In the P2P platforms, individuals both borrow as well as lend from each other. Typically, borrowers who are incapable to obtain funding from a financial institute mostly due to inadequate credit score opts for these platforms. When in need of some credit, be it due to some urgency or to buy the car that you were hoping to purchase in the past, there are different ways to avail a credit; one of them is P2P lenders. These digitally-driven platforms have emerged as a reliable financing option for those having issues in availing of unsecured loans through conventional means. Their rate of interest is also nominal.

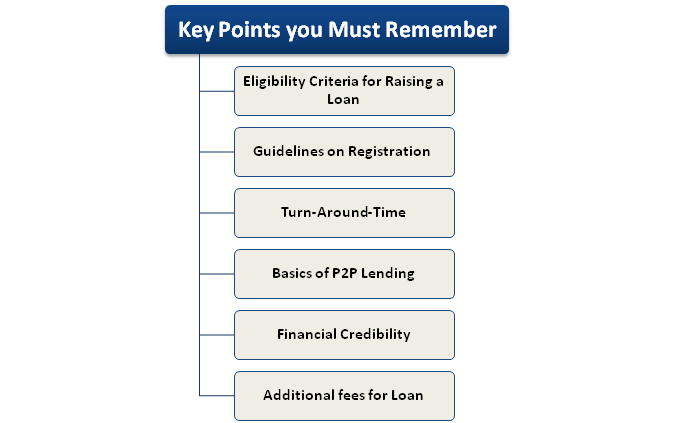

Key Points you Must Remember to Raise Money through a Loan from Peer to Peer Lending Platform

If you wish to raise money through a loan from Peer to Peer lending platform, here are some key points you must remember

Read our article:NBFC-Peer to Peer Lending Platform – Compliance and Registration

Eligibility Criteria for Raising a Loan

Before applying for credit, the borrower must satisfy the minimum eligibility criteria for raising a loan. Therefore, it becomes essential for the person to get accustomed to the eligibility criteria of that platform. If you know what they offer and what their constraints are, it becomes easier for you to avail of a loan. If you eyeing on the higher limit of credit, find out the same as even though Reserve Bank has set a limit for a loan of Rs 10 lakhs to a single individual, there are various peer-to-peer lenders who have their own upper limit.

Guidelines on Registration

These platforms are bound to follow the guidelines drafted by the Reserve bank. For example be it on the security front, privacy, information, collection, etc. Therefore, you must look into the platform and find out whether it has mandatory certificates and registration at the disposal or not. These platforms also require intimate higher authorities like CIBIL and Experian about the individual loan repayment details.

With these individuals paying their monthly installments on time, they will able to score better CIBIL score, only if the peer to peer lender is Reserve Bank registered NBFC -P2P.

Turn-Around-Time

If you are in a state of urgency to avail of financial help, scrutinize the lending platform regarding the disbursement time. Typically, the platform offers a turn-around time, aka TAT for two to three days which might differ if the platform lacks adequate lenders. According to experts, if the credit amount is higher than ten lakhs then it is feasible that one may not receive the credit amount even after waiting for two to three weeks.

Additional fees for Loan

Firstly, determine whether the particular loan scheme comprises any additional fees. For example, many lenders charge processing + registration fees with the monthly installment amount which the borrower will have to bear. According to the experts, the borrower must act wisely in such a situation and should estimate the total expenditure to avail of a loan.

Financial Credibility

Also, determine the financial credibility of the lender by looking into previous charges or penalties. Even though most P2P lenders do not charge pre-closure, it’s better to determine if there are any. Therefore, go through the loan agreement carefully and point out facts regarding charges, which you might have to bear in case of repayment delay, change in the bank, check bounce, etc.

Basics of P2P Lending

P2P lending site connects investors to borrowers. Rate, Terms & Conditions, and transaction mode could differ from platform to platform. The majority of the websites have a wide bandwidth of rate of interest depending on the creditworthiness of the applicant.

First, an investor opens the account on the P2P site and deposits some funds to be disbursed in loans. The applicant or the borrower posts a profile on the same site that is assigned a risk category that estimates the rate of interest the borrower will suppose to pay. The applicant, furthermore, can review the offers and pick one. The transaction and repayment related matters are handled on the platform itself. Even though the platform is fully automated, it allows interested parties to haggle without any issues.

Key Takeaways

- P2P lending websites is a digitally-driven online platform that allows both lenders and borrowers to interact with each other and serve their intention. The platform sets the rate of interest and terms and initiates the transaction.

- P2P lenders are regarded as investors who wish to reap more benefits from their savings than a bank saving account.

- P2P borrowers seek options to conventional banks or a better rate of interest than banks offers.

- NBFCs or registered companies are only the eligible entities who can run peer to peer lending platform in India.

- To avail of registration certification for a peer to peer lending business, one must have a net worth of two crores.

- If the organization was already engaged with such business before the registration certificate was made mandatory, then the organization shall meet all requirements as laid down by the Reserve Bank[1].

Conclusion

A P2P lender proves to be quite helpful when it comes to obtaining a loan without collateral. This is something you won’t find at conventional banks which makes this platform one of its kinds. The high-speed data and cutting edge automation has speed up the evaluation and disbursal process, allowing these platforms to respond swiftly to customer’s queries.

There is no doubt that P2P lending is the next big thing in the financial market. Of course, just like other services, it has its own loopholes and credibility issues which might diminish over the course of the times as the demand for credit escalates. Despite this promising situation, the p2p platform still lacks the support of mainstream banks. Stay connects with us for more information like that. Talk to the CorpBiz’s expert if you wish to avail professional guidance any financial related matters. We shall be happy to serve you!

Read our article:An Overview on P2P lending Framework Impacts on Indian Economy