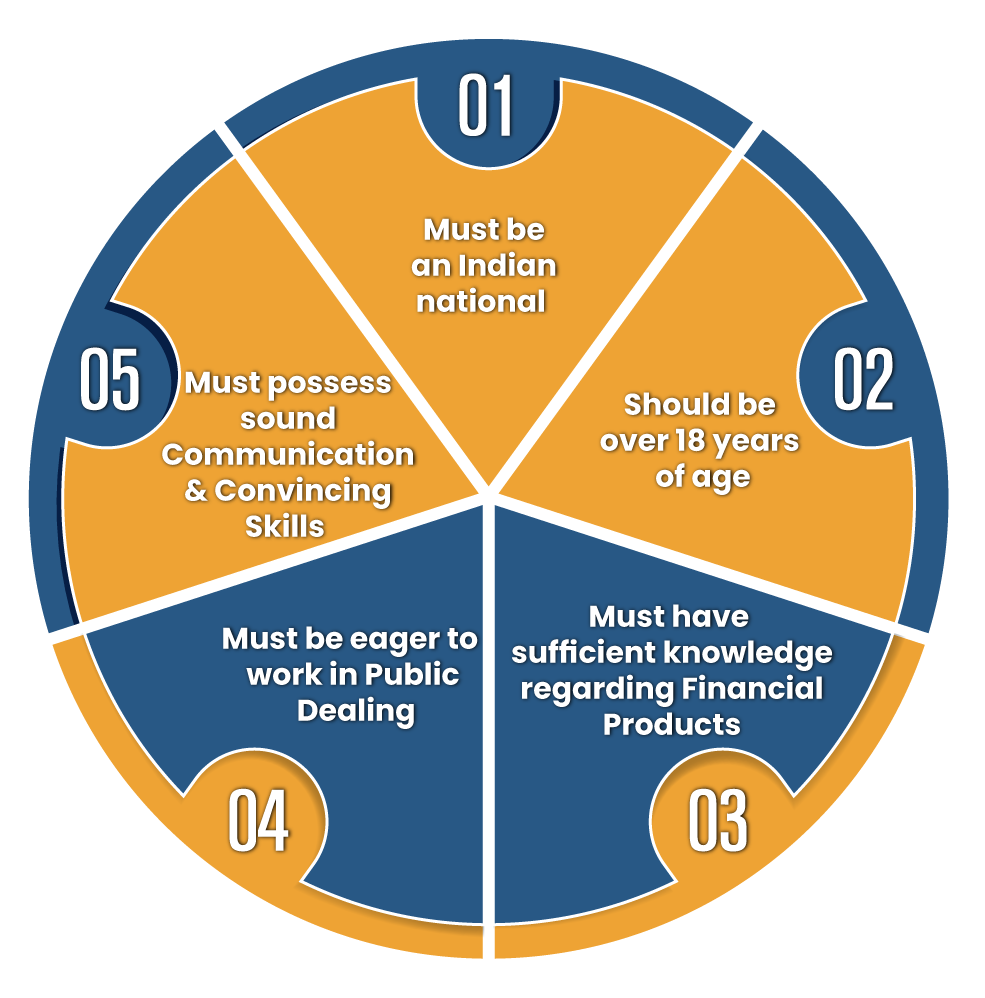

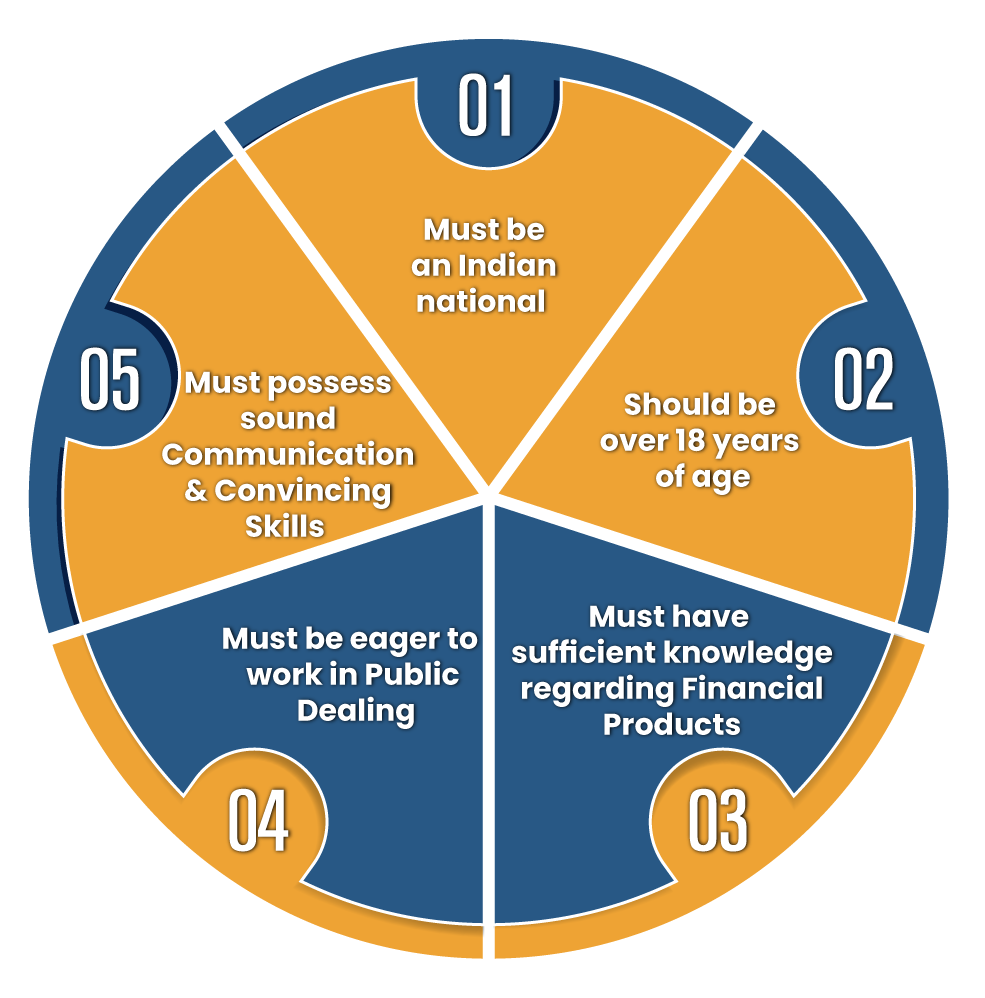

Eligibility Criteria for Obtaining NBFC DSA Registration

Following are the eligibility criteria outlined by the authority to become a direct selling agent in India.

Viable Benefits of Securing an NBFC Direct Selling Agent Registration

The following list illustrates the viable benefits of securing an NBFC DSA Registration:-

- Facilitates additional income, but the amount may differ from lead to lead;

- Allows commencing a new business with minimal risk and cost;

- Renders relaxed working timing;

- No requirement for higher qualification;

- Respective NBFC or Banks provides in-house training regarding skill development.

Viable Advantages Offered by NBFC DSA to the Potential Customers

The NBFC DSA offers several value-added benefits to the potential customers cites below:-

- Agent offers timely resolutions to customer’s problems and queries

- Enable customers to choose the right loan that fits perfectly in their budget.

- DSAs are best known for rendering top-notch after-sales assistance to potential customers.

What Type of Sustainable Benefits DSAs offers to Financial Institutions?

DSAs are considered a crucial asset for financial institutions owing to the following reasons:-

- DSAs can garner strong reach in the local region through in-person interaction with potential clients.

- A Direct Selling Agent is capable of identifying potential customers;

- Escalates awareness regarding the Financial[1] products provided by Banks or NBFCs to the common people;

- DSAs are quite proactive in convincing potential clients to seek loans for their needs.

- DSAs undertake Preliminary Verification and secure client’s requirement in written format for future correspondent.

Generalized Tasks Performed by the NBFC DSA (Direct Selling Agents)

Following is a list of the duties undertaken by the NBFC DSA in general, which are as follows:-

- Gathers the completed application for loans from the potential clients along with the necessary documentation;

- Undertake a Preliminary Check for both application & documents gathered;

- Ensure the legitimacy of the collected documentation;

- Upload or submits the collected applications along with documents.

- Provides Direct Selling Agent Code to the application before submission for seamless tracking.

Documentation Applicable to the NBFC DSA Registration

The given list encloses the type of documents required for the obtainment of NBFC DSA registration.

- Aadhar Card of the applicant;

- PAN (Permanent Account Number) Card of the applicant;

- Bank Account Details such as IFSC code and account number;

- Driving License

The Process to be Followed by Applicant seeking NBFC DSA Registration in India

Radically, every financial institution such as Bank and NBFC underpins an independent process for registering Direct Selling Agents in India. However, the generalized steps involved in the process of said registration are as follows:

- Make your way to the respective bank, NBFCs, and other financial platforms for the submission of the filled application;

- After submitting the said application, make the payment against the same as prescribed by the respective banks;

- Upon payment submission, the concerned bank, NBFC, or lending institution will get in touch with the applicant for further processing.

- Submit the requested documents as prescribed by the respective institution;

- The institution will then examine the submitted documents against the requisites set by them.

- A team of officials from the institution will conduct the process of Due Diligence and will determine the CIBIL score and credit history of the applicant;

- If the institutions stamp their approval on the form & documents submitted, a legally attested agreement of NBFC DSA registration will be sent to the applicant;

- The applicants are required to fill in the requested details in the manner cited in the agreement;

- After agreeing to the terms and conditions, the applicant is supposed to render their approval by signing the agreement;

- Submit the signed agreement to the respective institutions;

- Upon receiving the agreement, the institutions will grant the DSA code, which can be used as a reference number for monitoring the status of the loan application.

- Soon after securing the DSA, a Direct Selling Agent can perform the task of uploading the loan documents.

Conclusion

A Direct Selling Agent (DSA) acts as a representative of lending institutions for potential clients or credit seekers. Their primary task is to promote and sell the financial product of the lending institution through various marketing tactics. Every lead they generate attracts lucrative commissions, thereby allowing them to garner a sustainable source of income. It’s imperative to note that income generated by such services is subjected to tax obligation under the Reverse Charge Mechanism.

Connect with CorpBiz if you would like to pursue your career in the field of Direct Selling Agent (DSA). The interested candidates can join us and earn lucrative income and incentive on every lead they generate. CorpBiz has an aspiring presence in the market with years of expertise under the belt. We have a proven track record in rendering exquisite services in the field of legal advisory, compliances, and government-based registration.

Read our article:A Complete Guide on Operational Manual of the NBFCs