When the taxpayer has paid his income tax in excess of his income tax liability for that particular year, the amount that is paid in excess is then refunded to the taxpayer by the Income tax department. This refunded amount is known as “Income tax refund”.

In simple words, a tax refund or a rebate on tax is a refund granted to the taxpayer when he has paid more taxes than he is liable to. Taxpayers have the right to avail a tax refund on their income tax under Sections 237 to 245 of the Income Tax Act, 1961[1] if the tax they are obligated to pay for is less than the total sum of the amount of estimated taxes and the withholding taxes, in addition to the claim of credit from refundable tax. Tax refunds are generally paid following the end of the tax year.

What are the Eligibility Criteria of Income Tax Refund?

The taxpayer’s applying for the tax refund needs to make sure that they have updated and validated their bank accounts with the Income Tax Department where they would like to obtain their tax refund after income tax return filing.

The income tax department has made it mandatory for the taxpayer to link his PAN with the particular bank account where he will receive the payable refund. Such tax refunds shall be initiated only with the fulfillment of the above condition to such accounts.

The cases wherein the taxpayer shall be eligible for a refund are given below:

- Where the taxpayer has paid the tax amount in advance on the self-assessment basis which is more than the tax payable on the regular assessment basis.

- If the TDS from salary, interest on debentures or securities and the dividends is more than the payable tax on the regular assessment basis.

- If the charged tax gets reduced on the basis of regular assessment because an error in the assessment process was determined.

- Double-Taxation – The same income has been taxed in a foreign country and in India as well. As the Government of India has an agreement to avoid double-taxation so the tax refund shall be processed.

- In case the taxpayer has done investment which offers tax deductions and benefits and the taxpayer has forgot to declare the same.

- If the taxpayer after taking into consideration the taxes already paid and the deductions that are allowed realised that the amount of tax paid is in the negative.

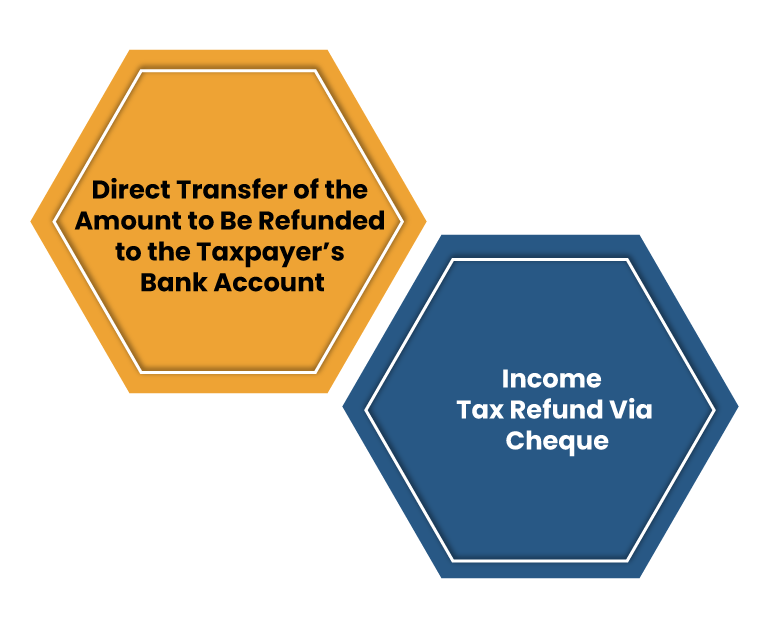

Transfer of the Refunded Amount to the Taxpayer’s Bank Account

This is the standard method used for the function of transferring the payable refund amount to the bank account of the taxpayers. Given below are the two methods:-

What are the Steps to get Income Tax Refund in India?

The taxpayer is eligible to avail allocated refund once he has filed for his IT returns. Generally, the date for filing income tax returns every year is July 31 unless the government by notification extends to further date.

- Form 16 – The simplest way to file for tax refund is that the taxpayer declares his investments in Form 16 (like if he has any life insurance premiums paid, house rent, investments in equity or NSC or mutual funds, any bank FDs, tuition fees, etc.) while filing his IT return and shall give the required evidence of the same.

If the taxpayer fails to declare his investment and has been paying the extra taxes that should have been avoided, then he shall fill out Form 30.

- Form 30 is essentially an application for requesting the Income Tax Department to look into the case and refund the excess tax that have been paid. The tax payer is mandated to submit the payable refund before the end of the financial year.

The said refund claim has to be accompanied with the income tax return in the form as has been prescribed under section 139.

- Verification – The taxpayers should make sure that their Income tax return is verified electronically through OTP, Aadhaar number and bank generated Electronic verification code (EVC) or physically verified and signed ITR-V to the Centralised Processing Centre (CPC) within 120 days of the income tax return filing.

- Form 26AS – The taxpayers should also keep in mind that the excess tax for which the tax refund is claimed should be mentioned in the Form 26AS. The tax refund is a matter subject to verification and is credited by the Income Tax department only if the refundable claim is found to be valid.

The early processing of the income tax refunds can result in the early refund receipt. Therefore, the tax refund will be done sooner by the CPC if the verification is done earlier by the Income Tax Department. The delay in verification shall cause the delay in tax refund. Moreover, e-verification is faster than physical verification.

- Interest on Income Tax Refund – if the refund amount received is somewhat more than the claimed amount in the income tax return. This difference in the amount is the interest paid on the tax refund. This is mandatorily paid by the income tax department, in case the refund is 10% or more than that amount of the amount paid.

- Section 244A is a provision for interest on income tax refund and allows for interest per month or fraction of the month at the rate of 0.5% on the income tax refund amount. The calculation of such an interest shall be from 1st April of the assessment year until the date of allowance of refund if refund is by reason of TDS or excess advance tax paid. An online request by logging in the account of the taxpayer for improvement can be done in case of any inconsistency in the interest computation.

Conclusion

The easiest and fastest way to file income tax return is by declaring investment under Form 16. Thus, where there is a direct deposit in the registered bank account, the tax refund is processed within the time period of 2 months to 6 months counting from the date of filing income tax return online.

The IT authorities at the Centralised Processing Centre (CPC) in Bangalore are the authorities responsible for processing the tax refund. Therefore, the taxpayer has the right to claim any excessive amount as income tax refund from them.

Read our article:Reduce your Income Tax Liability to save money for your future