In present times, the Search Assessment regime under Section 153D of the IT Act, 1961 mandates ‘Section 153A and 153C’ of the Income Tax Act, 1961 as the prior approval is necessary for a valid assessment.

In this blog, you will get a precise picture of all the Legality of Prior approval of Joint Commissioner for Assessment under Section 153D of the IT Act, 1961, in ”Search Cases.”

Overview of Search Cases under Section 153D of the IT Act, 1961

In the very first instance, the approval of the senior expert witness will ensure that the assessee is not intolerant by the irrelevant addition or undue assessment. On the other hand, the top authority’s approval will ensure that proper investigations or inquiries are carried out by the authoritative assessing consultant under Section 153D of the IT Act, 1961. Therefore, the provision provides safeguard to Revenue and the assessee for the mental application of a senior officer of the Subdivision/Responsibility.

Therefore, this critical provision cannot be treated as merely empty formality laid down by the legislature. If the very purpose of obtaining approval is defeated, then it will be meant that the superior authorities mechanically grant permission without application of mind.

What are the Search Case Laws concerning Lawfulness of Prior approval?

The power to approve is not to be exercised in a usual manner and casually under Section 153D of the IT Act, 1961. Moreover, the concerned authority is expected to examine the entire material before agreeing to the assessment order while approving. Such authorization is legally required to discharge the obligation by application of mind as laid down whenever any statutory requirement is cast upon any authority.

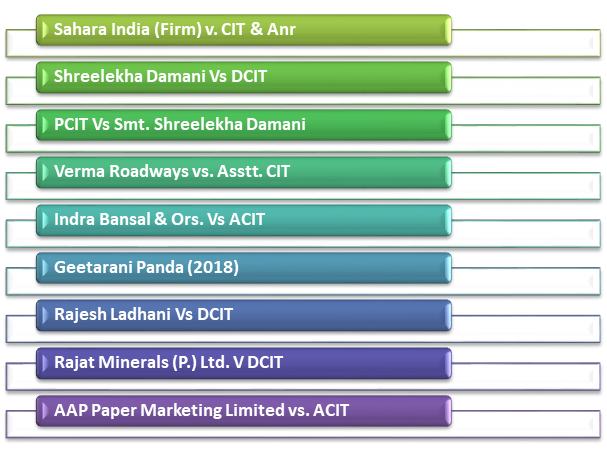

Important Case Laws are as follows:-

Case Law: Sahara India (Firm) v. CIT & Anr. (2008) 216 CTR (SC) 303: (2008) 300 ITR 403 (SC): (2008) 7 DTR (SC) 27

In this very case, under Section 153D of the IT Act, 1961, the Hon’ble Apex Court discoursed upon the requirement of previous approval of the Chief Commissioner or Commissioner. It is in terms of said provision being inbuilt fortification against the arbitrary or unjust implementation of authority by the assessing officer casts a very substantial duty on the said authority to see it that the approval enshrined under Section 153D of the IT Act, 1961. It is not turned into an empty ritual.

It has pronounced while discussing requirement of prior approval of the Chief Commissioner or Commissioner in respect of provision of section 142(2A) of the Act.

Case Law: Shreelekha Damani Vs. DCIT (2015) 173 TTJ (Mumbai) 332

The Hon’ble Apex Court, in this case, held that the approval reflects the application of mind to the facts of the case and must be granted only on the basis of material available on record. The view mentioned above that assessment enclosed on the asset of mechanical approval is bad approach in law. It also gathers strength from numerous judicial decisions under Section 153D of the IT Act, 1961.

The Hon’ble tribunal canceled the assessment allotment as under the fact that Addl. Commissioner has shown his incapacity to analyses the issues of draft order on merit. The evidently stating that no time is left inasmuch as the draft order was engaged before him on dated 31.12.2010 and the seemed approval was granted on the exact similar day.

Interpretation of Decision

- It can be said that the approval granted by the Addl. Commissioner is wrongfulness of any application of mind under Section 153D of the IT Act, 1961, without considering the materials on record seeing the factual matrix of the approval letter.

- Moreover, Joint Commissioner/Addl Commissioner to grant or not to grant approval is attached to duty. He is required to apply mind to the proposals put for approvals in the grace of the material dependent upon by the AO, which cannot be exercised casually and in a monotonous manner.

Read our article:Types of ITR (Income Tax Returns)

Case Law: PCIT Vs. Smt. Shreelekha Damani, 218(APB- 138-139): (2019) 307 CTR (Bom.)

After due interpretation and observation, it has been involving that there has been no application of mind before granting the approval by the Addl. Commissioner under Section 153D of the IT Act, 1961. For that reason, it apprehended that the assessment order is bad in law and deserves to be annulled made u/s. 143(3) of the Act r.w. sec. 153A of the Act.

However, the additional ground of appeal is permissible. The Hon’ble High Court approved the order passed by the Mumbai Bench of the ITAT, which is bringing into being reported in the plain relations under Section 153D of the IT Act, 1961.

Interpretation of Decision

- This case has made the Addl. CIT to record under Section 153D of the IT Act, 1961; the draft order for approval was submitted only on 31st Dec. 2010. Henceforward, there was not enough time left to analyze the issue of draft order on merit. Therefore, the order was permitted as it was submitted. As a result of this, the Addl. CIT for want of time could not scrutinize the issues retiring out of the draft order.

- As it is without any autonomous application of mind, his deed of granting the approval was merely mechanical exercise accepting the draft order. Therefore the tribunal is effortlessly reasonable in coming to the conclusion that the approval was unenforceable in the eye of law under Section 153D of the IT Act, 1961. The adequate conscious says that the statue does not give for any format in which the approval should be granted or the approval granted should be recorded.

Case Law: Verma Roadways vs. Asstt. CIT (2000) 75 ITD 183 (All): (2001) 70 TTJ (All) 728;

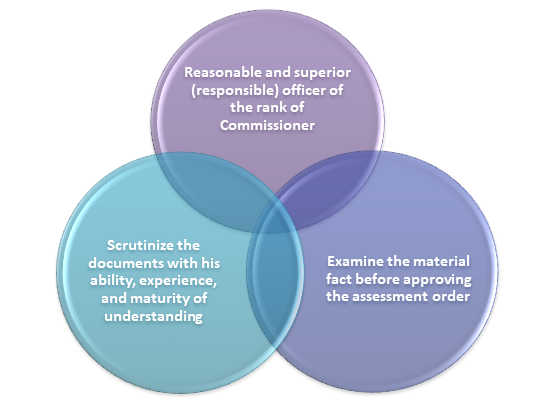

The question of the validity of approval could be raised to the root of the matter where no question of law arises under Section 153D of the IT Act, 1961.” In this case, it held that the commissioner must examine the material before approving the assessment order while granting approval.

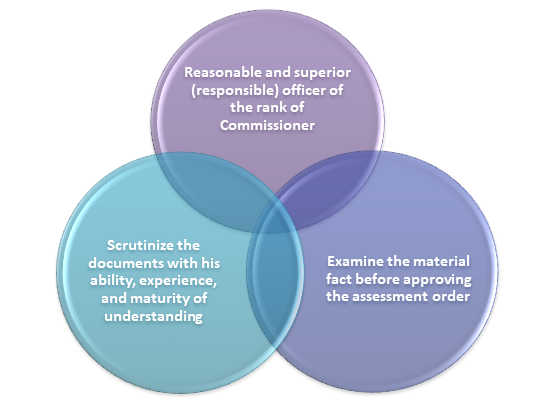

In this case, the Tribunal at Allahabad Bench opined that the object for entrusting job of approval to a reasonable and superior (sic-responsible) officer of the rank of commissioner while examining the issue of consent under section 158BG of the Act.

The commissioner has to be the one who can scrutinize the documents with his ability, experience, and maturity of understanding and can appreciate its factual and legal aspects and properly manage the entire assessment’s advancement under Section 153D of the IT Act, 1961.

Interpretation of Decision

- The considered authority, while granting the approval, is believed to examine the entire material before approving the assessment order, said by the tribunal.

- Moreover, that authority is legally required to discharge the obligation not mechanically, nor formally, but by application of mind whenever any such statutory obligation is cast on any authority.

Case Law: Indra Bansal & Ors. Vs. ACIT (ITA Nos. 321 to 324, 279 to 281, (Decree 23-02-2018) 325 to 331 & 400 to 404/JD/2016

As per the verdict of Hon’ble bench of Jodhpur, ITAT says in apparent from the documents on record, that without even going through the records as the registers, the Joint Commissioner was camping at Udaipur hurriedly.

All the 22 cases under Section 153D of the IT Act, 1961 was finished in one single day itself, i.e., 31-3-2013 for the entire work of seeking and granting of approval. As a consequence, it seems that the Joint Commissioner did not have satisfactory time to apply his mind to which the assessing officer had made the draft assessment orders to the substantial fact.

Interpretation of Decision

- The tribunal has discussed and has laid down that the power to grant approval is not to be implemented in a routine manner and casually. In addition, the concerned authority is expected to examine the entire material before approving the assessment order while granting approval under Section 153D of the IT Act, 1961.

- Whenever any statutory requirement is cast upon any authority under Section 153D of the IT Act, 1961, it has also been laid down that; such authority is legally compulsory to apply the mind while discharging the obligation. In all the circumstances, it indicates that this exercise was carried in a mechanical manner without proper application of mind out by the Joint Commissioner.

Case Law: Geetarani Panda (2018) 194 TTJ (Ctk) 915 (Cuttack)

In this case, the similar view has been adopted by the Cuttack Bench under Section 153D of the IT Act, 1961. Following an order passed was subjected to challenge before the ITAT on the ground of non-application of mind under Section 153D of the IT Act, 1961 by the Additional CIT.

In this very case, the ITAT suspected the approval letter dt. 27th March 2015 of the Addl. CIT Range-1, Bhubaneswar, which says that “the draft orders in M/s Neelachal Carbo Metalicks (P) Ltd. A group of cases has been fetched in this office only on dated “26th March 2015” in the afternoon in spite of a reminder given on 19th March 2015 to defer to the time barring draft assessment orders for sanction under Section 153D of the IT Act, 1961 before 23rd March 2015.

Having been the draft orders submitted only 5 days before the final orders are getting barred by limitation. Even though there is no time left over for commissioner, the approval to the same as the approval is still statutorily required under Section 153D of the IT Act, 1961[1].

Interpretation of Decision

- It is to safeguard that all the inquiries and investigations that are mandatory to be made are really made before finalization of the assessment orders. Moreover, the points established in the appraisal report, the appellate trials, audit inspection, etc. are authoritatively taken into account under Section 153D of the IT Act, 1961.

Case Law: In Rajesh Ladhani Vs. DCIT (ITAT Agra) in 108/Agra/2019 and ITA No. 106,107

ITAT held that if the superior authorities granted the approval for a mechanical manner without application of mind, in that case, the very purpose of obtaining approval is defeated.

Case Law: AAP Paper Marketing Limited vs. ACIT”, (2017) (4) TMI 1371

The ITAT Lucknow Bench coincidentally had the occasion to consider the rationality of validity approval granted by the similar Additional CIT Central Circle of Kanpur. In the current case, while quashing the assessments, JCIT has granted impugned approval without considering and perusing the material on record without application of mind, with no full concentration/focus.

However, the additional ground by way of ‘Rule 27 of the ITAT Rules’ in ‘ITA No. 321/Lkw/2016 for the Assessment Year 2006-07’ is allowed in the final appeal raised by the assessee.

Case Law: Rajat Minerals (P.) Ltd. V DCIT [2020] 114

In this case, the Ranchi Bench of the ITAT held that; it is pointless to look into the draft assessment framed by the subordinate officer with some degree of objectivity by adhering at the provision of section 153D of the IT Act, 1961 casts’ time-consuming responsibility on the superior authority.

Superficially, the whole exercise of the AO in claiming to have equipped assessment orders in as many as 28 cases enclosed by a short time available (after 11:30 a.m.) and approval thereon by the JCIT or termination of the assessment on the identical day is not judicially pleasant.

Interpretation of Decision

As also observed earlier, without even waiting for the completion of that date of hearing, the AO has prepared the draft assessment order, which is gross sub-version of the quasi-judicial procedure. Those are known to be ‘ipse-dixit’ behavior, which ultimately deserves to be criticized.

Conclusion

After due examination and observation in the case mentioned above laws, it is always commended that the authorities should act well in time. Also, the assessee should comply in a reasonable time without delaying the assessment proceedings intentionally opening from the Investigating Wing and to the Assessing Officer. Consequently, it will depict that necessary due time is presented with the approving authority to treat his approval in the spirit of law after going through the case records in-depth and due application of mind.

It pursuant to Section 153D of the IT Act, 1961, it is essential to mention that now the time limit available for framing assessments. It has been significantly reduced to only 12 months as against earlier 21 months in respect of searches conducted on or afterward 1st April 2019. As a result, substantial planning of time will be obligatory now so that due time is obtainable with the approving authority to consensus due to approval in the essence of the statute.

These are just an assessment, and we always encourage our readers to examine the issue in-depth, grounded on the mentioned case laws and amended rules/decided judicial decisions consequently. With this, the group of Corpbiz has legal professionals to assist you with the process of the Search Assessment regime under Section 153D of the IT Act, 1961 Compliances. Our expert will ensure the successful and favorable completion of your work.

Read our article:An Overall Assessment of Income Tax Notice