Corporate Governance refers to a set of system, principles & process by which an organization is governed. It underpins guidelines as to how an organization can be directed to meet its goals such that it adds value and is beneficial for shareholder as well. Since corporate Governance also set up a framework for attaining an organization’s objectives, it covers practically every facet of management, from internal controls & action plans to performance measurement & corporate disclosure. A transparent & agile corporate governance empowers a company to make informed and ethical decisions that oust anything which is against the stakeholder’s interest. A company with bad Corporate Governance is more likely to engage in scandals and bankruptcy. In this article, we shall briefly explain Corporate Governance in NBFC.

What is the Significance of Corporate Governance?

The following factors can help you understand the importance of corporate Governance

Compliance & Risk Alleviation

Compliance, risk alleviation & Governance are somehow interrelated. A company excels on principles that ensure legal and seamless inculcation of compliances. If a company carries out its operation in a bonafide way, it can handle any risk whatsoever.

Indispensable for Mergers & acquisitions

Corporate Governance is imperative, particularly in the event of mergers and acquisitions. It allows an organization to draw a line of distinction between the legit and bad deals. Mergers and acquisitions can help improve the Corporate Governance’s quality.

Fortify shareholder value

Corporate Governance strengthens and secures the shareholder’s interest. It plays a vital role in protecting the firm’s valuation as the primary aim of corporate Governance is to render complete protection to its shareholders.

Improves organizational efficiency

Corporate Governance is a key performance indicator of industrial competitiveness. Better Corporate Governance in NBFCs ensures improved corporate performance and also imparts better economic outcomes.

Read our article:Underlining Importance of Budget 2021 for NBFCs and Banks

Recent steps by Private Lender for Corporate Governance in NBFCs

Most of the recent steps taken by private lenders for better corporate Governance in NBFC are as follows:-

- Constitution of committees such as investor’s grievances Committee, Management Committee, ALM (Asset Liability Management) committee etc.

- Gradual inculcation of prudential norms as per the Reserve Bank of India.

- Introduction of the charter of a citizen in NBFCs.

- Inculcation of the KYC’s concept.

- Accountability of top management & Board of Directors for good Corporate Governance.

Pressing Ethical Issues in Corporate Governance

Corporate fraud refers to an illicit practice that occurs within a company by its owners or manager and involves:

- Malicious intention to deceive the investor.

- Public.

- Lending avenues, thereby resulting in financial gains to the company or the individual.

Most corporate frauds occur in the form of;

- Money Laundering

- Asset misappropriation

- Regulatory non-compliance

- Accounting frauds

- Frauds at the Senior management level

The practices mentioned above has dented the image of our financial infrastructure. The companies are henceforth required to be watchful and cautious about these issues & concerns. They ought to embrace anti-fraud measures as opposed to being reactive.

Possible remedies to ethical issues hampering Corporate Governance

The following factors can help alleviate ethical issues:

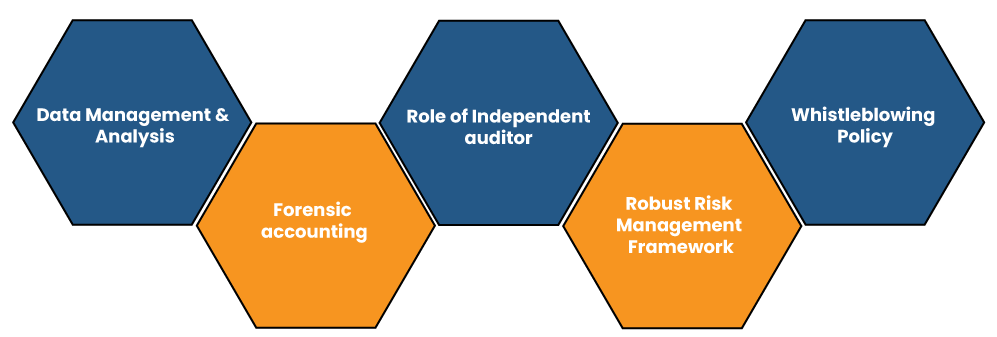

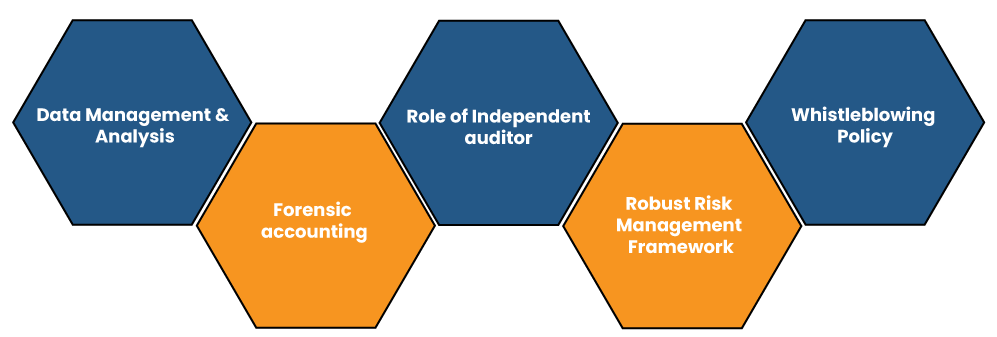

Robust Risk Management Framework

The erstwhile financial crisis has compelled financial and non-financial institutions to adopt a robust risk management[1] framework. Financial institutions, in particular, give more stress on financial risks like credit, market risks, and liquidity.

Data Management & Analysis

The ability of the company to reap revenue, handle expenses, and manage risks is reflected in its ability to spare, store, & retrieve the ever-growing data. Seamless management of data can help to foster a large customer base, thereby improving the ROI of the company.

Forensic accounting

As the name suggests, Forensic accounting deals with the accountancy profession wherein accountants inculcate their skill related to auditing, accounting, and investigations to identify malpractices, frauds, & other litigations. Forensic accounting is yet to achieve good traction in the banking sector despite its effectiveness in probing corporate frauds.

Internal & External Control System

The internal control system envisages continual improvement of the operational framework via inculcation of apt policies and procedures for the smoother functioning of the business. It helps lessen several forms of risk like unauthorized transactions, frauds, and poor maintenance of accounts which can compromise the company’s financial performance.

External control system entails the government regulations, public release & assessment of financial statements, market competition.

Role of Independent auditor

The fundamental goal of evaluating a set of codes for corporate Governance is to improve the auditing protocol to preserve the stakeholders’ interest. The auditor possesses the right to question the defaulter, discard prejudice from the company’s fiscal report. Lately, a lot of stress has been given to the auditor role in the context of Corporate Governance. It is because these officials are accountable for identifying scams.

Whistleblowing Policy

It is an essential part of the organization’s corporate governance strategy. Such policies empower employees to exercise their rights to report any misconduct and suspicious activities to the management which are against the company’s interest.

Key takeaway:

- Corporate Governance is the structure of practices, rules, & processes used to direct and control an organization.

- A company’s BODs is the primary force fostering corporate Governance.

- Bad corporate Governance can lead a company to a state of vagueness which will eventually hamper its profitability.

- Corporate Governance entails the areas of ethical behaviour, environmental awareness, compensation, corporate strategy, and risk management.

- The fundamental principles of Corporate Governance are transparency, responsibility, and fairness.

Conclusion

Having a robust and transparent corporate governance in NBFC (Non-Banking Financial Companies) is essential. It not only alleviates the pressing issues but also fosters a healthy relationship with investors and clients. Good Corporate Governance in NBFC is must-have requirements as it is the only way to stay ahead of pressing issues and operates seamlessly.

Read our article:RBI to limit funding in NBFCs from Non-compliant Financial Action Task Force Nations