According to the Notification No. 28/2020, the Central Board of Direct Taxes (CBDT) on Wednesday 28/5; reports the approval of Income Tax Exemption to Uttarakhand Environment Protection and Pollution Control Board (PAN AAALU0160D) – a Board constituted by the Government of Uttarakhand, & ‘Cochin Special Economic Zone Authority’, Kochi. It was held in terms of the subsequent specified income reflecting to that Board, under section 10(46) of Income Tax Act, 1961.

Uttarakhand Environment Protection & Pollution Control Board: Specified Income

According to the S.O 1658 (E) – Central Government hereby notifies for the determinations in exercise of the powers deliberated by clause (46) of section 10 of the Income-tax Act[1], 1961 (43 of 1961). It has marked the order for Board constituted by the Government of Uttarakhand i.e ‘Uttarakhand Environment Protection & Pollution Control Board’, Dehradun (PAN AAALU0160D) in conditional terms of few specified income arising to that Board.

Recognition of Specified Income

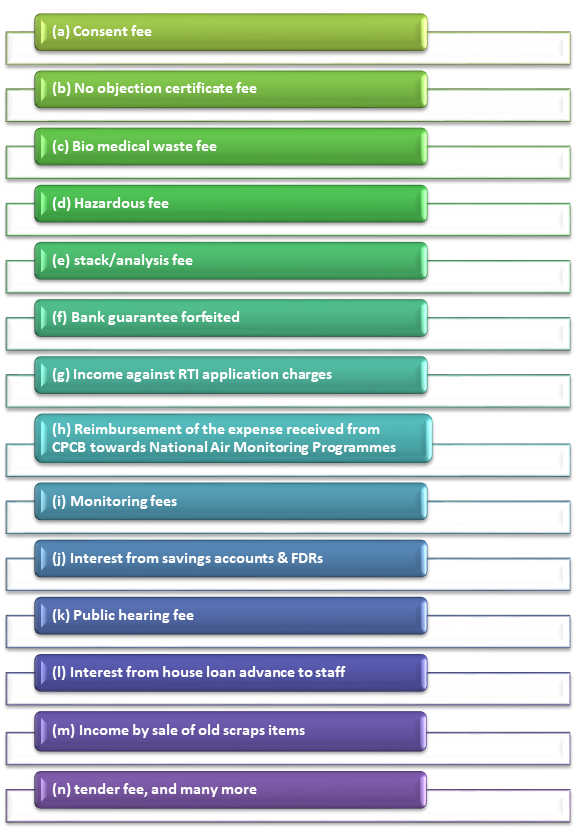

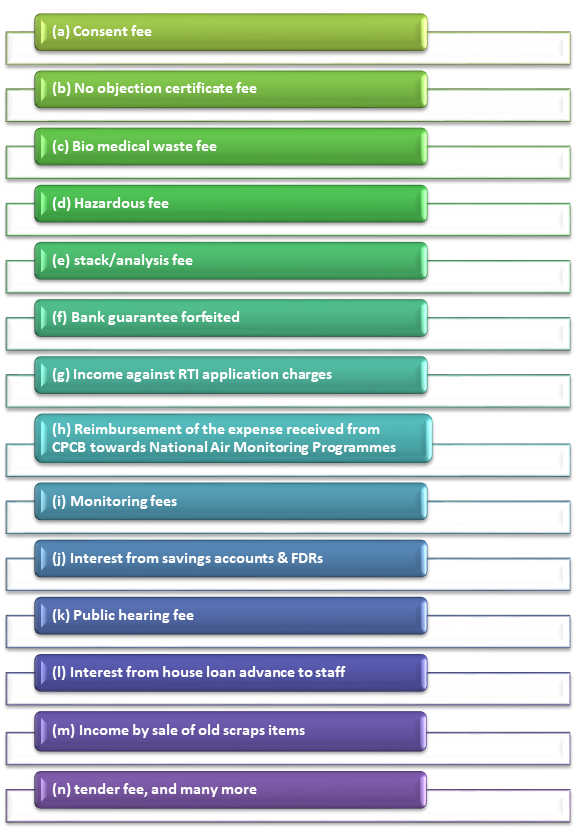

Consequently, the specified income included in terms of the Uttarakhand Environment Protection & Pollution Control Board constituted by the Government of Uttarakhand are as follows:-

Conditional Subjects

This notification provided by CBDT; concedes with few Conditional subjects involved in terms of the exemption given/provided. It will be operative with the subject to the conditions that Uttarakhand Environment Protection and Pollution Control Board must stand by the following conditions.

Those are as follows:-

- They shall not take part in any commercial transactions or activities.

- All the activities and the nature of the specified income must remain unpretentious all the way through the financial years.

- They should file the return of income in agreement with the provision of section 139, clause (g) of sub-section (4C) of the Income-tax Act, 1961.

- They should file the Audit report along with a certificate from the chartered accountant as an attachment that the above conditions are contented. It should also attach along with the Return, duly substantiated by the accountant as mentioned in explanation to section 288(2) of the Income-tax Act, 1961.

Time Frame

According to this latest pronouncement pertaining to Uttarakhand Environment Protection & Pollution Control Board, this notification shall apply with terms to the assessment years 2020-2025, i.e., “2020-2021, 2021-2022, 2022-2023, 2023-2024 and 2024-2025”

Read our article:CBDT Notice on Refunds Release & Welfare fund Eligibility for IT: May, 2020

Cochin Special Economic Zone Authority: Specified Income

According to the “Notification No. 27/2020-Income Tax”, the Central Government hereby informs to deliver the notification for the exemption of the said clause in the application of the powers discussed by clause (46) of section 10 of the Income-tax Act, 1961 (43 of 1961), ‘Kochi (PAN AAAGC0659L), Cochin Special Economic Zone Authority’, an authority constituted by the Government of India in respect of few specified income arising to that Authority.

Recognition of Specified Income

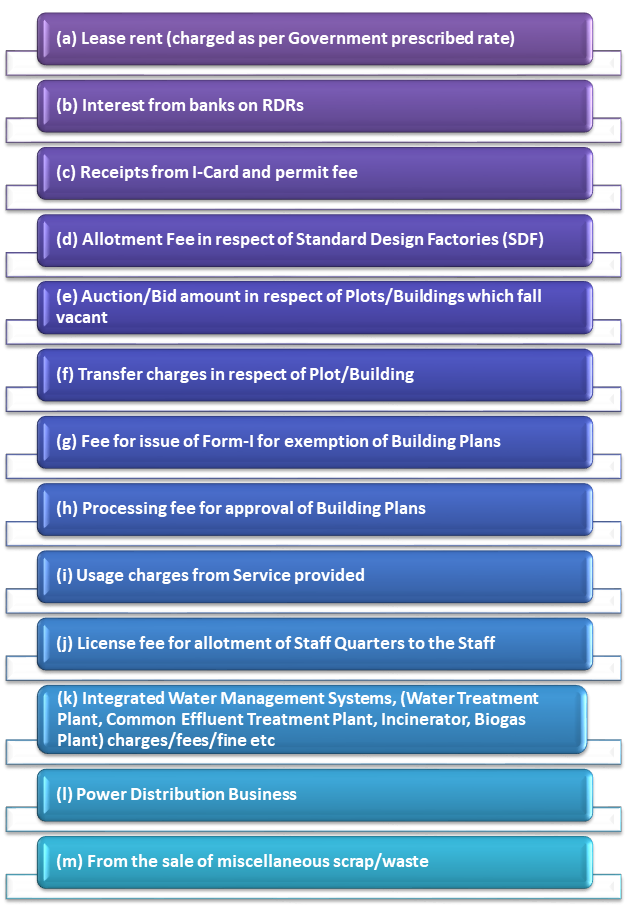

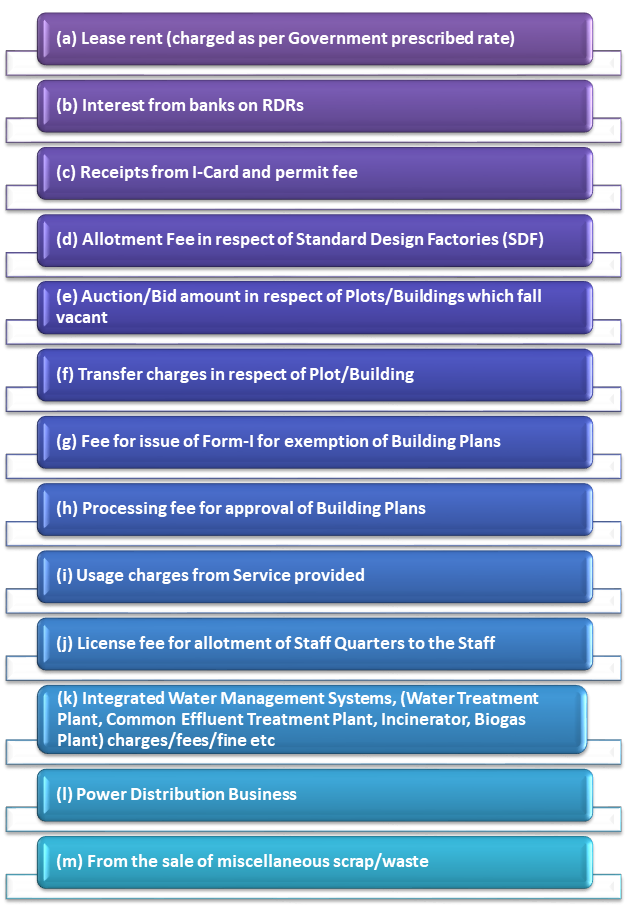

Consequently, including of the specified income in respect Kochi (PAN AAAGC0659L), Cochin Special Economic Zone Authority’, an authority constituted by the Government of India are as follows:-

Conditional Subjects

This notification concedes with few Conditional subjects attached in terms of the exemption given/provided. It shall be effective, subject to the conditions that Cochin Special Economic Zone Authority, Kochi must abide by the following terms.

Those are as follows:-

- Cochin Special Economic Zone Authority shall not take part in any commercial transactions or activity.

- All the activities and the nature of the specified income must remain unpretentious all the way through the financial years.

- Cochin Special Economic Zone Authority should file the return of income in agreement with the provision of section 139, clause (g) of sub-section (4C) of the Income-tax Act, 1961.

- Cochin Special Economic Zone Authority should file the Audit report along with a certificate from the chartered accountant as an attachment that the above conditions are contented. It should also attach along with the Return, duly substantiated by the accountant as mentioned in explanation to section 288(2) of the Income-tax Act, 1961.

Time Frame

According to this latest pronouncement pertaining to Cochin Special Economic Zone Authority’, this notification shall apply with terms to the assessment years 2020-2025, i.e., “2020-2021, 2021-2022, 2022-2023, 2023-2024 and 2024-2025”

Conclusion

CorpBiz professionals are prepared with the essential knowledge and skillsets to help businesses achieve their vision and contract with risks that could disturb their business presence. We at CorpBiz have expert legal consultants to aid you with the process of tax exemptions for your charitable reflections, confirming the fruitful and timely fulfillment of your work.

Read our article: CBDT on Annual Information Statement: New Avatar Form 26AS