Filing Income Tax Return is one of the most important duties as a citizen of India. Income Tax Return contains information about the person’s income, expenses and the taxes to be paid during the financial year. The due date for filing the income tax returns for individual taxpayers is 31st July of the assessment year.

It is always advised to file income tax return online and a person usually commits a mistake in ITR filing either due to hasty filing in late hours or due to natural human mistake which can create a negative impact on the taxpayer.

It is equally important to realise and recognise the mistakes in ITR filing. Therefore, the taxpayer should have the knowledge regarding the usual mistakes that can happen while filing Income Tax Return so that he can rectify those mistakes. As the new tax laws provide an option to the taxpayer to rectify his mistakes.

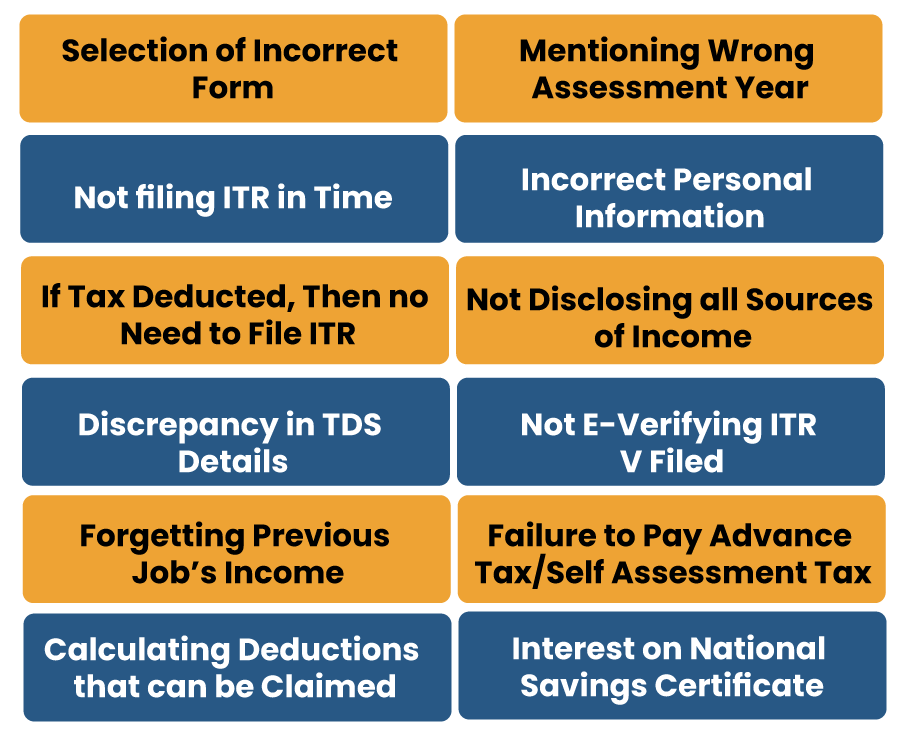

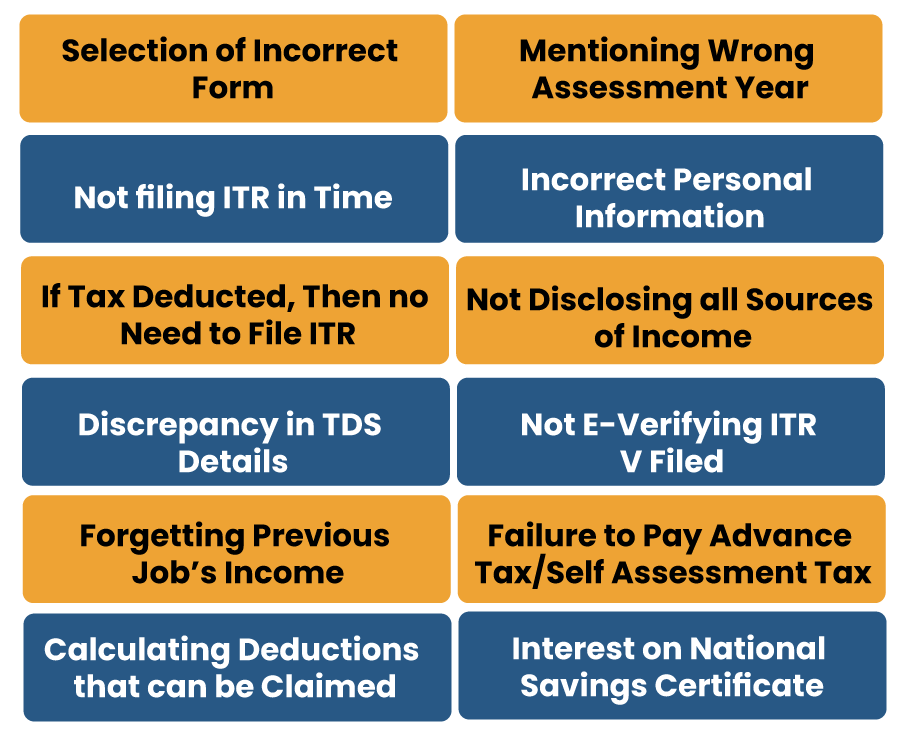

Few Common Mistakes While Filing Income Tax Return

There are few common mistakes that can occur while filing Income Tax Return, which is as follows:-

Selection of Incorrect Form

The selection of the right form of income tax return is dependent on the factors like nature of the income or the category to which the taxpayer belongs.

Therefore, it is important for the taxpayer to select the appropriate form. On this mistake in ITR filing, the tax department sends a defect notice to the taxpayer and gives him a chance to rectify the mistake within a given time period.

Mentioning Wrong Assessment Year

Quoting the wrong assessment year is one of the mistakes in ITR filing which can increase the chance of double taxation and can attract unnecessary penalty to the taxpayer.

Not filing ITR in Time

Mistake in ITR filing beyond the time limit not only attracts penalty but also takes away from the taxpayer certain benefits which he could have claimed while filing the ITR in time.

Incorrect Personal Information

Furnishing basic personal details like the name, address, phone number, mail id, PAN, etc is essential so as to avoid the mistake in ITR filing. Thus, the taxpayer should ensure that the details tally with those given in the PAN.

If Tax Deducted, Then no Need to File ITR

The taxpayer should disclose the income on which the tax has been deducted and should claim credit for tax deducted at source in the income tax return.

Not Disclosing all Sources of Income

Taxpayers have to disclose income from all the sources including savings account interest, any house property rental income, fixed deposit interests, short term capital gain incomes or any other source.

These incomes must be disclosed even if it is not taxable or exempt. This mistake in ITR filing can attract penalty and questions from the tax authorities.

The Discrepancy in TDS Details

It is important for the taxpayer to file returns while verifying with Form AS26 credit of TDS that is with the IT department. Thus, to avoid the mistake in ITR filing the taxpayer who has deducted TDS should deposit the same with the IT department and should mention PAN correctly so that the amount reflects correctly in Form AS26, not leading to any default.

Not E-Verifying ITR V Filed

The taxpayer is required to e-verify the filing of ITR through Aadhaar based OTP or demat account or net banking or he should manually send the signed copy of acknowledgement receipt of ITR within 120 days. This failure or mistake in ITR filing can invalidate the ITR filing.

Forgetting Previous Job’s Income

While changing job the new employer shall not consider the previous income of the taxpayer and he shall get tax exemption on the new income. Therefore, the taxpayer should keep that in mind.

Failure to Pay Advance Tax/Self Assessment Tax

The taxpayer who has income from sources where TDS is not applicable is required to pay advance tax before the closure of the financial year i.e. 31st March. This mistake in ITR filing shall attract a penalty of 1 % every month till the next financial year.

Calculating Deductions that can be Claimed

The taxpayers are allowed to claim deductions on certain expenses that are eligible deductions. Thus, the taxpayer can claim a deduction of up to Rs 1.5 lakh in a financial year by certain investments and expenses.

Interest on National Savings Certificate

The taxpayer’s mistake in ITR filing thinking that interest earned on NSC is tax free is totally wrong. But it is to be noted that the taxpayer can claim it as deductions under Section 80 C and must mention this income as “income from other sources” to receive the 80 C benefit.

Read our article:What is the Claiming Process of Income Tax Refund?

What is the Rectification Procedure to the Mistakes in ITR Filing?

There is an option to rectify the mistake in ITR filing. Section 139(5) of the Income-Tax Act permits the taxpayers to rectify their mistake in ITR filing by filing a Revised Income Tax Return. This section states that if a taxpayer after filing their return discovers any mistake, omission or any wrong statement then he is allowed to file for a revised return any time before the end of the respective assessment year or before the completion of that year whichever is earlier.

Section 154 (1) – a rectification request under section 154 (1) is permitted by the Income Tax Department[1] for correcting apparent mistakes in ITR filing like a mismatch in tax credit or mistake in filing advance tax mismatch, gender incorrectly mentioned, etc.

The list of the errors that can be taken care of by filing a rectification is given below:-

- An error of fact

- An arithmetic mistake

- A small clerical error

- An error due to overlooking compulsory provisions of law.

Conclusion

It is important for the taxpayers to have knowledge about the usual mistakes in ITR filing and to acknowledge those mistakes and file for the rectification of the same within the limited time allotted. Income Tax Act provides with the provision where the taxpayer can rectify his mistake and file a revised Income Tax Return and should ensure that e-verification of the returns is done.

Therefore, the taxpayers must be cautious while filing the ITR and should try to avoid mistakes in ITR filing so as to keep away from penalties and other negative consequences which can impact his tax profile.

Read our article:Types of ITR (Income Tax Returns)